"Our top customer is our top competitor"

![]() 12/09 2024

12/09 2024

![]() 687

687

Review the automotive stocks of the week and observe the dynamics of the auto market.

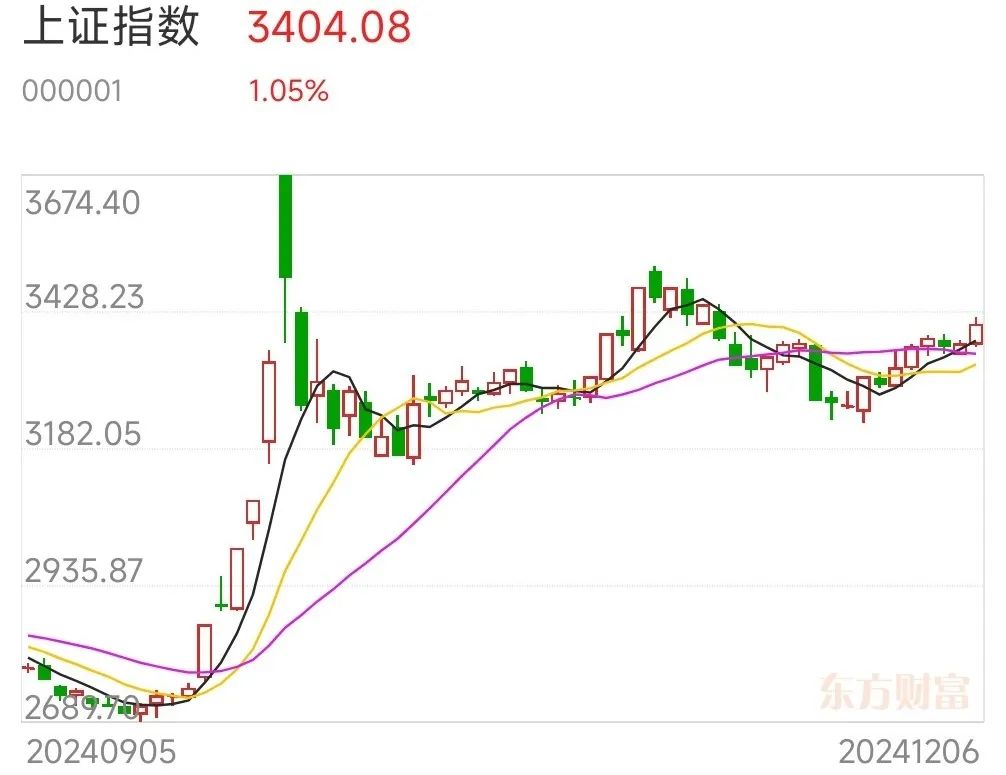

In the first trading week of December, A-shares achieved a "winning start," with all major stock indices recording impressive gains for the week. Among them, the Shanghai Composite Index rose on four out of five trading days, successfully surpassing the 3400-point mark on the 6th with a 1.05% increase; the Shenzhen Component Index closed at 10,791 points, up 1.47%; and the ChiNext Index closed at 2,267 points, up 2.05%.

With hundreds of stocks hitting their daily price limits and nearly 3,700 stocks showing across-the-board gains, the daily, weekly, and monthly charts all demonstrated strong performance, aligning with some market analysts' predictions. It seemed that overnight, the air was filled with the scent of a bull market.

Some investors said, "As a top short-term trader, I tell you that looking at the list, most of the major buyers are big funds, so the risk is basically low. If the market dips deeply on Monday, it's recommended to buy low." "The slight increase in trading volume on Friday was a very good sign, indicating that the cross-year rally should truly be kicking off."

Currently, with the continuous advancement of policy support and investment-side reforms, market confidence is gradually recovering, and multiple securities firms hold an optimistic outlook on the future market trend.

The chief strategy analyst at Huaxi Securities stated that positive policy expectations and funding are driving A-shares into a cross-year rally. Notably, the peak in equity fund issuances in November is expected to bring incremental funds to the A-share cross-year rally.

Guotai Junan Securities pointed out that the AI wave is accelerating the localization of semiconductors, with notable breakthroughs in advanced manufacturing processes. The new round of large-scale export controls initiated by the US is a strong catalyst for the domestic semiconductor supply chain, and the localization of chip products is expected to accelerate further in both the end market and supply chain.

Semiconductors and advanced manufacturing processes have always been key battlegrounds in the China-US trade war. Recently, an unprecedented confrontation has once again emerged.

On December 2, the US Department of Commerce's Bureau of Industry and Security issued new export control regulations, further restricting the development of AI and advanced semiconductors in China, adding over 140 companies to the export control list.

Of the 140 companies, 136 are Chinese, mostly concentrated in semiconductor equipment companies, with some software companies and chip investment firms. This includes 20 semiconductor companies, two investment firms, and over 100 chip manufacturing tool manufacturers. Most domestic core equipment enterprises, including Northern Microelectronics and Advanced Micro-Fabrication Equipment Inc., are included on the entity list.

The sanctions primarily restrict the supply of high-bandwidth memory (HBM) chips to China, which are crucial for high-end applications such as AI training. New controls have been imposed on 24 types of semiconductor manufacturing equipment and three software tools used for the development or production of semiconductors.

The sanctions explicitly restrict the transfer of key equipment, chips, and technologies from regions outside the US, Japan, and Europe. Among the 140 listed companies, 16 are labeled as "military end-users," meaning they will be subject to stricter regulation.

Additionally, semiconductor-related software and its "software keys" have been included in the scope of restrictions. With the increasing complexity of semiconductor design and manufacturing software, this measure will undoubtedly have a significant impact on Chinese companies' R&D capabilities, further increasing the difficulty for Chinese enterprises in technological innovation.

The details of these sanctions cover almost every aspect of China's semiconductor industry. "Everything that can be sanctioned has already been sanctioned."

Following the US Department of Commerce's request in November for TSMC, Samsung, and others to suspend 7nm and below advanced foundry services for AI chip companies in mainland China, the Chinese semiconductor industry faces another significant challenge. The rules clearly state: "All policy changes aim to restrict China's ability to localize advanced technology."

However, from another perspective, this could serve as a driving force for the localization of chips.

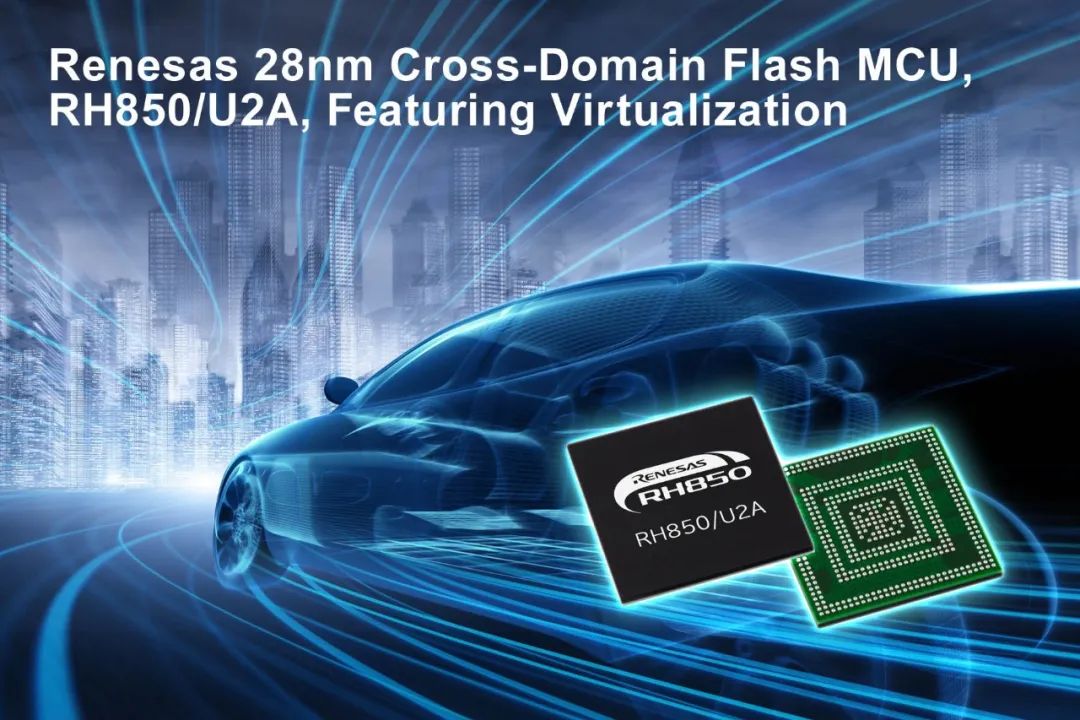

Since 2018, while the US has made every effort to block the development of China's high-end chips, it has neglected defenses in chip manufacturing above 28 nanometers, providing China with a valuable opportunity to break through. Data shows that in 2023, mainland China accounted for 29% of global production capacity in the field of mature semiconductor processes above 28 nanometers. This proportion is expected to jump to 39% by 2027.

The US sanctions over the past five years have not prevented the continuous growth and development of China's chip industry. The rapid rise of China's chip industry has also provided a strong foundation for responding to these US sanctions.

Faced with this situation, China quickly retaliated by introducing multiple countermeasures within 24 hours, apparently having prepared a plan in advance.

China's Ministry of Commerce immediately issued a statement strongly condemning the US for generalizing the concept of national security, abusing export controls, and implementing unilateral bullying. These actions not only undermine the international economic and trade order but also threaten the stability of the global industrial and supply chains.

Simultaneously, China announced stricter controls on the export of key raw materials such as gallium, germanium, and antimony, clearly targeting the US. This measure is a precise counterattack, demonstrating a firm determination to safeguard national interests.

Furthermore, four major industry associations in China jointly called on domestic enterprises to reduce purchases of US chips and use chips manufactured in China. This has been described as a tough counterattack.

Among them, the China Association of Automobile Manufacturers stated, "We welcome global chip companies to strengthen cooperation with Chinese automotive and chip enterprises in various aspects, invest in China, and conduct joint R&D."

In May this year, foreign media reported that to reduce dependence on imported chips, "China's Ministry of Industry and Information Technology has required automakers such as SAIC Motor, BYD, Dongfeng Motor, GAC Group, and FAW Group to increase the local procurement ratio of automotive-related chips to 20% or 25% by 2025."

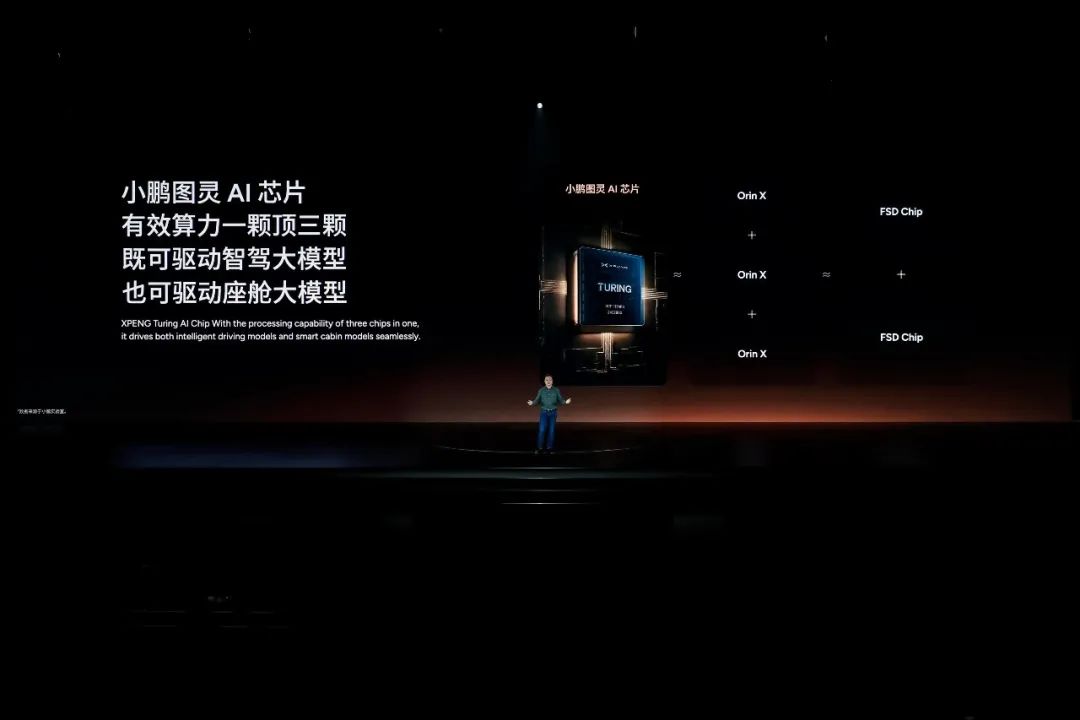

According to data from Gasgoo Auto Research Institute, Tesla's FSD chip ranked first in China's intelligent driving domain controller chip shipments in 2023, with approximately 1.208 million units shipped, accounting for 37% of the market. NVIDIA's Orin-X chip ranked second with 1.095 million units shipped, accounting for 33.5% of the market.

"Companies like NVIDIA have a gross profit margin of up to 90% on their chips, meaning automakers need to bear higher costs when procuring them. If automakers can independently develop chips, they can control costs to a certain extent," said an industry insider. China's automotive industry has this advantage. Meanwhile, Tesla's launch of its self-developed FSD chip in 2019 reduced its dependence on NVIDIA, boosting the confidence of later entrants.

According to IDC data, in 2023, China accounted for 20.3% of the global automotive semiconductor market share with a revenue of US$13.7 billion. Moreover, China has become the source of R&D and innovation for many applications. Based on this, self-developed chips not only have a geographical advantage but also a vast market size advantage.

Currently, domestic chips are increasingly advantageous in terms of cost-effectiveness, prompting domestic manufacturers to focus on localization. New energy vehicle makers such as BYD and NIO are using domestically produced chips on a large scale, reducing production costs while enhancing market competitiveness.

Simultaneously, there is a growing trend of automakers developing their chips. Tesla mass-produced its first self-developed FSD chip in 2019, prompting many domestic automakers to start planning their chip strategies around the same time.

On November 6, He Xiaopeng showcased the self-developed "Turing AI Chip" at the Xpeng AI Technology Day. In September last year, NIO also announced its self-developed intelligent driving chip, "Shenji NX9031," and successfully taped out in July this year. Li Auto is also advancing its self-developed chip project and plans to tape out within the year. Meanwhile, traditional automakers such as Dongfeng, SAIC, and FAW have entered the chip industry through strategic investments.

"Localizing chip production can reduce chip costs, ensure supply chain security, and better meet the differentiated needs of automakers," said a market analyst. China's advantages in mature process chips and its continuous exploration in AI chips are laying the foundation for its rise in the global semiconductor market.

The chip war has been raging for several years. What is the current situation?

Economic historian Chris Miller provides an accurate description in his book "Chip War." In the book, a US semiconductor executive tells a White House official, "Our fundamental problem is that our top customer is our top competitor."

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.