Topstar has 'concerns' despite being listed on the Dragon and Tiger List five times in the past month and soaring with the Huawei robot concept

![]() 11/22 2024

11/22 2024

![]() 604

604

Lanjing News, November 21 (Reporter: Zhai Zhichao) - Recently, Topstar (300607.SZ) has seen outstanding performance in the A-share market, hitting the daily limit for two consecutive days with a 20% surge, instantly attracting the attention of many investors.

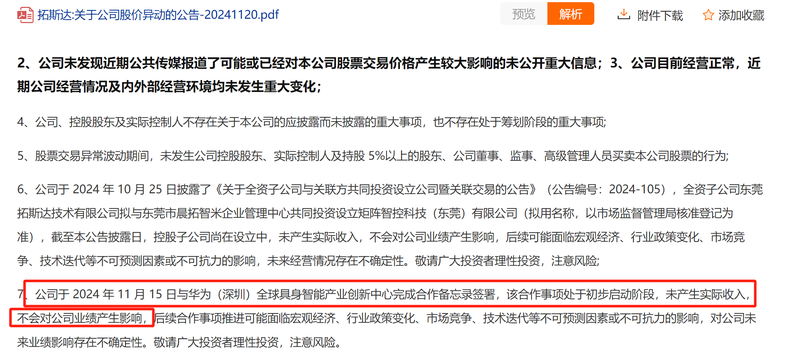

However, just as the stock price soared, the company's "cooling" announcement followed. On the evening of November 20, Topstar issued an announcement on abnormal stock price fluctuations, stating that the cumulative deviation of closing prices on November 19 and 20 exceeded 30%, constituting abnormal stock price fluctuations. Investors are advised to be cautious of risks.

Lanjing News reporters noted that in addition to routine explanations regarding undisclosed matters, the company's announcement also provided details on its recent cooperation with Huawei in robotics and its recent advancements in artificial intelligence.

Undeniably, the surge in the company's stock price is highly likely related to its collaboration with Huawei. Meanwhile, various speculative funds have frequently appeared during Topstar's rapid stock price climb, becoming a significant factor in pushing up its share price.

Furthermore, Huawei's preference for Topstar may be associated with its active layout in the robotics sector. However, Lanjing News discovered that amidst the soaring stock price and robust promotion of robotics business, there are aspects that the market should view with caution.

Who are the "drivers" behind the soaring stock price?

From the secondary market perspective, Topstar's stock price has been soaring recently. According to Choice Financial Terminal, the company's stock price hit the daily limit for two consecutive days on November 19 and 20, with a combined increase of 40%. On November 21, the company's stock price hit a record high of 32.95 yuan during the session. By the end of the day, the stock price closed at 32.08 yuan, up 5.08%, with a total market value of 14.5 billion yuan.

Image source: Choice Financial Terminal

The reporter found that behind the soaring stock price, the strong support effect brought by the Huawei concept and the active participation of various speculative funds are likely the two key factors.

On November 15, Topstar signed a memorandum of understanding with Huawei's (Shenzhen) Global Embodied Intelligence Industry Innovation Center. Although the current cooperation is still in its preliminary stages and has not yet translated into actual revenue contributions, as a global technology giant, Huawei's influence in the industry and its exceptional ability to integrate market resources have outlined an imaginative blueprint for Topstar's future development, according to the announcement.

Image source: Topstar announcement

Especially in the popular and highly potential field of humanoid robots, the cooperation between the two parties has filled market investors with anticipation for Topstar's technological innovations, product competitiveness enhancement, and market share expansion. This optimistic expectation has become a powerful undercurrent driving the continuous rise of Topstar's stock price.

It is understood that Huawei's Embodied Intelligence Center has signed memoranda of understanding with a total of 16 enterprises, including well-known technology enterprises such as Han's Laser, Zhongjian Technology, and Zhaowei Machinery and Electronics, in addition to Topstar. After the announcement of these signings, the stock prices of the aforementioned A-share companies were stimulated to varying degrees on the same day.

Furthermore, the figures of various speculative funds have frequently appeared during Topstar's stock price surge, becoming an indispensable driving force. For example, Huaxin Securities Co., Ltd.'s Shanghai Wanping South Road Securities Business Department, a well-known speculative fund, made a net purchase of 44.1625 million yuan on November 20. Other heavy investors included Guotai Junan Securities' Shanghai Haiyang West Road Securities Business Department and Shenzhen-Hong Kong Stock Connect.

From a longer-term perspective, in the past month, Topstar has been listed on the Dragon and Tiger List five times. Active trading has been observed at the Dongfang Fortune Securities Lhasa East Ring Road First Securities Business Department, Shenzhen-Hong Kong Stock Connect, Huatai Securities Beijing East Third Ring Road North Securities Business Department, among others.

Lai Dong, an investment advisor at Jinyuan Securities, told Lanjing News reporters that speculative funds are adept at creating market buzz, attracting many small and medium-sized investors to follow suit. When market sentiment is fully mobilized, a large influx of funds creates strong buying support, driving the stock price to surge.

Why has Huawei favored Topstar amid fierce industry competition?

In the current wave of technological advancements, competition in the robotics sector is intensifying, with both domestic and foreign enterprises actively laying out their strategies. What unique qualities does Topstar possess to stand out in Huawei's rigorous selection process? To delve deeper into the reasons behind this, it is crucial to review Topstar's past business trajectory.

Founded in 2007, Topstar initially focused on the production and sales of injection molding machine auxiliary equipment. At that time, the domestic injection molding machine market relied heavily on imported robotic arms, which were not only expensive but also inconvenient due to the need to order parts from abroad for after-sales maintenance. Topstar keenly captured this market pain point, established a research and development team in 2010 to tackle technical challenges, and successfully launched the country's first domestically developed manipulator control system the following year. With this product, Topstar quickly gained a foothold in the domestic market.

However, as market competition intensified and industry dynamics changed, Topstar's single injection molding machine auxiliary equipment business faced a growth bottleneck. To seek broader development opportunities, Topstar began transitioning into the robotics field. In 2022, Topstar successfully launched two new products - the gmu600 overhead crane-type five-axis linkage machining center and the dmu300 vertical five-axis linkage machining center, demonstrating its strong R&D and manufacturing capabilities in the high-end CNC machine tool sector and further consolidating its position in the industrial manufacturing field. That same year, it became the first listed company in the robotics industry in Guangdong Province.

In fact, Topstar may have close cooperation with Huawei. Previously, Topstar stated on an interactive platform that the company provides industrial robot products to Huawei and its suppliers and engages in exchanges and verifications related to underlying control, AI industrial robots, embodied intelligence, and other related technologies.

Although Topstar claims to value research and development, its R&D expenses have shown a declining trend. From 2020 to 2023, the figures were 161 million yuan, 142 million yuan, 130 million yuan, and 138 million yuan, accounting for 5.2%, 4.8%, 2.61%, and 2.3% of revenue, respectively.

Compared to peer companies, Topstar's R&D investment is also relatively low. Taking Huazhong Numerical Control as an example, its R&D investment has accounted for more than 15% of sales revenue for many years, while Topstar's R&D expenses accounted for only 3.3% of revenue in the first half of 2024. Looking at Estun Automation, the company invested approximately 300 million yuan in R&D in the first three quarters of 2024, while Topstar's R&D investment was only around 85 million yuan during the same period.

In response, a Lanjing News reporter called Topstar's board secretary office posing as an investor. A staff member explained that the overall decrease in R&D expenses might be due to reduced expenses in certain business areas, but R&D expenses for robotics have not decreased.

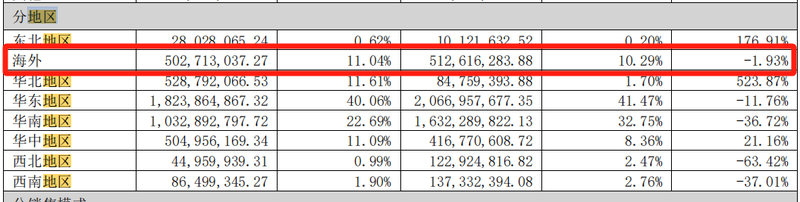

It is worth noting that the 2023 annual report revealed that Topstar's market share is mainly concentrated in the domestic market, with relatively little influence in the international market. Industry insiders pointed out that as competition in the global robotics market intensifies, Topstar faces significant challenges in expanding into international markets due to differing cultures, regulations, and market environments. The pace and effectiveness of its international expansion remain to be seen.

Image source: 2023 annual report

Transformation pains persist

The third-quarter report shows that in the first three quarters of 2024, the company continuously adjusted its business structure, deepening its focus on products and shrinking project-based operations as part of its transformation strategy. In fact, Topstar's transformation strategy began at the end of 2021. That year, the company established its strategic positioning as an "intelligent hardware platform driven by core technology" and identified industrial robots, injection molding machines, and CNC machine tools as its three core products.

Although the company's transformation strategy has been in place for nearly three years, transformational pressures remain. Financial data shows that in the first three quarters of this year, the company's total operating revenue was 2.235 billion yuan, a year-on-year decrease of 30.96%, and its net profit attributable to shareholders was 9.0237 million yuan, a year-on-year decrease of 92.99%. The overall gross margin was 20.31%, a decrease of 0.83 percentage points year-on-year.

The company stated that the primary reason for the revenue decline was the company's continued proactive reduction of project-based business, with revenue from smart energy and environmental management systems decreasing by 42.53% and revenue from automation application systems decreasing by 25.74%. The primary reason for the profit decline was the significant drop in the scale and profitability of the smart energy and environmental management systems business. Excluding this business, the gross margin of the company's other businesses was 37.78%, an increase of 3.94 percentage points year-on-year, with gross profit contributions accounting for 90.23%, an increase of 29.17 percentage points year-on-year.

Crucially, the strategic transformation has also placed certain financial pressures on Topstar. During the transformation process, the company needs to invest significant funds in research and development, production facility construction, and market expansion, leading to an increase in its asset-liability ratio. From 2020 to 2023, the company's asset-liability ratios were 46.48%, 63.95%, 63.79%, and 64.54%, respectively.

Against this background, the company's capital position is also tight. As of the end of September this year, the company had 841 million yuan in monetary funds, 567 million yuan in short-term borrowings, 1.4 billion yuan in accounts payable, and a total of 3.043 billion yuan in current liabilities.

So, when will the pain of transformation end? A staff member from Topstar's board secretary office told Lanjing News reporters that due to the payment terms for project-based business, the environment in 2024 remains challenging, and there are many uncertainties regarding when the pain of transformation will end.