Kimi falls into an Ofo-like situation, will Yang Zhilin be the next Dai Wei?

![]() 11/25 2024

11/25 2024

![]() 570

570

"Similarly, both are rising stars in entrepreneurship from prestigious universities, emerging from popular industries, and involved in capital games among large companies... The situations of Kimi and Yang Zhilin seem to be a microcosm of Ofo and Dai Wei years ago."

@TechNewKnow Original

Kimi's founder Yang Zhilin, embroiled in arbitration disputes, seems to be using his own methods to restore his public image.

On November 16, Yang Zhilin unveiled a mathematical model, k0-math, claiming to be on par with OpenAI's o1 series and emphasizing in-depth thinking. During the press conference, Yang Zhilin transformed into a technical explainer, showcasing k0-math's capabilities from various aspects. For two consecutive months, Kimi seems to have pressed the accelerator, continuously enhancing its performance and product strength.

The message Yang Zhilin intends to convey is simple and direct: Kimi is still technologically advanced, and behind this is his implicit message of continuing to gain the trust of capital. From a purely capital perspective, several large companies are already at Kimi's table.

Entering 2024, Yang Zhilin seems to have been on a rollercoaster ride. In March, Kimi quickly gained popularity due to its long-text capabilities, with monthly traffic growth reaching 321.58%, even causing server crashes. This peak didn't last long. Subsequently, in April, rumors spread that Yang Zhilin had cashed out $40 million, and although the company strongly denied these rumors, it seemed that the entanglement between Kimi and capital had begun to surface. In May, Alibaba disclosed its financial report, revealing an investment of approximately $800 million in Kimi, acquiring a 36% stake. In August, another major company, Tencent, entered the picture, assisting Kimi in completing its Series B funding round.

Under the spotlight, Yang Zhilin doesn't lack resources, but disputes behind the glamor have accelerated since then.

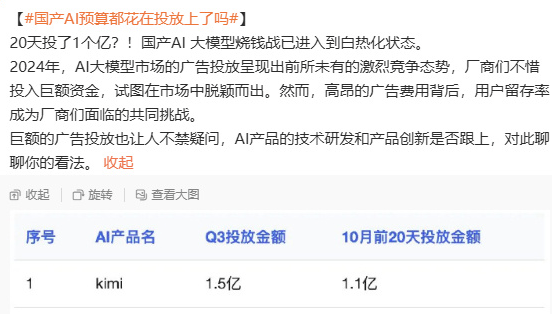

In October, Kimi trended on social media for burning through $100 million in just 20 days. Public opinion criticized Kimi for not pursuing technological breakthroughs but instead focusing solely on user growth. Subsequently, the soaring valuation backed by large companies triggered an arbitration dispute within the founder's team, once again placing Kimi and Yang Zhilin at the center of public scrutiny.

Of course, the troubles don't stop there. On the business front, in the latest reports, Yang Zhilin has cut off diversified development, returning from multiple products to focus solely on Kimi, which he personally admits is the biggest lesson he's learned in recent years. "Cutting businesses is essentially controlling headcount. Among these large model startups, we have always maintained the smallest team and the highest ratio of cards to people, which I believe is crucial."

Yang Zhilin has been cautious and prudent, but in the rapidly evolving industry and amidst the intricate capital landscape, he still seems inadequate. Shifting industry trends, equity disputes, management strategies, and capital games all seem to be variables affecting the company's development.

Founders who invariably talk about AGI are constantly struggling between technological ideals and business realities. The colossal failure of bike-sharing years ago has already taught entrepreneurs that when technology changes enter a plateau period and efficiency becomes paramount, the influence and competition for startups from large companies and capital will intensify once again.

In the more fiercely competitive overseas market, a large number of AI startups are facing broken funding chains and the fate of being absorbed. For domestic players, this serves as a warning. Kimi is undoubtedly walking on a tightrope, and whether it can successfully make it ashore seems shrouded in mystery at present.

01

Elimination rounds accelerate, and Kimi fights battles it's not good at

Entering 2024, the AI sector has begun to diverge significantly. As NVIDIA continues to set new highs and large companies begin to realize profits, a large number of once-celebrated AI startups are facing crises.

The renowned Stability AI, famous for its text-to-image models and having raised a total of $320 million in funding, once found itself in a dilemma of core R&D exodus, financial difficulties, and desperate sales attempts, only to be bailed out by a former Facebook president's investment; Afiniti, valued at $1.8 billion in its Series D round in 2017, recently filed for bankruptcy protection; Forward health, a vertical AI medical unicorn with a Series E valuation of $1 billion, suddenly announced the cessation of operations recently.

Once celebrated startups have fallen into commercialization dilemmas after their initial glamor. The allure of technological breakthroughs is constantly being tested by the market. Even more cruelly, from a final perspective, even if a star company is acquired, the premium is quite limited.

"Inflection was once a unicorn company, with Microsoft investing approximately $1.5 billion. Recently, almost the entire team was poached by Microsoft. With a market value of $3 trillion, Microsoft acquired a company and only provided investors with a return of principal plus interest," said well-known investor Zhu Xiaohu recently.

The fierce elimination rounds have made commercialization capabilities the main narrative for AI companies today. Returning to Kimi itself, commercialization pressure seems to have never ceased.

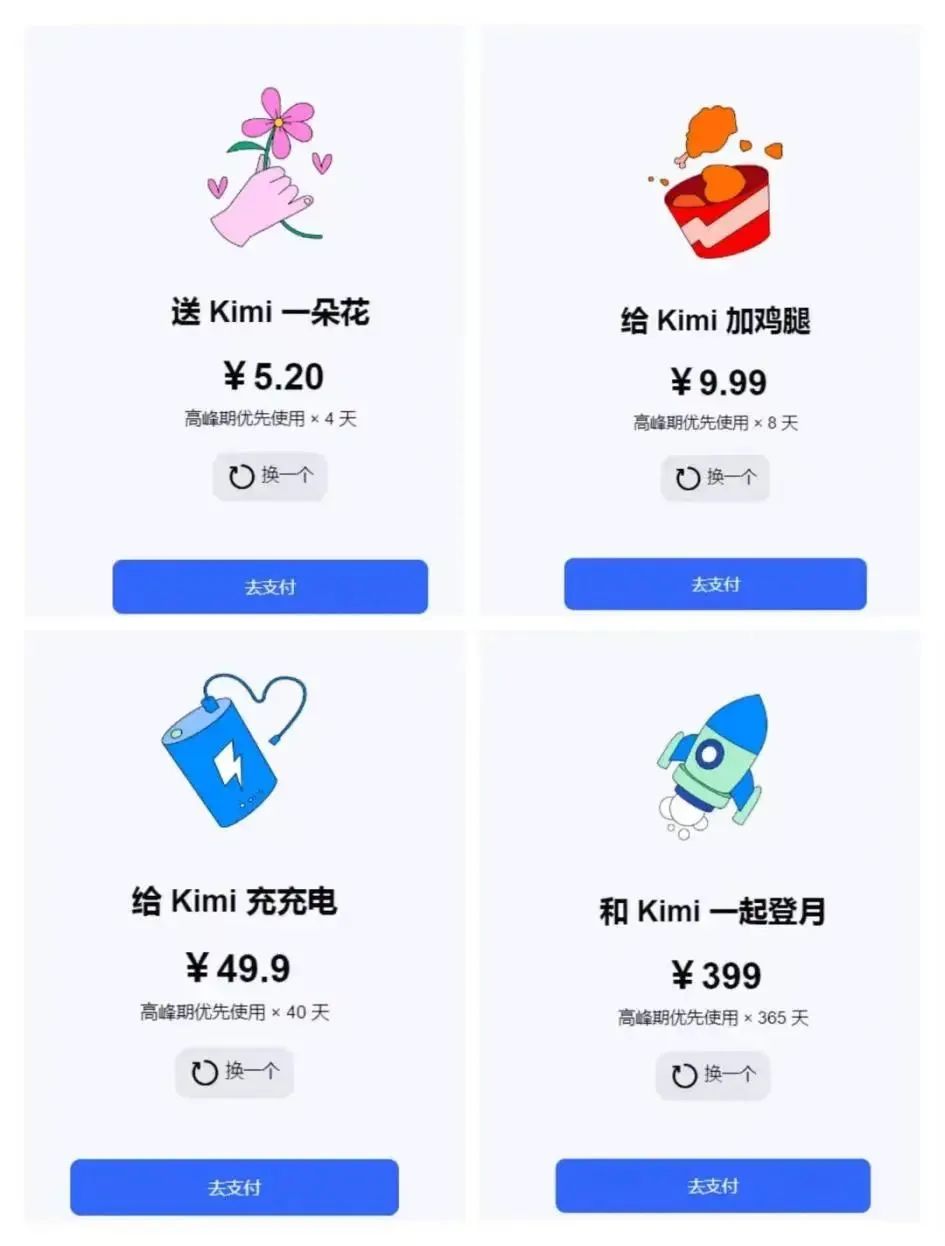

This year, Kimi has made multiple attempts at commercialization. In May, Kimi introduced a tipping feature, allowing users to pay amounts ranging from $5.20 to $399 to purchase gifts, thereby gaining different peak-hour priority usage times. On July 8, Kimi launched a browser extension, attempting to explore potential commercialization opportunities by enriching application scenarios. In August, Kimi released an enterprise-grade API, primarily targeting enterprises with a certain scale of business, providing API services to large enterprise customers with higher stability requirements. According to media reports, this was a crucial signal that Kimi was shifting from focusing solely on ToC applications to also embracing ToB business.

However, from the results, these attempts are difficult to support the company's development in the short term. With insufficient self-sufficiency, Kimi subsequently changed its strategy and began seeking growth. As a result, a large budget was spent on advertising to attract and retain new users. From recent statements, Yang Zhilin claims that Kimi's monthly active users have reached over 36 million. This figure still seems to show the market that the AI sector, especially Kimi, is disruptive to the current internet ecosystem.

Commercialization and growth falling short of expectations seem to be a downward spiral that continues to plague Kimi. The emergence of arbitration disputes also seems to reflect the capital market's anxiety about the company from the side. Industry insiders speculate that the successive entries of large companies, to some extent, reflect the founder's strategy of checking and balancing shareholders, which means that Kimi's development over the past year has seemingly fallen short of expectations.

02

How to escape the fate of being abandoned like Ofo?

Similarly, both are rising stars in entrepreneurship from prestigious universities, emerging rapidly from popular industries, and involved in power games among large companies' capital. Today, the dilemmas faced by Kimi and Yang Zhilin seem to echo those of Ofo and Dai Wei years ago. Such dilemmas can be ignited with just a spark.

From a technological perspective, although AI is rapidly evolving, the gap is narrowing among domestic large model enterprises.

Taking Kimi's most prized long-text capability as an example, in March, Alibaba announced the opening of its Tongyi Qianwen's 10 million-word long-text capability, allowing users to quickly read research reports, analyze financial statements, read academic papers, judge case situations, read medical reports, interpret legal provisions, and more through the Tongyi Qianwen website and APP. Also in March, 360 announced the official beta testing of its 360 Brain's 5 million-word long-text processing function, which will soon be available on the 360 AI browser. In April, Baidu's ERNIE Bot opened its 2 to 5 million-word long-text capability.

However, both the Kimi Exploration Edition and k0-math are currently in beta testing and difficult to apply on a large scale. Without key technological breakthroughs, Kimi is bound to face even fiercer competition for efficiency.

In the future, commercialization demands are likely to become the main direction for Kimi to seek breakthroughs. However, it is unclear whether Yang Zhilin is adept at commercialization and efficiency management. From current reports, the good news is that Yang Zhilin has already realized the importance of this direction, mentioning in an interview, "Cutting businesses is essentially controlling headcount. Among these large model startups, we have always maintained the smallest team and the highest ratio of cards to people, which I believe is crucial."

In addition to lacking distinctive technological features, similar to Ofo, as a capital provider, large companies also have related businesses. Whether it's Alibaba's Tongyi or Tencent's Hunyuan, they are, to some extent, in competition with Kimi. Large companies choose to invest in multiple lines based on FOMO (fear of missing out), adopting a saturated attack strategy. However, when the sector enters a phase of pure efficiency competition, as major shareholders, it is easy for them to vote in favor of mergers.

On the other hand, increasingly complex equity structures and the involvement of multiple large companies can easily distort Kimi's overall development. From the perspective of 2024, signs of such distortion have already emerged.

In an interview in early March, Yang Zhilin talked about his understanding of organizational form and the AGI roadmap, mentioning directions such as balancing ToB and ToC, internationalization, and GPT-4-like capabilities. However, in his public statements in November, he mentioned that the core task for Kimi now is to improve retention rates. Of course, the rapid development of the industry has made Kimi, as a technology follower, demonstrate more of its efficient imitation capabilities. However, it is not difficult to see that the current goals are vastly different from those a few months ago.

The gradual leveling of technological pathways, capital games, and challenges in goals and directions all make Kimi appear exhausted and struggling.

Zhu Xiaohu, founding partner of GSR Ventures, recently stated, "Among the top US large model companies, the top four have indeed raised a lot of money, and each one has found a powerful backer. However, for the second-tier large model companies in the US, this year they may still have some team acquisition value, but next year they may be worthless." In China, the situation seems even more complex. Although Kimi currently has the support of two powerful backers, without a sustainable blood transfusion from a healthy business model, and with competing subsidiaries under these backers, competition does not seem to be becoming easier but rather more difficult.

Whether Kimi will become an abandoned child like Ofo is still too early to tell, but there are some questions for which Yang Zhilin needs clear answers.

03

Difficult Questions Yang Zhilin Must Answer

From a technological perspective, Yang Zhilin is undoubtedly a genius. Not only did he graduate from a prestigious university but also worked at Google. Additionally, he co-authored a paper with a Turing Award winner, which is already very impressive for someone born in the 1990s.

However, in terms of business, Yang Zhilin has not yet demonstrated the decisiveness expected of a unicorn founder, and this seems to be becoming a key obstacle hindering Kimi's continued rapid development.

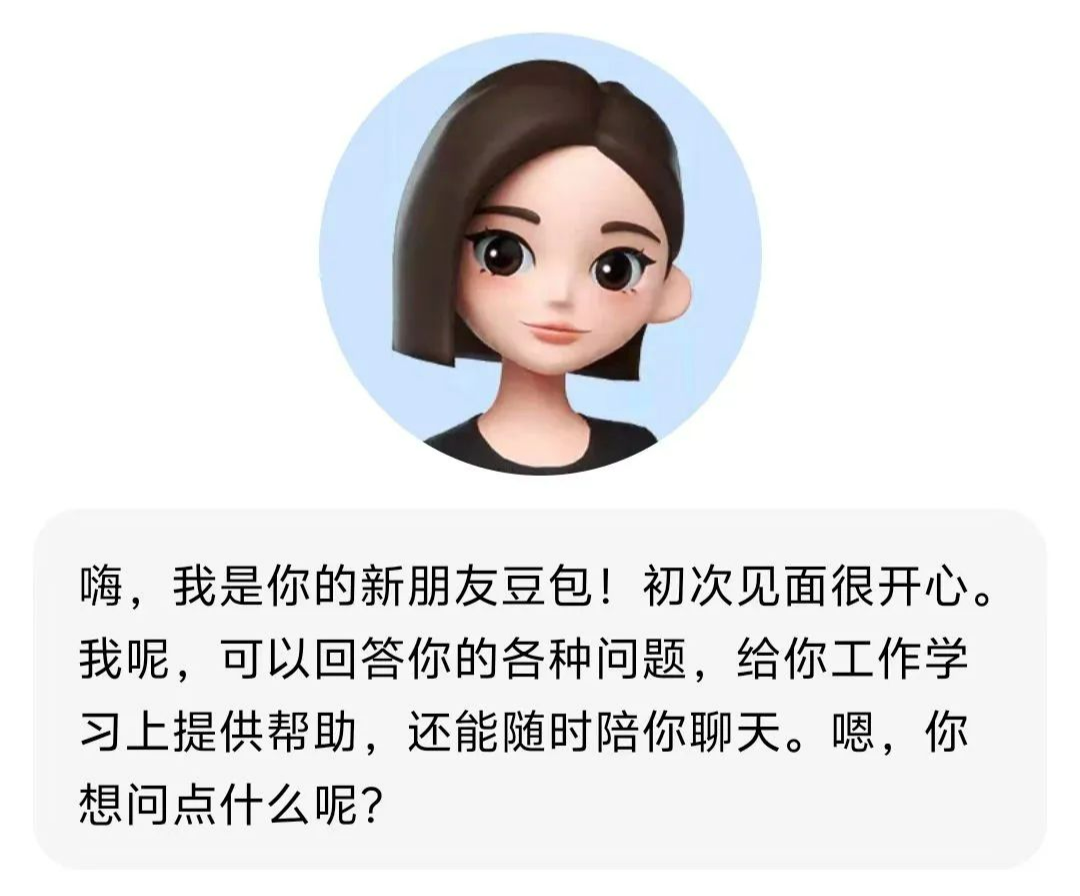

From the data, after an initial explosion, Kimi has been besieged by competitors like Doubao.

Public data shows that since its launch in May, Doubao has consistently ranked among the top free apps on the App Store for several consecutive months, occupying the top spot for an entire month in June. Even in October, Doubao was still ranked fourth. Doubao has quickly attracted a massive user base in a short period.

Not only Doubao but also MiniMax, another large model startup, is experiencing a surge. Since September, data for its AI smart assistant, Conch AI, has shown explosive growth, with monthly visits increasing by more than eight times and monthly active users approaching 5 million.

Under limited conditions, creating a hit product is not something Yang Zhilin excels at, but companies like Doubao have inadvertently amplified this shortcoming of Kimi.

Kimi's strategy still leans heavily towards technology. From the Kimi Exploration Edition, which was rushed out during the National Day holiday, to the newly launched k0-math, Kimi has indeed differentiated itself from mainstream large models. The user experience of the Kimi Exploration Edition has received positive feedback from multiple platforms, and industry insiders analyze that its search volume has reached 10 times that of the regular version. However, with only five daily uses and an inconvenient usage method, it seems that the company is still not ready for large-scale market launch.

For Kimi, k0-math is more like a "muscle-flexing" product showcasing its rapid imitation capabilities. In summary, it seems difficult for both to compete with Doubao, which is empowered by large companies.

How Yang Zhilin can win the product war in the large model sector has become an unavoidable issue for him.

On the other hand, internally, whether it's arbitration disputes over capital or power struggles among major players, these are gradually becoming issues that Kimi needs to coordinate.

From the current market perspective, the domestic AI sector is still in its honeymoon phase, and financing remains smooth and sustainable. However, despite this, striking a balance between technology and business remains a difficult puzzle. Kimi, which has raised two rounds of funding this year and is valued at USD 3.3 billion, still struggles to generate revenue on its own. How will Kimi, which will require more financial support in the future, address these challenges? While technological possibilities can be compensated for through late-mover advantages, how can its commercialization capabilities be proven?

For Kimi, who is walking on a tightrope, the future remains uncertain.