SenseTime rejects 'body shape distortion'

![]() 12/10 2024

12/10 2024

![]() 538

538

Author | Wen Yehao

Editor | Wu Xianzhi

In the context of technology and the internet, 'spin-off' seems to be becoming a collective subconscious.

On December 3, 2024, SenseTime Chairman and CEO Xu Li sent a company-wide letter announcing the completion of the group's organizational restructuring and the launch of a new '1+X' structure.

The '1' refers to SenseTime's core business, built around AI cloud, aiming to achieve seamless integration of large installations, foundational models, and AI applications. Its traditional business of CV (Computer Vision) is also included. Clearly, this part serves as SenseTime's strategic focus, carrying its profit expectations.

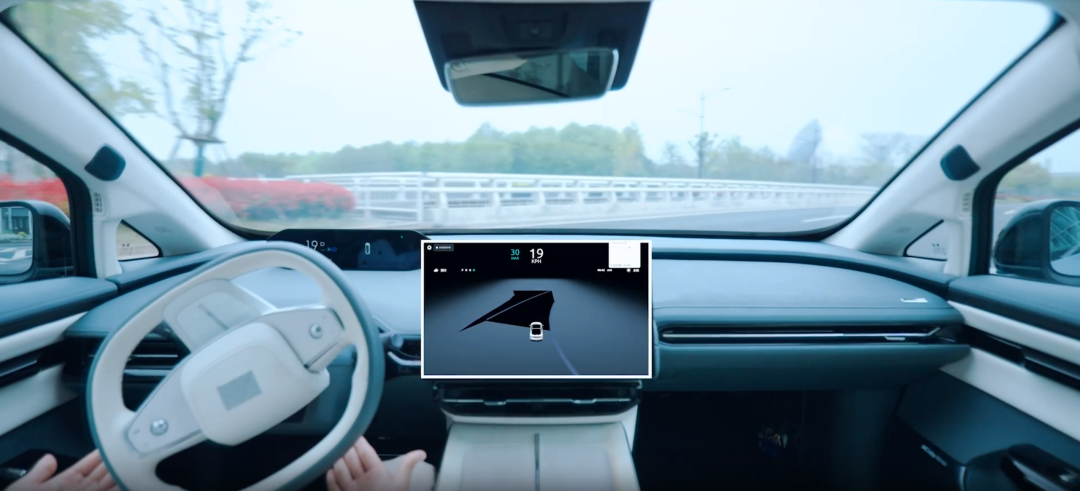

The 'X' represents an ecosystem of enterprises including Smart Auto 'Jueying', Home Robot 'Yuanluobo', and Smart Healthcare. Each ecosystem enterprise will have an independent CEO and may even seek independent financing and listing.

Currently, especially in the valuation system of technology enterprises, the market increasingly demands that enterprises demonstrate profitability and a clear business path. As a player active in the capital market for years, SenseTime's spin-off somewhat aligns with the capital market's wishes.

SenseTime's spin-off may not be a mere organizational restructuring but a measure taken under the pressure of continuous losses – spinning off unprofitable businesses still in the money-burning stage to allow them to grow independently and quickly, while allowing the group to focus more on profitable businesses, thereby optimizing financial reports and alleviating downward pressure on share prices. This also indirectly indicates that SenseTime, which has been striving to align with generative AI, is gradually approaching its idealized self.

Yearning for Rebirth

Over the past year, from business segment adjustments and layoffs to the current spin-off, SenseTime is undergoing a life-or-death transformation, attempting to become a 'new company.' After all, the once 'sexy' SenseTime seems to have lost its shape.

SenseTime Technology, once a domestic AI unicorn and the 'barometer' of China's AI industry, has seen its aura fade as the market environment has drastically changed.

Taking the CV business as an example, what was once SenseTime's 'trump card' over the years has now become a heavy shackle. The wave of smart cities has passed, and the demand for security surveillance has entered a stable period. The industry is no longer at the forefront, and the traditional CV business that once supported SenseTime has lost its growth momentum.

Financial reports show that in the first half of 2024, SenseTime's traditional AI business revenue halved, declining by 50.6% year-on-year, from 1.054 billion yuan to 520 million yuan. Behind this revenue decline lies the weakening of SenseTime's traditional strengths.

Before this, SenseTime had realized the severity of the problem and began adjusting its business segments – the original four segments of Smart Business, Smart City, Smart Life, and Smart Auto were reorganized into three core businesses: Generative AI, Traditional AI, and Smart Auto.

Among these, Traditional AI corresponds to the 'old SenseTime' familiar to the industry, while Generative AI represents the self-projection of the 'new SenseTime.'

In the first half of 2024, SenseTime's Generative AI business revenue soared from 295 million yuan last year to 1.051 billion yuan, a year-on-year increase of 255.7%, accounting for 60% of total revenue. Additionally, during the reporting period, over 3,000 leading enterprises in various industries used SenseTime's large models and intelligent computing services.

Behind this is SenseTime's proactive pursuit of change. Among the 'Four Little Dragons of AI,' SenseTime is the most sensitive to external and industry perceptions, enabling it to accurately grasp the turning points of industry evolution and establish an early and deep presence in the field of generative AI.

IDC data shows that in the first half of 2024, SenseTime's SuperSense AI Cloud ranked second with a market share of 14.8%. SenseTime is also the only player in China, independent of major internet companies, with a large-scale AI cloud platform. Coupled with the deterministic opportunities in generative AI, this undoubtedly injects hope for SenseTime's rebirth.

However, 'rebirth' is never easy.

Although the generative AI sector is hot, it is by no means a worry-free market. SenseTime's competitors include both domestic and international technology giants and a large number of emerging AI forces born from the AI wave. Against this backdrop, SenseTime finds itself in a tight spot.

On the other hand, although SenseTime's revenue in the first half of the year was 1.74 billion yuan, representing a 21% increase, its net loss was still as high as 2.457 billion yuan. This means that SenseTime's profitability situation remains severe.

With old businesses gradually declining and new businesses still struggling, SenseTime faces a challenging situation. Having already undergone business structure adjustments, what does SenseTime aim to achieve by choosing a spin-off at this moment?

Protect the Big or the Small?

Everything has its purpose, and corporate spin-offs are no exception.

To use an inappropriate analogy, it's a bit like the 'save the mother or the child' dilemma in childbirth – spin off unprofitable sub-businesses to allow the group to concentrate its efforts on core businesses to continue growing stronger; let go of high-potential, growth-oriented 'younger siblings' to allow them to venture out independently and attract investment for higher valuations.

Looking at the bigger picture, SenseTime's spin-off seems to have a stronger intention to 'protect the big,' but it also aims to unshackle sub-businesses and allow them to breathe freely.

As the leader among the 'Four Little Dragons of AI,' before the AIGC wave arrived, SenseTime integrated AI into many industries to enhance its imagination space. As Yin Qi, CEO of Face++, said, 'In the early stages of an industry, (AI enterprises) must try everything to survive. When the industry matures, they can step back and choose the most valuable aspect to focus on.'

For SenseTime, which was burdened with a high valuation at the time, if it could not achieve stable monetization, it would have to continuously explore new industries and scenarios, ultimately making SenseTime's business vast and complex.

When a company's business becomes too complex and tries to cover everything, it often leads to an imbalance in resource allocation and inefficient management during expansion, resulting in a loss of direction and focus. After all, trying to do everything often yields half the results with twice the effort.

More importantly, the development of the businesses that SenseTime intends to spin off, such as Smart Auto 'Jueying,' Home Robot 'Yuanluobo,' Smart Healthcare, and Smart Retail, is uneven. Although these innovative businesses have achieved certain results, some are still money-burning machines, while others have already lost their charm.

For example, the prospects for the Smart Healthcare business are broad, with enormous imagination space, but it is difficult to see returns in the short term. The Smart Auto business behind 'Jueying,' as the most promising segment after SenseTime's spin-off, benchmarks X.AI, which provides end-to-end AI solutions for Tesla's FSD, and holds an advantageous position in the industry. In the first half of 2024, its revenue surged by 100.4% to exceed 168 million yuan – both critically acclaimed and commercially successful. At this stage, IPOs in the autonomous driving sector are quite popular, and the spun-off 'Jueying' may consider independent listing in the future, offering more growth potential.

However, as Wang Xiaogang, CEO of SenseAuto, said, 'It may take about three years for autonomous driving to achieve break-even, depending on the number of autonomous vehicles, which must reach the scale of millions to support business development.' The underlying message is that before the industry truly takes off, Jueying cannot quickly achieve profitability, and losses will remain the norm.

On the other hand, according to previous media reports, SenseTime recently conducted a round of large-scale personnel optimization involving multiple business departments. The 'old' businesses can be explained, but what is puzzling is that the Smart Auto and Healthcare businesses, which should 'run independently' after the spin-off, also began optimization before the spin-off.

This may be one of the key motivations behind SenseTime's spin-off: Faced with segments that still need slimming down, targeted layoffs can achieve cost reduction and efficiency enhancement, but they are one-time and difficult to replicate, insufficient to make SenseTime profitable. To achieve profitability sooner, SenseTime needs to spin off businesses still in the money-burning stage and concentrate all its efforts on the most imaginative generative AI.

In other words, SenseTime's spin-off is not just about dismantling businesses but also about dismantling dilemmas – completely reinventing itself with the truly growth-potential business of generative AI and using healthier financial performance to dispel doubts about its 'continuous losses' and seek rebirth.

Conclusion

People tend to fall into the logical trap of self-imposed limitations, thinking that solving the immediate dilemma will resolve all problems. In reality, however, challenges often come one after another.

Over the years, SenseTime has been under scrutiny for its continuous losses. Over time, this noise has fermented in the industry context, becoming a challenge it must face. This spin-off can be seen, in a sense, as an antidote to shake off losses – better embracing AI 2.0, seizing market waves, and allowing SenseTime to slim down and move towards profitability with lighter steps.

However, whether profitability can be quickly achieved after the spin-off remains an open question. After all, the generative AI battlefield is still in the ammunition-dumping stage, and even the top player OpenAI is still losing money. This will be a long-drawn-out battle. A deeper question is, even if SenseTime manages to achieve profitability in the short term, will it be able to resolve all dilemmas? The answer is clearly not simple.

As mentioned earlier, the AI and autonomous driving sectors where SenseTime operates are no longer monopolized by a single player. With AIGC applications widely validated, giants have entered the field in droves, virtually changing the game rules of the entire sector. Now, the runway is filled with experts, and SenseTime still needs to work hard to defend its territory and expand further amidst the pursuit and blockade.

This means that profitability may no longer be the sole criterion for evaluating SenseTime. Besides 'profitability,' SenseTime also faces a more complex battlefield.

Fortunately, after a decade in the AI sector, SenseTime has a solid moat in computing power, large models, and application fields. Whether it can become sharper and shift from defense to offense after the spin-off remains to be seen. SenseTime, which has chosen to spin off, is now at a critical juncture.