Which AI Agent company has the strongest profitability?

![]() 11/18 2024

11/18 2024

![]() 662

662

An AI agent typically refers to a software program integrated with artificial intelligence technology capable of performing specific tasks or a series of tasks. An AI agent can be based on large models or other types of AI technologies, such as rule engines, machine learning models, etc. Profitability is often manifested in the amount and level of corporate earnings over a certain period. The analysis of profitability involves an in-depth examination of a company's profit margin. This article is part of the series on corporate value focusing on [Profitability], selecting a total of 21 AI agent companies as research samples, with evaluation indicators including return on equity (ROE), gross profit margin, net profit margin, etc. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 AI Agent Companies by Profitability:

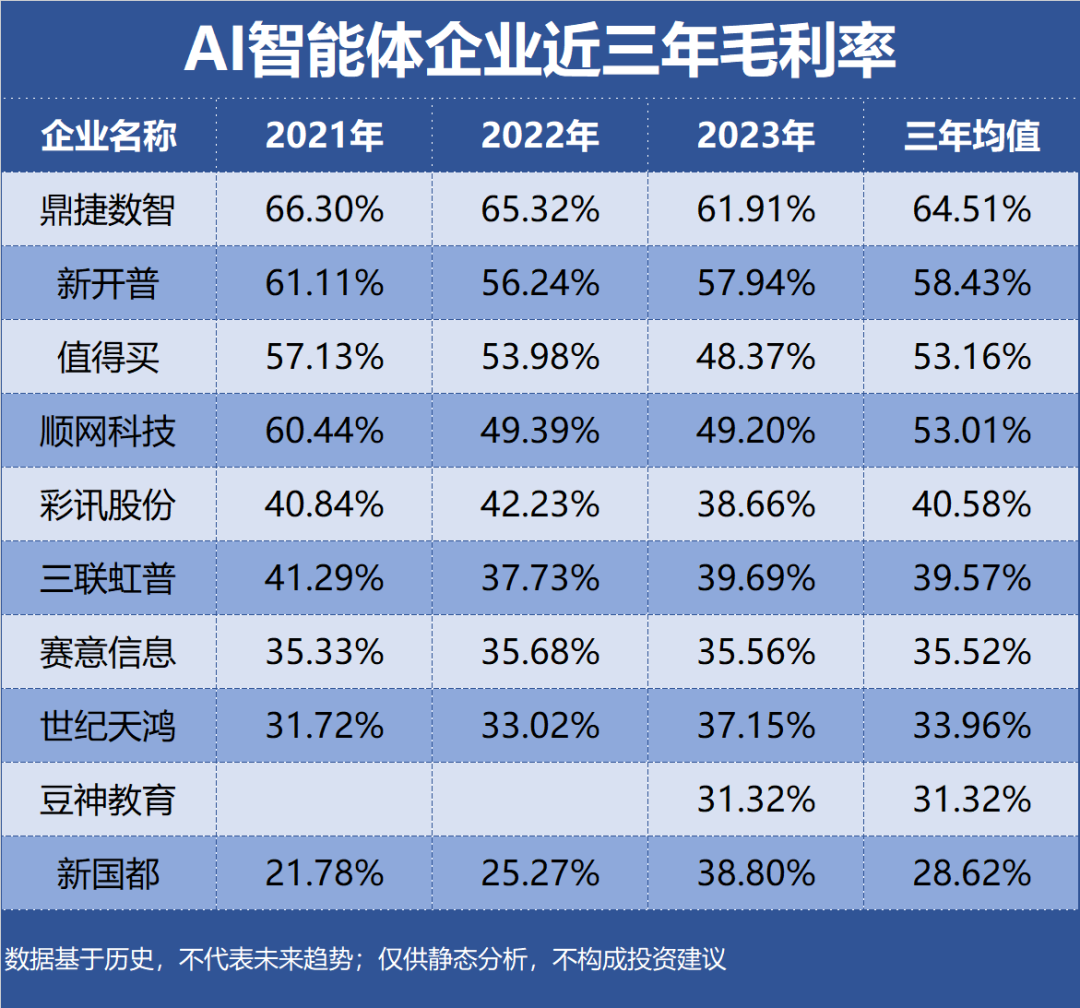

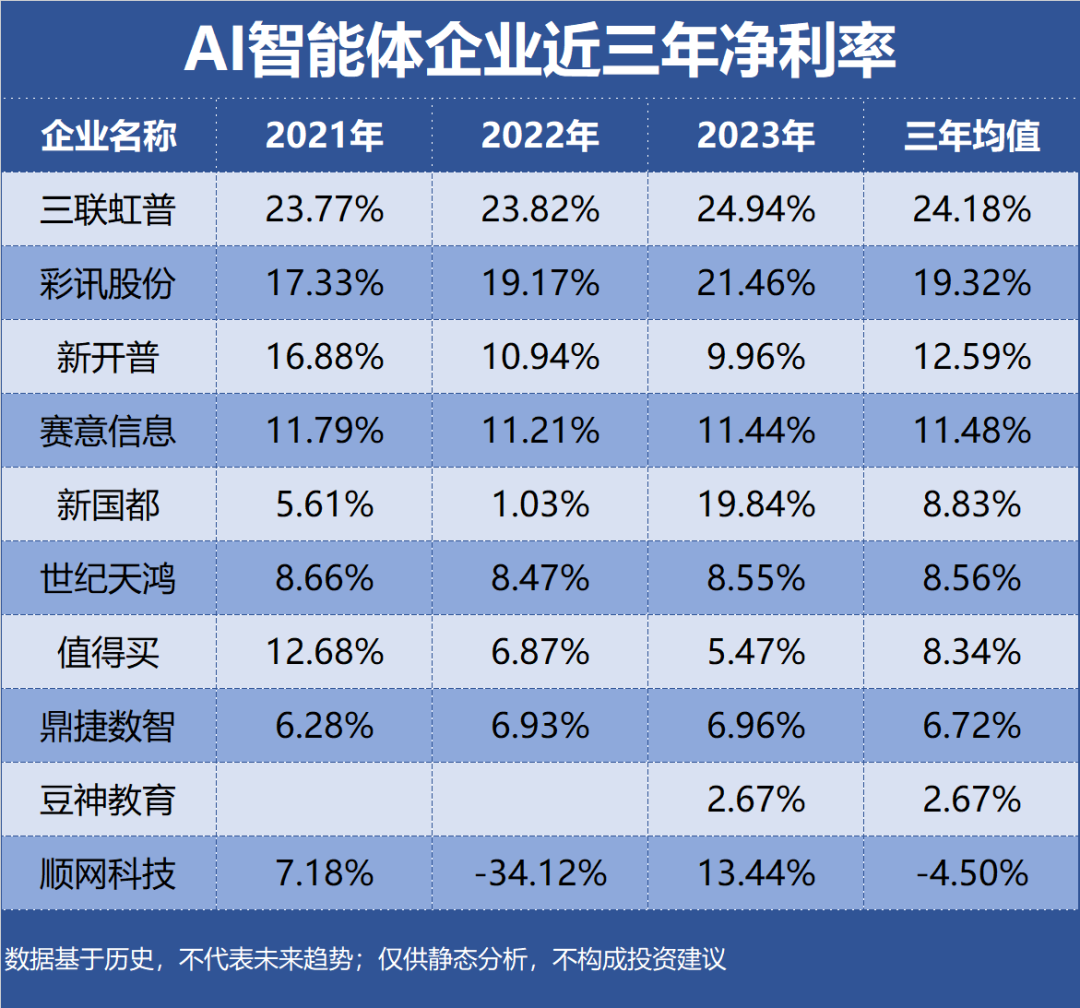

10. Zhidemai Industry Segment: Portal websites Profitability: ROE 6.48%, Gross Margin 53.16%, Net Margin 8.34% Performance Forecast: ROE has fallen consecutively for the past three years to 4.12%, with the latest forecast average at 4.80% Main Product: Information promotion revenue is the primary source of income, accounting for 43.43% of total revenue with a gross margin of 55.90% Company Highlights: The AI shopping assistant "Xiaozhi" is an agent product developed by Zhidemai based on its large consumption model, helping users efficiently screen products and content through dialogue.

9. Sunyard Industry Segment: IT Services Profitability: ROE 6.09%, Gross Margin 58.43%, Net Margin 12.59% Performance Forecast: ROE has fallen consecutively for the past three years to 4.80%, with the latest forecast average at 6.00% Main Product: Smart campus application solutions are the primary source of income, accounting for 50.23% of total revenue with a gross margin of 44.40% Company Highlights: Sunyard's smart campus agent service AI product "Xiaomei Tongxue" integrates advanced technologies such as digital humans, speech recognition, semantic understanding, and large language models.

8. Century Tianhong Industry Segment: Education Publishing Profitability: ROE 5.76%, Gross Margin 33.96%, Net Margin 8.56% Performance Forecast: ROE has fluctuated between 5% and 7% in the past three years, with the latest forecast average at 6.60% Main Product: Educational reference books are the primary source of income, accounting for 85.84% of total revenue with a gross margin of 38.87% Company Highlights: Century Tianhong's "Xiaohong Assistant" is an AI agent focused on serving teachers, developed based on a large language model.

7. Dlink Industry Segment: Horizontal general software Profitability: ROE 7.42%, Gross Margin 64.51%, Net Margin 6.72% Performance Forecast: ROE has risen consecutively for the past three years to 7.66%, with the latest forecast average at 8.07% Main Product: Technical services are the primary source of income, accounting for 48.08% of total revenue with a gross margin of 54.33% Company Highlights: Dlink has initiated multiple R&D projects based on its Athena platform integrated with AIGC technology, including the launch of a personal intelligent assistant "Nana Bangwo" in collaboration with Microsoft.

6. Sysware Industry Segment: IT Services Profitability: ROE 12.72%, Gross Margin 35.52%, Net Margin 11.48% Performance Forecast: ROE has fallen consecutively for the past three years to 10.08%, with the latest forecast average at 9.25% Main Product: Software implementation and development services are the primary source of income, accounting for 87.53% of total revenue with a gross margin of 31.61% Company Highlights: Sysware has embedded AI capabilities into its Shanwei·LCDP low-code process engine, leveraging advanced AI technology to create a process AI agent.

5. Richinfo Industry Segment: IT Services Profitability: ROE 10.65%, Gross Margin 40.58%, Net Margin 19.32% Performance Forecast: ROE has risen consecutively for the past three years to 13.34%, with the latest forecast average at 10.55% Main Product: Telecommunications are the primary source of income, accounting for 71.02% of total revenue with a gross margin of 43.13% Company Highlights: Richinfo has completed the R&D of the HarmonyOS version of the operator and e-commerce baseline 1.0 and has expanded access to the HarmonyOS "Xiaoyi" agent application.

4. NetEase Youdao Industry Segment: Value-added communication application services Profitability: ROE -2.51%, Gross Margin 53.01%, Net Margin -4.50% Performance Forecast: The highest ROE in the past three years was 8.72%, with the latest forecast average at 11.30% Main Product: Online advertising and value-added services are the primary sources of income, accounting for 75.66% of total revenue with a gross margin of 26.25% Company Highlights: NetEase Youdao's main business is internet technology platforms and services, and the company has released its own agent engine, Lingxi Engine.

3. Sunway Cofor Industry Segment: Chemical engineering Profitability: ROE 10.63%, Gross Margin 39.57%, Net Margin 24.18% Performance Forecast: ROE has risen consecutively for the past three years to 11.98%, with the latest forecast average at 13.17% Main Product: New materials and synthetic material process solutions are the primary source of income, accounting for 68.30% of total revenue with a gross margin of 43.71% Company Highlights: Sunway Cofor has utilized industrial AI technology to encapsulate process know-how into industry-specific apps and developed the "Chemical Fiber Industry Agent Solution V1.0" product based on the "end-edge-cloud" collaborative architecture.

2. Doushen Education Industry Segment: Education operation and others Profitability: ROE 20.20%, Gross Margin 31.32%, Net Margin 2.67% Performance Forecast: The highest ROE in the past three years was 20.20%, with the latest forecast average at 11.89% Main Product: Education products and management solutions are the primary source of income, accounting for 86.84% of total revenue with a gross margin of 42.73% Company Highlights: Doushen Education has formed a joint venture with Zhipu Huazhang and Hainan Hezun, focusing on AI education products.

1. Xinguodu Industry Segment: Other computer equipment Profitability: ROE 10.59%, Gross Margin 28.62%, Net Margin 8.83% Performance Forecast: ROE has fluctuated between 1% and 22% in the past three years, with the latest forecast average at 12.39% Main Product: Acquiring and value-added services are the primary source of income, accounting for 68.73% of total revenue with a gross margin of 42.38% Company Highlights: A subsidiary of Xinguodu has focused on the research and development of general-purpose AI agents, having released its first AI "digital employee" product. Top 10 AI Agent Companies by Profitability: ROE, Gross Margin, and Net Margin in the Past Three Years: