China Becomes the World's Largest Market for Industrial Robots, with Domestic Manufacturers Continuously Increasing Market Share

![]() 11/25 2024

11/25 2024

![]() 465

465

By Yang Jianyong

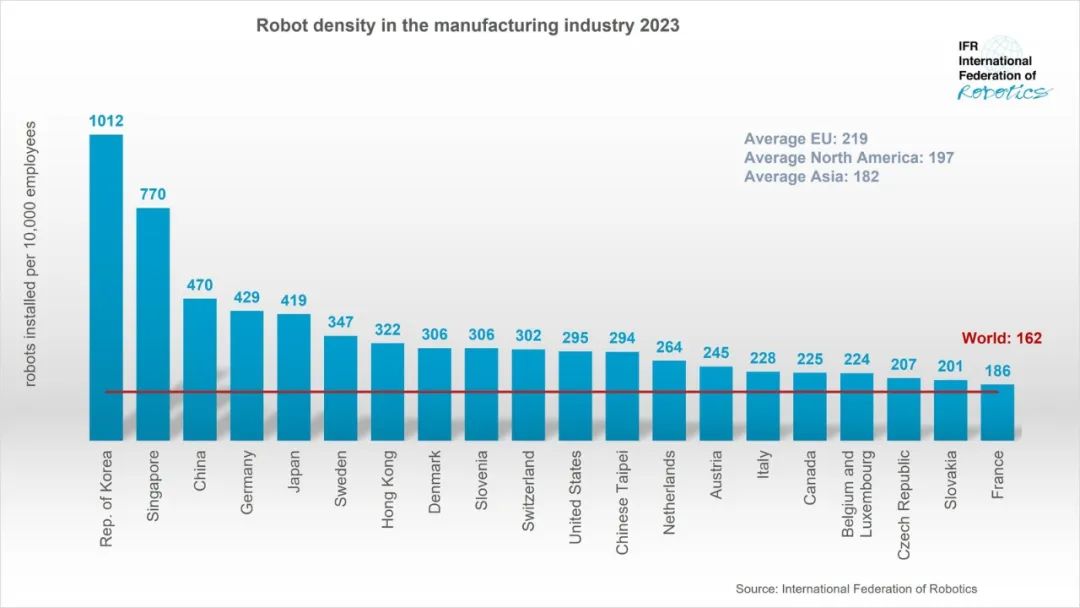

Recently, the International Federation of Robotics released the latest report, indicating that the global installation scale of industrial robots is expanding, and the global density of industrial robots has doubled in seven years. Data shows that in 2023, the global density of industrial robots reached a record high of 162 robots per 10,000 employees, twice the number seven years ago.

Notably, in terms of industrial robot density among countries globally, China has risen to third place, with 470 robots per 10,000 employees, ranking second only to South Korea and Singapore. This achievement is attributed to China's continuous promotion of automation technology in recent years, unleashing the potential of the industrial robot market and becoming a major driving force in the global robot industry.

As the manufacturing industry continues to enhance digitization, automation, and intelligence levels, including the deployment of industrial robots, production efficiency has significantly improved. As a result, China has become the world's largest consumer of industrial robots and has maintained its position as the world's largest market for industrial robots for 11 consecutive years.

In 2023, the global installation of industrial robots amounted to 541,300 units, with China accounting for 276,000 units, representing 51% of the global installation. As of 2023, China's total industrial robot stock reached 1.8 million units, ranking first globally.

It is worth noting that in the Chinese industrial robot market, Fanuc, ABB, Yaskawa, Kuka, and other manufacturers used to dominate the market share. Nowadays, domestic industrial robot brands have also developed rapidly, with outstanding manufacturers such as Estun Automation and Inovance Technology emerging, and their sales continuing to grow. According to MIR (Robot & Intelligent Equipment), sales of domestic industrial robots have surpassed those of foreign brands.

In the first three quarters of 2024, cumulative sales of industrial robots in China were approximately 216,000 units, a slight year-on-year increase of 5%. Despite the weak overall market demand, it still maintains a certain degree of resilience. Among them, domestic manufacturers in China have maintained a strong growth momentum. In the first three quarters of 2024, the year-on-year growth rate of domestic industrial robot manufacturers reached 21.1%, much higher than the overall market growth rate.

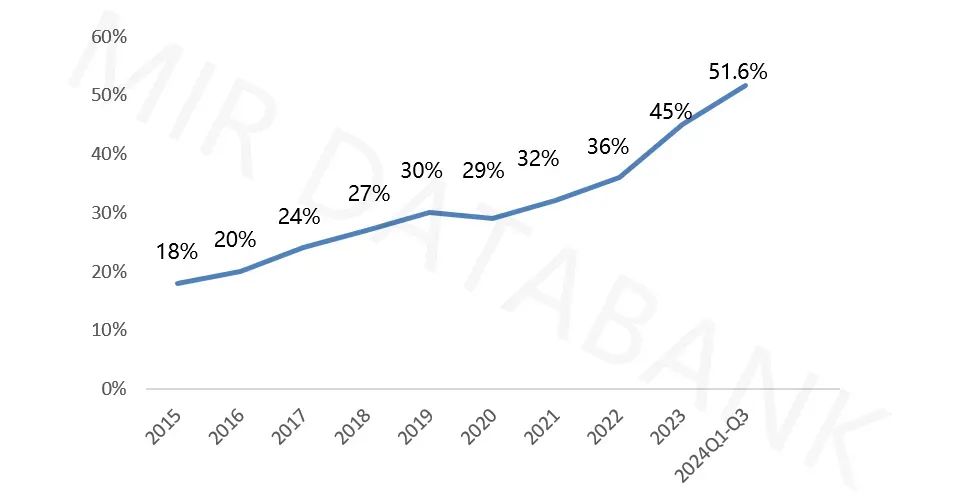

In competition with foreign brands, domestic Chinese manufacturers have maintained a strong growth momentum, leading to a continuous increase in market share for domestic brands, which now exceed 50%.

Localization Rate of Industrial Robots from 2015 to Q1-Q3 2024 (Data Source: MIR DATABANK)

In the first three quarters of 2024, the market share of domestic manufacturers increased to 51.6%, an increase of 4.5 percentage points from the same period in 2023, further enhancing their position and influence in the market.

Among domestic industrial robot manufacturers, Estun Automation, Inovance, Efort, and Stars Electric stand out, ranking second, third, eighth, and tenth in the market, respectively. Thanks to the accelerated substitution of domestic products in recent years, domestic manufacturers have continuously increased their market share, firmly occupying a favorable position in market competition.

As a leading domestic industrial robot company, Estun Automation's market share continues to increase. With the rapid increase in shipments, it has opened up room for revenue growth, and its industrial robot and intelligent manufacturing business have maintained rapid growth. In the first three quarters of 2024, revenue reached 3.366 billion yuan, a year-on-year increase of 4.38%. Revenue in the third quarter was 1.198 billion yuan, a year-on-year increase of 21.66%, with revenue from industrial robots and intelligent manufacturing systems increasing by 19.33% year-on-year.

Inovance Technology, as a domestic industrial control giant, has a market value of 156.8 billion yuan. It is worth mentioning that when Inovance Technology was first established, the Chinese industrial control market was almost monopolized by foreign brands. However, Inovance broke the monopoly of international giants such as ABB and Siemens in the field of industrial automation.

Since its establishment, Inovance Technology has developed at an astonishing rate, benefiting from the development trends of industrial automation and intelligent manufacturing, which have driven strong revenue growth. According to disclosed data, revenue has increased from 159 million yuan in 2007 to 30.4 billion yuan in 2023, representing a 191-fold increase in revenue scale. The compound annual growth rate from 2020 to 2023 was as high as 60%.

In the first three quarters of 2024, Inovance Technology's revenue was 25.398 billion yuan, a year-on-year increase of 26.22%, maintaining a high growth trend. Among them, revenue from general automation (including industrial robots) was approximately 10.9 billion yuan, a year-on-year increase of approximately 4%. During the performance presentation, Inovance Technology stated that the growth rate of its industrial robot products is higher than that of the general automation business and is one of the company's future strategic pillar businesses.

Inovance Technology is firmly optimistic about the development of the industrial robot business. The main driving force comes from the industry consensus on the trend of machines replacing humans. Enterprises used to consider the balance between input and output when considering machine substitution for humans but now focus on enhancing continuous production capabilities. Secondly, as the cost of industrial robots decreases and they become more flexible and intelligent, their application areas will also greatly expand. Therefore, it is expected that the industrial robot business still has good growth potential.

Finally, manufacturing enterprises are promoting smart manufacturing upgrades characterized by digitization and intelligence, significantly improving production efficiency. Against the backdrop of manufacturing upgrades and the continuous deepening of digital transformation in the manufacturing industry, the demand for industrial automation and industrial robots has surged. In the long run, China's manufacturing industry still has great growth potential.

MIR predicts that the year-on-year growth rate of China's industrial robot market is expected to reach approximately 5%-10% in 2024. The positive medium- and long-term trend remains unchanged. Industrial robots are still automation products in the growth stage and are expected to continue to maintain double-digit growth in the coming years.

Overall, with the support of domestic macroeconomic improvements, industrial upgrades, equipment updates, and other policies, leading domestic robot manufacturers are developing well, the market landscape is being reshaped, the industry is accelerating its shuffling, and the industrial robot industry will enter a stable development stage. For manufacturers in this sector, there is potential for continued revenue growth.

Yang Jianyong is a contributor to Forbes China and expresses only his personal views. He is dedicated to deeply interpreting cutting-edge technologies such as the Internet of Things, cloud services, artificial intelligence, and smart homes.