Does intelligent driving accelerate the pace of software-defined vehicles?

![]() 11/25 2024

11/25 2024

![]() 642

642

The global automotive industry is undergoing a revolutionary transformation, with the core driving force shifting from traditional hardware manufacturing to software empowerment. As the concept of "Software Defined Vehicle" (SDV) gains popularity, automakers have extended vehicle lifecycles and enhanced user experience and loyalty through continuous software updates and value-added services, thereby transforming the industry's profit model.

The automotive industry once centered on hardware technology, with engine, transmission, and chassis/body design being key areas of focus. Traditional automakers primarily relied on hardware innovations to compete in the market. However, the wave of digitization and intelligence has driven profound changes in the global automotive industry. Especially the concept of "Software Defined Vehicle" has fundamentally altered vehicle development, manufacturing, and user experience. Cars are no longer merely hardware products but "intelligent terminals" with continuous iteration and dynamic value-added features.

This transformation has not only reshaped automakers' business models but also altered consumer habits. By continuously providing services through software, automakers have increased vehicles' added value and profitability opportunities over their lifecycles. Users no longer rely solely on hardware upgrades to enhance vehicle functionality but instead enjoy new services and experiences through software updates.

The Rise of the "Software-Defined Vehicle Era"

1.1 Transformation of Electronic and Electrical Architecture (EEA): From Distributed to Centralized

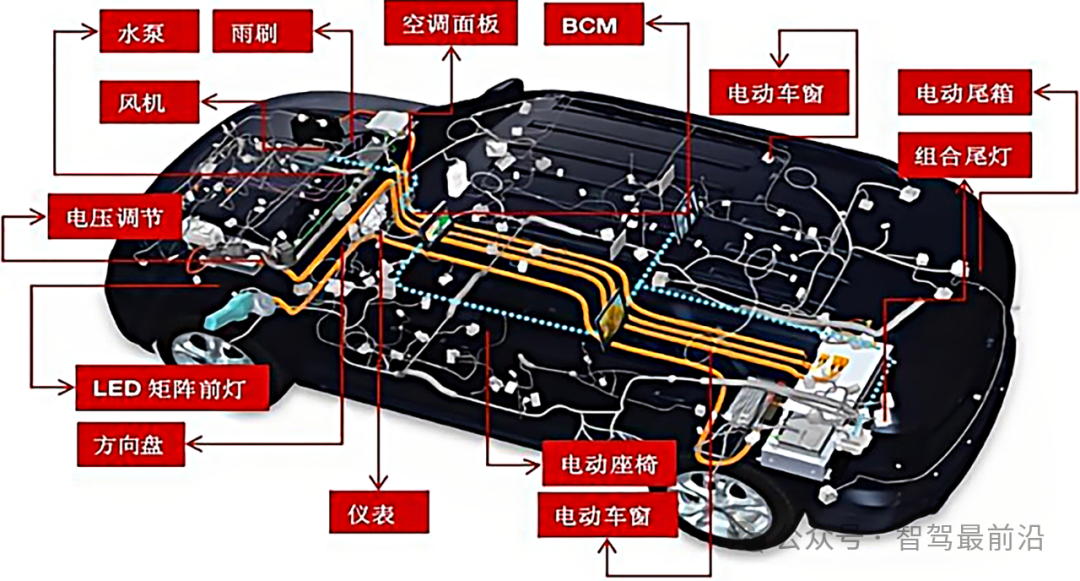

As automotive functions become increasingly complex, the electronic and electrical architecture (EEA) continues to evolve. Traditional architectures employed distributed Electronic Control Units (ECUs), with each ECU managing an independent functional module like the engine management system, brake control system, infotainment system, etc. High-end models featured over 100 ECUs, each requiring separate hardware and software for maintenance and updates. While effective in the era of conventional vehicles, this architecture revealed drawbacks—system complexity, decentralized computing power, and difficult upgrades—as cars became smarter and more connected. Notably, the tight coupling between software and hardware made function expansion and upgrades costly.

Currently, vehicles average about 25 ECUs, with high-end models exceeding 100

To address these challenges, the automotive industry is transitioning to centralized architectures. Domain controllers are at the core of this architectural revolution, integrating multiple functional domains (e.g., driver assistance, infotainment, safety control) to reduce ECU counts, simplify system structures, and significantly boost computational power and efficiency. For instance, Bosch's pioneering domain controller solution integrates multiple previously separate ECUs onto a high-performance computing platform, enhancing system flexibility and scalability. This centralized EEA provides the foundational hardware support for realizing "Software Defined Vehicles" and is a critical driver of automotive intelligence upgrades.

Audi was one of the first OEMs to adopt a domain controller architecture, implementing it in multiple functional areas of its high-end models like the Audi A8. By utilizing domain controllers, Audi achieved seamless integration of Advanced Driver Assistance Systems (ADAS) and shortened new model development cycles by reducing ECU counts. This also enhanced system upgrade and maintenance efficiency. The application of domain controllers allows Audi to flexibly address varying market demands, improving vehicle performance while lowering manufacturing costs.

1.2 SOA Architecture and Software-Hardware Decoupling: Modularity Boosts Software Flexibility

In the pursuit of "Software Defined Vehicles," the introduction of Service-Oriented Architecture (SOA) is a pivotal technological shift promoting software-hardware decoupling. SOA modularizes vehicle functions, enabling independent development and deployment of each module through standardized interfaces. Compared to traditional architectures, SOA not only enhances software flexibility but also substantially reduces development and maintenance costs.

In traditional architectures, software and hardware are tightly coupled, often requiring system redesign or even hardware replacements for new functionalities. SOA decouples functions, allowing modules to run on different hardware platforms and enabling iterative updates through simple software patches. This flexibility boosts development efficiency and enables Over-The-Air (OTA) remote upgrades without hardware modifications, enhancing user satisfaction and loyalty.

Tesla pioneers the application of SOA. Its vehicles receive software updates via OTA, eliminating the need for users to visit service centers for the latest features and security patches. Tesla's modular service architecture allows frequent software updates to enhance user experience despite fixed hardware platforms. For instance, Full Self-Driving Capability (FSD) is delivered via OTA, with users enjoying the latest autonomous driving features through one-time payments or subscriptions, even improving acceleration performance through software upgrades.

1.3 From Hardware Endpoints to Software Starting Points: A New Profit Model for Vehicle Lifecycles

Traditional automakers primarily relied on hardware sales for profitability, generating one-time revenues from vehicle sales. However, in the "Software Defined Vehicle" era, vehicle value extends beyond hardware sales to dynamic appreciation through continuous software service provision. Automakers sustain revenue streams throughout a vehicle's lifecycle by offering regularly updated features and services.

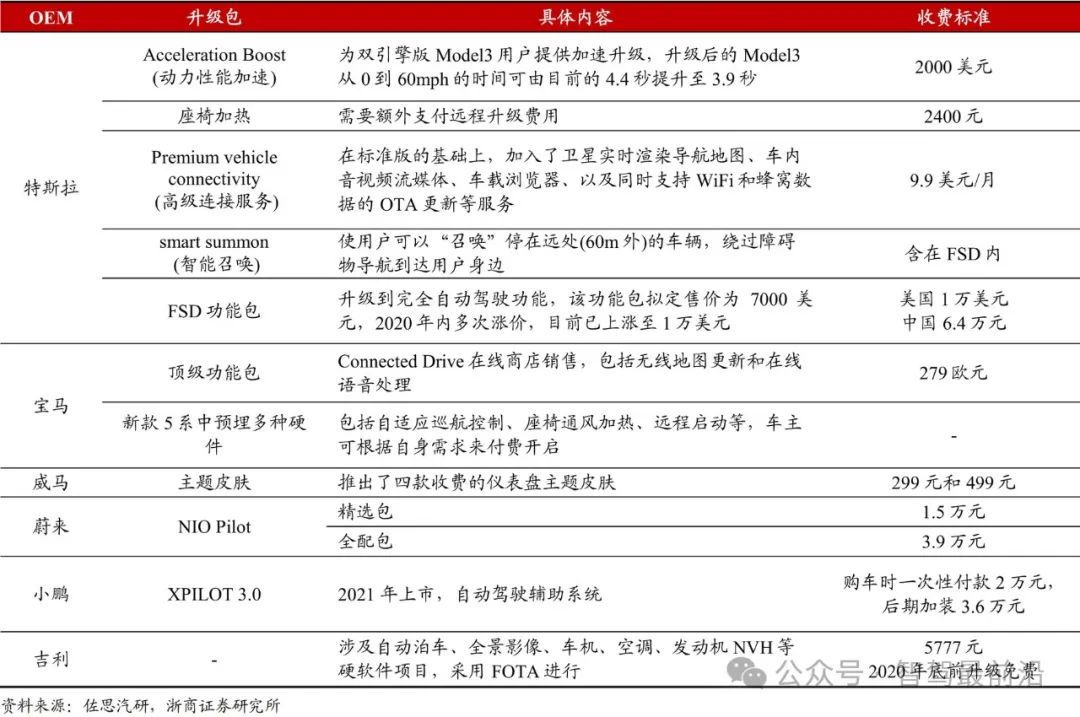

OTA Updates and Charging Practices of Selected OEMs

This shift from "hardware endpoints" to "software starting points" revolutionizes the automotive industry's profit model. Previously, vehicle value was realized at the point of sale, but in a software-driven model, value extends throughout usage. Automakers generate sustained revenue through software value-added services and subscription models, extending vehicle lifecycles and diversifying income sources.

Tesla exemplifies this transformation with its business model. Leveraging OTA technology, it provides users with the latest driving features and performance optimizations while generating recurring revenue through FSD subscriptions. According to Electrek, Tesla's FSD sales exceeded $1 billion in 2021. This model enhances user satisfaction and significantly boosts long-term profitability for automakers.

The Dominance of Intelligent Driving Software

2.1 The Importance of Intelligent Driving Software: Shift in Safety and Legal Responsibility

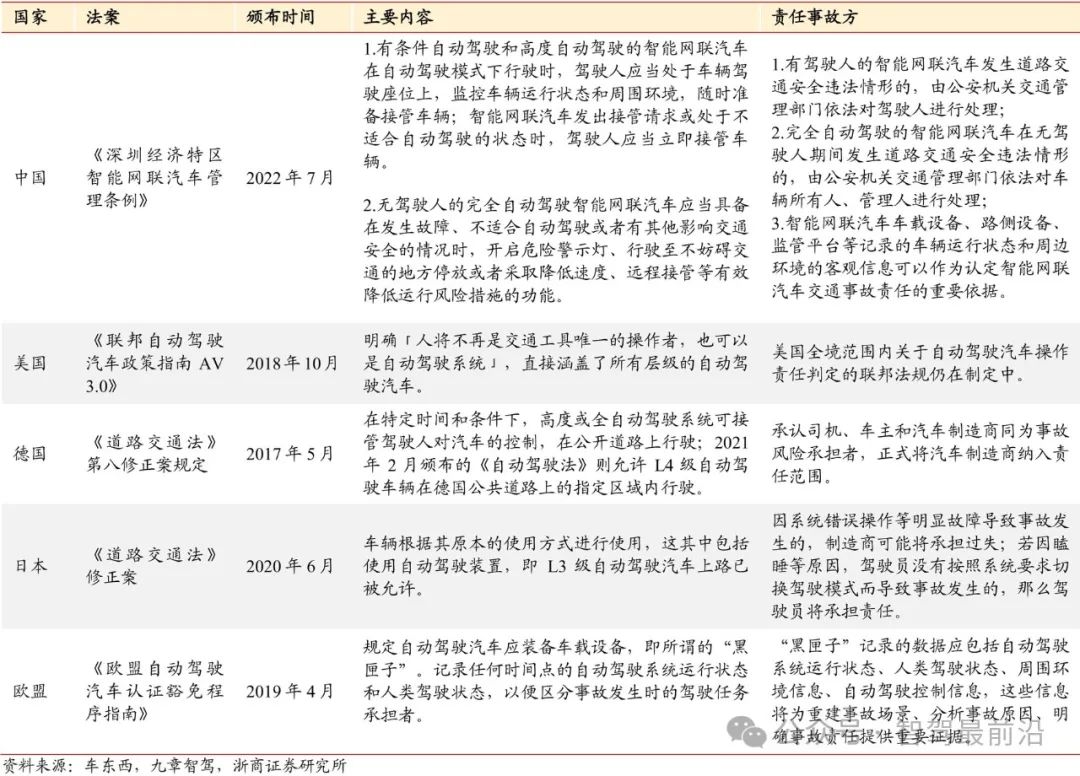

The rise of intelligent driving software signifies the automotive industry's entry into the "Software Defined Vehicle" era. As autonomous driving technology advances, especially with L3 and higher-level autonomy, driving responsibility gradually shifts from drivers to vehicles. This transition poses new technical challenges and legal liabilities, with intelligent driving software's reliability and safety becoming crucial for automakers' market presence.

In L3 autonomous systems, vehicles can take over driving tasks under specific conditions, with drivers serving as backups. Thus, the stability and response speed of intelligent driving systems directly affect driving safety. Questions arise regarding legal responsibility in case of system failures or judgment errors, prompting global legal and automotive discussions.

Legislation will provide guidelines for determining responsibility in autonomous driving, fostering its development. Countries are enacting relevant regulations to accelerate autonomous driving deployment. For instance, Shenzhen's Regulations on the Administration of Intelligent and Connected Vehicles, enacted in July 2022, clarifies that vehicle manufacturers may bear primary responsibility in accidents involving conditionally and highly autonomous driving. This legal shift encourages automakers to prioritize intelligent driving software development and testing, ensuring compliance with stringent safety standards.

Global Perspectives on Autonomous Driving Responsibility

2.2 Technical Layout and Market Competition in Autonomous Driving Software

Leading automakers and tech companies globally are actively positioning in the autonomous driving software market, aiming to dominate this rapidly growing sector. Companies like Tesla, XPeng, and Baidu have pioneered Advanced Driver Assistance Systems (ADAS) and L3 autonomous driving through in-house systems, while traditional automakers like Ford, BMW, and Toyota collaborate with Tier 1 suppliers on autonomous technology.

Technically, autonomous driving software comprises three core modules: perception, decision-making, and control. The perception module gathers environmental data through sensors (e.g., LiDAR, millimeter-wave radar, cameras); the decision-making module plans paths and assesses risks using AI algorithms; and the control module converts decisions into vehicle operations. Efficient software computation and algorithm optimization are crucial for these modules' synergy, enabling autonomous driving.

XPeng's XPILOT 3.0 system in the P7 model represents China's autonomous driving technology. Integrating LiDAR, millimeter-wave radar, cameras, and other sensors, it achieves L3 autonomy. XPILOT handles complex urban driving scenarios and improves decision-making and response speeds via OTA updates. XPeng plans further autonomous driving enhancements through software updates, gradually advancing to L4 autonomy.

2.3 Market Potential and Growth Forecast

The autonomous driving technology market holds immense potential, especially in China, where government support and tech innovation drive rapid development. McKinsey forecasts the global automotive software market to reach $84 billion by 2030, with a 9% CAGR from 2020-2030. The ADAS/AD software market is projected to hit $43.5 billion by 2030, accounting for 51.8% with an 11% CAGR over a decade. China's growth is particularly notable, fueled by local automakers' investments in autonomous technology.

With 5G proliferation and AI algorithm optimizations, autonomous driving will accelerate. High-definition maps, Vehicle-to-Everything (V2X) communication, and Internet of Vehicles technology will significantly boost intelligent driving software iterations. Autonomous driving will evolve beyond ADAS towards L4 and L5 levels, enabling true full autonomy.

Intelligent Cockpits: The Future "Third Living Space"

3.1 Evolution of Intelligent Cockpits: From Infotainment to Full Intelligence

As a vital automotive intelligence component, intelligent cockpits have evolved from basic in-car infotainment systems to comprehensive intelligent interactive platforms. With 5G, AI, and big data advancements, intelligent cockpits now integrate driving information, entertainment, human-machine interaction, voice assistants, navigation, and safety features, serving as the central hub for multifunctionality.

Intelligent cockpit development has seen key stages: early models offered basic entertainment and navigation (e.g., FM radio, CDs, GPS). With smartphone and mobile internet popularity, cockpits integrated more entertainment (e.g., Bluetooth, multimedia playback, touchscreen controls). Now, intelligence demands have expanded cockpit functions to voice interaction, scenario mode control, facial recognition, emotion sensing, etc., making them in-car "smart butlers".

BMW's Vision BMW i Interaction EASE concept cockpit, unveiled at CES 2020, showcased future intelligent cockpit directions. This cockpit adapts modes based on driver needs through voice assistants, Head-Up Displays (HUD), and ambient lighting. For instance, in "Entertainment" mode, the interior transforms into a private cinema, with lighting and screens syncing with movie content for immersive experiences. This intelligent, multi-scenario cockpit model offers crucial insights for future intelligent cockpit applications.

3.2 Personalization and Cockpit Experience: OTA Drives Cockpit Function Upgrades

Intelligent cockpits are not only the core of automotive intelligence but also key to automakers' differentiated competition. Through personalized customization and continuous upgrades, automakers offer unique driving experiences and generate revenue through value-added services.

Modern intelligent cockpits extend beyond basic entertainment and navigation, leveraging OTA for continuous function upgrades and personalized services. Users can customize UI interfaces, audio systems, seat adjustments, and even dynamically modify vehicle settings via voice assistants. Automakers use OTA to push the latest features and security patches, enhancing the user experience.

NIO's NOMI intelligent cockpit assistant represents a bold innovation. NOMI interacts naturally with users via voice and adjusts in-car lighting, climate control, and entertainment modes based on scenarios. For instance, during long drives, NOMI switches to "Relax" mode, playing soothing music and adjusting seat angles for a more comfortable ride.

3.3 Growth Prospects of the Smart Cockpit Market

With the gradual popularization of autonomous driving technology, the functions of smart cockpits will not be limited to infotainment and driving assistance, but will gradually expand to more life and office scenarios, becoming the user's 'third living space'. According to forecasts, the smart cockpit market size will grow from 7.7 billion yuan in 2020 to 30.8 billion yuan in 2030, with a compound annual growth rate of 15%.

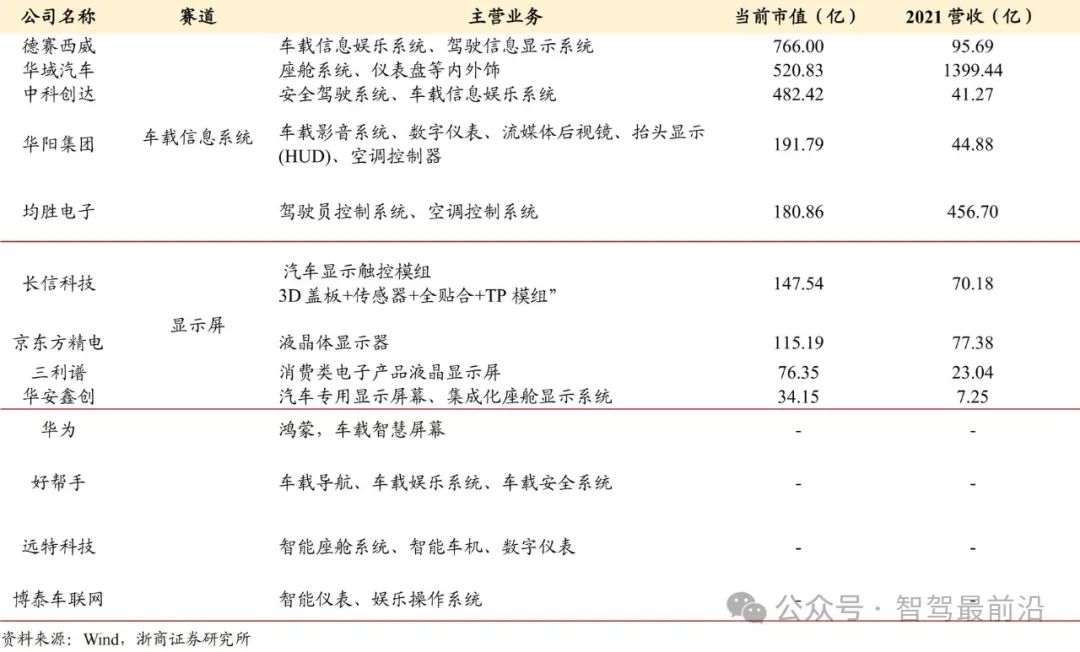

Layout of Major Vendors in Smart Cockpit Application Software

In the future, the smart cockpit will no longer be just an interface for driver-vehicle interaction, but the core control center of the vehicle. Through 5G, AI, and IoT technology, the smart cockpit will achieve seamless connection with the external environment, providing a full range of intelligent services from entertainment to office work, and from safety to leisure. For example, in future autonomous driving scenarios, the smart cockpit will become a space for users to handle daily affairs, allowing users to participate in video conferences, process documents, watch movies, etc., through the cockpit system. This intelligent cockpit experience will completely change the way users travel and provide new profit models for automakers.

Revolution in Profit Models in the Automotive Industry

4.1 From Hardware-Driven to Software-Driven: A Complete Transformation in Profit Models

Traditional automakers' profit models mainly rely on hardware sales, and after purchasing a vehicle, users primarily provide automakers with ongoing revenue through maintenance and parts replacement. However, with the advent of the 'software-defined vehicle' era, the software-driven business model has gradually replaced the traditional model. By providing continuous value-added services and software updates, automakers can generate revenue throughout the entire lifecycle of the vehicle, not just relying on one-time hardware sales.

BMW is a typical example of this transformation. By providing functions such as online map updates, voice processing, and remote start, BMW allows users to subscribe or unlock different cockpit functions on demand. For example, users can activate functions such as seat heating and automatic parking by paying a certain fee. This pay-as-you-go model not only provides users with flexible options but also brings BMW a continuous revenue stream.

4.2 Typical Business Model Transformations in the Industry

Tesla is a leader in the software-defined vehicle model. Through its OTA platform, Tesla not only provides users with the latest function and performance updates but also generates ongoing revenue through subscription services for the FSD (Full Self-Driving) suite. Tesla's success has inspired automakers worldwide to follow suit, with NIO, XPeng, BMW, and others beginning to explore similar business models that combine hardware with software services to enhance user stickiness and vehicle added value.

With the continuous advancement of software technology and the increasing demand for personalized services from users, the profit model of the automotive industry will increasingly rely on software and data services. Automakers need to find a new balance between hardware and software, enhance user experience by providing innovative services and functions, and maintain a leading position in the fiercely competitive market.

Conclusion

The concept of 'software-defined vehicle' has not only changed the business models of traditional automakers but also driven the rapid development of core technologies such as intelligent driving and smart cockpits. With the deepening of intelligent and connected technologies, the automotive industry is moving towards a new era, where software and data services will become new competitive focuses and profit sources for automakers. In the coming years, automakers will face a complete transformation from hardware-driven to software-driven models, and only through continuous innovation and technological breakthroughs can they occupy a leading position in this transformation.