Who has been overturned and consumed by end-to-end technology?

![]() 11/13 2024

11/13 2024

![]() 599

599

"With unclear mass production projects and financing, it is difficult to invest in end-to-end solutions in the long run." This is the dilemma faced by many technology companies.

"With the maturity and popularization of technology, I now believe that autonomous driving technology is no longer the soul."

On October 28, Feng Xingya, General Manager of GAC Group, shared his views on the long-debated "automaker soul theory" against the backdrop of GAC Motor's deep cooperation with Huawei.

Since GAC Group signed a cooperation agreement with Huawei in 2017, it has taken seven years for the fruits of their collaboration to bear. This delay may be due to considerations related to the soul theory, but now such considerations are no longer a priority, indirectly indicating that outsourcing autonomous driving technology still exists.

At the same time, this perspective also proves that L2-level autonomous driving technology is currently very mature. Suppliers can provide solutions that are on par with in-house research while meeting the needs of OEMs, eliminating the need for OEMs to waste resources on already mature technologies by starting from scratch.

However, this also transfers market pressure from OEMs to upstream suppliers, particularly requiring solution providers to deliver to automakers as quickly as possible and ensure regular OTA updates.

Especially with the growing popularity of end-to-end technology, suppliers have more work to do.

To win in "end-to-end", does it rely primarily on computing power?

Since the rise of large models, enthusiasm for them has quickly expanded from text-to-text and text-to-image interactions to assisted driving. Some companies even claim that end-to-end large models will be the only path to achieving L4 or higher levels of autonomous driving.

Regarding this, automakers naturally showcase their strengths in promotions, but technology companies or Tier 1 suppliers adopt a more cautious attitude.

"When we're unsure, we won't rush in. Once we're confident, we'll invest resources ten times that of others to drive core technological breakthroughs and openly share our accumulated experience and achievements with partners," said Yu Yinan, Vice President of Horizon Robotics and President of the Software Platform Product Line.

Currently, the industry widely believes that "end-to-end" will accelerate the adoption of L2+ assisted driving technology. Some optimists even believe it will facilitate the deployment of L3 autonomous driving. As for L4, more evidence is needed.

It is certain that currently, mainstream intelligent driving solutions generally transition from high-precision maps to map-free solutions, moving from a two-stage to a one-stage approach. Of course, many companies choose to jump directly to a map-free, one-stage solution, but this is always based on accumulated experience.

Behind this transition lies the demise of traditional rule-based control algorithms. Large models have indeed changed the research and development direction of high-level intelligent driving.

This is good news for emerging technology companies, as it means they can engage in intelligent driving even without traditional intelligent driving-related technologies. For technology companies that used to focus on rule-based control algorithms, the benefits of investment have decreased.

It can be said that large models have narrowed the research and development gap between startups and established technology companies to a certain extent, but only within a very narrow range. "In the past, many suppliers believed they were in different competitive landscapes from Huawei. In fact, this misconception is being corrected this year," admitted an industry insider.

"For the currently popular 'end-to-end large model' technology, what companies are actually competing for is more financial capital," described an employee from a leading domestic supplier to BC.

From the perspective of the entire process, among the three critical elements of data, algorithms, and computing power, large model algorithms are relatively easy to implement, especially in the domestic market. With the popularity of AI, many open-source algorithms are available, and each year, new graduates in related fields provide sufficient grassroots engineers.

According to the latest data on the AI industry released by Zhaopin, as of 2024, over 500 universities in China have established AI majors, attracting a large number of young people to this field.

Besides talent, any company engaged in autonomous driving research and development must accumulate sufficient data for algorithm training over the past few years. At the same time, cooperating with automakers can also provide enough data to support model training.

For intelligent driving companies, mass production is most significant in providing data. For a typical end-to-end model, 10,000 vehicles serve as a benchmark. With this number of vehicles on the road, the intelligent driving model can continuously evolve.

Abandoning rules and embracing data has quickly become an industry consensus. However, for intelligent driving companies still struggling to make a profit, without cooperation with automakers and scale, it is difficult to collect training data independently.

The remaining most critical factor is the support of computing power. From Tesla's computing center to Huawei's self-developed computing platform, it can be seen that end-to-end large models compete more on computing power. The faster the iteration, the higher the maturity of the model, and the more likely it is to achieve a breakthrough.

The scarcity and high cost of computing power have become core factors restricting the development of AI. Stockpiling computing power has become a basic operation for various industry companies. "An AI company with abundant computing power may achieve different results in intelligent driving," said an intelligent driving engineer.

Currently, the industry generally believes that there is a research and development gap of about 1.5 to 2 years between domestic automakers and Tesla. "When the data reaches the million-level, similar to Tesla's scale, through intensive training of the model, intelligent driving can learn video streams and directly guide drivers, similar to the currently popular ChatGPT,"

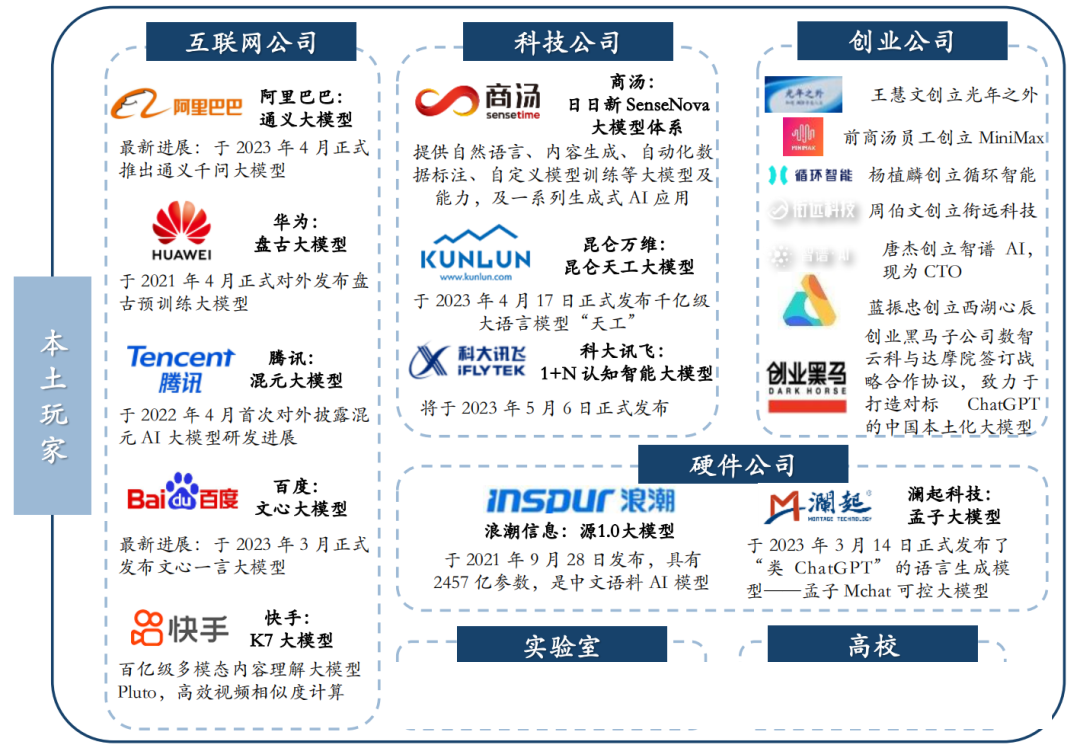

This has actually been confirmed by many domestic technology companies. From the large language model like ChatGPT, a subsidiary of OpenAI, earlier this year, to the dozens of similar models currently available in China, most of which are free to use.

At the beginning of the year, we were discussing why there were no such large models in China. Just a few months later, the discussion shifted to which company's large model was stronger, with ChatGPT even becoming a benchmark for measuring the capabilities of new large models.

One company in particular deserves attention.

As one of ByteDance's main brands, Douyin doesn't seem to have much to do with technologies like AI and large models. However, in May, ByteDance launched the Doubao large model, which can not only process text and generate images but has also entered the automotive supply chain, collaborating with multiple automakers.

Apart from ByteDance, SenseTime Technology has also rapidly expanded from large language models to the automotive supply chain, becoming a partner to multiple automakers and launching several models.

SenseTime believes that the survival space for traditional autonomous driving companies will continue to shrink.

Burning money, people, and technology

At the end-to-end table, suppliers represented by SenseTime Technology and Momenta are becoming a new technological force.

The logic behind these technology companies' rapid entry into the automotive supply chain is simple: burning money. This applies to large language models and intelligent driving models alike. With sufficient resources, capabilities can grow faster.

It is estimated that OpenAI's annual hardware operating costs are as high as $8.5 billion, including purchasing NVIDIA's computing cards, server maintenance, labor expenses, and other costs. For domestic manufacturers to catch up, the only option is to burn money even more Crazy .

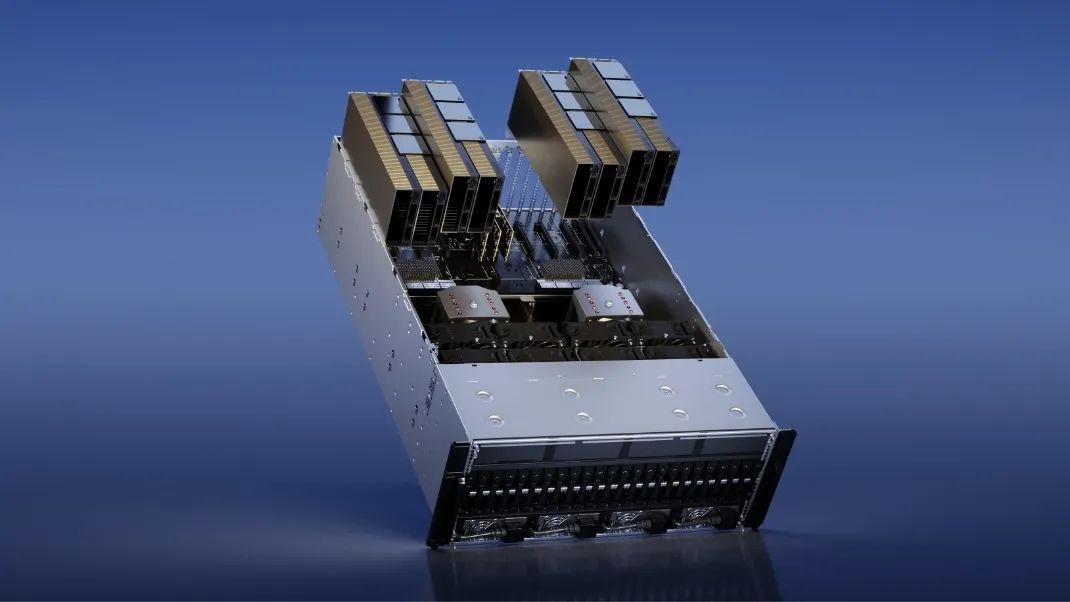

For example, at the beginning of the year, a server consisting of eight H100s cost around 3 million yuan, providing 536 TFLOPS of computing power. Within the automotive industry, it is generally believed that 1 EFLOPS is the basic threshold for intelligent driving training. This means 15,000 H100 graphics cards are needed, costing approximately 5 billion yuan, and that's assuming adequate supply.

With the United States continuing to tighten export controls, previous-generation graphics cards like the H100 are no longer readily available, and most companies are purchasing older A100s instead. While the procurement cost may be lower, operational costs will increase.

Based on data from several domestic technology companies that have disclosed information, Huawei currently has 7.5 EFLOPS of computing power, SenseTime Technology has 12 EFLOPS, and XPeng has 2.51 EFLOPS.

For comparison, Tesla has built a computing center exceeding 100 EFLOPS in the United States, which is why the industry generally believes Tesla's FSD has stronger intelligent driving capabilities.

Apart from computing power costs, labor costs cannot be overlooked. Huawei's leading position in the industry is due to its autonomous driving R&D team of over 7,000 people, even more than the combined number of employees engaged in autonomous driving R&D at NIO, Xpeng, and Li Auto. Furthermore, some suggest that the 7,000 people represent only 10% of the total team, with 90% hidden beneath the surface.

Moreover, automakers offer competitive salaries to key personnel.

Earlier this year, news of "ordinary autonomous driving engineers earning an annual salary of 500,000 yuan" sparked heated discussions online. This is even truer for core algorithm engineers, who are currently in short supply in China. On a job recruitment platform, the monthly salary for autonomous driving algorithm engineers at leading automakers like NIO can reach 70,000 yuan, while XPeng offers annual salaries of up to 1 million yuan for senior engineers related to end-to-end technology.

According to industry insiders, establishing a scaled autonomous driving R&D team requires approximately 100 million yuan in funding.

Therefore, the current competition in end-to-end technology is no longer primarily about technology itself but rather about more fundamental factors like funding and investment. Burning money can indeed yield good results, provided there is sufficient capital.

The cost of high-level intelligent driving R&D is too high, making the intelligent driving technology war a long-term "war of attrition" to some extent. For most startups, this is a considerable challenge.

In such industry competition, we often see news of intelligent driving technology companies suddenly facing cash flow difficulties or going bankrupt. "With unclear mass production projects and financing, it is difficult to invest in end-to-end solutions in the long run." This is the dilemma faced by many technology companies in the intelligent driving chain.

For example, media reported in August this year that changes had occurred in the reorganization plan between intelligent driving solution provider Hedor and GAC Group. Beyond financial tightness, Hedor had disbanded most of its core departments, including data and R&D, and suspended R&D activities.

However, in terms of past financing, the company has received investments from renowned venture capital firms like IDG and Sequoia China and support from automotive industry chain companies such as NavInfo and GAC Group, with cumulative financing exceeding 1 billion yuan.

Therefore, even for scaled technology companies, financial pressure remains severe. Judging from the financial reports disclosed by several companies that have already gone public or are preparing to go public, none are profitable and are all in a state of loss.

At the same time, as end-to-end solutions are gradually implemented, the probability of top suppliers winning orders is increasing, putting immense pressure on second-tier suppliers. "They may even be crushed by top technology companies and automakers," the industry generally believes that top players are accelerating their dimensionality reduction attacks on second-tier suppliers, a case of the big fish eating the small fish.

"Wanting it all"

Unlike automakers, suppliers engaged in intelligent driving R&D do not have fixed buyers. How to expand the market among many automakers with in-house R&D capabilities has become a challenge for suppliers.

In the era of L2 assisted driving technology, suppliers only needed to develop a mature solution and sell it to automakers. Automakers generally compared costs, and suppliers mainly focused on providing low-cost and reliable solutions.

With high-level intelligent driving and constant technological iteration, more consideration is given to whether suppliers can keep their solutions updated to ensure product competitiveness over an extended period. It can be said that end-to-end technology has made intelligent driving competition more challenging.

"When it comes to realizing autonomous driving, apart from end-to-end technology, I can't think of any other approach," said Horizon Robotics. In their view, high-level intelligent driving is a marathon, similar to a triathlon in sports. To win the race, three core elements are required: technology, engineering, and product. "Product thinking should be people-centered, focusing on users' experience and feelings towards the product."

Driven by such market demands, suppliers must not only excel in technology but also face consumers directly. For example, an increasing number of consumers considering intelligent driving are very concerned about its hardware and software, requiring suppliers to cooperate with automakers in promotion and even establish their own reputation in the consumer market.

For instance, Baidu used "Luobo Kuaipao" to make most passersby aware of what driverless technology is.

In 2017, the emergence of the Apollo platform marked Baidu's deep dive into driverless technology. In the following years, Baidu continuously pushed for the iteration and upgrade of the Apollo platform. Especially during the pandemic, Luobo Kuaipao's contactless delivery service shone, further verifying the social value and commercial potential of driverless technology.

Entering 2021, Baidu's Luobo Kuaipao officially debuted. With the rapid growth in order volume in recent years, Baidu's driverless business has expanded rapidly nationwide, with commercial demonstration operations launched in Wuhan, Shanghai, Beijing, and other cities. By 2023, Luobo Kuaipao had accumulated over five million orders, with fully autonomous driving orders accounting for up to 45% in Wuhan, and driverless travel services covering 11 cities across the country.

On the other hand, collaborating with automakers has become a more diversified approach. Automakers need to ensure they are not tied down to a single company in intelligent driving procurement and must achieve replaceability in key areas. This has transformed the once-common model of bundled sales of complete software and hardware solutions into multiple procurement contracts.

For example, Great Wall Motors' core intelligent driving supplier is Horizon Robotics, which was internally incubated in 2019. After years of development, Horizon Robotics has become a leading supplier of intelligent driving and autonomous driving technologies in the industry.

However, Great Wall Motors is not satisfied with Horizon Robotics' capabilities alone. In April 2024, it introduced another well-known intelligent driving technology supplier, WeRide, into its supply chain. WeRide primarily provides Great Wall Motors with "end-to-end" intelligent driving technology solutions, and it is expected that three related products will be launched in 2024.

This requires suppliers to provide customized services to meet the diverse needs of different OEMs. Even joint development has become more feasible to a certain extent.

Of course, sufficiently strong suppliers can still choose to only offer bundled sales without splitting supplies.

However, such suppliers are in the minority. More often, a healthy interaction with automakers is required. Especially now, with computing power distributed across multiple locations such as automakers and suppliers, cooperation seems to be a good solution. It allows results from different stages to run on different computing centers, saving considerable research and development time and costs.

From the perspective of the century-long history of the automotive industry, in-house research and development solutions and supplier solutions have never been mutually exclusive. For most of the time, they have coexisted, and neither has dominated.

Moreover, it is important to note that not all automakers choose full in-house research and development. Many automakers have only recently established end-to-end teams. Suppliers still have their market in the field of intelligent driving. Similar to the past century, providing products that balance cost and functionality remains crucial.

Suppliers continue to play an important role.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.