Who is the most profitable enterprise in the Sora model (text-to-video) field?

![]() 12/05 2024

12/05 2024

![]() 623

623

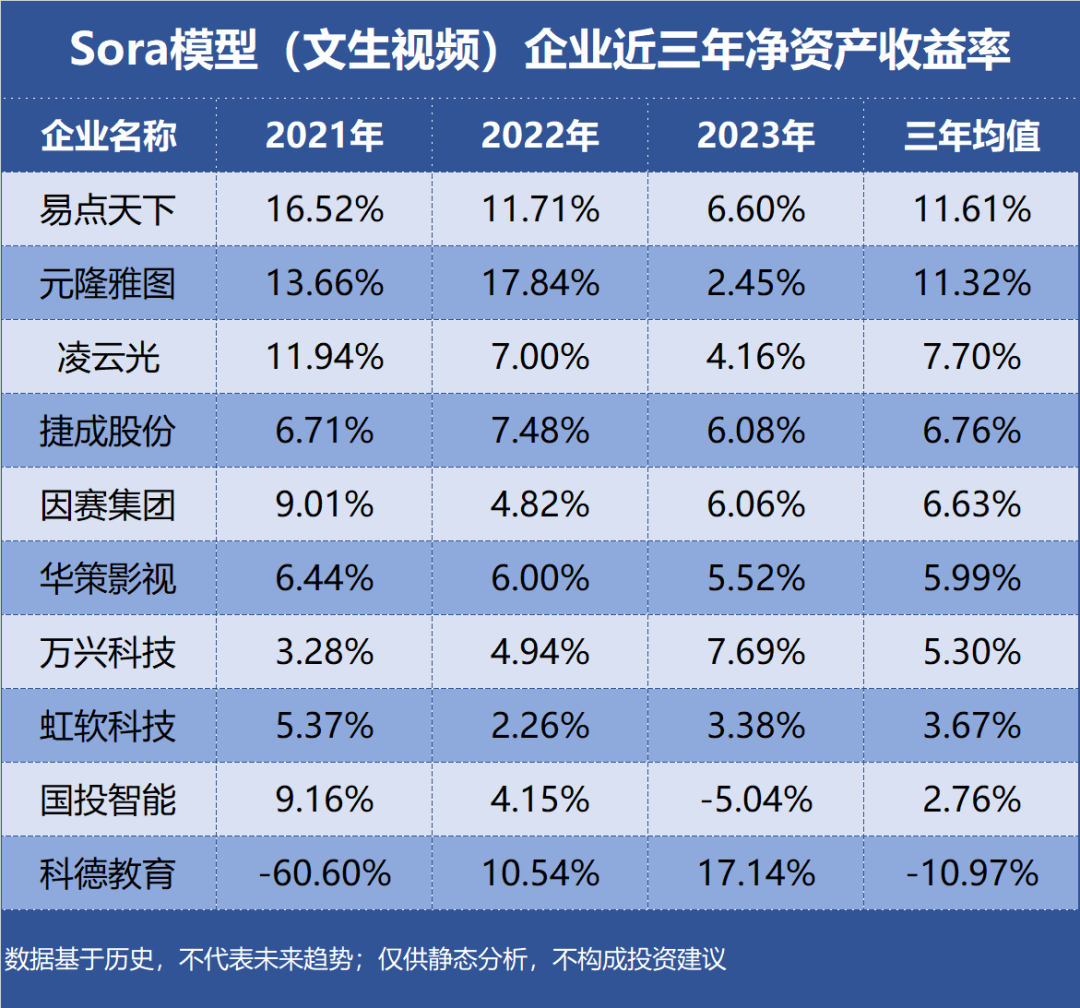

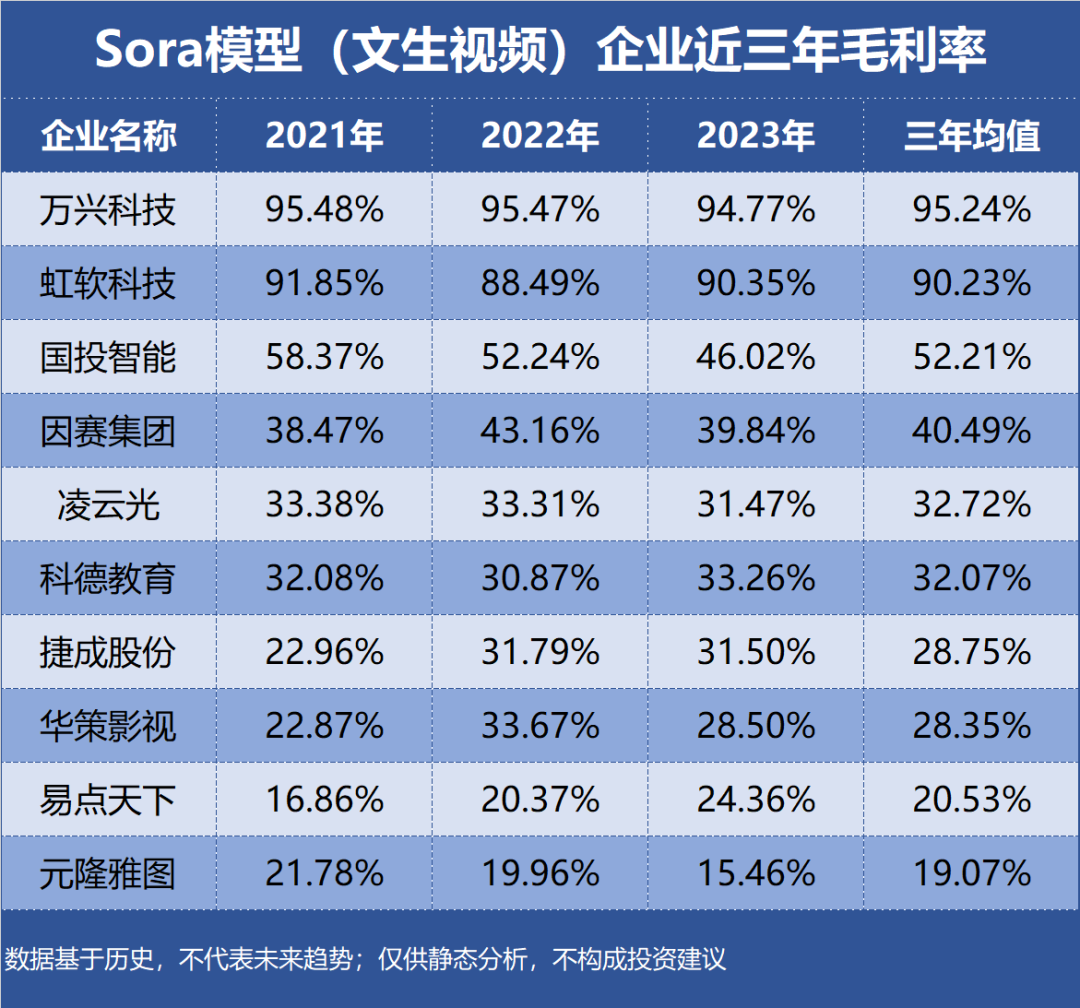

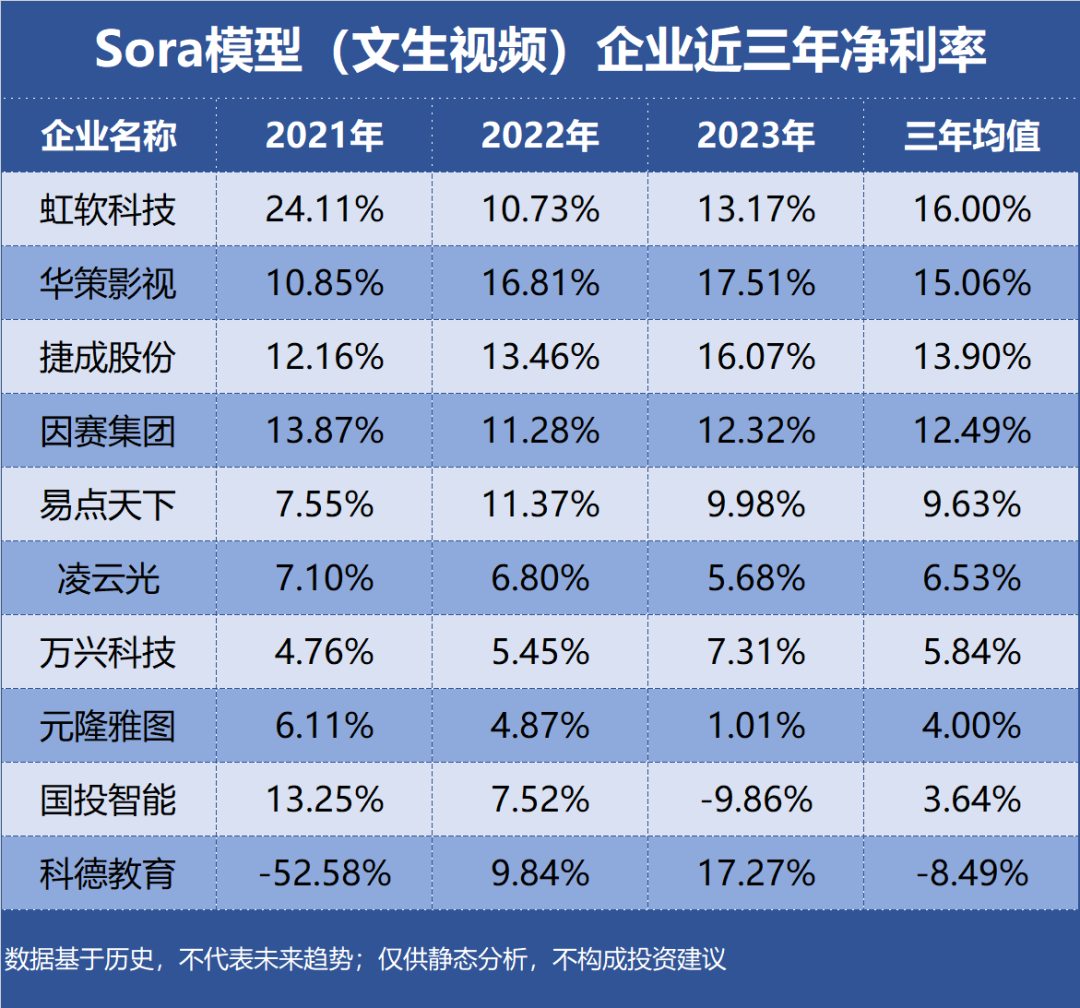

The Sora text-to-video model has advanced to a practical productivity tool compared to previous text-to-video models. It is expected to be applied on a large scale in the short video field for one-minute clips. Its ability to expand videos also holds promise for creating long-form videos, potentially sparking a new revolution in content creation. Profitability is typically reflected in the amount and level of corporate earnings over a certain period. The analysis of profitability involves an in-depth examination of a company's profit margins. This article, part of the Corporate Value series focusing on [Profitability], selects 28 enterprises involved in the Sora model (text-to-video) as research samples, using indicators such as Return on Equity (ROE), Gross Profit Margin, and Net Profit Margin for evaluation. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 most profitable enterprises in the Sora model (text-to-video) field:

10th Yuanlongyatu Industry Segment: Marketing Agency Profitability: ROE 11.32%, Gross Margin 19.07%, Net Margin 4.00% Performance Forecast: ROE fluctuated between 2%-18% in the last three years, with the latest forecast average at 4.35% Main Product: Gifts (promotional items) are the primary source of revenue, accounting for 47.55% of revenue, with a gross margin of 19.40% Company Highlight: Yuanlongyatu has launched promotional videos generated by AIGC technology. These videos combine general large model tools with the company's vertical application technology and experience, enabling stop-motion animation and partial dynamic effects.

9th Lingyun Guang Industry Segment: Other Automation Equipment Profitability: ROE 7.70%, Gross Margin 32.72%, Net Margin 6.53% Performance Forecast: ROE has continuously declined to 4.16% in the last three years, with the latest forecast average at 4.30% Main Product: Machine vision products are the primary source of revenue, accounting for 69.53% of revenue, with a gross margin of 31.82% Company Highlight: Lingyun Guang has successfully implemented AI-driven virtual digital human voice, movement, and video drivers. In the future, it will leverage AIGC technology to further expand application scenarios for creative content production.

8th SDIC Intelligence Industry Segment: Vertical Application Software Profitability: ROE 2.76%, Gross Margin 52.21%, Net Margin 3.64% Performance Forecast: ROE peaked at 9.16% in the last three years, with the latest forecast average at 4.34% Main Product: Cybersecurity products are the primary source of revenue, accounting for 42.54% of revenue, with a gross margin of 64.97% Company Highlight: SDIC Intelligence has launched the AI-3300 "Huiyan" video image authentication workstation for the detection, recognition, and authentication of content generated by generative AI.

7th Huace Film & TV Industry Segment: Film and Animation Production Profitability: ROE 5.99%, Gross Margin 28.35%, Net Margin 15.06% Performance Forecast: ROE has continuously declined to 5.52% in the last three years, with the latest forecast average at 5.27% Main Product: TV drama sales are the primary source of revenue, accounting for 56.23% of revenue, with a gross margin of 63.37% Company Highlight: Huace Film & TV has established an AIGC Application Research Institute. Through learning, absorbing, and digesting open-source technology, its current technological reserves can produce text-to-video content up to 4 seconds long.

6th Wondershare Technology Industry Segment: Horizontal General Software Profitability: ROE 5.30%, Gross Margin 95.24%, Net Margin 5.84% Performance Forecast: ROE has continuously increased to 7.69% in the last three years, with the latest forecast average at 4.56% Main Product: Video creativity products are the primary source of revenue, accounting for 65.38% of revenue, with a gross margin of 93.73% Company Highlight: Wondershare Technology is a leading provider of digital creative software products and services in China. Its video creativity product Wondershare Filmora can be used for the creation and editing of various videos.

5th Jiecheng Media Industry Segment: Film and Animation Production Profitability: ROE 6.76%, Gross Margin 28.75%, Net Margin 13.90% Performance Forecast: ROE fluctuated between 6%-8% in the last three years, with the latest forecast average at 6.54% Main Product: Film and television copyright operations and services are the primary source of revenue, accounting for 89.83% of revenue, with a gross margin of 33.45% Company Highlight: Jiecheng Media's self-developed AI intelligent creation engine, ChatPV, will provide AI-powered video creation functions such as film and television secondary creation, one-click video production, digital humans, and text-to-video.

4th ArcSoft Industry Segment: IT Services Profitability: ROE 3.67%, Gross Margin 90.23%, Net Margin 16.00% Performance Forecast: ROE fluctuated between 2%-6% in the last three years, with the latest forecast average at 4.66% Main Product: Mobile intelligent terminal vision solutions are the primary source of revenue, accounting for 87.14% of revenue, with a gross margin of 91.43% Company Highlight: ArcSoft's ArcMuse engine realizes two core functions: automatic generation of product display videos and automatic generation of clothing model videos.

3rd Madhouse Industry Segment: Marketing Agency Profitability: ROE 11.61%, Gross Margin 20.53%, Net Margin 9.63% Performance Forecast: ROE has continuously declined to 6.60% in the last three years, with the latest forecast average at 7.73% Main Product: Performance advertising and marketing services are the primary source of revenue, accounting for 96.46% of revenue, with a gross margin of 18.82% Company Highlight: Madhouse's AIGC product, KreadoAI, incorporates the fusion of multimodal models, including text generation, image-to-image, text-to-video, and speech-to-text generation.

2nd Insite Group Industry Segment: Marketing Agency Profitability: ROE 6.63%, Gross Margin 40.49%, Net Margin 12.49% Performance Forecast: ROE fluctuated between 4%-10% in the last three years, with the latest forecast average at 7.20% Main Product: Performance marketing is the primary source of revenue, accounting for 52.63% of revenue, with a gross margin of 5.80% Company Highlight: Insite Group's InsightGPT offers functions such as text-to-text, video intelligent editing, and image-to-video, and is currently developing text-to-video functionality.

1st KeDe Education Industry Segment: Training and Education Profitability: ROE -10.97%, Gross Margin 32.07%, Net Margin -8.49% Performance Forecast: ROE peaked at 17.14% in the last three years, with the latest forecast average at 15.88% Main Product: The ink and chemicals division is the primary source of revenue, accounting for 52.83% of revenue, with a gross margin of 24.06% Company Highlight: Zhonghao Xinying, invested in by KeDe Education, has launched the text-to-video large model V-Gen and entered into a strategic partnership with Turing Engine based on this.

ROE, Gross Margin, and Net Margin of the top 10 most profitable enterprises in the Sora model (text-to-video) field over the past three years: