Retreat of AI 1.0 Companies

![]() 11/14 2024

11/14 2024

![]() 644

644

SenseTime has laid off staff again, which is not new in the industry. What is new is that this round of layoffs occurs after actively embracing large models.

Founded in 2014, SenseTime was a leader in the AI 1.0 startup wave of 2014-2015, earning its first pot of gold and becoming the first AI stock to list on the capital market. To some extent, SenseTime's setbacks represent the overall plight of AI 1.0 companies during this period. In the transition to large models, AI companies that made their first fortune seem to fall behind step by step if they miss one step.

In 2023, SenseTime initiated a major strategic adjustment, actively promoting the SenseCore large device and releasing the 'SenseNova' large model system. However, the current results are not ideal, and organizational restructuring and larger-scale layoffs have begun. Nevertheless, SenseTime's large model products and revenue are already the most outstanding among AI 1.0 companies, with no competition.

Innovation is not easy, and temporary setbacks for AI companies should be tolerated. Understanding the reasons behind the difficulties will help companies and the industry move forward better.

Let's take SenseTime as an example to discuss how AI 1.0 companies, which received their first pot of gold from AI venture capital, are gradually retreating in the wave of large models.

For leading companies like SenseTime in the AI 1.0 era, there is a common impression among the industry and the public: a belief in technology.

SenseTime attaches great importance to basic scientific research and possesses world-class laboratories, talents, and research papers, enabling it to build a highly competitive technology tree. However, when this 'AI 1.0 technology tree' was directly transplanted to the soil of AI 2.0 large models, it experienced not acclimatized (incompatibility).

The core of SenseTime's AI 2.0 strategy: large devices + large models, both continue the past technological route, resulting in cost pressures far greater than revenue growth.

Let's start with large devices.

Large devices were proposed by SenseTime in 2021. At that time, AI infrastructure and MaaS services were scarce in the market, and the only solution to the computational resources required for model development was to build them oneself. With the advent of large models, the SenseCore MaaS (Model as a Service) Vantage model development platform provides MaaS services based on SenseTime's daily updated 100 billion-parameter large models.

However, the prospects for profiting from large device MaaS services are slim.

The first issue is the significant initial investment. AI infrastructure cloud services are a market characterized by 'heavy investment, heavy assets, and long return cycles,' with high initial costs that may impact SenseTime's revenue in the long run.

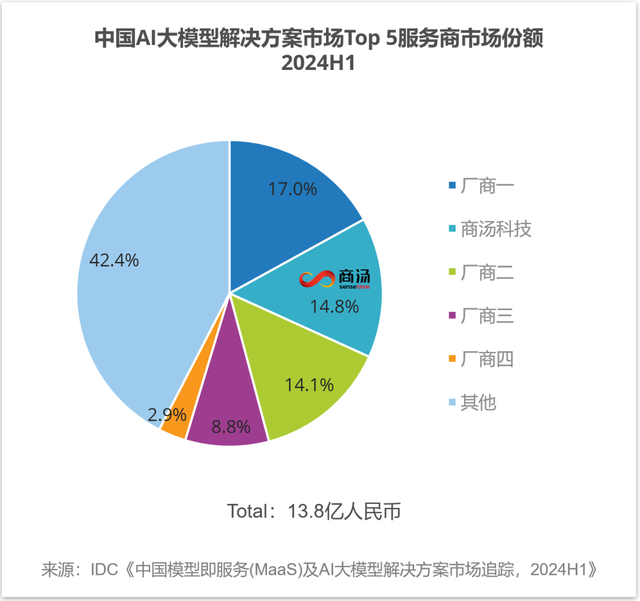

Secondly, competition is fierce. According to the recent IDC MaaS report 'China Model as a Service (MaaS) and AI Large Model Solution Market Tracker, 2024H1,' in the first half of 2024, SenseTime (SenseTime Vantage) accounted for 14.8% of the market share. Leading cloud vendors such as BATH (Baidu, Alibaba, Tencent, Huawei) actively promote their large models and cloud services. Compared to these top AI cloud service providers, SenseTime lacks significant cost advantages and user scale advantages, requiring more marketing costs to further expand its market share.

In this context, AI companies known for their algorithms find it difficult to engage in hands-on work like infrastructure service providers, leading to excessively high marketing costs.

For example, the term 'large device' is analogous to a particle collider in high-energy physics. While impressive, it creates a high cognitive barrier for non-technical industry personnel, who may not understand its purpose at first glance. Extensive exposure and marketing activities are required to educate the market and cultivate brand awareness, further increasing costs.

If 'large devices' are unreliable, surely large models should be the comfort zone for AI companies? Currently, SenseTime insists on leveraging its previously accumulated core competencies, primarily visual perception and multimodal models, but this has gradually distanced it from the center stage.

Initially, the AI 2.0 wave was led by breakthroughs in large language models. After the popularity of ChatGPT, many NLP scientists felt that decades of their work had become meaningless, and the gap between LLM and the CV field, where SenseTime has long been deeply involved, widened further. This led to SenseTime being overshadowed in the first wave of LLM applications focused on natural language interaction and chatbots. Among startups, the limelight was on the 'AI Six Tigers,' while SenseTime's 'SenseNova' large model did not create much buzz.

With the emergence of image and multimodal models like Sora and 4o, although SenseTime could reuse its previous technical accumulation in computer vision, the disconnect with mainstream market perceptions became difficult to bridge, robbing SenseTime of its market voice in the multimodal field and preventing it from establishing a distinctive brand identity.

For example, at this year's World Artificial Intelligence Conference in Shanghai, SenseTime's main promotion, SenseAuto, emphasized end-to-end autonomous driving and multimodal scenario brains but had limited appeal to automakers compared to autonomous driving companies and automotive clouds from leading cloud vendors.

(Netizen comments on SenseTime layoffs)

In summary, the 'technological wealth' of AI 1.0 may also be a historical burden for large model AI 2.0. Holding onto the AI 1.0 technology tree has caused this batch of AI companies to stumble on the path of pursuing large models, falling further behind with each step and drifting further from the mainstream spotlight.

During the AI 1.0 phase, CV businesses like SenseTime flourished. As the largest computer vision software company in China at the time, SenseTime's business covered four major sectors: smart commerce, smart cities, smart automobiles, and smart living. While customer composition appears diverse, closer inspection reveals that the business's countercyclical risk resistance is not high.

The core businesses of smart commerce and smart cities are essentially security. With the contraction of the real estate market and the slowdown in smart city construction, significant adjustments have occurred, leading to a continuous decline in business volume. Autonomous driving and healthcare are 'loss-making ventures' with small business scales, becoming hard-hit areas in the recent October lightweight adjustment.

In summary, AI 1.0 businesses are primarily concentrated in large enterprises and projects, leading to concentrated risks. Once a downturn occurs in this field, AI companies' revenues can shrink.

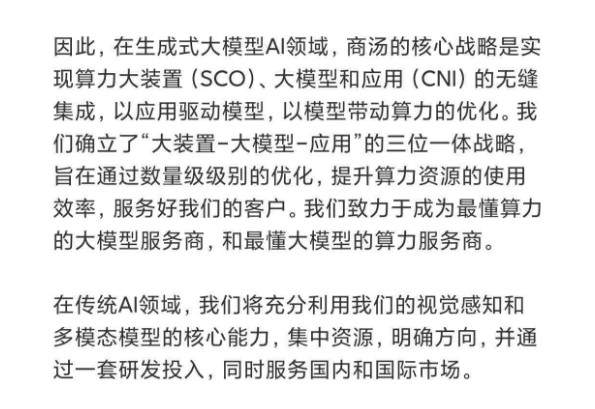

For AI 2.0, which is based on large models, SenseTime obviously hopes to build a more resilient customer base. In its latest 'large device - large model - application' trinity strategy, through the seamless integration of large computational devices (SCO), large models, and applications (CNI), it aims to become the large model service provider with the deepest understanding of computational power and the computational power service provider with the deepest understanding of large models, driving model optimization with applications and computational power optimization with models.

Theoretically, the trinity strategy can attract intelligent customers from various industries, increase customer diversity, diversify business risks, and enhance business resilience.

In practice, implementation faces considerable difficulties.

First, past strengths are difficult to reuse, and advantages are no longer present. Computational power and AI services target the first wave of large model explorers with strong digital capabilities, such as central and state-owned enterprises, operators, internet companies, and technology-related companies. These customers have significantly different requirements from previous clients in smart cities, smart security, and other fields, such as local governments, real estate companies, property management, and primary and secondary schools. For example, CV security emphasizes algorithm accuracy, robustness, and timely response, while computational power and model service providers prioritize cost optimization, service support, computational efficiency, and reliability. This means SenseTime must rebuild its capabilities to attract new customers.

Second, acquiring new customers takes time, so the landing of large devices and large models is still within previous areas of strength, contributing limitedly to revenue. For example, the medical large model 'DaYi,' based on the 'ShangLiang' large model, has received positive feedback within the technical community and was successfully selected as one of the 'Top Ten Excellent CCF Technical Public Welfare Cases in 2024,' but its commercialization has fallen short of expectations, making healthcare a focus of the recent layoffs.

Additionally, new customers often prefer 'multi-model' deployments, introducing multiple large models into their businesses for experimentation. This 'horse race mechanism' puts pressure on SenseTime, as it cannot reduce investment or decrease model iteration frequency while struggling to capture the entire market with an overwhelming advantage and attract users to place all their data on its products. Data shows that over 3,000 industry leaders have used SenseTime's large models and intelligent computing services, with the overall invocation volume of the 'SenseNova' large model increasing by 400%. However, revenue has not improved significantly.

Rebuilding business resilience is a necessary yet challenging task for AI 1.0 companies.

As technology iterates and customer needs change, the biggest difference between AI companies and traditional internet vendors or SaaS software providers lies in their evolvability. Unlike internet or software products, once an AI algorithm or product matures and stabilizes, it cannot achieve exponential returns through fissile growth to amortize research and development costs.

Algorithms often need continuous iteration in actual business scenarios and may even need to be overhauled due to changes in underlying model capabilities. Therefore, the evolvability of AI companies is crucial. Each technological wave must serve as a driving force for AI companies to continue progressing rather than getting stranded along the way.

In this wave of large models, the collective stranding of AI 1.0 companies exposes shortcomings in product evolvability.

The evolvability of AI technology requires re-establishing PMF (Product-Market Fit) each time. Obviously, in the AI 1.0 era, the match between computer vision and business scenarios such as smart security, AI industrial quality inspection, and face recognition achieved commercial success.

However, in the era of large models, 'large devices + large models' have neither captured C-end applications nor gained overwhelming advantages in B-end invocations, indicating room for exploring PMF.

Without completing PMF and forming new sources of commercial revenue, as AI venture capital enters a downturn, it becomes difficult to obtain new large-scale investments after the first pot of gold is spent. Without fresh capital, AI 1.0 companies like SenseTime, with larger organizational scales and higher costs, are prone to getting stranded during their transformation.

From this perspective, lightweighting is not a bad option for SenseTime, reducing resistance to progress and the difficulty of turning around.

Ultimately, transformation aims for better progress. Only by quickly completing PMF and proving one's evolvability in technology and business can AI companies regain the lifeblood of the commercial and capital markets and continue their AI 2.0 journey.