Four IPOs in Half a Year: Is the Golden Age of Autonomous Driving Upon Us?

![]() 12/09 2024

12/09 2024

![]() 476

476

In November 2016, Peng Jun and Lou Tiancheng met for coffee at Baidu Research USA, where they both worked.

Amidst the wave of enthusiasm for autonomous driving and the frequent moves by giants and startups, these two "technological geniuses" put down their coffee cups after a brief exchange and chose to found Pony.ai, diving headfirst into the great era of autonomous driving.

Eight years have passed, and the wave of autonomous driving technology has long receded. After a series of changes in the industry, autonomous driving has finally begun to be recognized by the market.

According to incomplete statistics, 10 companies in the autonomous driving industry chain sought to go public in 2024. On November 27, Pony.ai listed on Nasdaq; in October, Horizon Robotics and WeRide both went public on the Hong Kong Stock Exchange and Nasdaq, respectively. Prior to these, Black Sesame Technology, RoboSense, and Ruqi Travel had already gone public. A large number of industry players such as Momenta, Zongmu Technology, Cidei Intelligent Driving, and U-Drive are also "crowding" on the path to listing.

Behind this listing frenzy are investors competing with real money to grab shares in these companies. Among them, Horizon Robotics' Hong Kong public offering was oversubscribed by 33.8 times; Pony.ai was "forced" to issue additional shares and raise the upper limit of its issuance range; on the first day of WeRide's listing, its share price rose, triggering two trading halts due to circuit breakers.

The enthusiasm of capital is a stark contrast to the state of autonomous driving during the past "cold winter" period.

If two years ago, the essence of the industry's "decline" was due to the fundamental inability to see a timeline for the technology's usability, then today, with Tesla's expected timeline as a reference, it is clear that L4 autonomous driving is still at least two years away from widespread implementation. So why has the capital market changed its face completely?

Both L4 and L2 autonomous driving companies have Tesla to thank. With the implementation of advanced intelligent driving, "nationwide drivability" has subtly convinced consumers to accept autonomous driving.

This has directly driven up the revenue and valuation of L2 autonomous driving companies and indirectly promoted the rollout of L4 driverless taxis such as Baidu's Robotaxi service Apollo Go and Pony.ai's services.

With the hope of implementation, industry players have navigated through the cold winter, survived financial crises, and successfully converged at the mass production stage. With the implementation of autonomous driving technology, the nearly "utopian" market space of two years ago has suddenly been "opened up" by various technology giants.

Amidst the hustle and bustle of the industry, the golden age of autonomous driving has arrived.

2024: Autonomous Driving Finally Bears Fruit

In recent years, Robotaxi services have begun to transition from science fiction to reality.

Baidu's Apollo Go, WeRide, and Pony.ai's Robotaxi services have successively made their debut in first- and second-tier cities such as Beijing, Guangzhou, Shanghai, and Wuhan. Previously small-scale pilot Robotaxi services pressed the accelerator in 2024.

In October of this year, global giants coincidentally sounded the clarion call for expansion. Tesla made a high-profile entry with the release of a "prototype," while Waymo expanded its operational scope; Baidu was rumored to be seeking global partners to roll out Robotaxi services. In November, L4 Robotaxi companies Pony.ai and WeRide listed on Nasdaq one after the other, while Baidu obtained Hong Kong's first Robotaxi license.

With the market education provided by technology giants, consumers have gradually begun to accept Robotaxi services. It is understood that Baidu received nearly one million Apollo Go orders in the third quarter of this year.

In addition to Robotaxi, autonomous driving has developed rapidly in the passenger vehicle sector.

According to ZS Automotive Research data, the proportion of new vehicles equipped with L2 and above exceeded 50% in 2024. This means that autonomous driving capable of automatic following has already been rolled out in the automotive market. More advanced intelligent driving capabilities (City NOA) have begun to proliferate amidst competition among various automakers. Both "new forces" and traditional automakers have reached a consensus that "no intelligent driving, no premium".

Image: The proportion of new vehicles equipped with L2 and above exceeded 50% in 2024. Source: ZS Automotive Research

Under this consensus, as automakers and hardware manufacturers engage in an "internal battle" over autonomous driving, a large number of orders are also flowing to autonomous driving companies.

In terms of the implementation of advanced intelligent driving, Horizon Robotics and Momenta, as intelligent driving suppliers, have directly defined the driving experience of smart cars. On the other hand, WeRide and Bosch have integrated intelligent driving into Tier 1 solutions through a cooperative development model. Currently, the cooperation between autonomous driving companies and intelligent driving may not provide a high level of intelligent driving in some models (quasi-L2), but the implementation covers almost all brands familiar to consumers, including Mercedes-Benz, Changan, Li Auto, BYD, Nissan, Great Wall, and GAC.

On the other hand, in the L4 Robotaxi arena, some autonomous driving companies have chosen to temporarily halt progress due to the large number of orders from automakers. Among them, Horizon Robotics has long since given up. Although Momenta still claims to be iterating the L4 flywheel using mass-produced intelligent driving data, there has been a lack of new Robotaxi news for quite some time.

Currently, the only players still persisting and achieving certain results are Baidu, Pony.ai, and WeRide.

In terms of experience, although the Robotaxi services of these three companies still require fixed pick-up and drop-off stations, they can all achieve autonomous driving without safety drivers. In terms of driving smoothness, they can reach speeds of 40-50 km/h in urban areas, without the phenomenon of "slow" driving that interferes with normal traffic.

During a ride in a Robotaxi with Guangzhou-based AI media company Guangzhui Intelligence this year, I happened to meet a safety driver. According to the safety driver, although there may be bugs and situations where the Robotaxi is inferior to human drivers, and it may react slowly in complex situations, regarding safety, the safety driver stated that "accidents are rarely heard of in the industry, and if there are any, they are usually rear-end collisions caused by other vehicles."

With advancements in experience and technology, automakers have also increased their support for autonomous driving. They are attempting to seize the initiative in mass production amidst the trend of Robotaxi services potentially replacing ordinary taxis.

Among them, GAC Motor has made several significant moves this year. In June, GAC Motor invested in WeRide, and in October, it invested in both Pony.ai and Didi's autonomous driving division, with a total investment of nearly 2.5 billion yuan this year. On the eve of Pony.ai's listing, BAIC invested up to $70.35 million to participate in the IPO subscription. Globally, in October of this year, Waymo secured another cooperation with Hyundai Motor after partnering with Tata Motors of India and ZEEKR of China.

However, the widespread implementation of Robotaxi services will still take considerable time. Although both China and the United States provide policy support for Robotaxi services, operators still need to solve mass production and cost reduction issues on their own. Based on Musk's expected cost of $30,000, equivalent to over 200,000 yuan, Robotaxi services are still at least twice as expensive as common online car-hailing services.

Fortunately, players in the autonomous driving industry have also achieved implementation in other applications. Among them, WeRide has secured 2,000 intent orders for L4 autonomous minibuses; Pony.ai has over 190 driverless trucks shuttling goods across the country; EasyGo has over 1,500 driverless mining trucks transporting earth and debris; and Cidei Intelligent Driving, which has just revised its IPO filing, has 660 vehicles.

The autonomous driving industry is thriving, who would have thought that just two years ago, it was in dire straits?

Struggling for Survival, Destinies Converge at the Intersection of Mass Production

"Consider selling to Apple, Microsoft, or automotive parts suppliers."

In September 2022, the CEO of Aurora, the first global platform-based autonomous driving company and the first Robotaxi company, wrote in a memorandum to the board of directors. Subsequently, within just two months, autonomous driving industry giants experienced a "three-peat" of failures, plunging all players in the industry into a capital winter.

On October 26, Mobileye listed with a valuation of $16.7 billion (with a peak valuation of $50 billion). On October 27, Argo AI, an L4 autonomous driving company backed by Ford and Volkswagen, collapsed. Faced with the seemingly bottomless pit of autonomous driving, Ford finally lost patience after four years and a $2.7 billion investment. The pain of delayed autonomous driving technology implementation led Ford CEO Jim Farley to succinctly summarize:

"We won't necessarily have to create that technology ourselves.""

Amidst the failures of international giants, Chinese autonomous driving players have "separately" struggled for survival.

In 2019, when the story of driverless cars was just beginning, Cao Xudong, CEO of Momenta, early on proposed a strategy for mass production and delivery. While such a strategy made Momenta less attractive to the capital market, it did capture a "glimmer of hope" for automakers to test the waters of intelligent driving.

In 2020, SAIC Motor entrusted the IM project to Momenta, a "newbie" without mass production experience. The reason for choosing Momenta was twofold: on the one hand, SAIC Motor, as a local state-owned enterprise, operates with considerable flexibility in capital. Since the wave of automotive electrification, SAIC Motor has been "casting a wide net" by establishing joint ventures. On the other hand, amidst an industry where players were reluctant to engage in mass production, Momenta, as an autonomous driving company emphasizing algorithmic capabilities, was willing to "accompany" automakers in experimental projects, which was rare.

With the successful delivery of the IM project in April 2022, relying on a development model akin to "software outsourcing," Momenta gained the ability to compete with Huawei (HI and Smart Selection mode) and Horizon Robotics (full-stack software and hardware solutions). Although few IM-branded vehicles were ultimately sold, Momenta's early mass production experience put it far ahead of players focused on L4 autonomous driving in terms of commercialization progress.

On the Pony.ai and WeRide front, as the companies submitted their IPO prospectuses, more business details were revealed. Amidst the cold winter of autonomous driving, the two companies basically relied on a "little bit of everything" approach to maintain operations, persevering and waiting for the maturity of autonomous driving technology.

In terms of overall revenue, WeRide and Pony.ai achieved revenues of 150 million and 180 million yuan, respectively, in the first half of 2024, with extremely limited business volumes. Although the two companies are known for their Robotaxi services - Pony.ai operates a fleet of over 250 Robotaxis in Beijing, Shanghai, Guangzhou, and Shenzhen, while WeRide operates a fleet of over 300 Robobuses - their primary sources of revenue are not from autonomous driving. WeRide has secured orders for collaborative R&D of ADAS from Bosch and implemented advanced intelligent driving on the Chery Star Era model. Pony.ai's primary revenue has long shifted from "selling software services" to operating driverless truck fleets.

Now, as autonomous driving (and advanced intelligent driving) moves from behind the scenes to the forefront, the expected circumstances for these two autonomous driving companies have significantly improved.

On the WeRide front, Bosch, as a cornerstone investor, subscribed to 91% of the issued and additional shares. The mass production case of the Chery Star Era model has made WeRide favored by automakers and Tier 1 giants. Pony.ai, on the other hand, expects to deploy thousands of autonomous vehicles in cooperation with Toyota (Baozhi 4X Robotaxi) in first-tier cities in China from 2025 to 2026, further solidifying its commitment to the Robotaxi route.

"Achieving autonomous driving is like climbing Mount Everest. The path we must take has at least two routes to choose from: the south slope and the north slope. There will always be pioneers and followers. Although there is only one peak, the experiences of the climbers and the stories during the climb are often endless and fascinating, making people yearn for them." In 2023, Zhang Yaqin, academician of the Chinese Academy of Engineering and dean of the Institute for Artificial Intelligence, Tsinghua University, summarized the development of the autonomous driving industry in this way.

The metaphor of climbing Mount Everest is a consensus among almost all autonomous driving companies aiming for their ultimate goal. In the words of Han Xu, founder of WeRide, who often mentions "climbing the peak and laying eggs along the way," and Peng Jun, CEO of Pony.ai, who envisions that "L4 autonomous driving is like the highest peak in a mountain range. It stands there, but no one has ever successfully summited it, and people still don't know the correct path to get there," autonomous driving companies have taken different routes through the cold winter, with their destinies converging at the stage of mass production implementation.

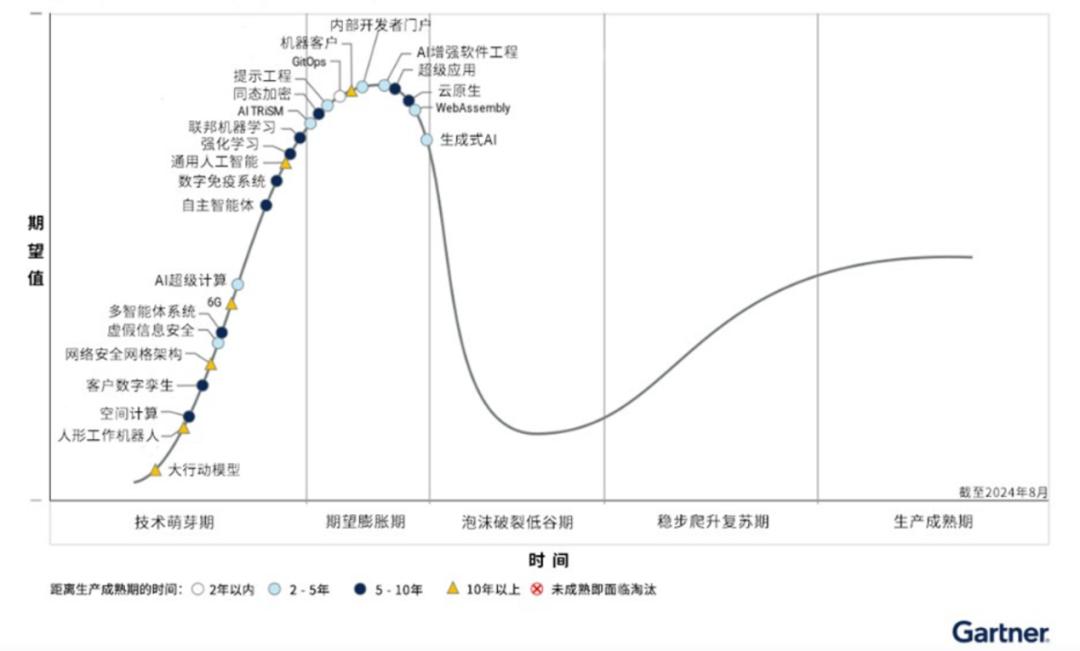

Although players in autonomous driving, such as Zongmu Technology and Haomo AI, who have been slow to achieve mass production, are facing brutal elimination pressures, as the classic Gartner curve shows, when a new technology transitions from emerging to mature, industry players will inevitably encounter a trough after the bubble bursts. In the process of technology implementation and market recognition, the industry matures amidst a "great reshuffle."

Now, with breakthroughs in key autonomous driving technologies and changes in consumer perception, the golden age of autonomous driving has finally arrived. The players gathered at the last camp on Mount Everest are now only 500 meters away from the summit.

AI Large Models: The Golden Age of Autonomous Driving

AI large models are the most significant factor contributing to the turning point in the autonomous driving industry.

In the past, autonomous driving was characterized by modular deployment that was heavily reliant on human effort. Autonomous driving developers needed to design small models for perception, prediction, planning, and control separately. Then, based on the specific functional effects, they would manually write code to handle various situations.

The advantage of this design model is that different players in the industry do not need to be proficient in all directions. They only need to excel in a single area and can integrate it into a complete intelligent driving system using a "stitching" approach. Overall, it facilitates collaboration among industry players and accelerates the pace of intelligent driving implementation.

However, the shortcomings are also evident. The most frustrating aspect is that manually writing rules cannot exhaust all real-world scenarios. As the code grows, it is impossible to completely eliminate long-tail problems. On the other hand, because the small modular models are independent of each other, data within the intelligent driving system cannot flow seamlessly. The more refined the data processing in the preceding model, the greater the error passed on to the next process.

Nowadays, with the evolution of AI to large models, the development process of autonomous driving has been completely reshaped.

"Waymo hasn't made much progress in six months. In the era of AI, a lot can actually be accomplished in six months.""

As Xiaopeng He, chairman of XPeng Motors, commented on his experience with Tesla's FSD in June this year. The training method based on data iteration has greatly accelerated the growth rate of autonomous driving. XPeng Motors just announced the adoption of end-to-end large models on May 20 and released a new "ceiling" for intelligent driving, the "door-to-door" feature, by the end of July.

At the same time, end-to-end technology has also directly improved the level of intelligent driving across the entire automotive industry. Last year, Great Wall Motors and ZEEKR, which were not considered adept at intelligent driving, showed exceptionally smooth performance in city NOA this year. BYD established a department focused on the implementation of end-to-end technology at the end of October this year, announcing that it will enable 50 vehicle models by next March.

The acceleration of autonomous driving by end-to-end technology is essentially developed through pure AI methods. The data training model enables autonomous driving to "freely" utilize raw sensor data. Furthermore, based on the variability of input data samples, autonomous driving can even learn capabilities such as navigating roundabouts and making U-turns, which exceed initial design expectations.

Beyond the training model, autonomous driving is also evolving its ability to understand objects by leveraging the capabilities of large AI models themselves.

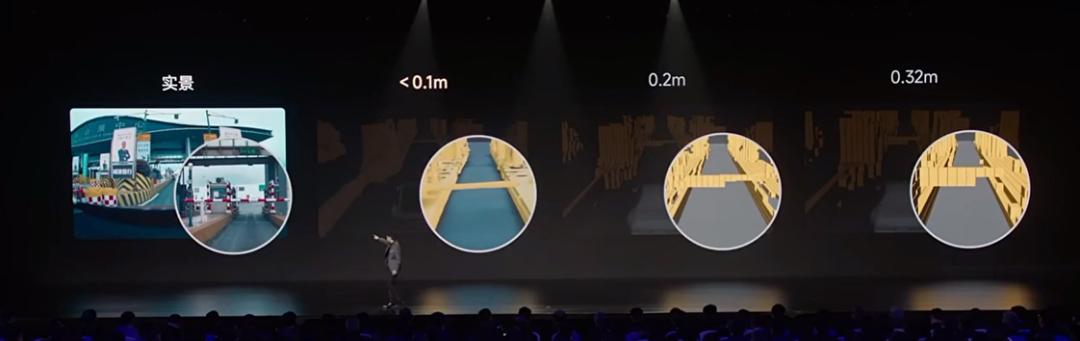

In the current iteration of autonomous driving, some manufacturers have begun to reduce reliance on network-based perception models (e.g., Huawei, Xpeng). With large models' cognitive abilities regarding objects, autonomous driving no longer converts perception data into individual "blocks." Instead, it integrates all road information (obstacles + road signs), enabling it to truly "understand" the road.

Image: Example of Network Occupancy Source: Xiaomi SU7 Pre-release Conference

"Generalizing on the basis of reconstruction to generate scenarios that conform to real-world laws. This model differs from previous autonomous driving simulations based on artificially 'placed' scenarios, and may essentially be similar to the 'brute force' training of large language models."

As Jia Peng pondered on the intelligent driving capabilities of Ideal Auto. Under the "brutal aesthetics" of AI computation, industry players have begun to pursue larger-scale computing power, enabling autonomous driving to have a more comprehensive understanding of space and time.

Utilizing the Attention mechanism of the Transformer model, autonomous driving can now remember the training content of long clips (video data slices), thereby better understanding the relevance of real-world objects. On the other hand, in the world model favored by players like NIO, Ideal Auto, Pony.ai, and others, greater computing power not only reproduces more realistic virtual training scenarios but also generates world scenarios that sensors have never "seen" before with the help of Diffusion models.

Ultimately, under the iteration of large AI models, autonomous driving technology has undergone tremendous changes. Supported by performance, players in autonomous driving have also emerged from the previous situation of emphasizing technology to "seek funding." The market value of many "star players" has been hotly contested by investors.

Recently listed players include Horizon Robotics, which attracted Baidu and Alibaba as cornerstone investors before its IPO. It was oversubscribed by 33.83 times (international offering oversubscribed by 13.81 times) and priced at the upper limit of HK$3.99 per share. Pony.ai was "forced" to issue additional shares and postpone pricing due to overwhelming investor demand during its IPO pricing stage. Four investors, including GAC, subscribed to US$153.4 million of Pony.ai's ordinary shares through a private placement. WeRide, on the day of its listing, saw its share price surge by more than 27% at one point, triggering circuit breakers twice.

Remember just two years ago, the autonomous driving industry was frequently questioned. The public obviously had not yet embraced these "unmanned taxis" that basically only "roamed" around Beijing's Yizhuang District with a safety officer on board. However, today, consumers of both traditional and driverless vehicles no longer question the technology. Especially when observing this year's Robotaxi ride experience evaluations, ride costs have quietly become the primary focus of consumers.

It is evident that autonomous driving will soon become another "mundane" advancement in technology. But for all players in the industry, acceptance is the greatest good news.

The golden age of autonomous driving has arrived.