Baidu: No Miraculous Turnaround, Only Difficulties Ahead

![]() 11/25 2024

11/25 2024

![]() 554

554

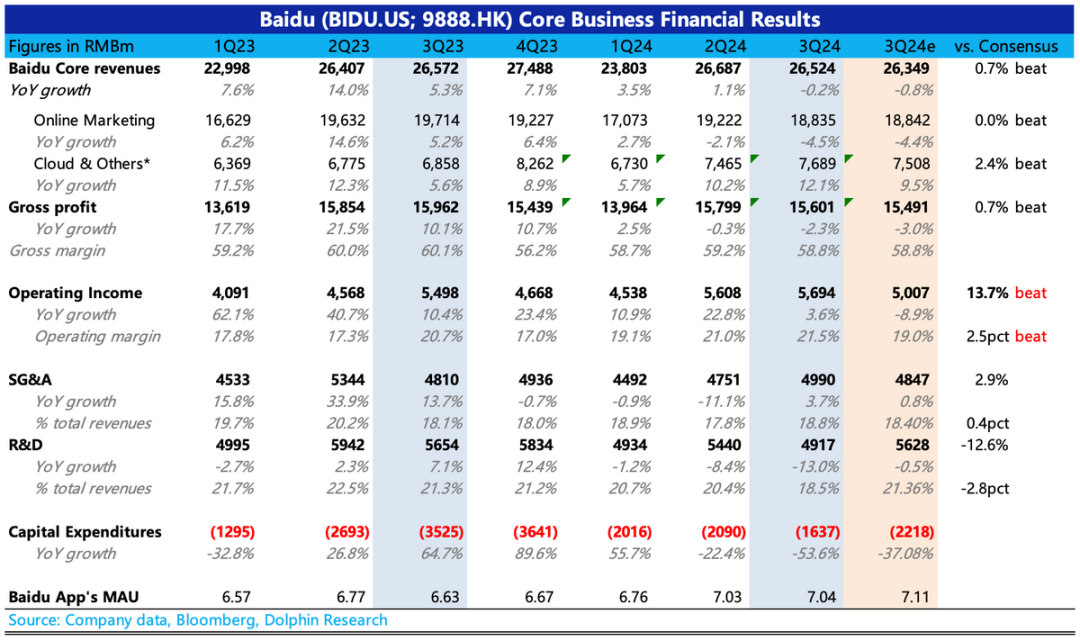

Baidu's third-quarter report was released after the Hong Kong stock market closed on November 21, 2024. Although the Q3 performance was generally in line with market expectations after institutions unanimously lowered their forecasts at the end of October, it was the company's subsequent guidance during a smaller meeting indicating a high single-digit decline in core advertising revenue growth for Q4, rather than a slight recovery after policy stimulus, as well as the lack of a clear repurchase upgrade plan, that truly caused the market to express dissatisfaction through sharp declines.

(The following focuses on Baidu's fundamentals, so only Baidu's core performance is discussed.)

Specifically:

1. Advertising Under Pressure, Even More so in Q4?: Despite the strong promotion of AI, Baidu's current valuation and cash flow primarily rely on advertising. Therefore, the performance of advertising directly determines Baidu's stock price performance for some time.

The pressure on advertising in the third quarter was expected, and at the end of October, institutions made another round of downward adjustments, with some institutions being notably more conservative. However, for the fourth quarter, institutions expected some recovery driven by recent policies, such as a low single-digit year-on-year decrease in revenue.

However, things did not go as planned. During the conference call, management revealed that they have not seen any improvement in advertisers' confidence. Furthermore, during a smaller communication meeting, they directly provided guidance for further deterioration, indicating that the decline in Q4 would increase to a high single-digit, which undoubtedly greatly disappointed the market.

Although traditional search is under pressure, for new AI businesses, the company still stated that it is currently only focused on user education and not on commercialization. In the third quarter, the penetration rate of AI search reached 20%, up from 18% in the previous quarter, but the rate of increase has slowed down.

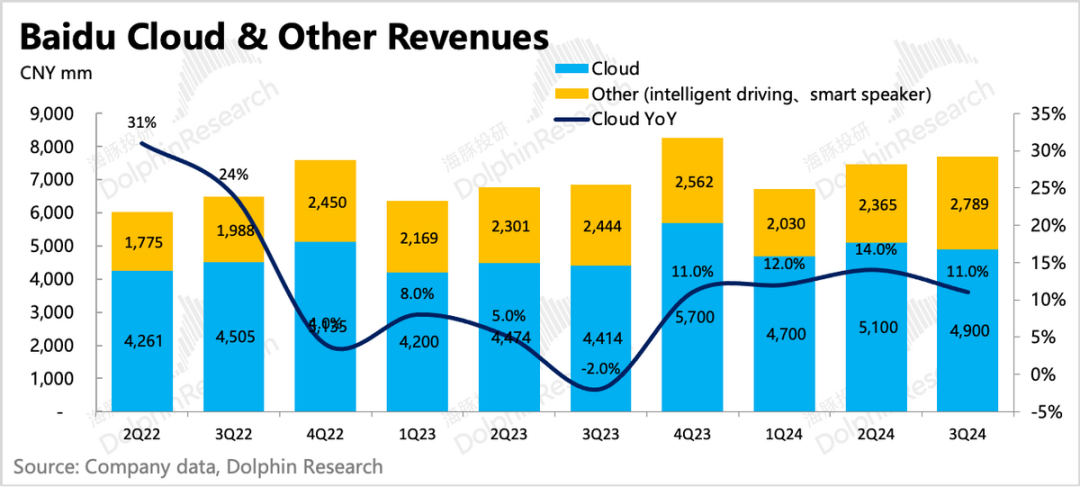

2. Unexpected Deceleration in Cloud Growth?: In the third quarter, the growth rate of intelligent cloud was only 11%, a slight decline from 14% in the previous quarter, despite a lower base in the third quarter.

Dolphin believes that there are macroeconomic and business adjustment reasons for this (the cloud storage business was moved from the intelligent cloud department to the mobile ecosystem department in the third quarter), but it cannot be ignored that there may also be a phased slowdown in demand for Gen-AI cloud:

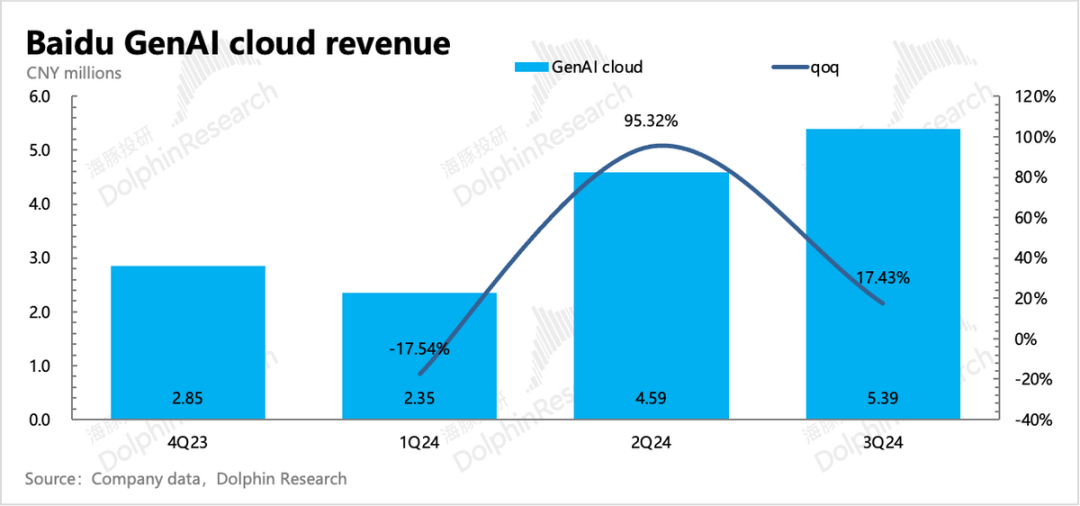

Of the 4.9 billion intelligent cloud revenue in the third quarter, revenue driven by generative AI accounted for 11%, an increase of 2 percentage points from the previous quarter. However, the actual scale of 540 million saw its quarter-on-quarter growth rate rapidly decline from 95% in the previous quarter to 17%.

This can also be seen from specific API calls: After a significant reduction in inference costs, API calls surged in the third quarter, with the last week of September seeing a year-on-year increase of 240%. However, most of the current API calls come from the demand for ToC products (mainly internal product demand) rather than external enterprise customer demand that can truly generate incremental revenue.

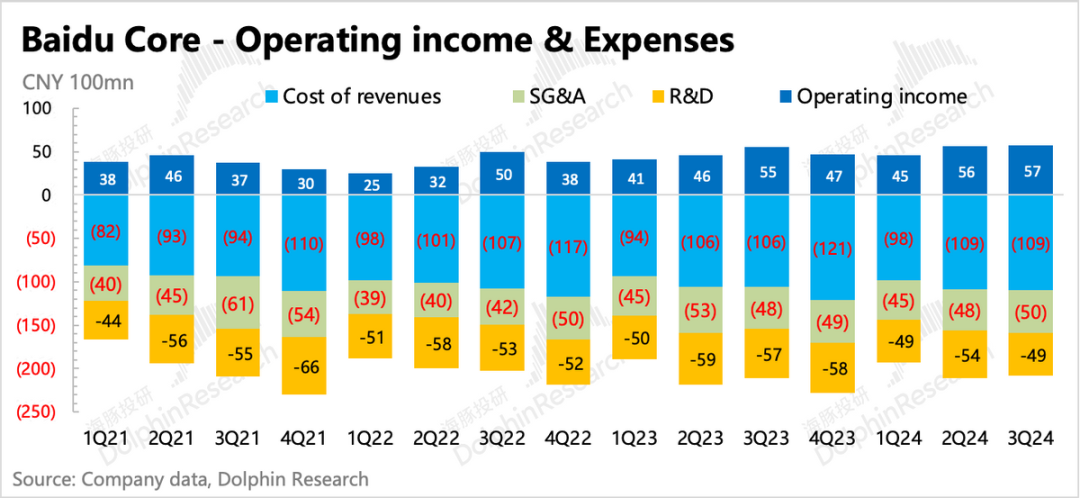

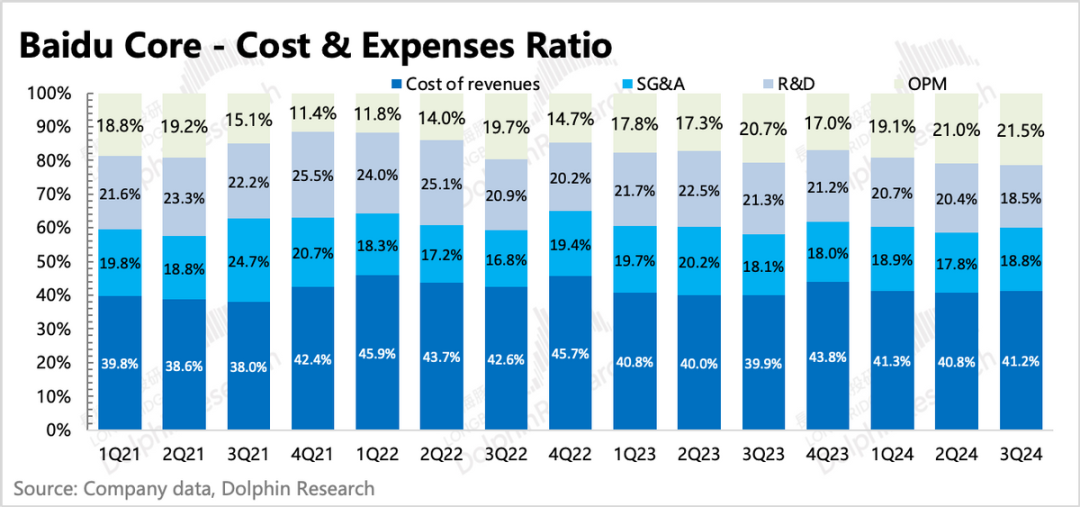

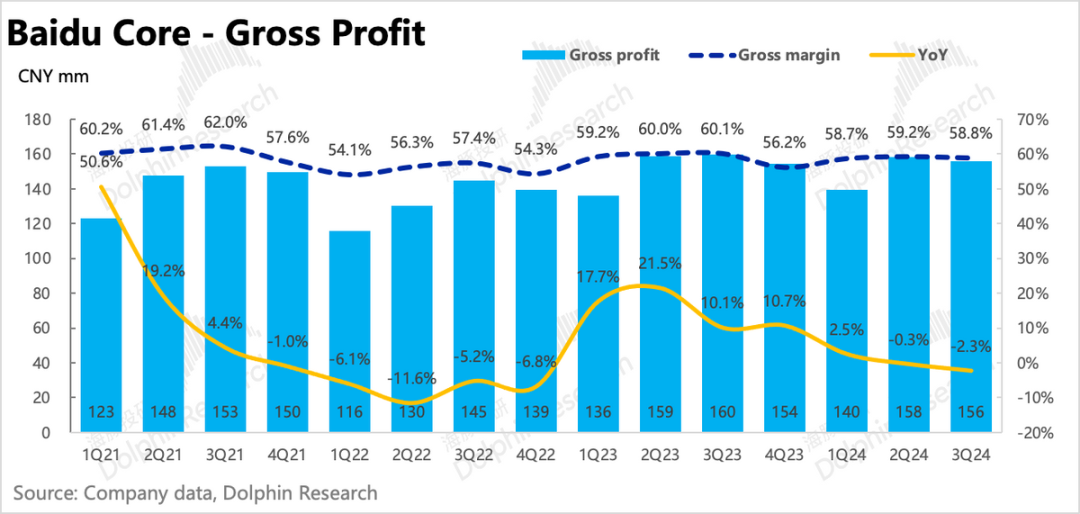

3. Profit Exceeding Expectations?: Similar to the previous quarter, the profit beat in the third quarter was also due to personnel reductions during the organizational adjustment process, as can be seen from the 19% year-on-year decline in equity incentives.

In the third quarter, Baidu merged its Healthcare Business Group (HCG) into the Mobile Ecosystem Group (MEG) and also included Baidu Cloud Storage in MEG. Ultimately, driven by a 13% year-on-year decline in R&D expenses, operating profit margin increased by 0.5 percentage points quarter-on-quarter.

4. Will Autonomous Driving UE Become Profitable Next Year?: Excluding intelligent cloud revenue, businesses such as Xiaodu, intelligent transportation, and autonomous driving grew by 14% year-on-year in the third quarter, continuing to accelerate significantly compared to the previous quarter.

In the third quarter, Luobo Kuaipao received 988,000 orders, a year-on-year increase of 20%, with fully autonomous driving orders accounting for over 70%, rising to 80% in October.

However, for the autonomous driving business, the market is most concerned about when Luobo Kuaipao's UE economic model will become profitable. Currently, the most significant cost factor is vehicle costs, and the company has clearly stated that it expects to achieve a profitable model in some cities by the time the Apollo RT6 is launched.

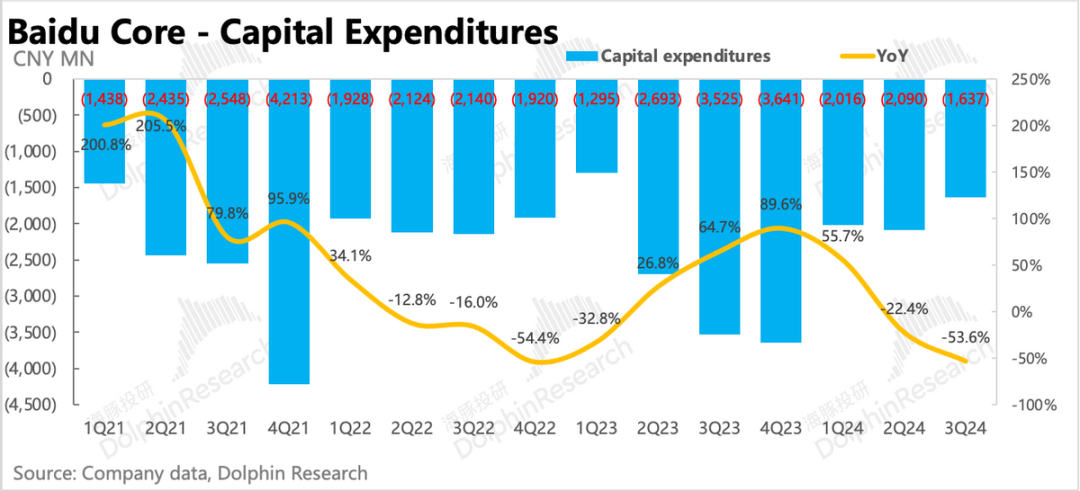

5. Higher Profits but Worse Cash Flow?: Baidu Core's free cash flow in the third quarter was only 2.4 billion, a year-on-year decline of 59%, making it only higher than that in the first quarter of 2022. The main reason for such poor cash flow is the decline in operating cash flow, not capital expenditures, which have actually contracted against the trend.

Management did not explain the reasons behind this during the conference call. Dolphin believes that the main reasons for the decline in operating cash flow are:

(1) The cash flow of the advertising business has always been good, so when Baidu's advertising is under pressure, its cash flow will naturally be affected to some extent; (2) At the same time, although other businesses (intelligent cloud, smart hardware, autonomous driving, etc.) appear to have good revenue growth rates, they may not necessarily result in current receivables.

In addition, the contraction of capital expenditures against the trend in the third quarter may not be the norm, mainly due to previous upfront supply investments. When subsequent AI demand continues to expand, Baidu may also need to increase investments again. Conversely, does the current contraction in Capex indicate that Baidu is also experiencing a cooling of short-term AI demand?

6. Fewer Repurchases?: The scale of Baidu's repurchases in the third quarter was lower than in the past, with only 160 million USD repurchased. Management explained that this was due to the rebound in market capitalization in the third quarter. Based on the repurchase pace of 1 billion USD over the past year, the shareholder return rate is 3.5% (as of the market close on November 21), which is low among Chinese concept stocks.

However, Baidu is not short of funds. As of the end of the third quarter, Baidu Core had 20 billion USD in cash and short-term investments. Even after deducting long- and short-term borrowings, net cash was 18.4 billion USD.

During the conference call, management stated that the repurchase pace would resume when the market capitalization was low in the fourth quarter but did not provide a quantifiable commitment. From the perspective of the proportion of repurchase expenditures, management still prefers to retain earned money for subsequent operational investments and short- and long-term deposits/financial products (over 15 billion RMB of short-term funds were continued to be converted into long-term fixed deposits in the third quarter).

Currently, Baidu's net cash as a percentage of market capitalization has reached an astonishing 64%, but it is not surprising that the market chooses to ignore it. For a company facing short-term growth bottlenecks and unsuccessful long-term transformation, if it does not generously reward shareholders, then having more cash has no relationship with shareholders and cannot be added to its valuation. Among Chinese concept assets, there are not a few cases where the market capitalization is lower than net cash. If the company does not increase its commitment to long-term shareholder returns, such a "cash floor" cannot become a true "valuation floor."

7. Overview of Detailed Financial Report Data

Dolphin's Perspective

Only when the tide recedes do you discover who has been swimming naked. This saying perfectly describes Baidu in recent years. During the full transformation to AI, Baidu's persistent problem of losing market share in search has not been resolved. On the contrary, due to the immaturity of current AI commercialization, it has harmed the group's overall revenue generation. This has made Baidu's performance lag behind among several leading platforms during a severe macroeconomic period.

Of course, this is determined by the pain points of search engines themselves. Google, across the ocean, also faces the erosion of search entries by AI, but the actual experience is vastly different - Google search maintained strong growth of 12% in the third quarter, and cloud revenue accelerated to 35%.

Although the macroeconomic environments of the two differ, there are more differences in themselves:

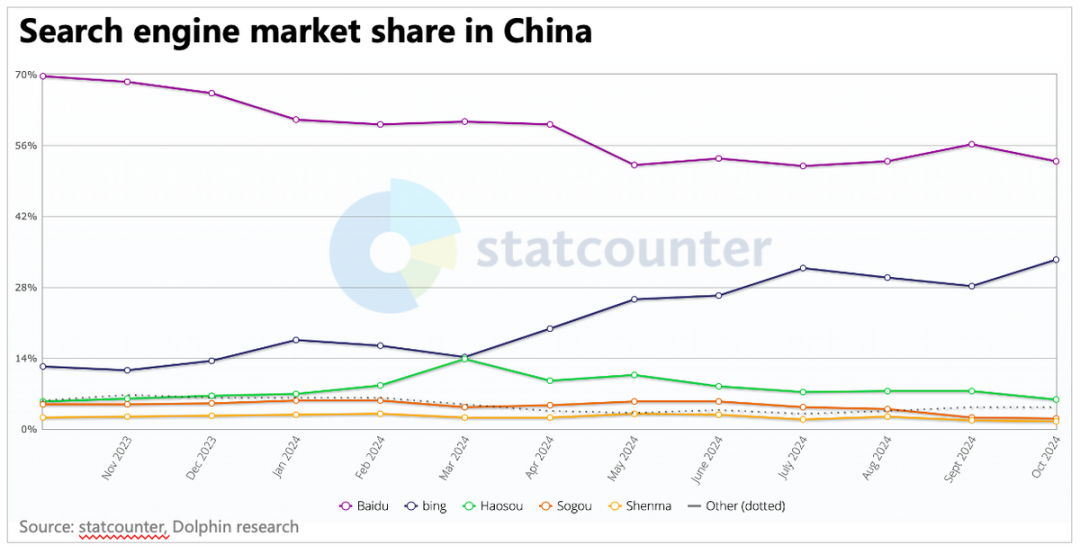

Google has at least not lost its search scenarios. This stems from its leading product experience and good user reputation. However, Baidu's search engine has a mediocre reputation, with users often struggling to efficiently obtain information amid advertising pages. Coupled with the emergence of new information carriers such as short videos, social platforms and other search engines (Bing, WeChat Search) have been diverting traffic from Baidu.

The rapid improvement in information acquisition efficiency brought about by AI undoubtedly hits these pain points even more directly. Even after peers have successively launched large AI models, Baidu's search, even with 20% of search volume coming from AI, may still see a decrease rather than an increase in overall traffic. The lack of user scenarios is truly fatal, making it so that even if Baidu's AI improves advertising effectiveness, it may only be regarded as insignificant by current advertisers.

Another significant change in these quarters is that Baidu is reducing costs and increasing efficiency. However, cost reduction and efficiency enhancement have always been the icing on the cake rather than a lifesaver. During a revenue pressure period, relying solely on cost reduction and efficiency enhancement is difficult to support the market's long-term growth confidence in the company.

After the performance release, Baidu's market capitalization further shrank to 28.6 billion USD. At first glance, it seems that with net cash of 18.4 billion USD (after deducting long- and short-term borrowings), management only needs to make a little more effort to privatize the company. But as always, under inefficient investments, net cash that is not used to reward shareholders has zero value to shareholders. In the third quarter, Baidu took advantage of the higher market capitalization to reduce its already scarce repurchases and instead continued to convert some short-term funds into long-term deposits. At least subjectively, management may not intend to significantly expand repurchases within one year.

Therefore, Dolphin's judgment on Baidu remains the same as in the previous quarter. Before AI truly produces miracles, if subsequent policies are effective, Baidu can only follow the overall industry valuation repair space as the macroeconomy marginally recovers, without room for an independent market trend.

Below is a detailed interpretation of the financial report

Baidu is a rare internet company that breaks down its performance in detail into:

1. Baidu Core: Covers traditional advertising business (search/information flow advertising) and innovative businesses (intelligent cloud/DuerOS Xiaodu smart speakers/Apollo, etc.);

2. iQIYI Business: Memberships, advertising, copyright sublicensing, and other services.

The two businesses are clearly separated, and with iQIYI being an independently listed company with detailed data, Dolphin Investment Research will also break down the two businesses in detail here. Since the two major businesses have an offset item of about 1% (between 200 million and 400 million), the detailed data of Baidu Core broken down by Dolphin may slightly differ from the actual reported numbers, but this does not affect the trend judgment.

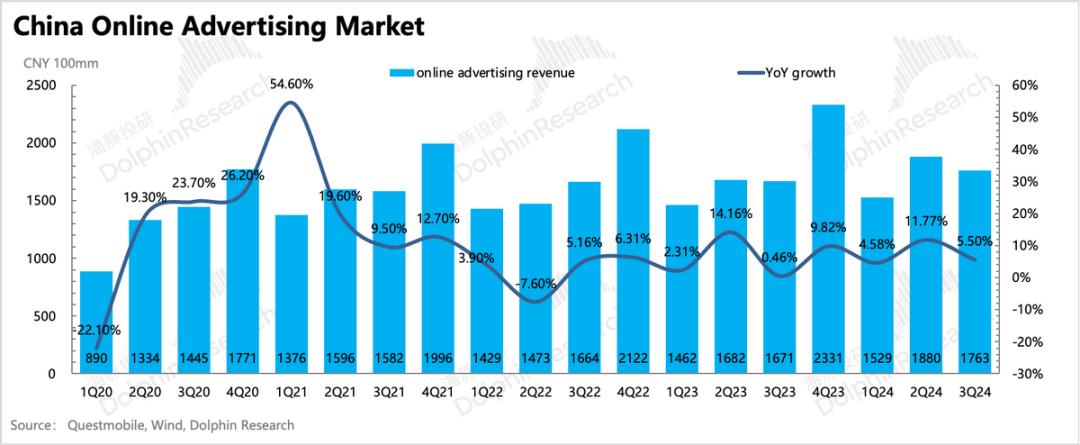

I. Advertising Under Pressure, Even Worse Guidance?

Baidu Core's advertising declined by 4.5% year-on-year in the third quarter, which was basically in line with the adjusted market expectations. Among them, high-margin managed page advertising accounted for 51%, remaining flat quarter-on-quarter.

There is no need to elaborate on the macroeconomic pressure in the third quarter; the growth rate of the entire industry also rapidly slowed down to 5.5%. However, despite some stimulus policies introduced in October, management's guidance for the fourth quarter did not show any improvement, but rather worsened.

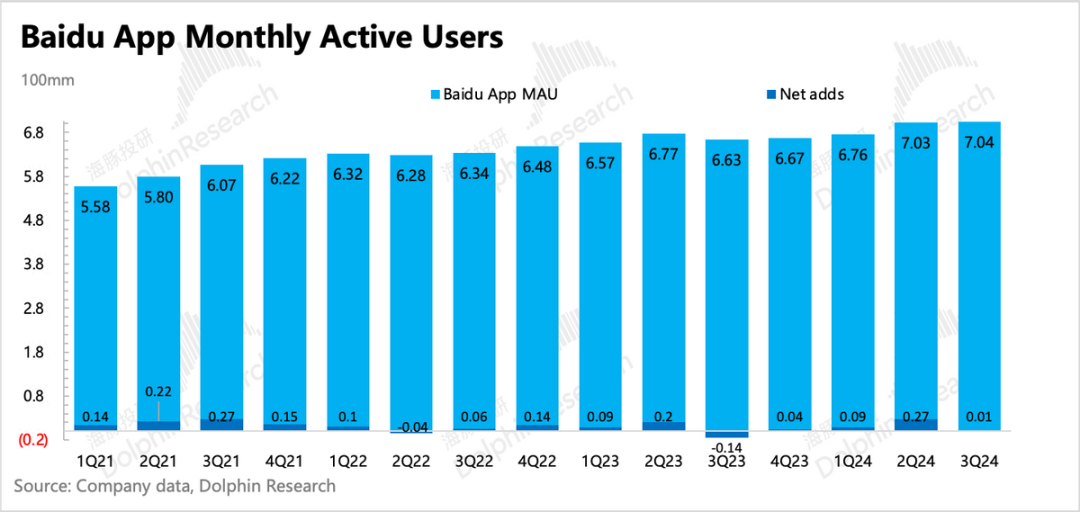

The core reason is that Baidu's search ecosystem does not have inherent advantages, only a relatively high scale (the monthly active users of Baidu Mobile increased by 1 million in the third quarter to 704 million). However, user stickiness and time spent are relatively weak.

This is not only insufficient in social platforms but also in the subcategories of search engines. Baidu's share is rapidly declining.

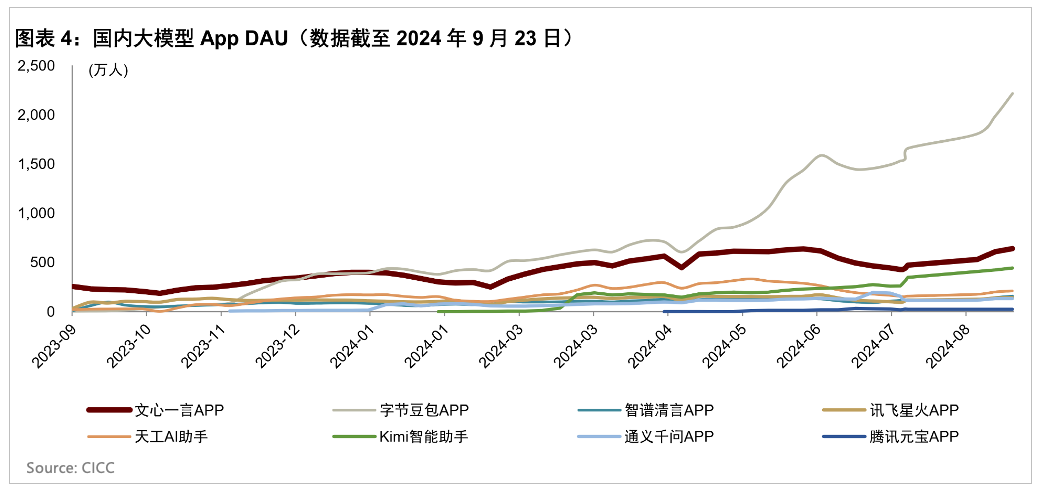

It seems that AI's advantage has also long been surpassed by ByteDance's Douyin, widening the gap. Dolphin believes that when AI is still a relatively insignificant function for most ordinary users (during the user education period), it is still necessary to look at the hard power of the traffic base camp. ByteDance's exclusive and flood-like rapid penetration relies on the traffic advantage of its original ecosystem. Conversely, the weakness of Baidu's traffic base camp may further weaken the ability of ERNIE Bot to maintain its lead.

Management expects a high single-digit decline in core advertising revenue for the fourth quarter. In addition to the macroeconomic pressure and competitive pressure mentioned above, it also includes the growing pains during Baidu's AI search transformation.

In the third quarter, AI search results accounted for 20% of overall search results, an increase of 2 percentage points quarter-on-quarter. Perhaps due to the slowing growth rate and insufficient actual user penetration, Baidu stated that it is still not in a hurry to monetize, which will undoubtedly continue to exert greater pressure on short-term advertising revenue.

II. Slowdown in Intelligent Cloud Growth Rate: Short-term Disturbances but Demand Pressure Cannot Be Ignored

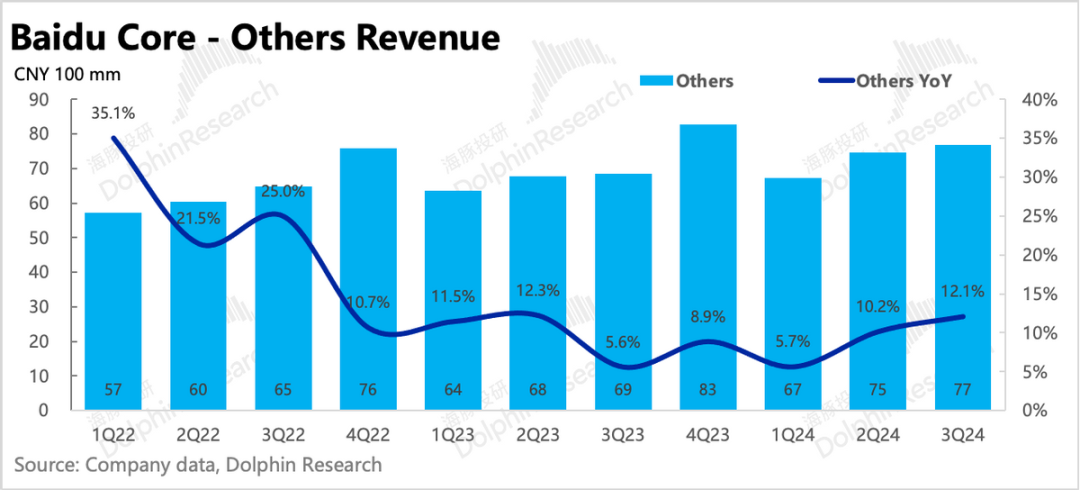

Of Baidu Core's other businesses (non-advertising), nearly 80% of revenue comes from intelligent cloud, with the remaining 20% mainly from autonomous driving technology solutions, smart speakers, and other revenue.

Other business revenue in the third quarter was 7.7 billion, a year-on-year increase of 12%, accelerating compared to the previous quarter, mainly driven by a low base and Luobo Kuaipao (which received 990,000 orders in the third quarter, a year-on-year increase of 20%, slowing down from the 26% growth rate in the previous quarter). However, intelligent cloud growth was 11%, slowing down from 14% in the previous quarter, even though the base in the third quarter of last year was lower.

This includes factors such as the adjustment of Baidu Cloud Storage business, but Dolphin believes that the rapid decline in the quarter-on-quarter growth rate of generative AI cloud, from 95% to 17%, indicates that at least in the short term, there has been a slowdown in demand for AI cloud.

III. Layoffs for Efficiency, Continued Slowdown in Investments

Regarding market concerns about the impact of AI investments on the profit side, although there was some confirmation in the third quarter, the impact on the overall gross margin was still controllable, which may be related to the fact that the currently more direct and extensive call scenario - AI search issues have not yet been directly monetized.

From the perspective of capital expenditures, Baidu's investments in AI servers and chips continued to contract significantly in the third quarter, continuing the slowing trend from the previous quarter.

Dolphin believes that this investment cycle of contracting against the trend (where industry leaders are all increasing capex) is not a medium-to-long-term norm, and subsequent changes will still need to follow the actual demand changes in the industry. Conversely, does the current capex contraction imply that the demand for AI felt by Baidu is also cooling down?

However, for now, if there are no more groundbreaking products on the downstream application side, Baidu's motivation to continuously increase capital expenditures should not be too high under the pressure of revenue in the short term of 1-2 quarters.

Like the previous quarter, SBC expenses in the third quarter continued to decline significantly by 18% year-on-year, indicating that expenditure optimization mainly comes from layoffs/pay cuts, followed by depreciation and amortization of equipment directly related to R&D. In the end, Baidu's core operating profit in the third quarter was 3.9 billion, with a profit margin of 21%. Under the pressure of revenue, it improved by 1 percentage point year-on-year, exceeding market expectations.