NVIDIA remains the backbone, just nearing peak firepower

![]() 11/21 2024

11/21 2024

![]() 566

566

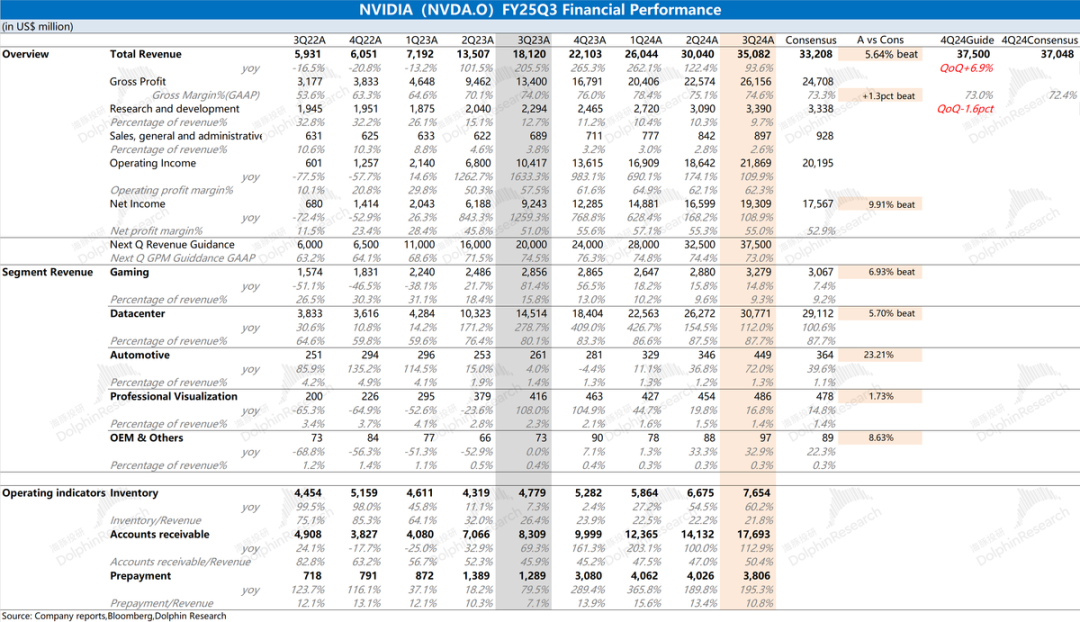

NVIDIA (NVDA.O) released its third-quarter fiscal 2025 financial results (ending October 2024) after market close on November 21, Beijing time. Details are as follows:

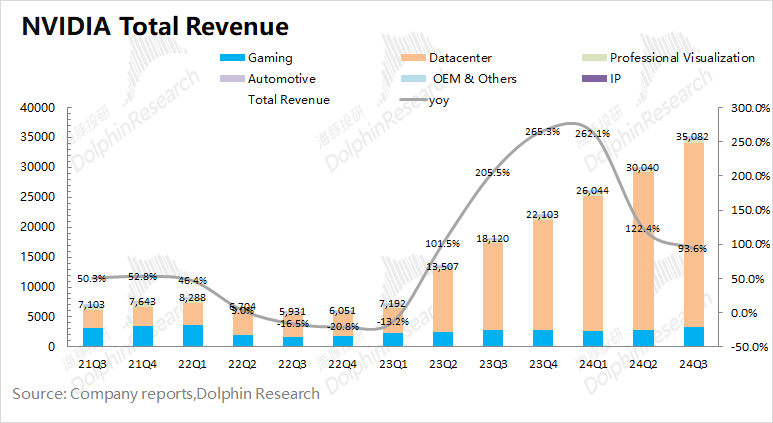

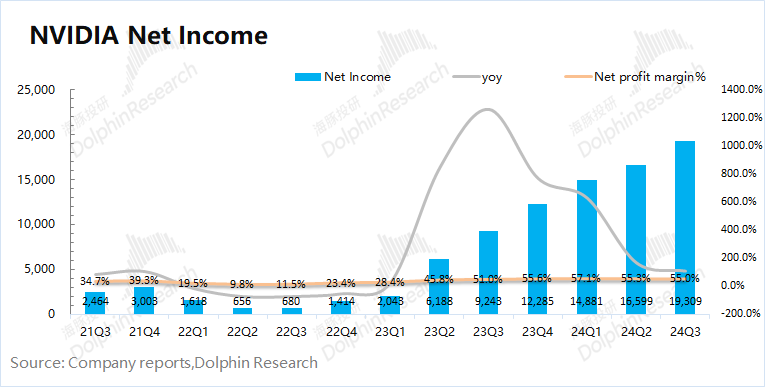

1. Overall Performance: Revenue continues to grow, with gross margin under short-term pressure. NVIDIA reported revenue of $35.08 billion this quarter, up 93.6% year-over-year, better than Bloomberg's consensus estimate of $33.2 billion. Revenue growth was mainly driven by increased demand for data center services. NVIDIA achieved a gross margin (GAAP) of 74.6% this quarter, better than the Bloomberg consensus estimate of 73.3%. However, due to factors such as inventory preparation for new products like Blackwell, the company's gross margin experienced a phased decline. Net profit for this quarter was $19.3 billion, up 109% year-on-year, setting a new record for profit.

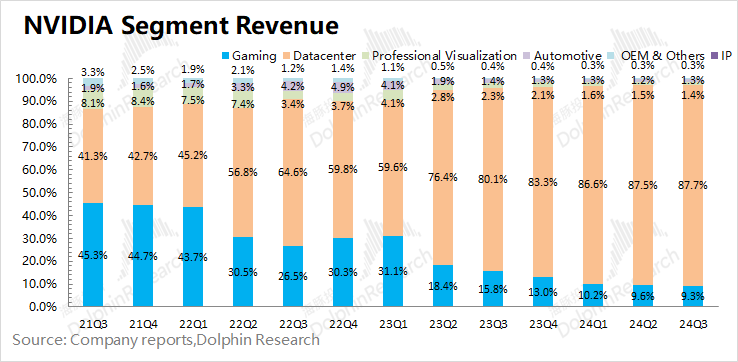

2. Core Business: NVIDIA is a big winner in AI. Data center business accounted for 87.7% of the company's revenue and is currently its core business.

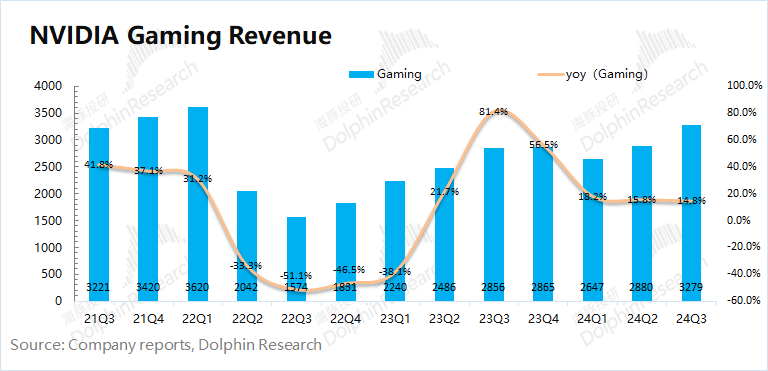

1) Gaming business grew 14.8% year-over-year this quarter, continuing its recovery. Dolphin believes that the growth in NVIDIA's gaming business this quarter was mainly due to an increase in the company's gaming graphics card market share. Considering the 0.9% year-over-year growth in the global PC market this quarter and the significant decline in AMD's gaming business during the same period, NVIDIA benefited mainly from its RTX product shipments exceeding expectations this quarter.

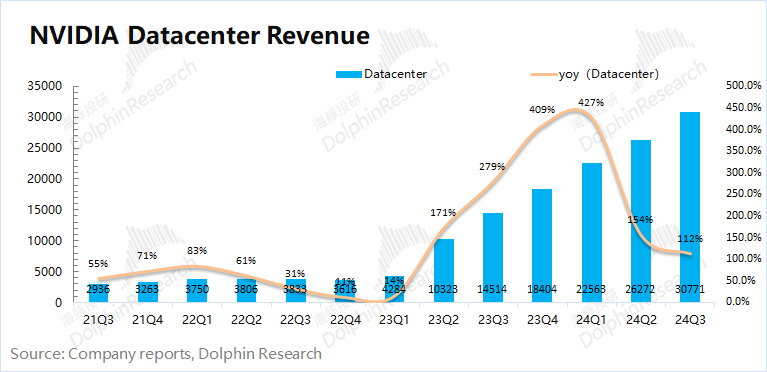

2) Data center business grew 112% year-over-year this quarter, mainly driven by demand for large models, recommendation engines, and generative AI. Business growth was facilitated by increased capital expenditures from cloud service providers. With the shipment of Blackwell in the next quarter, the company's related revenue is expected to continue to grow.

3. Key Financial Indicators: Operating profit margin remains stable. NVIDIA's operating expense ratio continued to decline to 12.3% this quarter, with revenue growth offsetting cost increases. Inventory currently accounts for a still historically low proportion, indicating that demand for the company's current products remains healthy.

4. Next Quarter Guidance: NVIDIA expects revenue of $37.5 billion (plus or minus 2%) in the fourth quarter of fiscal 2025, representing a year-over-year increase of 69.7% and exceeding the Bloomberg consensus estimate of $37 billion. The company expects a gross margin of 73% (plus or minus 0.5%) in the fourth quarter, better than the Bloomberg consensus estimate of 72.4%.

Dolphin's Overall View: NVIDIA's financial report this time is quite good.

The company's revenue this quarter continued to exceed guidance by "+$2 billion," and the gross margin also met expectations. All business segments of the company showed varying degrees of growth this quarter, with the data center and gaming businesses contributing significantly to the company's growth. With downstream cloud providers continuing to increase capital expenditures, the company's data center business grew to over $30 billion, accounting for nearly 90% of the company's total revenue. As the company's business scale expands, although the absolute values of expenses such as research and development and sales have increased, the expense ratio continues to decline. Overall operating expenses are still developing healthily.

After achieving the regular "+$2 billion" beat in guidance, the market is paying more attention to the company's guidance for the next quarter. In the company's guidance for the next quarter, revenue is expected to be $37.5 billion, with a gross margin of 73%. The company's next quarter performance will be mainly driven by the mass production of Blackwell, while the initial ramp-up will have a certain impact on gross margin. The overall guidance and pace are close to market buyers' expectations (between $37.5 billion and $38 billion).

NVIDIA's stock price has recently risen mainly due to three favorable factors: 1) The company replaced Intel in the Dow Jones Industrial Average in November; 2) Jen-Hsun Huang and the market further confirmed that the company's fourth-quarter Blackwell mass production schedule is progressing as planned, alleviating previous market concerns about Blackwell; 3) The company's strategy in PC is expected to introduce related PC products to the consumer market in 2025, potentially bringing new growth to the company.

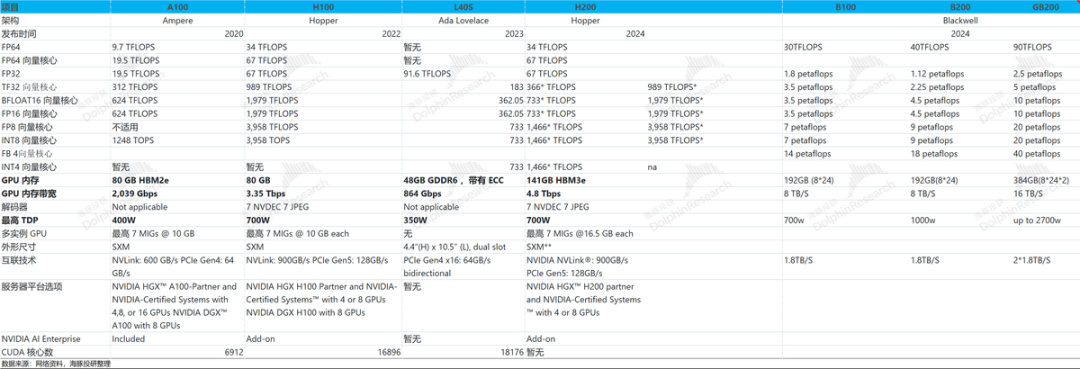

Additionally, regarding Blackwell, which is of current market interest, servers equipped with Blackwell by Hon Hai, Quanta, and Dell are expected to be shipped by the end of 2024. The company's management has also raised its guidance, exceeding previous expectations of "several billion dollars" in Blackwell revenue in the fourth quarter (previous market expectations were between $3 billion and $5 billion).

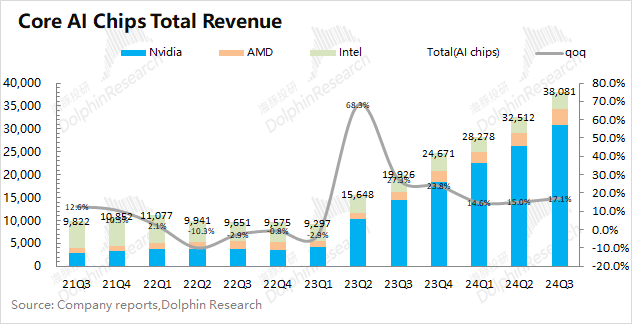

In terms of short-term performance, the market's focus is on the data center business, which accounts for nearly 90% of revenue. The company's data center business continued to show strong growth this quarter, accounting for 80.8% of revenue in the core AI chip market for data centers, far surpassing AMD and Intel.

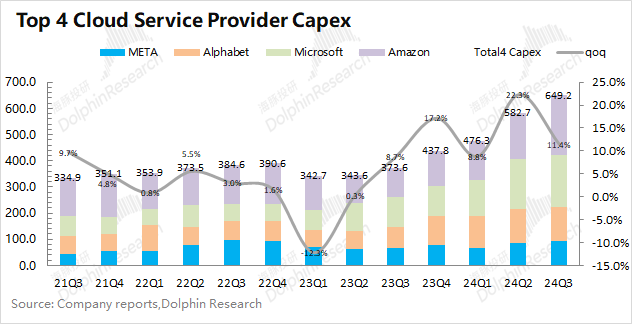

As the revenue from AI chips for data centers mainly depends on the capital expenditures of downstream cloud providers. Considering the situation of the four major cloud providers (Meta, Google, Microsoft, and Amazon), Dolphin expects their combined capital expenditures to reach $69.6 billion in the next quarter, representing a 7.2% quarter-on-quarter increase. Compared with AMD's weak guidance, the majority of market growth has been captured by NVIDIA, and the company's share in the AI chip market is expected to further increase in the next quarter.

Overall, NVIDIA's financial report this time is quite good. The company's guidance for the next quarter, which is the market's focus, generally meets buyers' expectations (between $37.5 billion and $38 billion). As the market is accustomed to the company's regular "+$2 billion" beat, fourth-quarter revenue is actually expected to reach around $40 billion. The upward revision of Blackwell revenue is slightly better than originally expected. With the expected high investment from cloud providers in the next fiscal year and the company's new Blackwell product, Dolphin expects the company's current stock price to correspond to a profit multiple of around 33 times PE for the next fiscal year, which is acceptable to the market. After the previous rally, as this financial report did not bring significant highlights, the stock price did not experience further gains.

Here is a detailed analysis:

I. Core Performance Indicators: Revenue Continues to Grow, with Gross Margin Under Short-Term Pressure

1.1 Revenue: NVIDIA reported revenue of $35.08 billion in the third quarter of fiscal 2025, up 93.6% year-over-year and better than the Bloomberg consensus estimate of $33.2 billion. The company's revenue continued to increase this quarter, mainly driven by growth in downstream data center and gaming businesses.

Looking ahead to the fourth quarter of fiscal 2025, the company's revenue is expected to continue to grow. NVIDIA expects fourth-quarter revenue of $37.5 billion (plus or minus 2%), representing a year-over-year increase of 69.7% and exceeding the Bloomberg consensus estimate of $37.05 billion. The revenue growth is mainly driven by the mass production of Blackwell in the data center business. Previously, mainstream market buyers expected revenue between $37.5 billion and $38 billion, and this guidance is relatively close, basically meeting expectations. Additionally, Blackwell's revenue in the fourth quarter will be better than the company's previous guidance of "several billion dollars."

1.2 Gross Margin (GAAP): NVIDIA achieved a gross margin (GAAP) of 74.6% in the third quarter of fiscal 2025, better than the Bloomberg consensus estimate of 73.3%. The company's current gross margin is mainly affected by the data center business, with factors such as low-volume inventory preparation for Blackwell materials impacting it this quarter.

The company believes that the medium- and long-term gross margin for Blackwell products will still reach around 75%. Therefore, as Blackwell's mass production accelerates, the company's overall gross margin is also expected to rebound. However, during the current ramp-up phase, the gross margin will be affected to some extent.

NVIDIA expects a gross margin of 73% (plus or minus 0.5%) in the fourth quarter of fiscal 2025, better than the Bloomberg consensus estimate of 72.4%. Driven by demand for AI and other applications, the company's gross margin center has increased from 65% to above 70%. Judging from the company's continuously improving guidance, the company's data center business orders remain full, and product prices are relatively stable. However, during the current inventory preparation and ramp-up phase for Blackwell, the company's gross margin will be under short-term pressure.

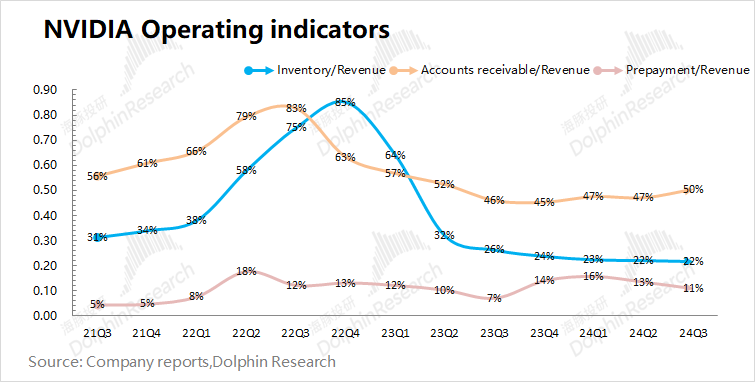

1.3 Operating Indicators

1) Inventory/Revenue: The ratio was 22% this quarter, remaining flat quarter-over-quarter. The company's inventory rebounded to $7.6 billion this quarter, with a portion allocated for Blackwell product inventory. Compared to the company's high-growth revenue, the proportion of inventory remains at a historically low level. Considering the company's continuously improving growth guidance, the company's products are still in short supply, and the gross margin will continue to remain at a relatively high level;

2) Accounts Receivable/Revenue: The ratio was 50% this quarter, showing an increase. The proportion of accounts receivable is also relatively low, indicating that the company's collection situation is still good.

II. Core Business: NVIDIA is a Big Winner in AI

Driven by demand for AI and other applications, NVIDIA's data center business continued to expand its share of the company's revenue in the third quarter of fiscal 2025, reaching 87.7% this quarter. The share of the gaming business was squeezed to less than 10%, making the data center business the most important factor affecting the company's performance.

2.1 Data Center Business: NVIDIA's data center business generated revenue of $30.77 billion in the third quarter of fiscal 2025, up 112% year-over-year. The data center business is the market's primary focus, with this quarter's growth mainly driven by demand for the Hopper GPU computing platform, which is used for training and inference of large language models, recommendation engines, and generative AI applications. The company's year-over-year growth this quarter was driven by both computing and networking demand.

Breaking it down: Computing revenue within the company's data center business was $27.6 billion, up 132% year-over-year; networking revenue was $3.1 billion, up 20% year-over-year, benefiting from Ethernet for AI, including the Spectrum X end-to-end Ethernet platform.

For the new product Blackwell, the company has successfully completed mask changes to increase related production. Blackwell's production and shipment schedule begins in the next quarter and will continue to increase in the following fiscal year. (This aligns with previous market expectations that servers equipped with Blackwell by Hon Hai, Quanta, and Dell will be shipped by the end of 2024.)

The company will ship Hopper and Blackwell systems in the fourth quarter of fiscal 2025 (November 2024 to January 2025) and beyond. Both Hopper and Blackwell systems have certain supply constraints, and the company expects demand for Blackwell to exceed supply over several quarters in the next fiscal year.

As cloud service providers currently account for approximately 50% of the company's data center revenue, their capital expenditures have a direct impact on the company's data center business. Considering the capital expenditures of the four major cloud providers (Meta, Google, Microsoft, and Amazon), their combined capital expenditures reached $64.9 billion this quarter, up 73.8% year-over-year. Considering the 112% year-over-year growth rate of the company's data center business, NVIDIA's share of capital expenditures from core cloud providers continues to increase. The continuous increase in capital expenditures by these giants provides a guarantee for the growth of the company's data center business.

Looking at the expected capital expenditures for the next quarter, the combined capital expenditures of the four companies are expected to be approximately $69.6 billion, up 59% year-over-year and 7.2% quarter-over-quarter. Meanwhile, AMD has provided relatively weak AI guidance. Dolphin believes that core companies will increase their procurement of NVIDIA products in the next quarter and begin shipping new Blackwell products, potentially further enhancing NVIDIA's market position in AI chips (current share: 80.8%). This also provides significant incremental support for the company's guidance of $37.5 billion for the next quarter.

2.2 Gaming Business: NVIDIA's gaming business generated revenue of $3.28 billion in the third quarter of fiscal 2025, up 14.8% year-over-year. This growth was mainly due to increased sales of GeForce RTX 40 series GPUs and gaming console SOCs.

Considering AMD's performance, Dolphin believes that NVIDIA significantly gained more market share this quarter. AMD's gaming business declined 69.3% year-over-year this quarter, totaling only $462 million. In contrast, NVIDIA continued to grow year-over-year, allowing the company to gain more independent graphics card market share.

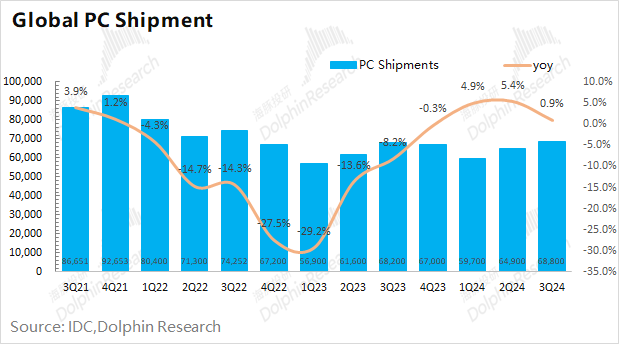

In addition, the overall performance of the PC market will also impact the company's gaming business. According to the latest IDC data, global PC shipments in the third quarter of 2024 reached 68.8 million units, a year-on-year increase of 0.9%. With the overall recovery of the PC market, there will be direct benefits for AMD and Intel's PC businesses. Since gaming graphics cards are primarily installed on PCs, this also has a driving effect on discrete graphics cards. Recently, AMD's gaming business has continued to decline, while NVIDIA's gaming business has been growing continuously, and the company's share in the discrete graphics card market has also increased.

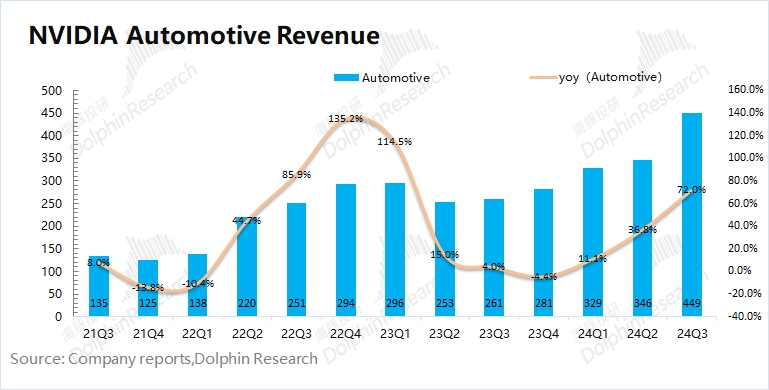

2.3 Automotive Business: In the third quarter of fiscal year 2025, NVIDIA's automotive business generated revenue of $449 million, a year-on-year increase of 72%. NVIDIA's automotive business is mainly driven by its autonomous driving platform.

Although the company's automotive business has shown significant growth, it currently accounts for a very small proportion of revenue (less than 2%). NVIDIA's current performance is still primarily focused on its data center and gaming businesses.

III. Key Financial Indicators: Stable Operating Profit Margin

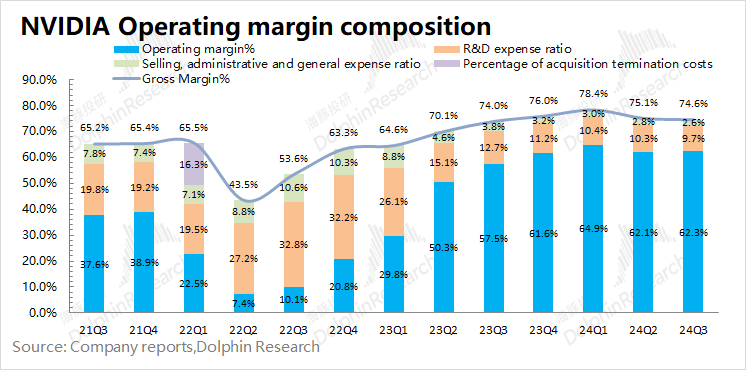

3.1 Operating Profit Margin

In the third quarter of fiscal year 2025, NVIDIA's operating profit margin was 62.3%, remaining stable quarter-on-quarter. The decline in the company's expense ratio this quarter offset the quarter-on-quarter decline in gross margin, resulting in a stable operating profit margin.

Analyzing the components of the operating profit margin, the specific changes are as follows:

'Operating Profit Margin = Gross Margin - R&D Expense Ratio - Sales, Administrative, and Other Expense Ratio'

1) Gross Margin: 74.6% this quarter, a decrease of 0.5 percentage points quarter-on-quarter. Due to factors such as inventory reserves of new materials for Blackwell products, the company's gross margin was under pressure;

2) R&D Expense Ratio: 9.7% this quarter, a decrease of 0.6 percentage points quarter-on-quarter. The absolute value of the company's R&D expenditure increased, but due to the rapid growth in revenue, the expense ratio declined again;

3) Sales, Administrative, and Other Expense Ratio: 2.6% this quarter, a decrease of 0.2 percentage points quarter-on-quarter. Although the absolute value increased, the company's sales expense ratio remains relatively low.

The company's guidance for operating expenses in the fourth quarter of fiscal year 2025 continues to rise to $4.8 billion, but compared to the growth in revenue, the operating expense ratio is expected to remain at around 12.8% next quarter. With high-speed growth in revenue, the expense ratio is in a healthy state.

3.2 Net Profit (GAAP) Margin

In the third quarter of fiscal year 2025, NVIDIA's net profit was $19.3 billion, a year-on-year increase of 109%. The net profit margin for this quarter was 55%, a quarter-on-quarter decline. While the company's revenue continued to grow this quarter, and operating expenses continued to decline, these two factors largely offset each other. Although the net profit margin declined, the company's operating profit margin remained stable at a high level.

Earnings Season

August 29, 2024 Earnings Review "NVIDIA: AI Faith Collapses, Mysterious Potion Turning Poisonous?"

May 23, 2024 Earnings Review "NVIDIA: The Strongest Stock in the 'Universe,' Non-Stop Gift Bombs"

February 22, 2024 Earnings Review "NVIDIA: AI Stands Out, the True King of Chips"

November 22, 2023 Earnings Review "NVIDIA: Computing Power Tsar at Full Throttle? 'Phantom Heat' Glimmers"

August 24, 2023 Earnings Review "NVIDIA: Another Explosion, the 'Solo' of the AI King"

May 25, 2023 Earnings Review "Explosive NVIDIA: A New Era of AI, the Future Has Arrived"

February 23, 2023 Earnings Review "Surviving the Cycle, Meeting ChatGPT, NVIDIA's Faith Returns"

November 18, 2022 Earnings Review "NVIDIA: Profits Slashed by 70%, When Will the Turning Point Come?"

August 25, 2022 Earnings Review "NVIDIA in a Quagmire, Reliving 2018?"

May 26, 2022 Earnings Review "'Pandemic Fat' Gone, NVIDIA's Appearance Tarnished"

February 17, 2022 Earnings Review "NVIDIA: Hidden Concerns Behind Exceeding Expectations | Reading Financial Statements"

November 18, 2021 Earnings Review "Computing Power Profits Explode, Metaverse Boost, Will NVIDIA Continue to Soar?"

In-Depth

June 6, 2022 "U.S. Stock Market Turmoil, Were Apple, Tesla, and NVIDIA Wrongly Punished?"

February 28, 2022 "NVIDIA: High Growth is True, but Lacking in Cost-Effectiveness"

December 6, 2021 "NVIDIA: Valuation Cannot Rely Solely on Imagination"

September 16, 2021 "NVIDIA (Part 1): How Was a 20-Fold Growth Chip Giant Forged in Five Years?"

September 28, 2021 "NVIDIA (Part 2): Dual-Wheel Drive No More, Will a Double Davis Kill Come?"