Pony.ai Finally Rings the Bell for IPO in the US, Stock Price Rises First and Then Falls on the First Day

![]() 11/28 2024

11/28 2024

![]() 608

608

After eight years of establishment, Pony.ai finally welcomed its IPO.

On the evening of November 27, Beijing time, the autonomous driving company Pony.ai was listed on Nasdaq under the stock symbol "PONY".

After expanding the issuance scale, Pony.ai issued 20 million American Depositary Shares (ADS, each ADS corresponding to one common share) at a price of $13 per share, reaching the upper limit of the issuance price range. The total fund-raising scale amounted to $260 million.

Meanwhile, combined with the approximately $153.4 million worth of common shares sold through concurrent private placements, Pony.ai's IPO raised a total of $413.4 million.

Peng Jun, co-founder and CEO of Pony.ai, said that since its establishment in 2016, Pony.ai has led the industry through cycles and made unremitting breakthroughs for technological change. Now, it has finally reached a critical inflection point in commercialization.

Lou Tiancheng, co-founder and CTO of Pony.ai, also said that Nasdaq listing is only the beginning of autonomous driving technology changing the world, and our journey is far from over. From today on, Pony.ai's belief will take root around the world - AI can not only provide safer and more efficient services but also bring unprecedented experiences, completely revolutionizing human understanding of driving.

On the first day of listing, Pony.ai's stock price rose first and then fell.

Pony.ai's stock price movement on the first day of listing

It had a good start, with the opening price reported at $15 per share, an increase of over 15% compared to the issue price of $13 per share, and once rose to a maximum of $15.75 per share. However, it then fell all the way down, and as of the close of trading on November 27, US Eastern Time, Pony.ai's stock price fell to $12 per share, below the issue price, with a decrease of 7.69%.

However, it rose slightly after the market closed.

01 Pony.ai Shrouded in the 'Star Halo'

Founded in 2016, Pony.ai is one of the earliest autonomous driving companies in China and one of the most 'star-studded' enterprises, mainly thanks to its two 'key figures': CEO Peng Jun and CTO Lou Tiancheng.

Both are alumni of Tsinghua University and have worked at Google and Baidu successively.

Founder and CEO Peng Jun

Co-founder and CEO Peng Jun was previously the Chief Architect of Baidu's autonomous driving team, responsible for the overall strategic planning and technological development of Baidu's autonomous driving. Earlier, Peng Jun worked as a software engineer at Google and won the highest award at Google - the Google Founders' Award.

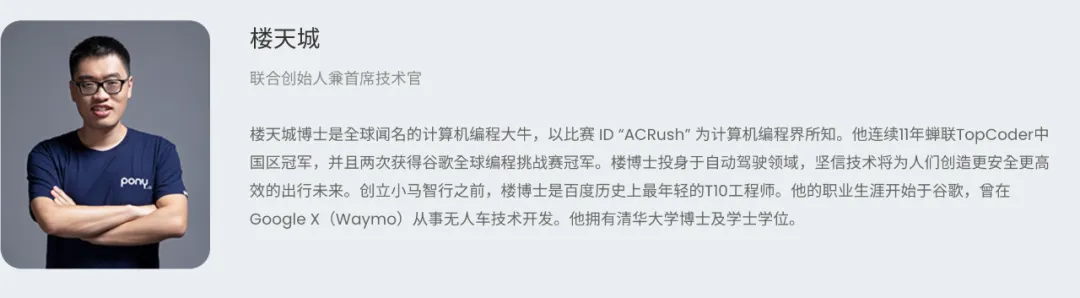

Another co-founder and CTO, Lou Tiancheng, is known as the 'first programmer in China'. He has won the TopCoder China championship for 11 consecutive years and won the Google Global Coding Competition twice. He was once a member of Google's autonomous driving team and later worked at Baidu as the youngest Chief Architect at the time.

Founder and CTO Lou Tiancheng

In addition, Yao Qizhi, the world's only Chinese Turing Award winner and a computer scientist, serves as Pony.ai's chief advisor. Yao Qizhi is currently a professor and dean of the Institute for Interdisciplinary Information Sciences at Tsinghua University. The renowned computer science experimental class at Tsinghua University, 'Yao Class', was founded and named by him.

With such a powerful founding team, it naturally attracts more technical talents. According to the prospectus, as of now, Pony.ai has a total of 1,359 employees, of which 601 are purely in the R&D team, excluding deployment and product teams, and are considered as 'one of the strongest autonomous driving teams in China'.

Riding on the earliest wave of autonomous driving enthusiasm and shrouded in the halo of a star team, Pony.ai has been the most capital-attractive Chinese autonomous driving company since its establishment, and it is difficult to add the attributive 'one of' after it.

Public information shows that since its establishment, Pony.ai has conducted multiple rounds of funding, with a cumulative amount exceeding $1.3 billion, and the post-investment valuation of the last round exceeded $8.5 billion.

In 2020 alone, Pony.ai disclosed fund-raising of $730 million

Among them, there are leading OEMs such as Toyota and GAC, as well as leading institutions such as Sequoia China, CPE, and IDG Capital.

Although multiple rounds of high-intensity funding have diluted the equity of the founding team and company executives to some extent, the two core founders still have absolute control over Pony.ai.

The latest prospectus shows that Pony.ai's largest shareholder is Peng Jun, with a shareholding ratio of 17.3%. According to the A/B share structure (Class A shares have one vote per share, and Class B shares have ten votes per share), Peng Jun holds 55.6% of the voting rights, while the other founder, Lou Tiancheng, holds a 6.1% shareholding ratio and 19.5% of the voting rights.

For a company with technology as its core label, it is essential for the founding team to have the core voice.

02 Pony.ai Reaches a Commercial Inflection Point

On the day of the listing, Peng Jun said with emotion that Pony.ai has finally reached a critical inflection point in commercialization.

The listing is a critical inflection point, and so is the revenue growth.

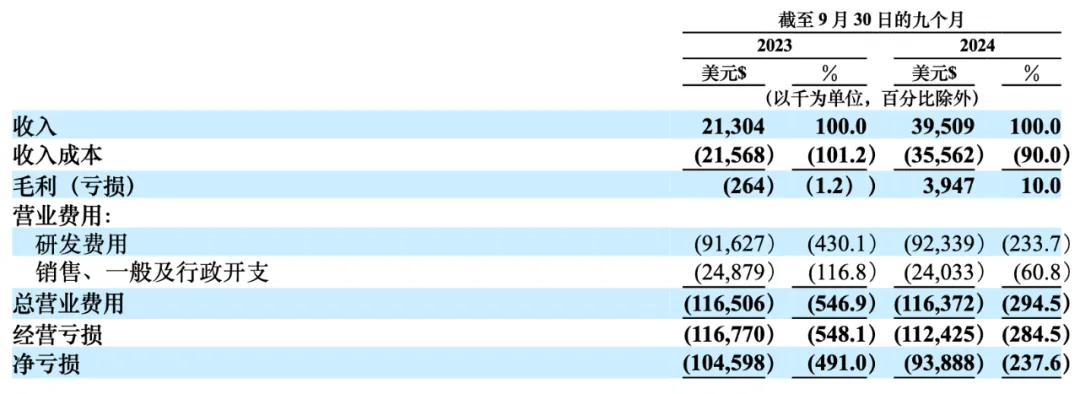

According to previous prospectus data, Pony.ai also disclosed some financial data for the first three quarters of 2024. Its overall revenue for the first three quarters increased by 85.5% year-on-year to $39.51 million.

In terms of business, all revenue streams have increased.

Pony.ai's financial status for the first three quarters of 2024

For the first three quarters of 2024, Pony.ai's autonomous driving mobility service revenue was $4.7 million, a year-on-year increase of 422.2%. According to Pony.ai, this is mainly due to the technical service fees for providing autonomous driving solutions for a project in Korea.

In addition, as Pony.ai expands its paid autonomous taxi service for the public in first-tier cities in China, the increase in passenger fares has also contributed to some extent. However, it also admitted that these businesses are still in the early stages of commercialization.

Revenue from autonomous freight services was $27.4 million, a year-on-year increase of 56.5%. Pony.ai said that this growth is mainly due to the increase in transportation service fees charged by Cyantron.

In the first nine months of this year, compared with the same period in 2023, Cyantron expanded its geographical coverage and added 45 robot trucks, leading to an increase in transportation service fees. Meanwhile, the mileage traveled by Cyantron's autonomous truck fleet increased from over 12 million kilometers in the first nine months of 2023 to over 17 million kilometers in the same period of 2024.

Revenue from technology licensing and application services was $7.4 million, a year-on-year increase of 155.2%. Pony.ai said that this growth is mainly due to an increase of $4.4 million in value-added service revenue.

Overall, Pony.ai, which is still in the business exploration phase, has seen significant changes in its revenue structure during this period. Notably, the autonomous truck business has grown significantly over the past period and contributed a large proportion of Pony.ai's revenue.

Data shows that revenue from the autonomous truck business increased from $22.37 million in 2022 to $25.02 million in 2023. By the first nine months of this year, this figure reached $27.4 million.

Over the past two years, the proportion of this business in revenue has increased from 32.7% to 69%.

In contrast, the revenue proportion of Pony.ai's Robotaxi business during the same period decreased from 13.1% in 2022 to 10.7% in 2023 and less than 11.9% in the first nine months of this year, with overall insignificant changes.

In terms of gross margin, for 2022, 2023, and the first nine months of this year, Pony.ai's gross margins were 46.9%, 23.5%, and 10%, respectively, showing a clear downward trend. Previously, Pony.ai stated in its prospectus that the decline in gross margin was mainly due to changes in the revenue mix.

In terms of expenses, R&D expenses accounted for the majority of its expenditures during the same period. From 2022 to the first nine months of this year, its R&D investments were $154 million, $123 million, and $92.34 million, respectively.

With a cumulative investment of approximately $367 million in less than three years, R&D expenditures have basically been more than twice the revenue.

Sales, general, and administrative expenses were $49.18 million, $37.42 million, and $24.03 million, respectively, during the same period.

Whether in absolute terms or as a percentage of revenue, there is a downward trend overall, which also reflects Pony.ai's internal emphasis on cost reduction.

In terms of net losses, they were $148 million, $125 million, and $93.9 million for 2022, 2023, and the first nine months of this year, respectively.

Finally, in terms of cash, as of the first half of this year, its cash and cash equivalents and restricted cash on hand amounted to $335 million (approximately RMB 2.38 billion).

Given the current burn rate, Pony.ai's operational pressure in the short term is manageable, but the financial pressure remains significant in the long term, especially as various businesses have not yet generated stable commercial revenue.

However, according to Pony.ai's projections, the Robotaxi business is expected to achieve a positive gross margin per vehicle in 2025.

03 Three Business Lines Constituting Pony.ai's Commercial Landscape

Pony.ai's business lines are currently composed of three main areas, which have basically stabilized by now.

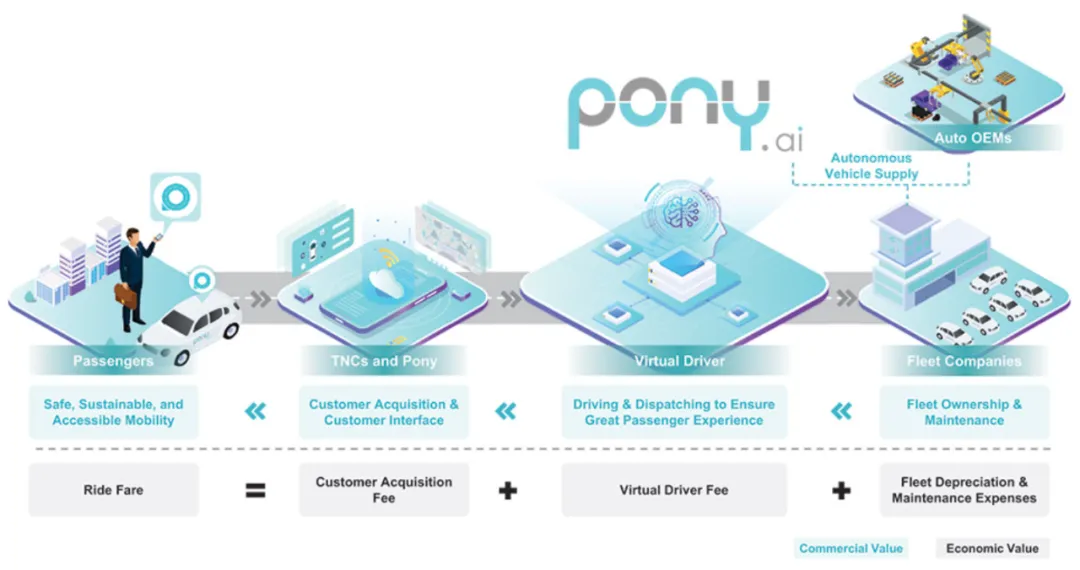

Pony.ai's Robotaxi service

First is the earliest-laid-out Robotaxi business. Currently, Pony.ai operates a fleet of over 250 Robotaxis in cities such as Beijing, Shanghai, Guangzhou, and Shenzhen and has obtained licenses for fully autonomous commercial operations.

As of the first half of 2024, the number of registered users of the Pony.ai PonyPilot mobile application exceeded 220,000. At the end of August this year, the proportion of users who repeatedly used the service was about 70%, with an average of over 15 orders per vehicle per day.

The specific implementation and commercialization methods of this business are as follows: one is to provide autonomous driving solutions to OEMs or multinational companies, including software deployment, maintenance, integration, engineering, and road testing services, thereby generating revenue; the other is to provide Robotaxi services to users through autonomous operations (or third-party platforms) and charge fees.

In this regard, Pony.ai has the closest cooperation with Toyota. On April 26, 2024, Pony.ai jointly established a joint venture with Toyota China and GAC Toyota, with Toyota providing the latest generation of Robotaxi vehicles to Pony.ai.

The desired business model for Pony.ai's Robotaxi

In the future, Pony.ai said it hopes to expand its fleet size through a 'light asset' model by developing a network of third-party fleet companies. These third-party fleets include GAC's Ruqi Chuxing.

In addition, Pony.ai has also accessed third-party ride-hailing platforms such as Amap, Alipay, and Ruqi Chuxing. As of June 30, 2024, the average daily order volume for each fully autonomous Pony.ai Robotaxi exceeded 15.

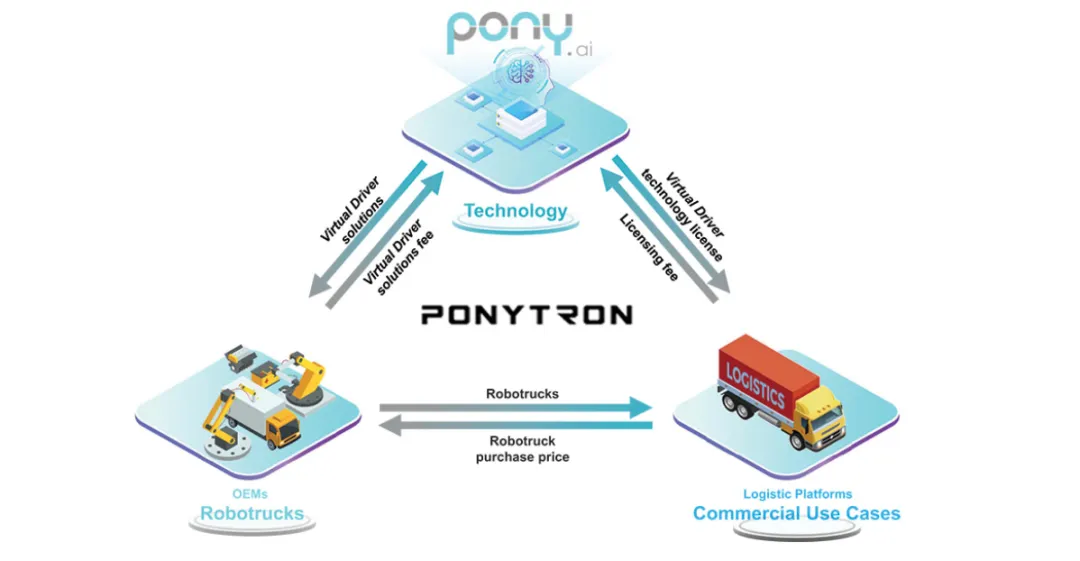

The second is also the Robotruck business based on high-level autonomous driving. Currently, Pony.ai operates a fleet of 190 autonomous trucks, with a cumulative operating mileage of 767 million ton-kilometers (ton-kilometers refer to the sum of the product of the amount of transported goods and the distance traveled, which is an important indicator reflecting the efficiency of the transportation industry).

This business is mainly implemented through an ecosystem model, that is, building an ecosystem with OEMs and logistics platforms. Pony.ai provides autonomous driving technology to OEMs and deploys vehicles for different logistics platforms.

Pony.ai's Robotruck business model

In this regard, Pony.ai cooperates with Sany Heavy Industry upwards and establishes a joint venture, Qingzhi Logistics, with Sinotrans China. Currently, Qingzhi Logistics has over 160 autonomous trucks.

And as we mentioned earlier in the financial report review, Qingzhi Logistics has become the backbone of Pony.ai's commercial revenue.

Finally, there is the licensing and application segment, which has a more complex business composition.

One of them is the POV business unit established by Pony.ai at the beginning of last year, which mainly provides full-stack technical capabilities for intelligent driving assistance from software to hardware to passenger car OEMs, including the intelligent driving software solution PonyPilot, the domain controller 'Fangzai', and the data tool chain 'Qiangchong'.

The known customer is Gemstone Automobile.

In addition, there is also a part of the V2X business, which contributed significantly to revenue before 2023.

Pony.ai Technology Overview

Behind this is a complete set of autonomous vehicle (AV) software stack serving as the "brain" of the virtual driver. This AV software stack employs end-to-end (E2E) technology, eliminating the traditional boundaries between perception, prediction, planning, and control, thereby achieving a unified and seamless approach to analyzing complex road conditions and ensuring the vehicle operates safely and smoothly.

Three business lines constitute the entire business landscape of Pony.ai.

However, we also observe that this business landscape is still in a very early stage of development. A concrete manifestation of this is the instability in revenue structure mentioned in Part 1.

This also indicates that none of the business segments can currently sustainably generate high revenue, ultimately leading to instability in the company's overall income and a continued deterioration in gross margin.

In the short term, Robotaxi and Robotruck are not feasible for large-scale deployment or positive commercialization cycles due to factors such as technology and policy.

The drastic fluctuation in these business segments and the progress in achieving key business objectives will be key areas of focus for investors in the future and the primary issues that Pony.ai needs to address.

Now, Pony.ai has finally gone public, but this is clearly not the end.

As Lou Tiancheng said, the Nasdaq listing is only the beginning of how driverless technology will change the world, and our journey is far from over.

"The path to breakthroughs in driverless technology is akin to climbing Mount Everest, and we have chosen to uphold perseverance, patience, and long-term vision to achieve a qualitative technological leap beyond human drivers." In his view, from today onward, Pony.ai's belief will take root worldwide – AI can not only provide safer and more efficient services but also bring unprecedented experiences, fundamentally transforming human perceptions of driving.

END-