Betting on the Return of AI King, GoerTek's 'Intelligent Agent' is Playing a 'Big Game'

![]() 12/03 2024

12/03 2024

![]() 456

456

Author|Tianfeng

Source|Bowang Finance

GoerTek saved itself with AI.

At the end of 2022, GoerTek was exposed to have been kicked out of Apple's supply chain, causing its stock price to plummet rapidly in a short period, falling from a peak market value of nearly 200 billion to less than 50 billion. One of the 'three musketeers' of Apple's supply chain and a global leader in acoustic equipment and VR, its growth logic was widely questioned.

In 2022 and 2023, GoerTek's net profit was only 1.749 billion yuan and 1.088 billion yuan, respectively, with year-on-year decreases of 59% and 37.8% for two consecutive years.

Questions about GoerTek poured in, and its market value once fell to 50 billion yuan, with a price-to-sales ratio of less than 0.5. Unexpectedly, GoerTek 'saved' itself with the global AI wave in 2023.

After entering 2024, large model companies generally faced significant technical investments and the need for substantial funds to purchase AI chips and other infrastructure, but the implementation of large models became a major challenge. This presented an opportunity for GoerTek.

Since the third quarter of this year, consumer electronics brands such as Apple, Huawei, and Xiaomi have successively launched AI hardware products, including AI PCs, AI phones, AI glasses, and other smart terminals, allowing GoerTek to rebound directly from its lows. In the third quarter, revenue increased by 1.7% year-on-year to 29.26 billion yuan, reversing the downward trend, with a net profit of 1.12 billion yuan, a year-on-year increase of 138%.

The boost from AI to GoerTek's intelligent hardware has also led to a rebound in its stock price, which rebounded from around 14 yuan in May to the current 25.81 yuan per share. It has shown a 'slow bull' trend for more than half a year.

Source: Baidu Stock Connect

Can GoerTek ride the AI wave to return as a king?

01

Follow Industry Hotspots, Fastest Recovery

What kind of enterprise is GoerTek?

Its product categories roughly cover three aspects: one is headphones and audio products; the second is AR, VR devices, and other intelligent hardware; the third is MEMS, speakers, optical modules, and other precision components.

Currently, intelligent hardware products have become the company's primary source of income, accounting for up to 49.15% of its revenue in the first half of 2024.

As mentioned above, GoerTek's orders from Apple decreased significantly in 2022, coupled with the company's asset impairment, resulting in a sharp decline in net profit that year to 1.749 billion yuan, a year-on-year decrease of 59.08%.

However, with the recovery of the AI and consumer electronics markets in 2024, GoerTek's performance has significantly improved. In the first three quarters of 2024, the company achieved revenue of 69.65 billion yuan, a year-on-year decrease of 5.82%. Despite the decline in revenue, profits showed a significant improvement, with a net profit of 2.345 billion yuan for the period, a year-on-year increase of 162.88%.

Along with the recovery in profits, the company's profitability has also increased significantly.

Since the first half of 2023, GoerTek's gross profit margin has increased from 7.29% to 11.44% in the third quarter of 2024, and its net profit margin has also significantly increased from 0.91% to 3.29%. As of the third quarter of 2024, the company's monetary funds amounted to 16.288 billion yuan, with ample cash flow.

Although heavily impacted by Apple's orders in these two years, GoerTek has not been idle and has actively expanded its customer base. In the headphones sector, besides contract manufacturing for Apple's AirPods, the company has also established stable relationships with leading Android customers such as Huawei, Xiaomi, and OPPO. In the VR headset sector, the company is a core producer for technology giants such as Meta, PICO, and Sony, maintaining stable cooperative relationships with multiple leading enterprises.

Unlike O-Film Tech, which took nearly five years to recover after being kicked out of Apple's supply chain, GoerTek has managed to eliminate the impact of Apple's order cuts in just over a year, becoming the fastest consumer electronics enterprise to shake off the effects of Apple's supply chain. At the same time, with its customer base stabilized, GoerTek can naturally leverage its advantages in acoustics.

From 2019 to 2023, GoerTek's R&D expenses increased significantly from 1.807 billion yuan to 4.716 billion yuan, with R&D investment accounting for nearly 5% of revenue. This not only further consolidates GoerTek's position in acoustic consumer electronics but also extends its reach into VR devices.

As Apple's Apple Vision Pro production costs gradually decline, the VR industry is poised for a new wave of growth. In terms of market share, Meta leads the VR industry, with shipments reaching 5.34 million units in 2023, far surpassing competitors with a market share of 71%. GoerTek is a core supplier to Meta.

Moreover, Meta plans to launch two versions of VR products in 2026, a high-end and a low-end model, to meet the needs of users with different consumption capabilities downstream.

On this basis, it is expected that Meta's VR product shipments will continue to increase, benefiting GoerTek, its primary OEM. Besides VR products, what is GoerTek's layout in other intelligent agent directions?

02

AI Intelligent Agent on the Verge of Explosion

Since 2013, GoerTek has been involved in the field of virtual reality (VR) and has elevated it to a core business at the company's strategic level.

In its 2022 annual report, GoerTek explicitly stated that it would actively explore new business directions and opportunities, particularly in the development of new products in the fields of precision optical devices and modules, sensors, microsystem modules, VR, and augmented reality (AR). Therefore, GoerTek urgently needs new partners to upgrade and transform the traditional VR track.

If Apple's orders are somehow 'toxic,' can GoerTek find alternatives? Indeed, there is one: Xiaomi.

Currently, Xiaomi is reshaping intelligent hardware devices with AI concepts. Previously, media reported that Xiaomi's AI glasses would fully compete with Meta Ray-ban, not only incorporating advanced AI functions but also integrating audio headphone modules and camera modules, with plans to launch them under Xiaomi's own brand.

Besides Xiaomi, which is progressing rapidly, companies such as OPPO, vivo, Huawei, Tencent, and ByteDance are actively evaluating AI glasses projects.

The entire industry is waiting for which company will ignite the 'iPhone moment' for AI glasses.

In addition to the AI glasses market, the prospects for the AI headset market are equally promising.

On October 10, ByteDance/Douyin Group's Doubao launched its first AI intelligent agent headset, Ola Friend, featuring an open design with a single earbud weighing only 6.6 grams, the lightest in its class.

This headset is deeply integrated with the Doubao large model. By touching the headset or saying the wake-up phrase 'Doubao Doubao,' users can invoke the Doubao app on their phones through voice commands for interaction. With Doubao access, the headset possesses general intelligence and can be used in various scenarios such as travel, English learning, and chatting. It officially went on sale on October 17 for 1,199 yuan.

Currently, many headsets and speakers with intelligent voice assistant functions have emerged on the market, such as Apple's AirPods series deeply integrated with Siri and Amazon Echo speakers equipped with Alexa intelligent voice services. These products not only have basic audio playback functions but can also complete complex tasks such as information inquiries, smart home control, and schedule management through voice commands, greatly enhancing user convenience and life efficiency.

Headsets and speakers are rapidly emerging as one of the important footholds for AI intelligent agents. It can even be said that if everything will have AI in the future, then all products will have AI headset and AI speaker functions.

Therefore, whether it's AI glasses or AI headsets, GoerTek occupies a unique position in the ecosystem layout of AI intelligent agents, demonstrating the potential to become a 'system integrator.' However, merely receiving upstream AI intelligent agent orders is not enough; the key lies in also being able to supply components for AI intelligent agents, especially MEMS sensors.

03

MEMS Sensor Leader

MEMS sensors play a vital role in the application of various intelligent agents in the future.

Taking smart speakers as an example, AI intelligent terminals need to analyze and make decisions based on collected data, and the quality and diversity of data provided by MEMS sensors are crucial for decision accuracy. By fusing and analyzing data collected from multiple MEMS sensors, the AI system can gain a more comprehensive understanding of the user and environmental status, making more reasonable and intelligent decisions.

Another example is in autonomous vehicles, where the vehicle's control system integrates data from multiple MEMS sensors, such as cameras, radars, and inertial measurement units, to accurately perceive and judge road conditions, vehicle positions, and speeds, enabling safe and efficient autonomous driving functions.

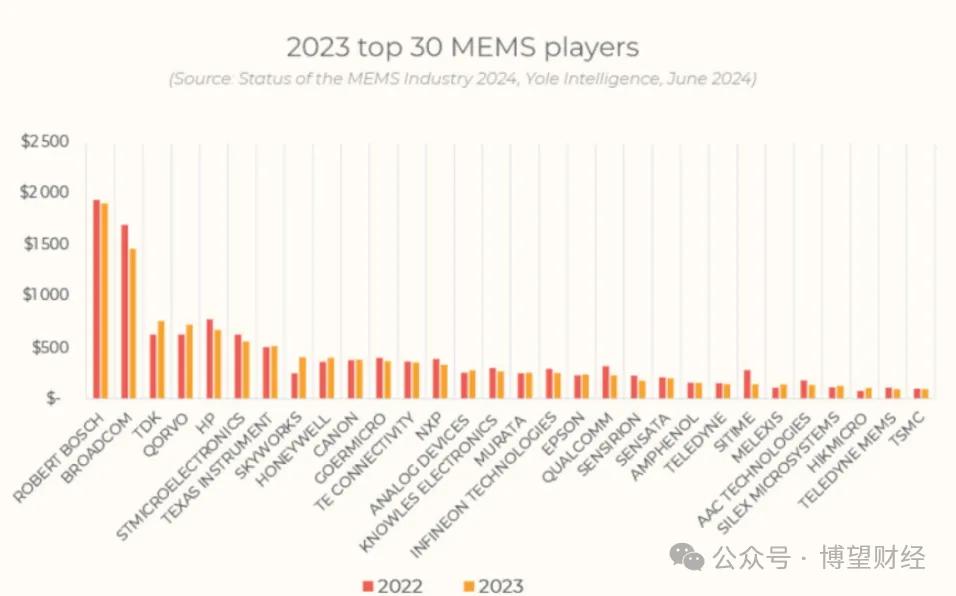

In the 2024 MEMS Industry Report "Status of the MEMS Industry 2024" released by Yole Group, five Chinese MEMS enterprises entered the global TOP 30. Among them, GoerTek Microelectronics ranked 11th, the highest-ranked Chinese MEMS company. Additionally, Chinese companies such as AAC Technologies (26th) and Hikvision Microelectronics (28th) also made the top 30.

To further enhance the technical level of MEMS sensors, on the evening of September 13, GoerTek announced its plan to spin off GoerTek Microelectronics Corporation for an IPO in Hong Kong.

Bloomberg recently quoted news that GoerTek has selected China International Capital Corporation, China Merchants Bank International, China Securities, and UBS as the arrangers for GoerTek Microelectronics' Hong Kong listing, with an IPO expected in Hong Kong as early as next year, potentially raising at least $300 million. After the fundraising, GoerTek Microelectronics will inevitably focus more on the R&D and production of MEMS sensors, enhancing the overall competitiveness of GoerTek's product system.

According to industry forecasts, the compound annual growth rate of global AI mobile phone shipments is expected to reach 63% from 2024 to 2028. Against this backdrop, GoerTek Microelectronics' high signal-to-noise ratio and high-performance products are expected to fully benefit from this trend. At the same time, extending from current AI mobile phones to various AI end-side application fields such as AI PCs and AI speakers, the value of MEMS sensors is expected to continue to increase.

Moreover, voice will become an important interaction mode between humans and vehicles in the future, gradually becoming another significant business growth area for GoerTek Microelectronics. According to Yole's data, the five-year compound annual growth rate of the MEMS automotive market is 7%, with the market size growing from $2.8 billion to $4.2 billion.

Currently, GoerTek Microelectronics is actively entering the automotive field and has obtained supplier qualifications from manufacturers such as BMW, Volvo, and NIO.

Overall, it is evident that grasping the opportunities of the AI era from the perspective of MEMS sensors has become the key for GoerTek to break through in the AI era.

Besides the aforementioned fields, emerging areas such as smart healthcare, Industry 4.0, and embodied intelligent robots have also injected new growth momentum into the MEMS industry.

Against the backdrop of established long-term growth logic in multiple application ends, GoerTek needs to further optimize resource allocation, enhance competitiveness, and deeply explore its growth potential in the AI era.

With the support of huge growth potential in the future, how will GoerTek perform, and will its financial indicators improve? The market will provide the answer, and we eagerly await it.