Who is the most profitable enterprise in the core components of humanoid robots?

![]() 12/04 2024

12/04 2024

![]() 712

712

The upstream core components of the humanoid robot industry chain mainly include harmonic reducers, frameless torque motors, hollow cup motors, planetary roller screws, encoders, sensors, bearings, etc.

Profitability is usually reflected in the amount and level of corporate earnings over a certain period. The analysis of profitability is an in-depth analysis of the company's profit rate.

This article is part of the corporate value series on [Profitability]. A total of 58 enterprises in the core components of humanoid robots are selected as research samples, with return on equity, gross profit margin, net profit margin, etc., as evaluation indicators.

The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 most profitable enterprises in core components of humanoid robots:

10th. Best

Industry segment: Chassis and engine system

Profitability: ROE 10.80%, gross profit margin 34.37%, net profit margin 19.91%

Performance forecast: ROE has fluctuated between 10%-12% in the past three years, with the latest forecast average of 10.31%

Main product: Automotive parts are the primary source of revenue, accounting for 90.20% of revenue, with a gross profit margin of 32.70%

Company highlight: Best's main products include high-precision ball/roller screw pairs and high-precision rolling guide pairs used in industrial machine tools, humanoid robots, and other fields.

9th. RDI Drive

Industry segment: Other general equipment

Profitability: ROE 25.11%, gross profit margin 29.52%, net profit margin 14.46%

Performance forecast: ROE has fluctuated between 24%-26% in the past three years, with the latest forecast average of 12.00%

Main product: Electromagnetic brakes are the primary source of revenue, accounting for 58.93% of revenue, with a gross profit margin of 37.26%

Company highlight: RDI Drive's research and development project for high-precision planetary roller screws for humanoid robots is primarily targeted at the humanoid robot market.

8th. Kele Sensors

Industry segment: Instrumentation

Profitability: ROE 12.31%, gross profit margin 40.53%, net profit margin 27.37%

Performance forecast: ROE has fluctuated between 11%-13% in the past three years, with the latest forecast average of 11.39%

Main product: Mechanical sensors and instrumentation series are the primary source of revenue, accounting for 61.88% of revenue, with a gross profit margin of 41.39%

Company highlight: Kele Sensors has collaborated with customers in industrial robots and collaborative robots and is currently sending samples to humanoid robot customers.

7th. Buker Technology

Industry segment: Industrial control equipment

Profitability: ROE 11.15%, gross profit margin 37.02%, net profit margin 14.26%

Performance forecast: ROE has fluctuated between 8%-14% in the past three years, with the latest forecast average of 9.86%

Main product: Drive systems are the primary source of revenue, accounting for 64.86% of revenue, with a gross profit margin of 32.20%

Company highlight: Buker Technology has launched its third-generation frameless torque motor products, which can meet the requirements for miniaturization and lightweighting of collaborative robots and humanoid robots.

6th. Siling Joint-Stock

Industry segment: Chassis and engine system

Profitability: ROE 23.89%, gross profit margin 27.87%, net profit margin 16.44%

Performance forecast: ROE has fluctuated between 18%-28% in the past three years, with the latest forecast average of 11.68%

Main product: Braking system bearings are the primary source of revenue, accounting for 76.84% of revenue, with a gross profit margin of 31.40%

Company highlight: Siling Joint-Stock's robot component products are planned to cover the fields of industrial robots, collaborative robots, and humanoid robots. Currently, the harmonic reducer is in the preparatory stage before mass production.

5th. Shuanghuan Transmission

Industry segment: Chassis and engine system

Profitability: ROE 9.58%, gross profit margin 20.95%, net profit margin 8.49%

Performance forecast: ROE has continuously risen to 10.67% in the past three years, with the latest forecast average of 11.86%

Main product: Passenger car gears are the primary source of revenue, accounting for 54.67% of revenue, with a gross profit margin of 23.40%

Company highlight: Shuanghuan Transmission's main business is mechanical transmission gears and related components, primarily used in automotive powertrains and transmissions, including transmissions and transfer cases.

4th. CoreMotion

Industry segment: Analog chip design

Profitability: ROE 16.77%, gross profit margin 84.77%, net profit margin 51.10%

Performance forecast: ROE has fluctuated between 12%-21% in the past three years, with the latest forecast average of 10.13%

Main product: MEMS gyroscopes are the primary source of revenue, accounting for 89.37% of revenue, with a gross profit margin of 82.42%

Company highlight: CoreMotion's MEMS pressure sensor works on the same principle and basic technology as inertial sensors, both resulting from the combined action of resonant MEMS devices and matching ASIC control chips.

3rd. Leadshine Technology

Industry segment: Robotics

Profitability: ROE 16.55%, gross profit margin 39.15%, net profit margin 15.19%

Performance forecast: ROE has continuously declined to 11.05% in the past three years, with the latest forecast average of 14.16%

Main product: Stepping systems are the primary source of revenue, accounting for 43.32% of revenue, with a gross profit margin of 38.02%

Company highlight: Leadshine Technology's initial positioning in the humanoid robot business is as a servo control product and solution provider, offering a series of servo control core components and module-level solutions to numerous OEMs.

2nd. Changsheng Bearing

Industry segment: Metal products

Profitability: ROE 11.97%, gross profit margin 30.95%, net profit margin 15.71%

Performance forecast: ROE has fluctuated between 7%-17% in the past three years, with the latest forecast average of 15.48%

Main product: Metal-plastic polymer self-lubricating rolled bearings are the primary source of revenue, accounting for 35.03% of revenue, with a gross profit margin of 49.33%

Company highlight: Changsheng Bearing's products are used in robot joints and reducers.

1st. Inovance Technology

Industry segment: Industrial control equipment

Profitability: ROE 24.44%, gross profit margin 34.79%, net profit margin 18.34%

Performance forecast: ROE has continuously declined to 21.66% in the past three years, with the latest forecast average of 17.93%

Main product: General automation products are the primary source of revenue, accounting for 46.47% of revenue, with a gross profit margin of 44.31%

Company highlight: Inovance Technology's layout in the humanoid robot industry is still in the early stages of insight and pre-research. Components under development include motors, drives, actuator modules, etc.

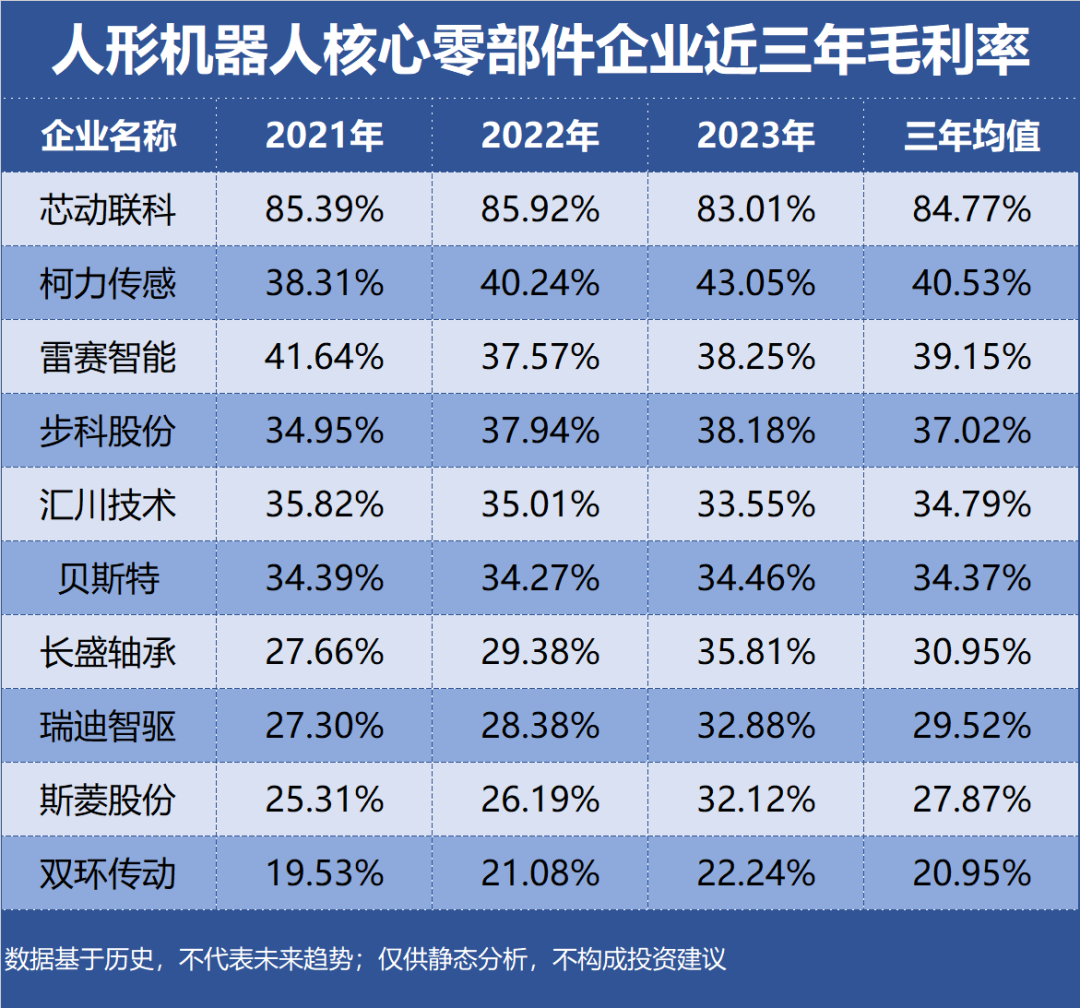

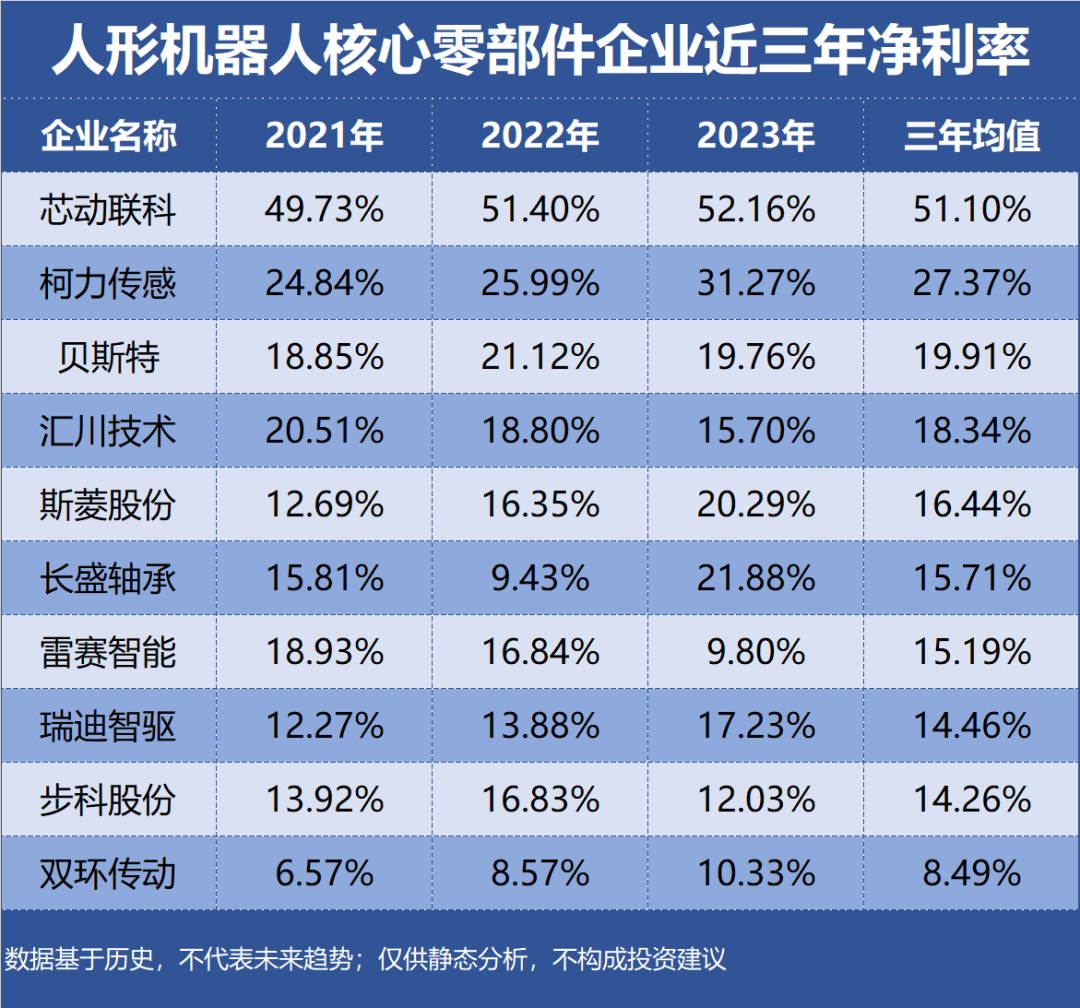

Top 10 most profitable enterprises in core components of humanoid robots, ROE, gross profit margin, and net profit margin for the past three years: