Tencent's Slow Heat and AI Search's Rising Popularity

![]() 11/15 2024

11/15 2024

![]() 622

622

Written by | Hao Xin

Edited by | Wu Xianzhi

On November 13, Tencent released its Q3 2024 financial report, and based on various data, it has basically ended its cost-reduction cycle.

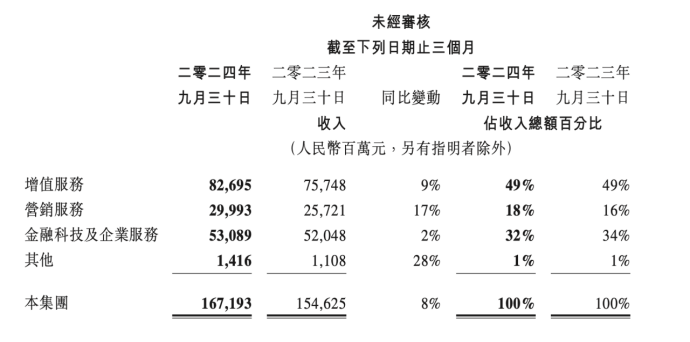

During the reporting period, Tencent achieved revenue of 167.193 billion yuan, an 8% year-on-year increase, which was flat compared to the previous quarter. Gross profit was 88.828 billion yuan, up 16% year-on-year. Adjusted net profit was 59.813 billion yuan, up 33% year-on-year. Both gross profit and adjusted profit growth rates were lower than those in the previous quarter.

In terms of business segments, value-added services, including gaming, generated revenue of 82.695 billion yuan, up 9% year-on-year, with both domestic and overseas game revenues increasing, and international game revenue reaching a quarterly high of 14.5 billion yuan. The former 'Online Advertising' segment was renamed 'Marketing Services' this quarter, with revenue of 29.993 billion yuan, up 17% year-on-year. Financial technology and enterprise services revenue was 53.089 billion yuan, up 2% year-on-year.

When reviewing Q3 performance, Pony Ma mentioned three keywords: games, e-commerce, and AI.

Currently, although marketing services revenue accounts for the smallest proportion of Tencent's total revenue, it has seen the largest average growth rate over several consecutive quarters. The financial report stated that this growth was mainly driven by video numbers, mini-programs, WeChat search ads, and AI technology applications. At the same time, the enterprise services business benefited from cloud services and technical service fees from video number merchants, leading to significant improvements in gross profit.

It is evident that Tencent's future growth potential lies in the 'WeChat ecosystem'.

WeChat, known for being slow to adopt new trends, has been active recently, especially in search-related functionalities. By the time the financial report was released, WeChat Search had launched the 'Direct Search' function; a new 'Shop' entry was added to WeChat Search; and an AI Q&A feature is currently undergoing gray-scale testing, allowing the WeChat search box to answer some questions.

'No one wants to lag behind in AI search.' Tencent, which has been pushed by large models for nearly two years, has finally come to the point of redefining search.

WeChat is slow to heat up, but search is 'impatient'.

Zhang Xiaolong once revealed WeChat's new logic, stating, 'Even small changes can have significant consequences, so we must carefully consider their impact on users.' Adhering to the principle of 'less is more,' WeChat has undergone subtle changes over the years, earning criticism from some for being 'slow to heat up' and 'conservative.'

This unique pace of WeChat was disrupted by AI search. According to TechPlanet, project teams from various departments within Tencent, such as WXG (WeChat Business Group) and PCG (Platform and Content Business Group), are all testing AI search functionalities.

The reason WeChat is forced to 'heat up' is that AI search has become a deterministic opportunity in this wave, accelerating the erosion of the market share of existing general search engines. With AI capabilities, every search box has the potential for transformation. For the WeChat ecosystem, this includes content boxes, social boxes, and e-commerce transaction boxes, which not only enhance efficiency but also affect revenue.

So far, WeChat has not yet launched a complete AI search function. Currently, users can only ask questions in the search box. Based on the question, AI automatically generates a response of a few hundred words, ending with a link to a WeChat official account. Only direct and clear questions will trigger AI, and most questions will still display the original page.

Asking the same question in Yuanbao yields similar answers, and the reference sources are basically the same, suggesting that Yuanbao and the WeChat ecosystem are likely interconnected. Currently, WeChat's AI search function is similar to 'instant search,' providing concise answers that align with users' habits of searching and leaving quickly. For complex searches and problem analysis, users still need to return to Yuanbao. For example, WeChat AI search can handle questions like 'What new products has Apple released this year,' but it may struggle with questions like 'What Apple products can I buy with a budget of 10,000 yuan?'

This is just the tip of the iceberg for WeChat's AI search. Compared to general AI search engines on the market, the types of AI search based on the WeChat ecosystem are much richer. Today's AI search can handle open and generalized information to the greatest extent, aiming to provide answers based on factual analysis, essentially determined by the data it can access.

In WeChat's closed-loop search ecosystem, there are two types of search data sources: personalized data skewed towards social relationships and public data skewed towards content and e-commerce, which effectively expands the scope of WeChat's AI search capabilities. Currently, no single AI search engine is omnipotent. Some are integrated as tools, some excel at research and investigative questions, some focus on local areas, and others lean towards personalized social AI search.

Next, the competition for data in AI search will shift to personal data, as public data sources on the internet no longer pose a barrier. Recently, Perplexity has been enriching its search sources by allowing users to upload personal databases. WeChat has a natural advantage in this regard, with higher-quality public data backed by official account content resources and comprehensive knowledge graph data accumulated over time by individual users and structured data from enterprises.

AI search in the WeChat ecosystem can follow two parallel paths: one for general, public, and rigorous searches, and another for localized, personalized, and emotional assistant-level searches.

It's important to note that AI search within WeChat offers a seamless user experience, switching seamlessly from public to personalized search, potentially within a 'personal assistant' dialogue box or by invoking AI functions at any time during browsing. Users can browse, search, and make decisions within a single application, reducing the fragmentation caused by opening and switching between apps, making AI search more complete.

AI Adheres to the WeChat Ecosystem

Perhaps in the future, AI search similar to Copilot can shoulder the responsibility of integrating the private and public domains of the WeChat ecosystem. An important prerequisite for this is that the entire ecosystem is interconnected and actively functioning.

An ecosystem is like an intricate forest where various trees intertwine as the business expands. It is essential to prune branches and regraft them in a timely manner. Google's progress in many AI search-related businesses has been slower than expected because it must consider how to clear the path for AI implementation and its impact on ecological balance before launching new features.

Before releasing its AI search function to the public, WeChat did a lot of 'gardening' work. Search, mini-programs, video numbers, and official accounts constitute the WeChat ecosystem. Recently, a series of WeChat actions have invariably strengthened the connections between these components, improved search efficiency, and removed intermediate branches.

To enhance the connection efficiency between search and mini-programs, WeChat Search launched the 'Direct Search' function, allowing users to directly access corresponding mini-program services by searching for common needs like 'airplane tickets' or 'hotels,' without the need to search for and switch between mini-program interfaces.

To improve connections with video numbers and enhance e-commerce conversion rates, WeChat upgraded 'Video Number Store' to 'WeChat Store' in August and added a 'Store' entry within WeChat Search. Both entries provide the same services, displaying merchant storefronts and product images and prices through search keywords. The entire shopping process, from search to selection and order completion, is relatively convenient.

As WeChat embarks on AI, connection and entry points remain key. Currently, WeChat considers two important technical directions: AI search and Agent. For the WeChat ecosystem, AI search is about re-exploring the value of various data, breaking down data barriers, and forming new knowledge graphs. It functions like blood, delivering and providing feedback to mini-programs, video numbers, official accounts, and users.

It is reported that the WeChat Cloud Development Team has launched the 'Cloud Development AI Agent' application platform. Through this platform, users can achieve zero-code development and create personalized intelligent assistant products.

Interestingly, Zhang Xiaolong once predicted that mini-programs would one day replace apps. History repeats itself, as the notion that Agents will kill apps gains momentum. The coexistence of mini-programs, apps, and Agents may become the norm, and the relationship between AI search and Agents is two sides of the same coin.

The division of labor within the WeChat ecosystem is gradually becoming clearer. AI search serves as the foundation of the ecosystem's circulation, continuously penetrating every aspect. Agents function more like transit hubs in the system, which can also be understood as a new entry point for WeChat's ecosystem. They are responsible for building, reviewing, and distributing Agents to official accounts, mini-programs, video numbers, and WeChat Stores.

Commercialization of the WeChat Ecosystem

Direct Search and AI transformation are both attempts to shorten the shopping link and make transactions more efficient, which is closely related to WeChat's bet on e-commerce.

Previously, Tencent President Martin Lau positioned Tencent's live e-commerce as the 'WeChat e-commerce system,' constructing an e-commerce ecosystem within WeChat, interconnected with the entire WeChat ecosystem. As of September 30, 2024, WeChat and WeChat had a combined monthly active user base of 1.382 billion, up 3% year-on-year, indicating a stable foundation.

Tencent revealed that Search, mini-programs, and video numbers were important sources of Q3 advertising revenue and high gross margins. Marketing services revenue in Q3 2024 increased by 17% year-on-year to RMB 30 billion, thanks to strong advertiser demand for ad inventory on video numbers, mini-programs, and WeChat Search. Gross profit from marketing services increased by 18% year-on-year to RMB 15.9 billion, driven by revenue growth from video numbers, mini-programs, and WeChat Search.

Mini-programs continued to grow steadily, with transaction volume exceeding RMB 2 trillion in Q3 2024, up by more than ten percentage points year-on-year. This growth was attributed to better coverage and optimized solutions in dining, electric bike charging, medical services, and other application scenarios.

The financial report first mentioned WeChat Store, positioning it as 'a platform where merchants can operate indexed and standardized product storefronts,' still relying on the powerful WeChat ecosystem.

With the deep integration of AI, new revenue growth opportunities may emerge around the WeChat ecosystem.

There is high potential value in AI search assistant services for consumer-end users. WeChat has a strong user base and high user stickiness, with a single account providing access to a wide range of personalized data dimensions, creating a barrier for competitors aiming to become personal assistants. Everyone wants a true 'personal assistant,' but current AI cannot cater to individual needs. WeChat's natural advantages may simplify this process.

Merchants can leverage AI search's precise targeting capabilities to deliver ads more accurately to target users. AI search can analyze users' potential needs and purchase intentions based on their interests, behaviors, geographical locations, and other multi-dimensional data, enabling personalized ad recommendations, thereby increasing ad click-through and conversion rates. This not only enhances marketing effectiveness for merchants but also improves user acceptance of ads.

The Agent platform can provide merchants with tools to build Agents, market insights, and user needs analysis, helping them better understand market dynamics and consumer demands, optimize products and services, proactively capture leads and identify issues in daily customer service, provide timely feedback to merchants, and enhance business conversion rates.

'We continue to deploy AI in our products and operations, including marketing services and cloud services. We will continue to invest in AI technology, tools, and solutions to serve users and partners.'

The seeds of AI have already sprouted in the WeChat ecosystem, awaiting further growth and harvest.