Valued at over RMB 6 billion, another 'Geely-affiliated' intelligent driving company races to the Hong Kong stock market

![]() 11/25 2024

11/25 2024

![]() 740

740

Another intelligent driving company is making a run at the Hong Kong stock market.

On November 22, Freetech (Zhejiang) Intelligent Technology Co., Ltd. (abbreviated as "Freetech") submitted a listing application to the Hong Kong Stock Exchange, officially kicking off the process of listing on the Hong Kong stock market. CITIC Securities, CICC, Huatai International, and HSBC served as joint sponsors.

Founded in 2016, Freetech differs from most autonomous driving startups where the founding teams are typically young. Freetech's CEO and CTO have extensive experience in the automotive industry.

Founder and CEO Zhang Lin previously held senior positions at Chrysler and Geely Automobile; CTO Shen Junqiang worked at Delphi's Electronics and Safety division and was responsible for establishing Delphi's Active Safety development team in China.

The backgrounds of the core executives determine Freetech's DNA, which is to start with mass-producible ADAS functions. This is also the starting point and focus of Freetech's business.

Overview of Freetech's Business Development

The prospectus reveals that as of June 30, 2024, Freetech has established business partnerships with 46 OEMs, covering all the top ten domestic OEMs by vehicle sales in 2023, with a cumulative total of over 280 designated projects and over 200 production projects.

According to Frost & Sullivan, in the Chinese L2 and L2+/L2++ intelligent driving solutions market in 2023, Freetech ranked third among independent suppliers with a market share of 14.6%.

Sales volume means "recovery." According to the prospectus data, Freetech's revenue for the first half of 2024 was RMB 312 million, a year-on-year increase of 33.7%.

However, Freetech still faces the common dilemma in the intelligent driving industry: the delay in profitability. In the first half of this year, Freetech still faced a loss, with a net loss of RMB 278 million.

At a time when intelligent driving companies are collectively racing to go public, Freetech is clearly taking advantage of the trend.

01 The 'new' company of seasoned automotive professionals

As mentioned above, Freetech's DNA carries a "traditional automotive flavor," starting with the backgrounds of the core team.

Zhang Lin, the helmsman, who is primarily responsible for formulating the company's overall development strategy and business plan, has been deeply involved in the automotive industry for nearly 30 years. Before joining Freetech, he worked at Geely Holding Group and served as Vice President from April 2011 to February 2016, primarily responsible for Geely's overseas marketing and factory construction.

Freetech's Core Team

Shen Junqiang, the technical leader, Executive Director, and Chief Scientist of the company, joined in 2018 and is primarily responsible for the company's overall R&D efforts. From 1999 to 2016, Shen Junqiang served as a Director at Delphi Automotive Systems (China) Investment Co., Ltd. (now known as "Aptiv (China) Technology R&D Co., Ltd."); from 2016 to 2018, he served as Chief Scientist of the Autonomous Driving System at a leading global technology company.

He Junjie, Vice President of Product Development, joined in September 2023 and is responsible for the company's product development efforts. Prior to joining, he held senior positions at Beiqi Foton, ZF, and Bosch, and served as Director of Engineering at Arriver Software GmbH (a Qualcomm subsidiary) and Arriver Software GmbH (a Veoneer subsidiary).

...

Meanwhile, Freetech has established an internal research institute headquartered in Hangzhou, with three additional R&D centers in Shanghai, Wuzhen, and Chengdu. As of June 30, 2024, the research institute consisted of 625 personnel, accounting for 73.1% of the total workforce. Among them, 50.6% hold bachelor's degrees, and 47.2% hold master's degrees or higher.

It is evident from the above information that Freetech's executive team has more or less background in the traditional automotive industry.

Consequently, Freetech's investors are also predominantly traditional groups.

The prospectus shows that since its inception, Freetech has completed multiple rounds of financing before the IPO, with investors including Changxing Financial Holdings, PICC Capital, Origin Capital, Everbright Financial Holdings, Wuzhen Tourism Investment, Chunxin Hongtu, CCCC Fund, BAIC Industrial Investment, TCL Venture Capital, Shaanxi Automobile Group, Geely Group, etc.

After the C3 round of funding on May 30, 2024, Freetech's current valuation has reached RMB 6.06 billion.

According to the prospectus, the proceeds from Freetech's Hong Kong IPO are intended to strengthen the company's R&D of intelligent driving solutions and products, fund capital expenditures related to expanding and upgrading manufacturing capabilities over the next three years, expand the company's sales and service network over the next three years, and be used for working capital and general corporate purposes.

02 While shipments increase, facing the issue of high customer concentration

As financing increases, so does Freetech's shipment volume.

Freetech initially focused on in-vehicle cameras and gradually expanded into products such as millimeter-wave radars, camera modules, and domain controllers.

However, currently, Freetech's revenue primarily comes from intelligent driving solutions.

In Freetech's view, its core competitive advantage lies in its full-stack R&D capabilities and ODIN platform. This platform integrates advanced controllers, precision sensors, powerful software algorithms, and a data closed-loop platform. As a scalable, reusable, and iterable modular platform, it enables the company to rapidly iterate and optimize intelligent driving solutions.

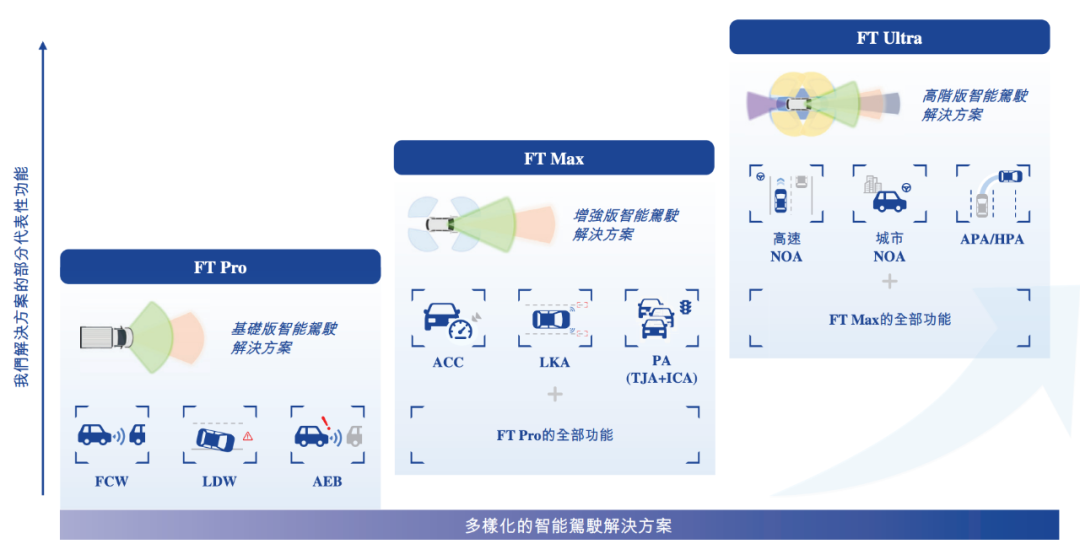

Freetech Launches Three Intelligent Driving Solutions

Based on the ODIN platform, Freetech has launched three solutions: FT Pro, FT Max, and FT Ultra, offering intelligent driving capabilities ranging from L0 to L3.

Among them, the FT Pro solution covers L0 and L1 intelligent driving capabilities, effectively reducing potential collision risks through real-time monitoring and early warning systems, and providing emergency intervention through automatic emergency braking to slow down or stop the vehicle, thereby preventing or reducing accidents.

The FT Max solution focuses on L2 intelligent driving capabilities, primarily relying on all-in-one machines and radar sensors to provide functions such as LKA, LDW, AEB, ACC, and FCW.

The FT Ultra solution covers L2+ and L3 intelligent driving capabilities, equipped with arrays of sensors and controllers, supporting functions such as Highway NOA and Urban NOA.

According to the prospectus, as of June 30, 2024, Freetech has established business partnerships with 46 OEMs, covering all the top ten domestic OEMs by vehicle sales in 2023, with a cumulative total of over 280 designated projects and over 200 production projects.

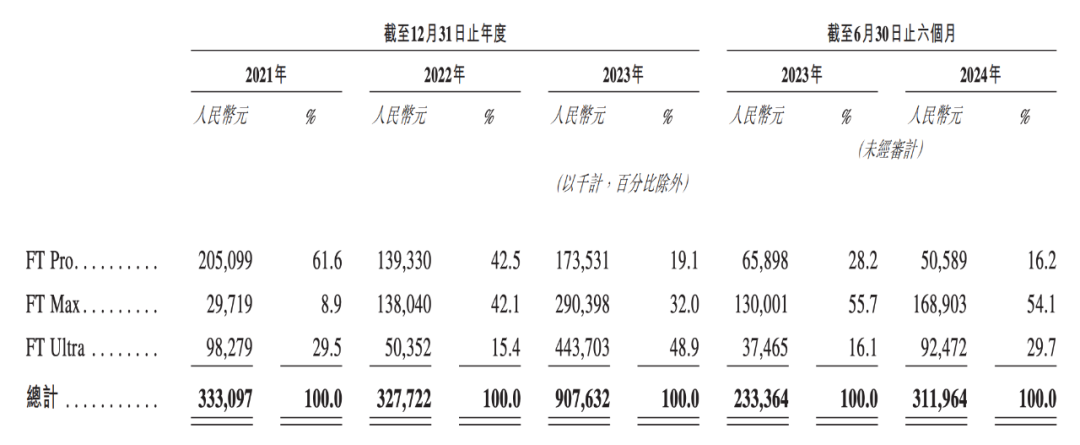

Revenue Breakdown of Freetech's Solutions

Meanwhile, according to the prospectus data, the revenue share of FT Pro is continuously declining, while FT Max and FT Ultra show fluctuating increases.

In response, Freetech explained that this is mainly due to the optimization of strategic resources to meet the demands of the growing customer base for L2 solutions.

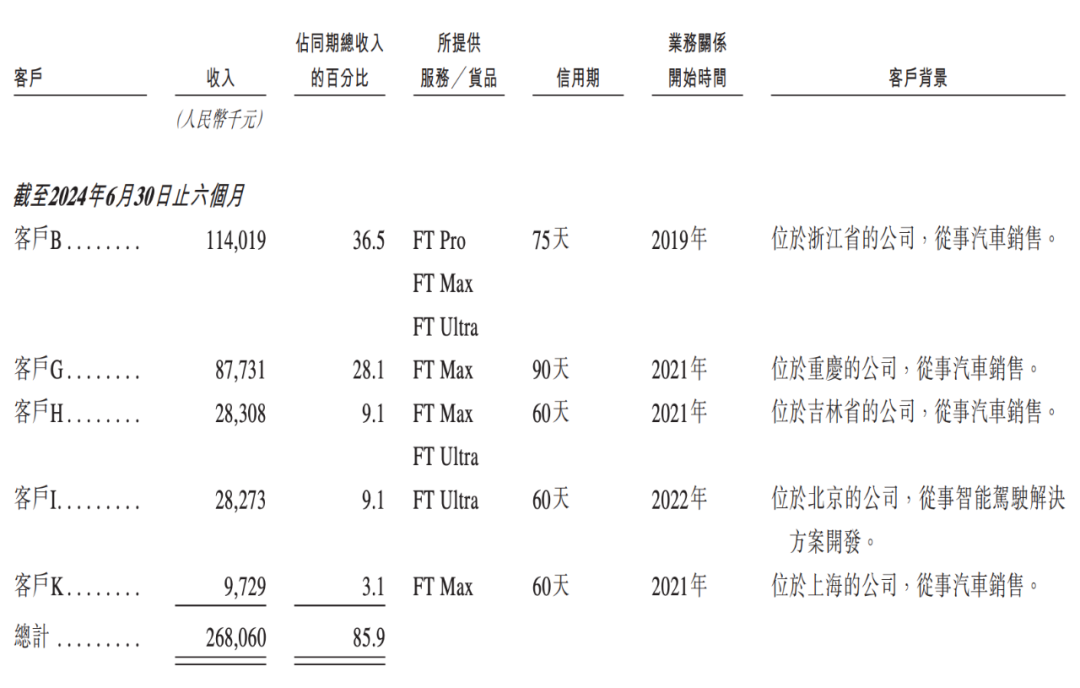

However, like many startups, Freetech also faces the issue of high customer concentration.

Data shows that for the years ended December 31, 2021, 2022, and 2023, as well as the first half of 2024, revenue from the top five customers accounted for 84.0%, 73.6%, 76.4%, and 85.9% of total revenue, respectively; revenue from the single largest customer accounted for 43.5%, 22.0%, 43.3%, and 36.5% of total revenue, respectively.

Although Freetech did not state it explicitly, summarizing the information reveals that its single largest customer is Geely Holding.

Revenue Share of Freetech's Top Five Customers in the First Half of 2024

As mentioned above, Geely Group is a capital contributor to Freetech, and as of the latest practical date, Geely and related contacts hold a significant proportion.

The prospectus also specifically mentions in related-party transactions that from 2021 to 2023 and the first half of 2024, the amount of products and services provided by Freetech to Geely Holding was RMB 100 million, RMB 64.53 million, RMB 393 million, and RMB 114 million, respectively.

Freetech also estimates that from 2025 to 2027, the amount of products and services provided to Geely Holding will reach RMB 1.115 billion, RMB 1.33 billion, and RMB 1.548 billion, respectively.

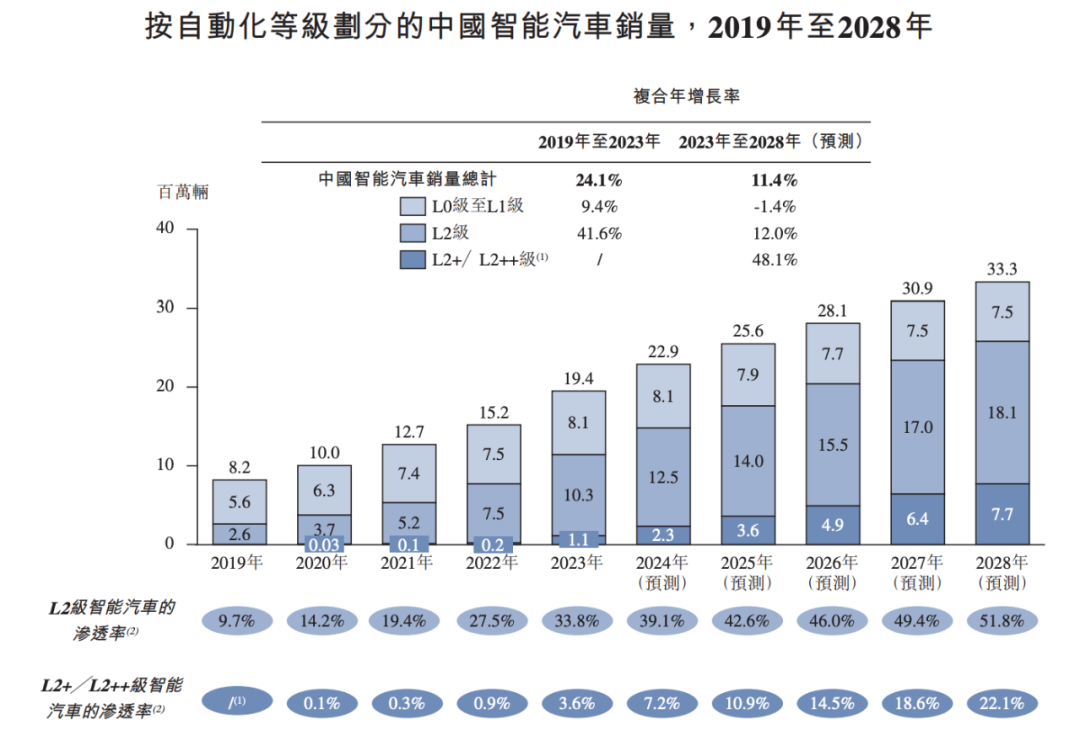

Not only for Geely, Freetech is also very optimistic about the overall market trend.

It stated that the global market size for intelligent driving solutions from L0 to L2+ levels increased from RMB 108.3 billion in 2019 to RMB 277.1 billion in 2023, with a compound annual growth rate of 26.5%; it is expected to reach RMB 650.3 billion by 2028, with a compound annual growth rate of 18.6% from 2023 to 2028. Specifically, China's compound annual growth rate from 2023 to 2028 is 24.1%, with a market size of RMB 210.3 billion.

03 Overall revenue growth, but cash flow is not optimistic

With the continuous increase in customers, Freetech's overall revenue has also shown an upward trend.

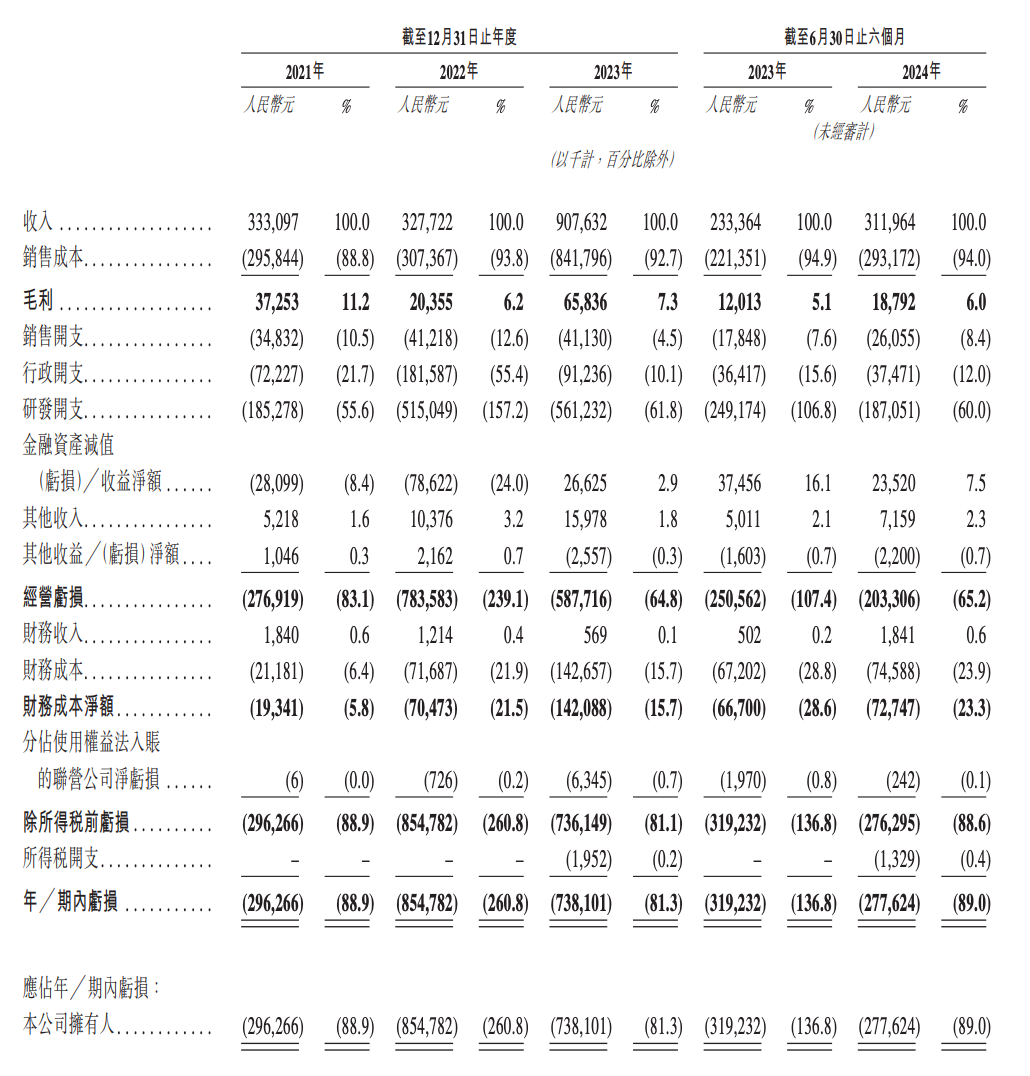

The prospectus shows that Freetech's revenue from 2021 to the first half of 2024 was RMB 333 million, RMB 328 million, RMB 908 million, and RMB 312 million, respectively.

Freetech's Overall Financial Status

However, despite the increase in revenue, the gross profit margin has declined. Freetech's gross profit margin was 11.2% in 2021 and 6% in the first half of 2024.

In response, Freetech explained that the company has strengthened R&D investment and investment to support larger-scale operations and will take measures to improve the gross profit margin in the future.

Meanwhile, Freetech specifically stated that the company began generating a positive gross profit margin for the FT Max solution in 2022. In 2021, the solution had a negative gross profit margin of 17.2%, which further improved to 8.1% by the first six months of 2024.

Like most autonomous driving startups, Freetech is still in a loss-making state. From 2021 to the first half of 2024, the adjusted net losses were RMB 276 million, RMB 691 million, RMB 627 million, and RMB 217 million, respectively.

Freetech stated that the loss situation is mainly due to a combination of factors, including being in the early stages of operational expansion and scale expansion; procurement costs for raw materials and consumables; investment in R&D; and investment in attracting and retaining talent.

Regarding R&D funding, from 2021 to the first half of 2024, Freetech invested RMB 185 million, RMB 515 million, RMB 561 million, and RMB 187 million, respectively.

In terms of cash flow, as of June 30, 2024, Freetech had cash and cash equivalents of RMB 276.7 million. At the same time, Freetech specifically pointed out that it has unused bank financing of RMB 1.1 billion. The company completed two rounds of equity financing in 2024, raising a total of approximately RMB 353 million.

"We actively seek to optimize working capital and capital management, including signing more favorable working capital terms with customers and suppliers." Freetech stated that after considering the available financial resources, it believes it has sufficient working capital to meet current needs and those of the next 12 months from the date of this document. -END-