Lenovo prefers the new to the old!

![]() 11/26 2024

11/26 2024

![]() 582

582

To solidify its market foundation, going it alone is clearly inferior to the power of a group.

@ New technological knowledge original

In October, Lenovo was very busy.

First, the Lenovo Tech World 2024 was held on the 15th in Seattle, Washington, USA, where Lenovo showcased its innovative products, technologies, and solutions in the field of artificial intelligence, with Intel, AMD, and NVIDIA all lending their support simultaneously; later, it engaged in a patent lawsuit against ZTE in the High Court of England and Wales.

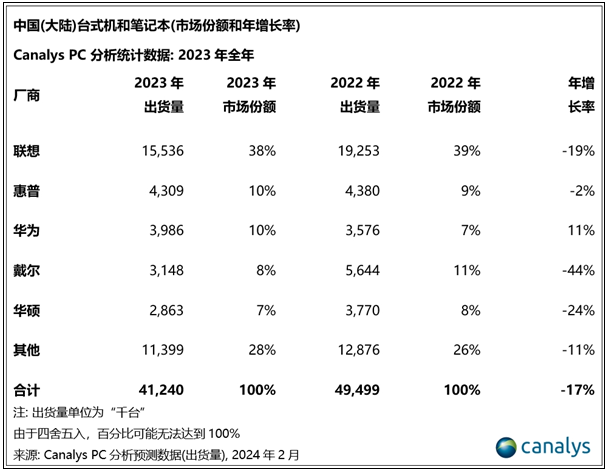

Under the strategy of ALL in AI, Lenovo is making a comprehensive push in the directions of personal computers, mobile phones, and smart solutions, and its determination to make a big move is obvious. However, the higher the expectations, the greater the difficulties. According to the 2023 Mainland China PC Market Report (desktops + notebooks) released by market research firm Canalys, in the fourth quarter of 2023, shipments of PCs (excluding tablets) in Mainland China were 11.3 million units, a year-on-year decrease of 9%. Among them, desktop shipments decreased by 13% year-on-year to 3.3 million units; notebook shipments decreased by 7% year-on-year to 8.1 million units. For the full year 2023, shipments totaled 41.2 million units, a year-on-year decrease of 17%.

Lenovo needs to increase its voice to consolidate its basic market, and clearly shouting by itself is far inferior to the momentum of a group. Relying on friends is naturally the preferred solution for Lenovo. However, in the business world, the establishment of a social circle is inherently based on interests. If someone helps you, there will be someone who cannot help you; if someone comes first, there will be someone who comes later.

In assessing the situation, Lenovo inevitably "prefers the new to the old".

01

Making friends in the automotive circle

Lenovo has once again expressed its stance to the automotive circle.

On October 17, Rui Yong, President of Lenovo ETG (Emerging Technology Group), reiterated that Lenovo's entry into the smart car field is not to obtain data from automakers but to focus on the computing platform, positioning itself as a computing power platform provider.

This statement has somewhat reassured Lenovo's friends in the automotive circle. Currently, there are approximately 140 automotive brands competing in the Chinese market, including nearly 100 local brands and over 40 multinational brands. According to data from the China Passenger Car Association, from January to August 2024, there were 173 brands that reduced prices in the domestic automotive market, exceeding the 150 models that reduced prices in 2023 and significantly surpassing the total of 95 price reductions in 2022.

More seriously, many automakers have disappeared amid this intense competition in the automotive circle. Zhu Huarong, Chairman of Changan Automobile, estimates that 60%-70% of brands will face closure, merger, or transformation in the next 2-3 years.

Against this backdrop, Lenovo's commitment not to manufacture cars is good news for automakers. Lenovo also values the role of a shovel seller, which is why it decided to enter the market. Back on November 9, 2022, at the Lenovo Tech World, Lenovo Group first announced its strategic planning and development vision for automotive computing, focusing on the development of main products such as intelligent cockpit systems, autonomous driving, and smart displays, and providing services related to computing platforms such as operating system software, middleware, and application development environments. At that time, the new energy vehicle market was in an explosive growth phase, with the industry consensus being that the first half focused on electrification and the second half on intelligence. Serving automakers with equally huge sales and demand was naturally Lenovo's main direction of advancement.

In fact, at that year's Tech Innovation Conference, Lenovo first exhibited an intelligent cockpit system jointly developed with Chery Automobile, including intelligent products such as one device with multiple screens, intelligent cockpit domain controllers, curved transparent A-pillar systems, driver health monitoring systems, and multi-device wireless charging. The intention to bundle with automakers is obvious.

Lenovo's choice to befriend automakers and reiterate at this year's Tech Innovation Conference that it does not want data is also a matter of circumstance. As intelligent driving technology evolves at an accelerated pace, the issue of data ownership with the participation of intelligent computing cores has increasingly become the focus of automakers. Tesla, BYD, NIO, and other automakers have experienced cases where driving data collected through the backend was used to resolve disputes. At this time, as a super vendor, Lenovo naturally needs to provide customers with sufficient convenience and security by not competing for data ownership.

Of course, the closer Lenovo gets to automakers, the further it means getting from some competitors. Huawei is a name that Lenovo cannot avoid since entering the automotive industry. Early on, speculation about whether Lenovo would become the second Huawei never ceased. From a business perspective, Lenovo and Huawei compete in multiple dimensions such as computing power, systems, and in-vehicle domain controllers. To date, Huawei's Business Unit has attracted investments and partnerships from automakers such as Changan Avitar and Thalys, and whether in terms of service depth or customer stickiness, Huawei has stably outperformed Lenovo.

However, Lenovo is not without aces up its sleeve. At this year's Lenovo Tech World, Chairman and CEO Yang Yuanqing and NVIDIA CEO Jen-Hsun Huang jointly announced that Lenovo Group will independently develop the latest generation of in-vehicle domain controller platforms based on the new generation of NVIDIA DRIVE Thor system-on-chip. Lenovo Group is the first Tier 1 company to adopt the NVIDIA DRIVE Thor platform.

High-performance chips are a sweet blessing for Lenovo but a painful reality for Huawei. "The chip shortage severely impacted Huawei's mobile phone business, and to this day, it struggles to obtain high-end chips. In this regard, Lenovo is indeed doing much better than Huawei," said a senior industry insider comparing Lenovo and Huawei's chip situations. Relying on deep cooperation with international giants, Lenovo can obtain richer external assistance than Huawei, both in terms of technology and hardware. From this perspective, Lenovo's social circle once again plays a significant role.

However, to enter the automotive industry, the core competitiveness still lies in products. Whether Lenovo can play its good hand well still needs time to verify.

It is understood that the DRIVE Thor chip can integrate various smart car functions into a single AI computing platform, enabling full-vehicle intelligent driving and intelligent cockpit functions on a single computing platform, including autonomous driving, parking, driver and passenger monitoring, digital dashboards, and in-vehicle infotainment systems.

02

Support from giants

An exhibition is a social circle.

Lenovo's connections in the overseas market were fully demonstrated at this exhibition. NVIDIA CEO Jen-Hsun Huang, Intel CEO Pat Gelsinger, and AMD CEO Lisa Su all personally attended the conference to lend their support, while Microsoft Chairman and CEO Satya Nadella, Meta CEO Mark Zuckerberg, and Qualcomm President and CEO Cristiano Amon also sent video speeches.

As the AI trend sweeps the globe, the connection between upstream core hardware manufacturers and downstream OEMs has once again become tight. The three giants on-site recalled their profound "friendship" with Lenovo Chairman Yang Yuanqing. Jen-Hsun Huang said that he and Yang Yuanqing have been friends since childhood, and that NVIDIA and Lenovo have experienced several computer revolutions together and are now doing their utmost to reshape the computer industry, which is an honor.

With guests arriving in abundance, Lenovo was naturally pleased to see this, and the host's appeal was indeed powerful. The long-term competitors in the CPU field, Intel and AMD, were both able to attend Lenovo's exhibition, demonstrating Lenovo's influence.

Intel CEO Gelsinger took the initiative to joke about the encounter with his competitor: "Today may be the unprecedented first collaboration between Intel and AMD." AMD CEO Lisa Su's expression was more pragmatic. She believed that AMD's focus is on accelerated computing, and Lenovo's market share in fields such as PCs and mobile phones is a valuable partner for AMD processors and graphics cards in terms of product application.

However, what exactly does Lenovo have that can tightly bind these three giants? The answer is sales volume.

As early as last year, ALL in AI was Lenovo's future strategic direction. Institutional data shows that the proportion of AIPC in the overall PC market will reach 55% in 2024 and 85% by 2027. Meanwhile, market research firm Counterpoint also predicts that by 2027, AI PCs will account for 3/4 of the entire PC market, with nearly 500 million AI PCs sold between 2023 and 2027.

In this round of AI-driven replacement trends, Lenovo has a strong presence. According to research firm Canalys, as of August 2024, Lenovo's AI PC shipments increased by 228% month-on-month, outpacing the global AI PC shipment growth rate of 204%. The greater expectation lies in the future: Lenovo plans to achieve a 10% shipment share by the end of the year, reach 25% globally next year, and approach 50% by 2026.

Both upstream and downstream need sales volume, so the three giants naturally follow Lenovo's lead. With the strong support of its social circle, Lenovo's influence has surged worldwide, prompting it to consider breaking into the sports marketing scene.

During the Tech World, Lenovo announced a partnership with FIFA, becoming an official technology partner of FIFA. The partnership covers the 2026 FIFA World Cup to be held in Canada, Mexico, and the United States, as well as the 2027 FIFA Women's World Cup to be held in Brazil.

Lenovo Group's products, services, and solutions, including a range of the latest AI innovation portfolios, iconic ThinkPad laptops, tablets, Motorola mobile phones, and servers, will be used in the 2026 and 2027 World Cup tournaments.

Clearly, with the support of its social circle, Lenovo is unstoppable on the path to breaking through.

03

Increasing investment in India

With more friends, it is inevitable that some will be neglected, and Lenovo is falling into such a dilemma.

According to Lenovo Group, it will recently expand its investment in India by establishing an AI server R&D center in Bangalore and enhancing the production capacity of the Pudukkottai manufacturing plant.

It is reported that the plant's production capacity target is 50,000 AI rack servers and 2,400 graphics processing unit (GPU) servers per year.

Obviously, the increased investment in India is still heavily focused on AI. Within the same sector, Dell, which entered the market earlier, is expected by Morgan Stanley's analyst team to ship 38,000 AI servers with the Hopper architecture, while Lenovo plans to ship 50,000, clearly intending to compete for a significant share of the AI server market.

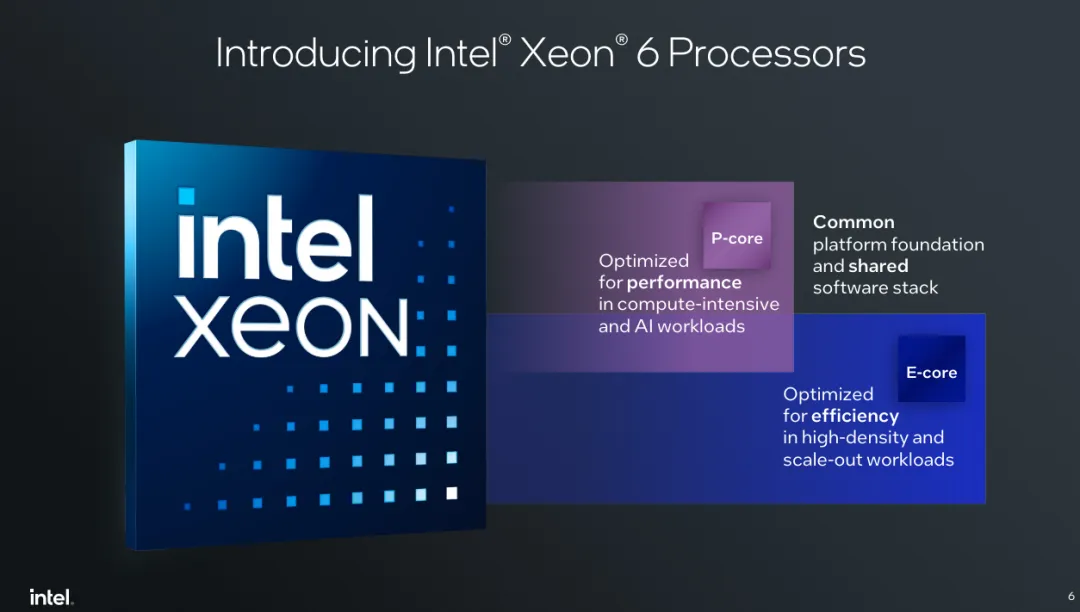

It is important to note that under Lenovo's ALL in AI strategy, its existing product technology structure is facing a significant transformation. For a long time, Lenovo's dominance in the global PC market has been underpinned by its bundling with Intel's X86 architecture CPUs. With the advent of the AI wave, the previous CPU-centric host structure has shifted to a GPU-centric one. However, Intel's products have not kept pace with this change.

Compared to Google and Microsoft's early investments in the AI sector and their applications of high-performance graphics computing, Intel has long rested on its laurels with CPUs. It was not until 2018 that it announced its return to the GPU market.

The mismatch between Lenovo and Intel is even more dramatic. Last September, Intel CEO Gelsinger was the first to propose the concept of AI PCs in Silicon Valley. Subsequently, many manufacturers followed suit at a high speed, with Lenovo taking the biggest step. However, Intel's product structure did not meet Lenovo's needs, making a full transition to NVIDIA and AMD inevitable for Lenovo.

Intel's sluggishness in the AI field based on the X86 architecture has indirectly led to the rapid rise of products based on the ARM processor architecture. Market analysis firms predict that by 2027, the market share of PC devices based on the ARM architecture will exceed 25%.

The trend is irreversible. Not only is Lenovo partnering with NVIDIA and AMD, but embracing ARM has also become inevitable, and the market trend is the same. "NVIDIA is too hot right now, and Intel is indeed facing a critical moment. Missing out on this wave of AI will have a significant impact on its development," an observer said, noting that Intel's market influence has declined significantly. In the fourth quarter of 2022, Intel's market share in the entire data center (including CPUs and GPUs) was 46.4%, which fell to 19.1% in the third quarter of 2023. During the same period, NVIDIA's market share increased from 36.5% to 72.8%, with GPU revenues for data centers growing by over 400% year-on-year, while Intel's data center revenues fell by over 40% from their peak.

Even old friends like Lenovo are adjusting their cooperation layouts, leading to the argument that "X86 is facing death." However, Lenovo has still secretly helped its old friend Intel by brokering a partnership between Intel and AMD to formally establish the X86 Ecosystem Advisory Group, aimed at simplifying software development, ensuring interoperability and interface consistency, and providing developers with standard architecture tools, instruction sets, and development directions.

The implied meaning is that Lenovo urges Intel to quickly join its inner circle of friends to avoid being left behind step by step.

04 Suing ZTE

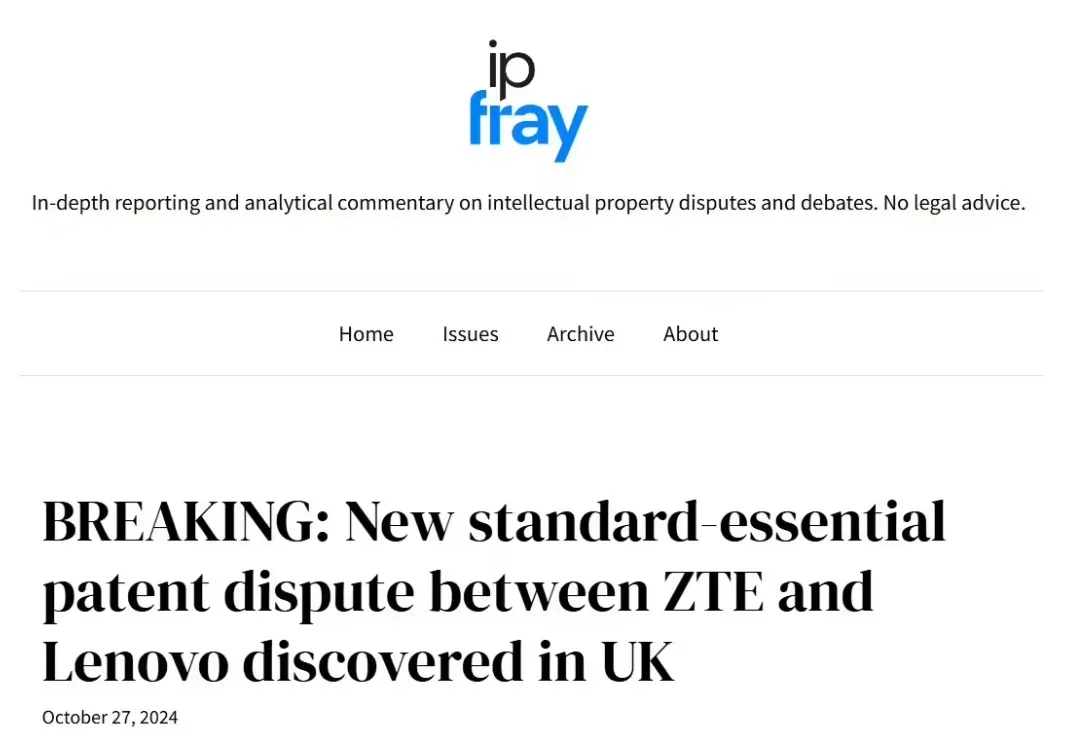

In contrast, ZTE, which has been cultivating the communications and mobile phone markets with Lenovo for many years, has not been so lucky.

Last month, Lenovo Group sued ZTE for infringement of "Standard Essential Patents (SEP)" in the English and Welsh High Court (EWHC). Lenovo Group was the patent licensor, and there were a total of six defendants (four of whom were ZTE dealers).

The news caused an uproar in the market. It is extremely rare for public lawsuits between Chinese giant businesses, especially when both parties are competitors in the same market.

In fact, the focus of this lawsuit is still on interests. According to insiders, Lenovo and ZTE have negotiated on patent licensing fees for several years, focusing on communication products such as mobile phones and computers, with the core being the use of "Standard Essential Patents (SEP)".

However, the complexity lies in the fact that the patent fee disputes between Lenovo and ZTE mainly involve two types: terminals and base stations. Both parties' communication equipment businesses require each other's authorization, so cross-licensing requires considering the respective business volumes and patent values of both parties. The disagreement lies precisely in the perception and judgment of value.

According to the financial report released by ZTE Corporation, as of the first half of 2024, it had approximately 91,500 global patent applications and a cumulative total of approximately 46,000 global authorized patents. According to the "Global 5G Standard Essential Patents and Standard Proposal Research Report (2024)" released by the China Academy of Information and Communications Technology in September this year, ZTE ranks fifth globally in the global patent family ranking, with a share of 6.97%. Lenovo did not appear in the top 10 list.

According to the well-known market research company IPlitics' "4G Standard Project Ranking Table" in the patent field, Lenovo has approximately 300 families of 4G valid standard essential patents, while ZTE has over 2,000 families. Additionally, according to IPlitics' "5G Standard Project Ranking Table", Lenovo has over 2,000 families of 5G valid standard essential patents, while ZTE has over 6,000 families.

Obviously, in terms of technical accumulation, ZTE is more confident in itself, but Lenovo also has its trumps, such as Motorola.

Lenovo Group acquired Motorola and obtained over 2,000 core patents in the field of communication technology. It also obtained non-exclusive use rights for 15,000 patents. With this killer feature, Lenovo's mobile phone shipments can be guaranteed in overseas markets, especially in Europe and the United States. According to the latest 2024 Q3 global mobile phone sales TOP 10 ranking released by market research institution TechInsights, Motorola's shipments increased by 26% year-on-year, with a market share of 5%, ranking seventh. In North America, Lenovo-Motorola ranks a stable third, with its market share increasing to 12%. In contrast, ZTE mobile phones have made no significant impact.

One party focuses on technology, while the other focuses on monetization. Years of negotiations between the two parties have yielded no results, leading to a lawsuit that caused an uproar in the market. However, according to professional interpretation, the most important consideration for choosing to appeal in the UK is to control the compensation amount, rather than involving punitive measures such as sales bans. It seems that Lenovo's attitude towards its old friend is still profit-oriented.

- The end -