Challenging Tesla, but Rivian Needs to Learn from Musk

![]() 11/25 2024

11/25 2024

![]() 611

611

New forces in the auto industry are facing challenges everywhere.

Compared to the fierce competition in the domestic new energy vehicle market, the U.S. market can only be considered a beginner's level from various aspects. However, even in such a beginner's market, there are still dragonslayers. Rivian, a new automaker known as a Tesla killer, has been targeting Tesla since it started manufacturing cars and is recognized as one of the most promising new energy companies in the U.S. market.

The pressure faced on this journey to slay the dragon is imaginable. In July 2020, Tesla filed a lawsuit in a California court, accusing Rivian of recruiting employees through improper means and allegedly stealing trade secrets. This lawsuit has dragged on for four years with no progress.

It was not until Trump was re-elected as President of the United States and Musk was nominated as a government official that this lawsuit saw new developments. Tesla submitted a settlement agreement and reached a conditional settlement with Rivian, which will be withdrawn after the agreement is implemented.

It can be said that Musk has become more efficient in handling issues after assisting the "Trump administration." He quickly brought the four-year-long lawsuit to an end within a short period.

Rivian's Strengths

Apart from new energy vehicles, Rivian is a legend in the U.S. capital market in terms of business achievements alone. In 2021, Rivian's IPO ranked as the seventh largest in U.S. history, with a valuation exceeding $70 billion.

Meanwhile, the capital behind Rivian is also substantial. Companies like Amazon and Ford Motor are investors in Rivian. Investments from U.S. financial groups make Rivian's prospects look very bright. As for products, Rivian's first mass-produced model, the R1T, is the most popular electric pickup truck in the U.S. market, even earlier than Tesla's Cybertruck.

With a first-mover advantage, Rivian has successfully established itself in the U.S. market as a new energy company with innovative strength, regarded by many investors as a potential replacement for Tesla.

Rivian quickly shifted its products to the passenger vehicle segment, launching the R1S, a 7-seat electric SUV, hoping to surpass Tesla through differentiated competition.

After validating its technology with two products, Rivian finally mustered the courage to face Tesla head-on. In March 2024, Rivian released the R2, an all-electric SUV model with a positioning almost identical to Tesla's Model Y, surpassing the Model Y in both power performance and range.

This momentum led Rivian to encounter another patron. In June this year, the Volkswagen Group announced that it would invest $5 billion in Rivian to jointly develop new energy vehicles. Then, in November, Volkswagen increased its investment to $5.8 billion.

With the support of various funds, Rivian's development has also accelerated. In 2022, Rivian delivered 20,332 new vehicles. By 2023, Rivian's deliveries doubled to 50,122 new vehicles, and most of these orders were pre-orders received in 2021.

It can be seen that even with a long delivery cycle, Rivian still has strong competitiveness in the U.S. new energy market. It is also evident that Rivian does not lack orders. Besides orders from individual users, Rivian has also received large orders from Amazon, one of its investors.

Amazon CEO Jeff Bezos is very optimistic about Rivian's development. Not only did he take the lead in investing, but he also announced the purchase of 100,000 electric delivery vehicles from Rivian. Currently, over 10,000 vehicles from this order have been delivered, helping Amazon build a large new energy fleet in the U.S., which is faster than Tesla's electric trucks.

By competing with Tesla in a differentiated manner, Rivian has rapidly grown in the U.S. market, occupying multiple segments such as electric pickup trucks, 7-seat large SUVs, and electric delivery vehicles, becoming a rival that Tesla cannot ignore in the U.S. local market.

This led to the commercial dispute in 2020 mentioned earlier. Personnel mobility is not uncommon among automakers, and even the founders of many new forces have left automobile companies to start their own businesses. Facing numerous new companies, Tesla solely targeted Rivian, indicating that there is indeed an intersection in business competition between the two, and Rivian's existence has already affected Tesla's sales.

However, facing Tesla's lawsuit, Rivian also actively responded, denying all accusations. Nevertheless, the judicial department still chose to accept the case. Originally scheduled to be heard in March 2025, Tesla proposed a settlement before the trial, which was equally puzzling.

Capacity and Profitability

Compared to the lawsuit with Tesla, Rivian is more troubled by the persistently low production capacity. As mentioned earlier, Rivian delivered about 50,000 new vehicles in 2023. According to its third-quarter financial report, Rivian's deliveries this year will remain at around 50,000 vehicles and may even decline.

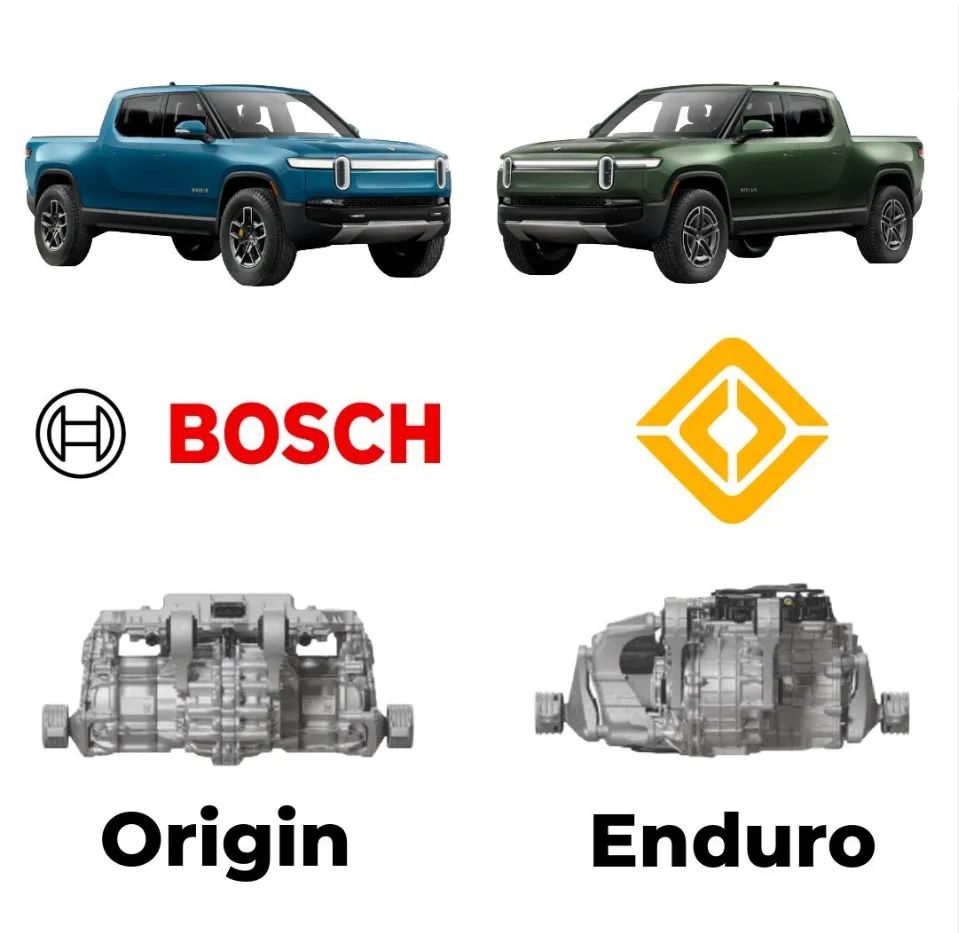

In July this year, Rivian filed a lawsuit against the world's largest automotive parts supplier over a motor supply contract, which eventually led to a court dispute.

In the lawsuit, Rivian accused Bosch of "reckless mistakes" in the motor supply contract and claimed that Bosch affected Rivian's production, resulting in the production of 30,000 fewer vehicles than planned in 2022.

Rivian blames Bosch for all previous production capacity issues, arguing that external motor procurement has affected production capacity and prevented the delivery of more new vehicles. According to the procurement contract, Bosch needs to deliver 200,000 motors to Rivian in 2024, and it is precisely Bosch's issues that have led to a decline in Rivian's production capacity this year.

In response, Bosch claims that Rivian wanted to reduce costs by developing its motors independently to save its long-term loss-making business. Therefore, Rivian unilaterally terminated the contract.

This is indeed true. According to Rivian's financial report, since its listing in 2021, its operations have been in a state of long-term loss, relying on continuous external financing to survive. It is estimated that with the recent investment from the Volkswagen Group, Rivian's operating conditions can be maintained until 2026.

This long-term loss-making business situation has obviously made investors feel uncertain about the future, which is also reflected in Rivian's share price. When Rivian listed in 2021, its share price once reached $100, with a market value exceeding $100 billion. However, Rivian's current share price is only one-seventh of its issue price, hovering around $10.

It can be said that it is the loss-making financial reports that have gradually driven down Rivian's share price. According to Rivian's latest financial report, Rivian's revenue was $874 million, a year-on-year decrease of 53%; gross loss was $392 million; operating loss was $1.339 billion; and net loss was $1.326 billion.

Behind the losses is Rivian's long-term negative gross margin per vehicle. Ideally, with a selling price of $70,000 per vehicle, Rivian should be able to maintain a decent gross margin. However, in reality, Rivian's gross margin has long been around -40%, meaning it loses money on every car sold, and the more it sells, the more it loses.

Unlike domestic new forces that lose money, Rivian actually loses money on every car sold. According to third-party estimates, Rivian's production cost per vehicle is approximately $127,000, while the average selling price is only $86,000, resulting in a loss of $40,000 per vehicle sold. It is no wonder that Rivian needs to reduce production.

Although Rivian has always emphasized that it hopes to achieve positive profitability in the fourth quarter with a series of reform measures, it is unlikely to achieve profitability even with another year given the current production situation.

Judging from the development of domestic new forces, there are very few automakers that can maintain profitability, even with a gross margin per vehicle of over 10%. In the U.S. market supply chain environment, it is difficult for Rivian to significantly reduce the cost per vehicle, even through independent research and development.

As for price increases, it is even more difficult. The price of Rivian's electric pickup trucks is already double that of Tesla's. Any further price increase would push consumers towards Tesla."

Losing money on new energy vehicle sales has long been a problem plaguing new forces. Huge initial investments and the inability to form a scale advantage to reduce production costs have led to persistent losses.

From the perspective of domestic new forces, a few automakers that are profitable have only managed to overcome operating losses after experiencing rapid sales growth. As for Rivian, with annual deliveries of 50,000 vehicles, achieving profitability is almost a fantasy.

To learn from Tesla, one needs to have strong capabilities and, more importantly, explore more diversified markets. From Tesla's experience, it achieved rapid sales growth and profitability after entering the Chinese market. Rivian, which is only focused on the U.S. market, may find it difficult to realize its ambition of surpassing Tesla.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.