Server Market: A Win-Win Situation for Intel and AMD

![]() 11/13 2024

11/13 2024

![]() 612

612

Compiled by Semiconductor Industry Insights (ID: ICVIEWS) from nextplatform

It remains to be seen when server shipments will recover to pre-GenAI boom levels.

Any notion that Intel is an easy target to beat can be refuted by simply reviewing the historical trends in market share statistics provided by Mercury Research. The data for the third quarter of 2024 has been released, and when combined with Gartner's historical trends in shipments and revenues, it offers deep insights into the dynamics of the data center X86 CPU market.

To compile and analyze these data, the author received assistance from Aaron Rakers of Wells Fargo's Equity Research department, who closely monitors the semiconductor sector and is passionate about constructing complex spreadsheets, charts, and tables.

Mercury Research data reveals that while AMD's market share has grown, Intel still supplies three-quarters of the X86 CPUs in global data centers. Meanwhile, AMD's performance in server CPU revenue streams has consistently exceeded its market share, primarily due to the cost-effectiveness of its "Milan" and "Genoa" generations of Epyc processors.

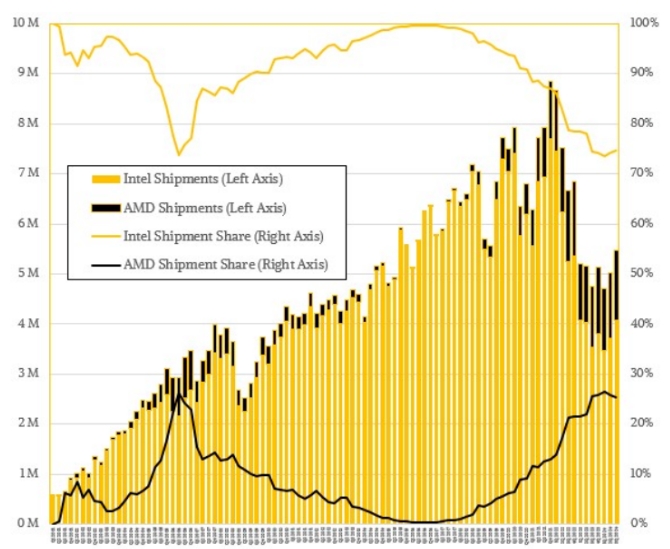

Here are the latest data on AMD and Intel X86 server CPU shipments provided by Mercury Research:

In the third quarter, Intel shipped 4.09 million X86 server CPUs, a year-on-year increase of 15.3% and a quarter-on-quarter increase of 9.8%, compared to 3.55 million units shipped in the third quarter of 2023. As shown in the above image, the Mandelbrot fractal line graph of Intel and AMD's market shares is superimposed on the bar chart of total X86 server CPU shipments from the first quarter of 2001 to the third quarter of 2024. Intel seems to have bottomed out in the third quarter of 2023 and again in the first quarter of 2024, when it sold 3.46 million CPUs. Clearly, the "Granite Rapids" and "Sierra Forest" Xeon 6 processors are more popular than their predecessor, the "Sapphire Rapids" – at least based on early data. The author will know more definitively when the data for the fourth quarter of 2024 and the first quarter of 2025 become available.

In terms of shipments, AMD's growth rate in the third quarter of this year was actually lower than Intel's but still maintained a good pace. According to Mercury Research, AMD sold 1.39 million Epyc processors in the third quarter of 2024, a year-on-year increase of 14.4% from 1.22 million in the third quarter of 2023 and a quarter-on-quarter increase of 7.1% from the second quarter of 2024. During this period, total X86 server CPU sales increased by 15.1% to 5.48 million units, a quarter-on-quarter increase of 9.1%.

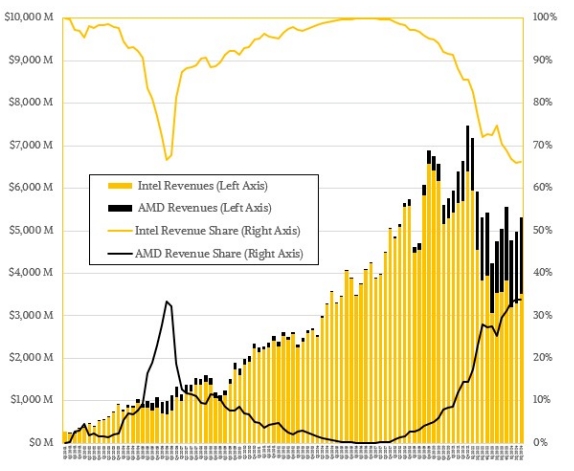

From a financial perspective, Intel's performance was not as strong, as evidenced by Intel's financial analysis (see here) and AMD's financial analysis (see here) for the third quarter of 2024. Let's take a look at the revenue streams of these X86 server CPUs over time:

In the third quarter, Intel's Xeon server CPU revenue appeared to decline by 1.4% to $3.51 billion but increased by 6.9% quarter-on-quarter, in line with the overall quarter-on-quarter revenue growth rate of X86 server CPUs. AMD's performance is easier to compare due to its lower market share a year ago. Its Epyc CPU revenue increased by 20.7% year-on-year to $1.8 billion and by 6.9% quarter-on-quarter. According to Wells Fargo's compiled data, overall X86 server revenue increased by 5.1% to $5.31 billion.

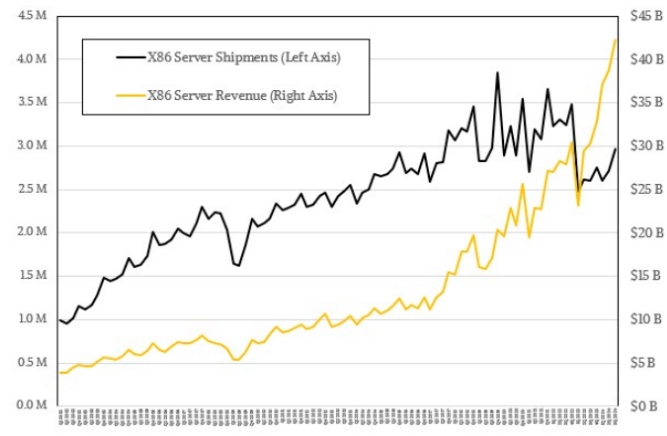

Having understood AMD and Intel's relative positions in X86 server CPUs, the author is curious about the revenue of devices using these server chips. (The data here is obviously somewhat lagged because CPUs sold in the third quarter may not necessarily appear in servers sold in the same quarter.) Fortunately, Wells Fargo has access to Gartner's server shipment and revenue data for the second quarter of 2024. Data for the third quarter of 2024 has not been released yet as most server OEMs and ODMs have not yet announced their quarterly financial results as of September.

Based on historical trends and the increase in the average selling price (ASP) of servers, shipments and revenues for the third quarter of 2024 were estimated in the following chart, as more and more AI servers are sold by ODMs and OEMs, and sometimes by chip manufacturers themselves. (Especially Nvidia and its DGX series.)

Assuming the ASP of servers remained unchanged from the second quarter of 2024, the author believes that server consumption was $38.7 billion in the second quarter of 2024, with Gartner reporting the sale of 2.72 million machines. If you assume the ASP remains unchanged and overall server shipments will match the Mercury Research X86 server shipments above, then approximately 3 million servers were shipped in the third quarter of 2024, driving global total sales to $42.2 billion.

This implies a year-on-year increase of 13.9% in X86 server shipments and a year-on-year increase of 39.4% in X86 server revenues. This chart obviously overlooks the increasing number of Arm-based servers deployed by global hyperscalers, cloud builders, and HPC centers, as well as the small but stable presence of IBM's relatively expensive Power and z mainframe systems.

The above chart shows Gartner data from the first quarter of 2002 to the third quarter of 2024, including estimates made by the author to fill in the gaps.

This is a highlight of these data. You can see what proportion of the cost of a typical server is accounted for by the CPU over time. If you do the math, you'll find that in 2002, the CPU accounted for about 10.5% of the system cost, but this proportion rose to over 15% of the overall server price by 2004 and 2005, when AMD held a strong market position with more cores and a better design than Intel. As hyperscalers and cloud builders' workloads continued to grow, sales of high-capacity server CPUs helped push the CPU share of servers up to just over 20%, and by the time AMD's Opteron nearly disappeared from the market after the Great Recession, this share far exceeded 30% of the system cost due to a lack of competition and the need to pack more computing resources into the chassis.

If you're wondering why hyperscalers and cloud builders want their own Arm server CPUs, this is the answer. In the absence of competition, Intel's CPU prices were very high. The financial situation in the 2010s also proved this point.

By the late 2010s and early 2020s, with AMD back in the market and Arm server chips becoming a viable option, customers were reluctant to pay high fees for CPUs because in many servers, they needed to spend heavily on GPU accelerators and advanced networks to build AI clusters. As a result, the share of X86 CPUs in the cost of X86 servers plummeted to below 20% of system costs in early 2022 and fell again to about 12% in 2024.

Gartner's data also reveals some other insights. The post-GenAI boom decline in server shipments was much more severe than the decline following the financial crisis of 2008 and 2009. During the financial crisis, shipments fell by double digits for four quarters, and revenues declined for five quarters, with double-digit declines in four of those quarters. (Revenue declines preceded shipment declines by one quarter.) If shipment levels had remained constant at 2.2 million units in late 2008 and early 2009, approximately 1.65 million more servers would have been sold. This would have resulted in a loss of about $5 billion in X86 servers on the market. You can see this gap in the chart above.

Since hyperscalers and cloud builders are large and volatile buyers of servers, and they tend to be early adopters of each generation of CPUs, the author has actually witnessed multiple declines in X86 server shipments (i.e., at least two consecutive quarters of decline) over the past decade. Specifically, there was a three-quarter decline in server shipments from the third quarter of 2016 to the first quarter of 2017, followed by another decline from the first quarter to the third quarter of 2019. From the third quarter of 2020 to the second quarter of 2021, there was a four-quarter decline in server shipments. From the fourth quarter of 2022 to the fourth quarter of 2023, there was a five-quarter decline in server shipments, which aligns perfectly with the GenAI boom.

In earlier server shipment declines, there was usually a quarter of revenue decline but not a true two-quarter decline. Nevertheless, revenues would weaken. But this was not the case during the GenAI boom, with ASPs continuously growing due to the rapid increase in GPUs, memory, flash storage, and network components in AI servers.

Regardless, if you assume that an average of 3.2 million servers should be shipped each quarter, the shipment decline combined with below-average shipments in the past two quarters may have resulted in a reduction of 4.5 to 6 million servers on the market to help pay for AI servers. This could equate to 4.5 to 6 billion dollars in unsold general-purpose machines. This is significantly more than during the Great Recession and likely represents a much larger loss in revenue.

The good news is that the potential X86 server shipment decline appears to have ended in the second quarter of 2024, which should help boost the profitability of both Intel and AMD. AMD has gained so much market share, while Intel has remained in the game despite its lack of competitiveness due to foundry failures.

The author looks forward to seeing what happens in the fourth quarter of 2024 and whether Intel can reverse some of the difficult trends in the above chart. Now that the server decline has ended, it remains to be seen when server shipments will recover to pre-GenAI boom levels. With so many cores packed into a single device and price competition per core, it may indeed take a long time. This is another good thing for customers.

*Disclaimer: This article is created by the original author. The content represents their personal views, and our republication is solely for sharing and discussion, not representing our endorsement or agreement. For any objections, please contact us.