L4 Reborn Star, Market Cap Over $30B, China's Version of Waymo Rings the Bell in the US

![]() 11/28 2024

11/28 2024

![]() 634

634

China and US Robotaxi Stories Have Something to Tell

Author | Wang Lei, Liu Yajie

Editor | Qin Zhangyong

People still hope that China can produce an L4 star enterprise. After Pony.ai's successful IPO, many analysts have dubbed it China's version of Waymo.

Indeed, there are many similarities between the two, such as their insistence on pursuing L4 and aiming for large-scale commercialization of Robotaxi, and their business models of making extensive connections and steadily advancing around strategic focuses.

Pony.ai's ADS pricing for its US stock offering was originally planned to be in the range of $11-$13, but ultimately settled at $13/ADS. As of this writing, its market capitalization has reached $4.2 billion.

In the eight years from its establishment to IPO, autonomous driving has transitioned from wild growth to implementation-centric, and this once trendy industry is no longer synonymous with high-tech sophistication.

Fortunately, Pony.ai persevered.

01 Robotaxi Landscape Stands Out

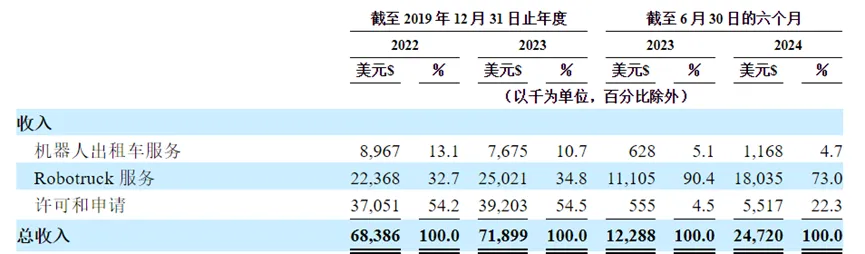

Breaking down its prospectus reveals that Pony.ai is not only involved in autonomous ride-hailing services (Robotaxi) but also in autonomous trucking (Robotruck) and technology licensing and applications.

Behind this multi-faceted approach lies a technical system with over 80% underlying reusability, encompassing vehicle-end perception and recognition, prediction and game theory modules, as well as backend data processing, training, and deployment capabilities, all universally applicable. Its technical goal is to create a "virtual driver" suitable for different vehicle models and scenarios.

Specifically, the largest contributor at present is Robotruck, with cumulative revenue of $27.4 million in the first three quarters of 2024, accounting for up to 69% of total revenue.

This was also Pony.ai's earliest commercial product. In March 2021, Pony.ai launched an autonomous freight solution. In December 2021, it established a holding joint venture, Cyantron, with Sinotrans.

The specific model involves providing services to logistics platforms through Robotruck fleets, charging service fees based on mileage and cargo tonnage. As of the end of June this year, Pony.ai had a fleet of over 190 Robotrucks, with a cumulative freight volume exceeding 767 million ton-kilometers.

Before the rapid growth of the Robotruck business in 2024, technology licensing was Pony.ai's largest source of revenue, with $37.05 million and $39.2 million in 2022 and 2023, respectively, accounting for 54.2% and 54.5% of total revenue. However, in the first half of 2024, this figure was only $5.51 million, accounting for 22.3% of total revenue.

This primarily comprises two parts: the POV business unit, which mainly targets passenger vehicle OEMs and provides full-stack technological capabilities for intelligent driving assistance, ranging from software to hardware, including the PonyPilot intelligent driving software solution, the domain controller "Fangzai", and the data toolchain "Qiongkong". Additionally, there is a V2X business, which contributed significantly to revenue before 2023.

Robotaxi revenue for 2022, 2023, and the first half of 2024 was $896,700, $767,500, and $1.168 million, respectively, accounting for 13.1%, 10.7%, and 4.7% of total revenue.

While the proportion is not large, the progress is rapid. Cumulative revenue for the first three quarters of 2024 was $4.7 million, a year-on-year increase of 422.2%.

According to Pony.ai's plans, it aims to achieve profitability per Robotaxi vehicle in 2025, turning gross profit positive and shifting towards large-scale commercialization of Robotaxi, including providing autonomous driving solutions to OEMs or multinational companies and charging users for Robotaxi services through platform operations.

Pony.ai has made good progress in both areas. The prospectus shows that as of June 30, 2024, Pony.ai had a Robotaxi fleet of over 250 vehicles, already operating in cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, and had obtained licenses for fully unmanned commercial operations.

The platform app had over 220,000 registered users, with an average of over 15 daily orders per fully unmanned Robotaxi vehicle within half a year. As of the end of August 2024, approximately 70% of registered users had used the Robotaxi service multiple times.

Furthermore, Pony.ai has collaborated with Toyota and BAIC to mass-produce Robotaxi models. In April, the next-generation L4 autonomous driving model, Bozhi 4X Robotaxi, developed in collaboration with Toyota, was unveiled.

Upon rollout, it will be directly connected to Pony.ai's Robotaxi operation platform to provide large-scale fully autonomous ride-hailing services in first-tier cities in China. It is expected that by 2025-2026, thousands of Bozhi 4X autonomous vehicles will be deployed in the Chinese market.

Additionally, Pony.ai and BAIC will collaborate to develop fully autonomous Robotaxi models based on the ARCFOX Alpha T5 model and Pony.ai's seventh-generation autonomous driving software and hardware system solution, aiming to form an operational capacity of thousands of vehicles as soon as possible.

These three business lines constitute the entire business landscape of Pony.ai, making it the L4 autonomous driving company with the highest revenue scale among those that have publicly disclosed financial data. The latest prospectus shows that from 2022 to the first three quarters of 2024, its cumulative revenue exceeded $180 million (approximately RMB 1.3 billion).

Despite the three major businesses driving continuous revenue growth for Pony.ai, the Robotaxi profitability story still needs time to unfold.

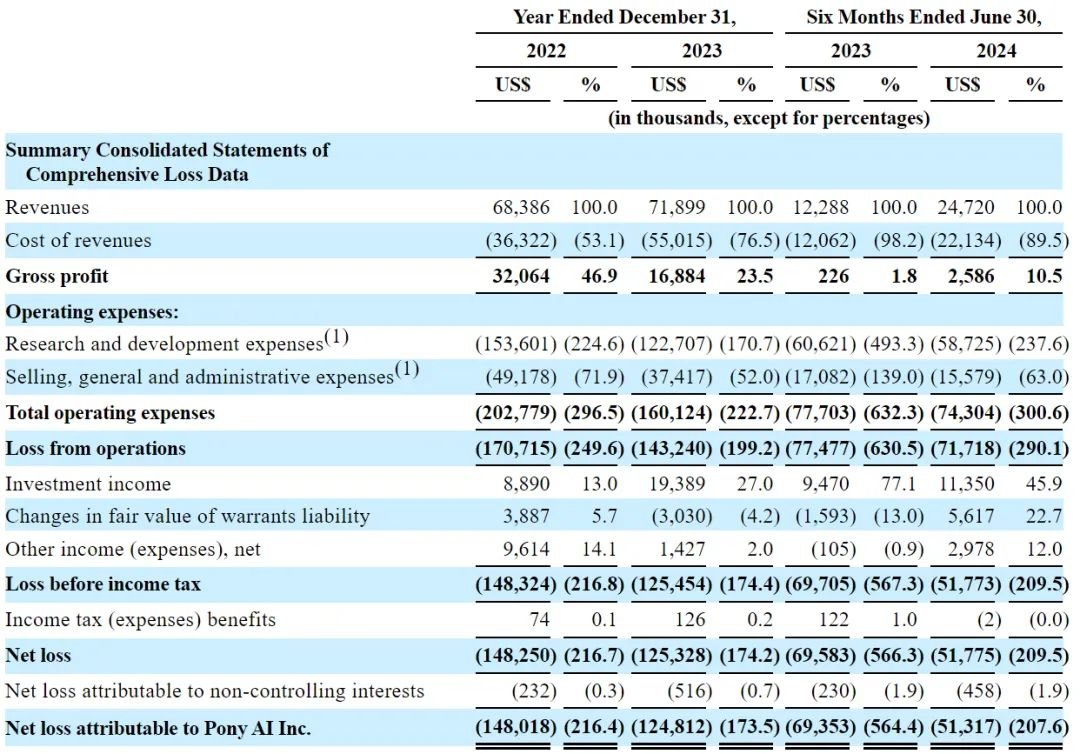

In terms of profits, Pony.ai incurred net losses of $148 million and $125 million in 2022 and 2023, respectively, and a loss of $93.89 million in the first three quarters of 2024.

02 Tsinghua Elite Leaves Baidu to Start a Business

"Listing on Nasdaq is just the beginning of driverless technology changing the world; our journey is far from over."

At the bell-ringing ceremony, Lou Tiancheng, co-founder, and CTO of Pony.ai, expressed these sentiments. Among the key individuals in the "we" he mentioned were co-founder and CEO Peng Jun and Chief Advisor Andrew Yao.

From left to right: Lou Tiancheng, Andrew Yao, Peng Jun

Andrew Yao was Lou Tiancheng's teacher when he studied at Tsinghua's Yao Class, while Peng Jun was an alumnus of Lou Tiancheng. Before starting their joint venture, Peng Jun and Lou Tiancheng had very similar life trajectories.

After obtaining his bachelor's degree from Tsinghua University, Peng Jun went on to further his studies at Stanford University. After graduation, he worked at Google and Baidu, serving as Chief Architect of the Autonomous Driving Department, responsible for the overall strategic planning and technological development of Baidu's autonomous driving efforts.

Lou Tiancheng was a member of the inaugural class of Tsinghua's Yao Class and was once known as the "World's Best Programmer." In programming, he could single-handedly outperform an entire opposing team, earning him the nickname "Professor Lou."

From left to right: Peng Jun, Lou Tiancheng

Their paths truly crossed in 2016. Lou Tiancheng joined Baidu and met Peng Jun, and although he worked there for less than a year, he became Baidu's youngest T10-level employee. However, they still decided to start an autonomous driving venture.

With their academic prowess and Andrew Yao's support, recruitment was very smooth in the initial stages. Yao Class graduates Jin Ce and Du Yuhao followed in the footsteps of "Professor Lou," and many people from Baidu, Google, and IBM also joined.

Moreover, because both founders had solid technical backgrounds and experience in autonomous driving, Pony.ai initially focused all its energy on full-stack, self-developed L4 autonomous driving technology, rather than starting with L2 or L3.

At the time, this decision was quite bold, but the team was strong, and the founders were able to attract many technical talents to join. Many investment institutions still chose to bet heavily on them.

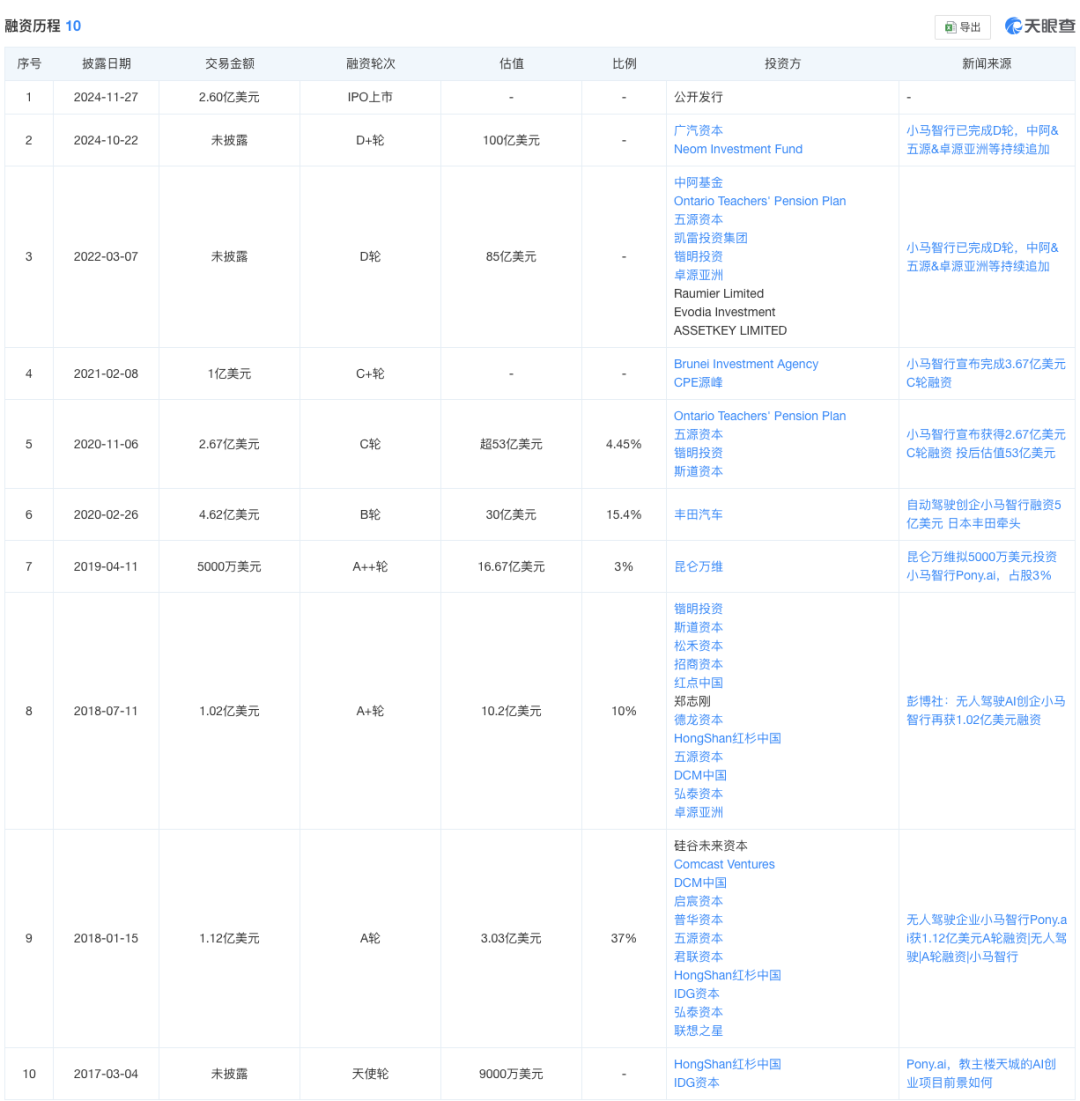

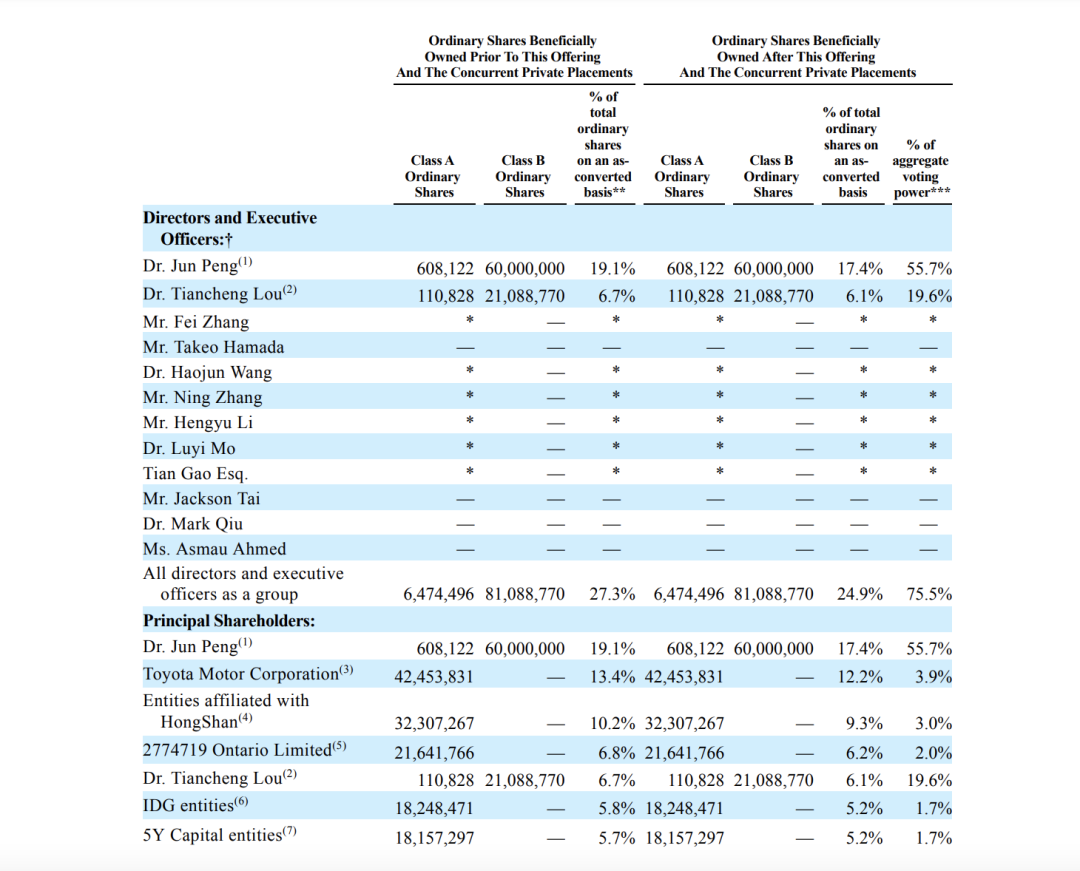

Before the IPO, Pony.ai completed seven rounds of funding, raising over $1.3 billion.

Sequoia China was one of the earliest financial investors. During the first round of funding, Pony.ai opened up a 20% quota. In early 2017, Pony.ai completed its angel round of funding, with Sequoia China leading the investment with a 15% shareholding. Since then, Sequoia China has invested in three more rounds.

Pony.ai is also one of the few projects deeply involved and managed by three Sequoia China partners. In the following eight years, Sequoia China has been a benefactor on Pony.ai's growth path, holding a 9.4% stake post-IPO with 3% voting rights.

The strategic investor with the highest shareholding is Toyota, holding a 12.3% stake post-IPO with 3.9% voting rights. In early 2018, Matrix Partners China co-led Pony.ai's Series B funding and continued to participate in Series C and D funding rounds.

03 Autonomous Driving Ushers in a Warm Winter

Autonomous driving has always been an unpredictable race.

In 2022, the number of financing deals and the amount of financing in the domestic autonomous driving sector declined by 32% and 61%, respectively, year-on-year. Last year, Cruise also had its commercial license revoked, Apple terminated its autonomous vehicle development, and major autonomous driving enterprises both domestically and internationally experienced setbacks or transformations.

However, with the promotion of the Robotaxi industry by Robotaxi Go in July this year and Waymo's completion of its largest funding round to date, amounting to $5.6 billion in October, the autonomous driving sector has shown visible signs of recovery.

Additionally, Tesla's unveiling of its Robotaxi at the "We Robot" conference, though mostly conceptual, has also brought considerable attention to the Robotaxi industry due to its influence in the autonomous driving sector.

According to incomplete statistics from Chaodian Labs, about 10 companies related to the autonomous driving sector have queued up for IPOs this year. For example, Pony.ai's collaborator Ruqi Chuxing went public on the Hong Kong Stock Exchange in July, Black Sesame Technologies and Horizon Robotics also rang the bell for their Hong Kong IPOs, and WeRide successfully went public in the US, becoming the "first global general autonomous driving stock."

This expansion of Pony.ai's offering size before its IPO also serves as evidence of the sector's recovery.

Of course, the influx of IPOs among many enterprises has also intensified the elimination race. Against this backdrop, there have been cases of layoffs and stalled funding, such as the recent news of Zongmu Technology halting salary payments.

It is certain that behind the mixed fortunes, a new era of autonomous driving is on the horizon.