Which AI big model company is the most profitable?

![]() 12/09 2024

12/09 2024

![]() 615

615

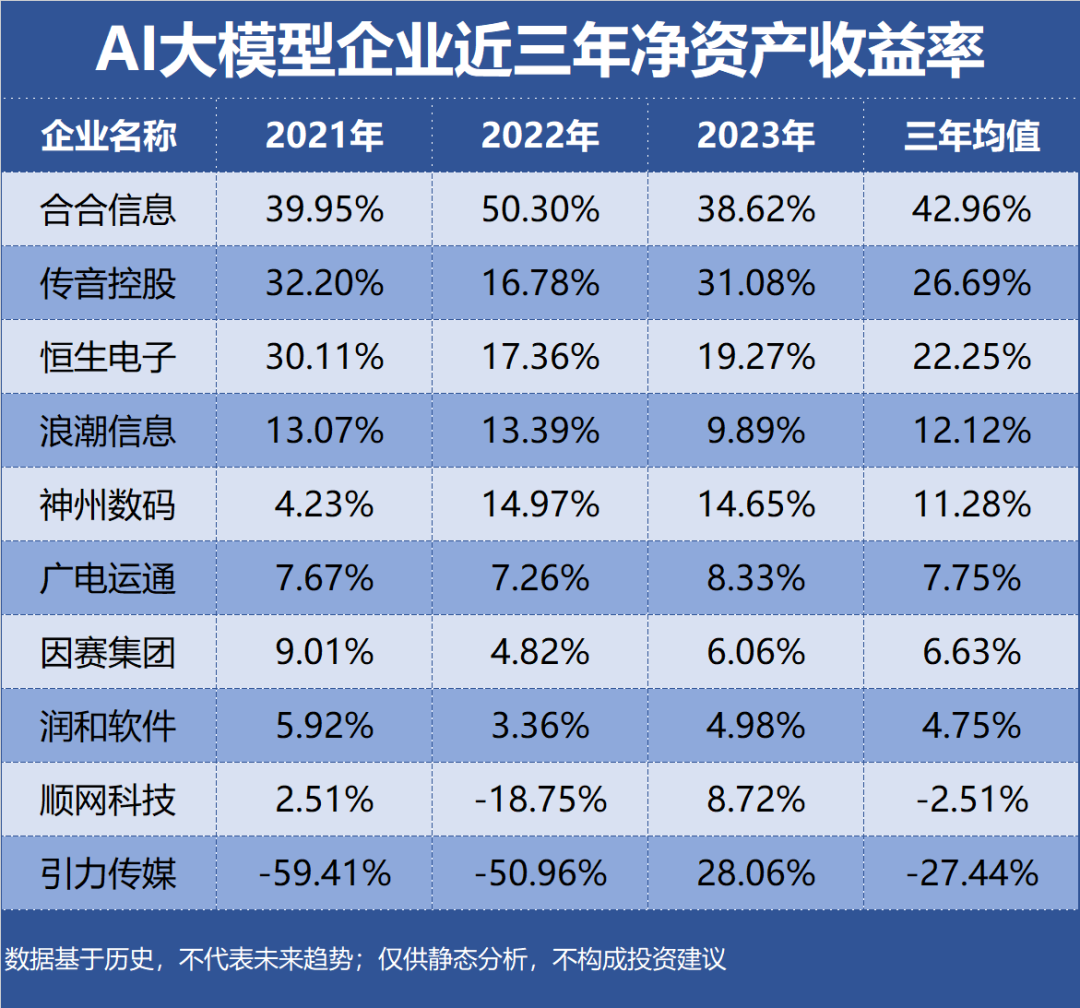

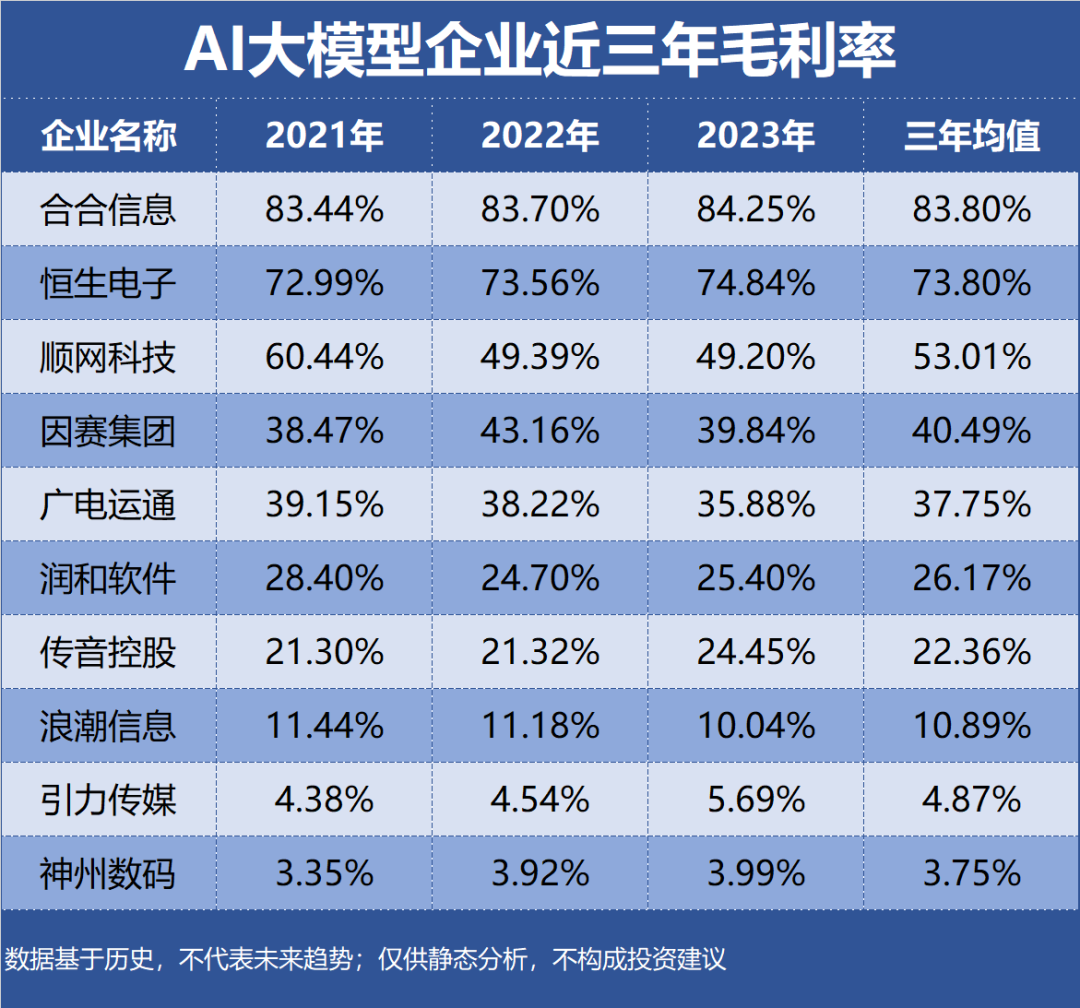

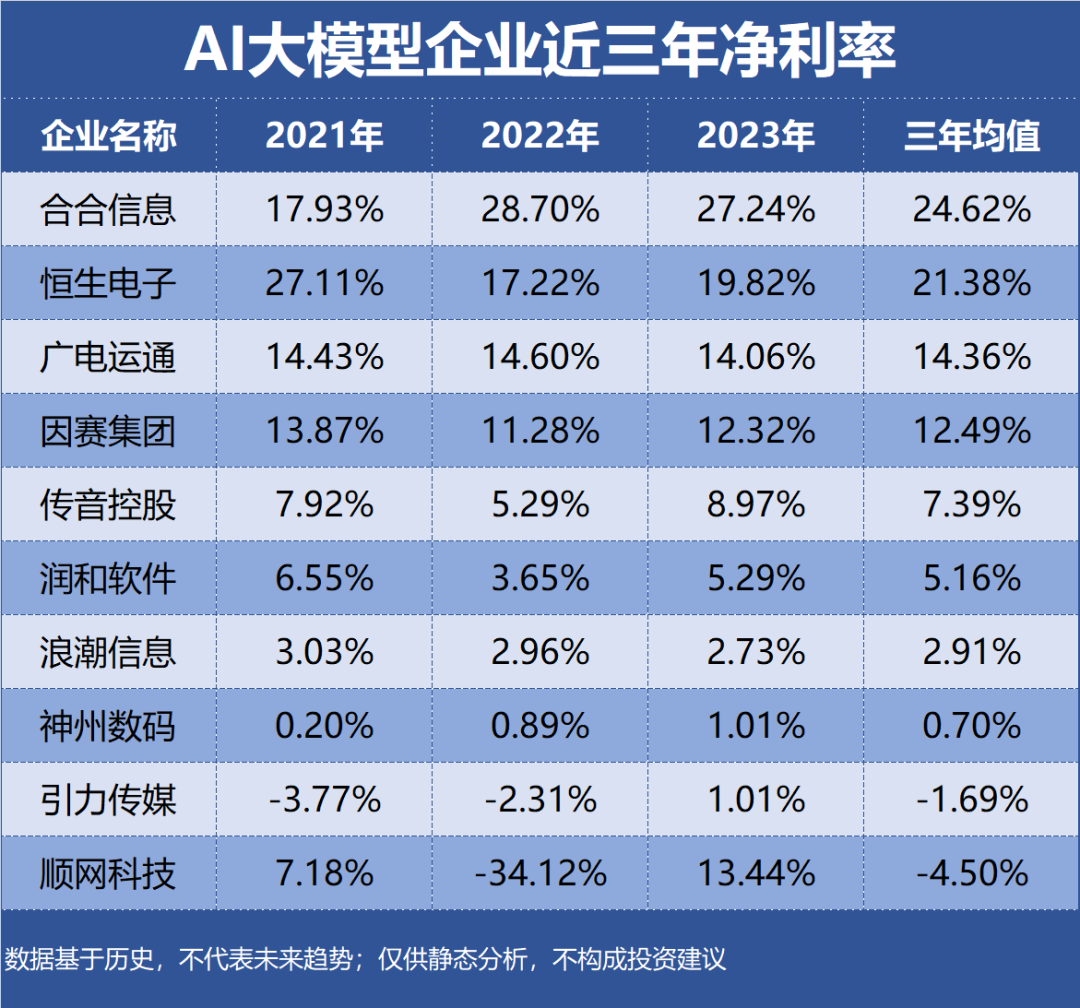

The AI big model, equivalent to a "super brain", is becoming a new frontier in artificial intelligence. The AI big model is expected to achieve a leap from perception to cognition in artificial intelligence, redefining the industrial model and standards of the AI industry, and bringing significant changes to some industries. Profitability is typically reflected in the amount and level of corporate earnings over a certain period. The analysis of profitability is an in-depth examination of a company's profit margins. This article is part of the series on corporate value focusing on profitability. A total of 61 AI big model companies were selected as research samples, with evaluation indicators such as return on equity (ROE), gross profit margin, and net profit margin. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 AI big model companies by profitability:

10. Runhe Software Industry Segment: IT Services Profitability: ROE 4.75%, Gross Margin 26.17%, Net Margin 5.16% Performance Forecast: ROE fluctuated between 3%-6% in the last three years, with the latest forecast average of 7.07% Main Products: Financial technology business is the primary source of revenue, accounting for 53.08% of revenue, with a gross margin of 25.63% Company Highlights: Runhe Software has launched a new generation of AI hub platform based on the big model and four industry application beta products: Runhe Zhishu, Runhe Zhice, Runhe Zhiyan, and Runhe Zhizao.

9. Inca Group Industry Segment: Marketing Agency Profitability: ROE 6.63%, Gross Margin 40.49%, Net Margin 12.49% Performance Forecast: ROE fluctuated between 4%-10% in the last three years, with the latest forecast average of 7.20% Main Products: Performance marketing is the primary source of revenue, accounting for 52.63% of revenue, with a gross margin of 5.80% Company Highlights: Inca Group raised funds through private placements for the research and development and application projects of the marketing AIGC big model. The project independently develops the marketing AIGC big model and AIGC marketing application engine capable of producing various high-quality marketing content.

8. GRG Banking Industry Segment: Other Computer Equipment Profitability: ROE 7.75%, Gross Margin 37.75%, Net Margin 14.36% Performance Forecast: ROE fluctuated between 7%-9% in the last three years, with the latest forecast average of 8.59% Main Products: Operation and maintenance services and others are the primary sources of revenue, accounting for 50.23% of revenue, with a gross margin of 31.30% Company Highlights: GRG Banking has released the industry big model "Wangdao" for the financial, government, transportation, and other sectors.

7. Inspur Information Industry Segment: Other Computer Equipment Profitability: ROE 12.12%, Gross Margin 10.89%, Net Margin 2.91% Performance Forecast: ROE fluctuated between 9%-14% in the last three years, with the latest forecast average of 11.20% Main Products: Servers and components are the primary source of revenue, accounting for 99.57% of revenue, with a gross margin of 7.65% Company Highlights: Inspur Information has released four skill big models under the "Yuan 1.0" massive model, namely dialogue, question-answering, translation, and ancient text, which can be directly applied in areas such as human-computer interaction, knowledge retrieval, language translation, and literary creation.

6. Shunwang Technology Industry Segment: Value-Added Services for Communication Applications Profitability: ROE -2.51%, Gross Margin 53.01%, Net Margin -4.50% Performance Forecast: The highest ROE in the last three years was 8.72%, with the latest forecast average of 11.30% Main Products: Online advertising and value-added services are the primary sources of revenue, accounting for 75.66% of revenue, with a gross margin of 26.25% Company Highlights: Shunwang Technology's GPU cloud computing business involves deep learning and AI training scenarios.

5. Digital China Industry Segment: IT Services Profitability: ROE 11.28%, Gross Margin 3.75%, Net Margin 0.70% Performance Forecast: ROE fluctuated between 4%-15% in the last three years, with the latest forecast average of 14.15% Main Products: Consumer electronics business is the primary source of revenue, accounting for 65.33% of revenue, with a gross margin of 2.14% Company Highlights: Based on data and AI, Digital China has launched the Jarvis AI knowledge platform, leveraging cloud-native technology, unique data algorithms, and AI training models.

4. Hundsun Technologies Industry Segment: Vertical Application Software Profitability: ROE 22.25%, Gross Margin 73.80%, Net Margin 21.38% Performance Forecast: ROE fluctuated between 17%-31% in the last three years, with the latest forecast average of 16.13% Main Products: Asset management technology services are the primary source of revenue, accounting for 25.44% of revenue, with a gross margin of 78.58% Company Highlights: Hundsun Technologies has released the LightGPT big model for the financial industry and uses it as the pre-training corpus for the big model, supporting fine-tuning for over 80 financial-specific task instructions.

3. Hexin Information Industry Segment: Vertical Application Software Profitability: ROE 42.96%, Gross Margin 83.80%, Net Margin 24.62% Performance Forecast: ROE fluctuated between 38%-51% in the last three years, with the latest forecast average of 20.46% Main Products: Intelligent text recognition business is the primary source of revenue, accounting for 75.91% of revenue, with a gross margin of 86.41% Company Highlights: Hexin Information has released the acge text vectorization model, which can be applied in AI and big data fields such as intelligent search, intelligent question-answering, and data mining in the future.

2. TECNO Mobile Industry Segment: Branded Consumer Electronics Profitability: ROE 26.69%, Gross Margin 22.36%, Net Margin 7.39% Performance Forecast: ROE fluctuated between 16%-33% in the last three years, with the latest forecast average of 25.58% Main Products: Mobile phones are the primary source of revenue, accounting for 92.54% of revenue, with a gross margin of 20.84% Company Highlights: TECNO Mobile's ongoing research project, the smart cloud platform, aims to enhance rapid third-party service access and intelligent distribution capabilities, complete the construction of the MLOps platform service related to end-side AI, and accelerate the evolution of mobile OS.

1. InMedia Holdings Industry Segment: Marketing Agency Profitability: ROE -27.44%, Gross Margin 4.87%, Net Margin -1.69% Performance Forecast: The highest ROE in the last three years was 28.06%, with the latest forecast average of 22.40% Main Products: Digital marketing is the primary source of revenue, accounting for 97.07% of revenue, with a gross margin of 5.31% Company Highlights: InMedia Holdings has signed a strategic cooperation agreement with Beijing Lanzhou Technology to jointly deploy AIGC lightweight models and product applications based on the AI2.0 era in the content and marketing fields.

Top 10 AI big model companies by profitability, ROE, gross margin, and net margin in the last three years:

Join the community, apply for reprints, business cooperation

Add WeChat: cuixs92