Can large models save AI glasses, or can AI glasses save large models?

![]() 12/10 2024

12/10 2024

![]() 434

434

Last year, the domestic tech industry witnessed the 'Hundred Models War', and this year may usher in the 'Hundred Glasses War'.

In August this year, Hive Technology released the Jiehuan AI glasses, which support mainstream domestic large models. On November 12, at the Baidu World Conference, Baidu Duer released AI glasses equipped with the Wenxin large model. Shortly after, on November 18, Rokid, a long-established domestic AR vendor, launched Rokid Glasses equipped with the Tongyi large model. Additionally, Xiaomi and Zijing Weizhi are set to release products in 2025. Furthermore, Apple is also rumored to be organizing a team to research the AI glasses market.

This hardware craze was ignited by the American tech giant Meta. Earlier, it collaborated with the eyewear brand Ray-Ban to develop the AI glasses 'Ray-Ban Meta' (hereinafter referred to as Meta glasses). Nine months after its release, over 1 million units have been sold, making it a dark horse in the smart hardware field this year.

The birth of this bestseller has excited entrepreneurs in the smart hardware field, but perhaps even more delighted are the players in the large model industry. Despite the hustle and bustle, the large model products of leading players are still largely similar, and a true killer app for large models has yet to emerge in China. Anxiety pervades the entire industry, and now that AI glasses have become popular, they provide a promising platform for the implementation of large models.

However, will this trend be an opportunity for domestic large models to break through their current predicaments? Smart glasses and large models, two once-hot concepts, have now combined after their popularity waned, giving each other new narratives. Rather than being true innovation, this may merely be a 'pseudo-trend' created by mutual exploitation.

The story is running out of steam

Instead of engaging in a technical battle, large models have first fallen into a price war, which many insiders did not anticipate.

In May this year, Alibaba Cloud announced significant price reductions for multiple commercial and open-source models under its Tongyi Qianwen series, with the highest reduction reaching 97%. After Alibaba took the lead, other cloud service providers such as ByteDance's Volcano Engine, Baidu Intelligent Cloud, Tencent Cloud, and iFlytek also announced substantial price reductions for their large models, with industry price reductions reaching around 90%.

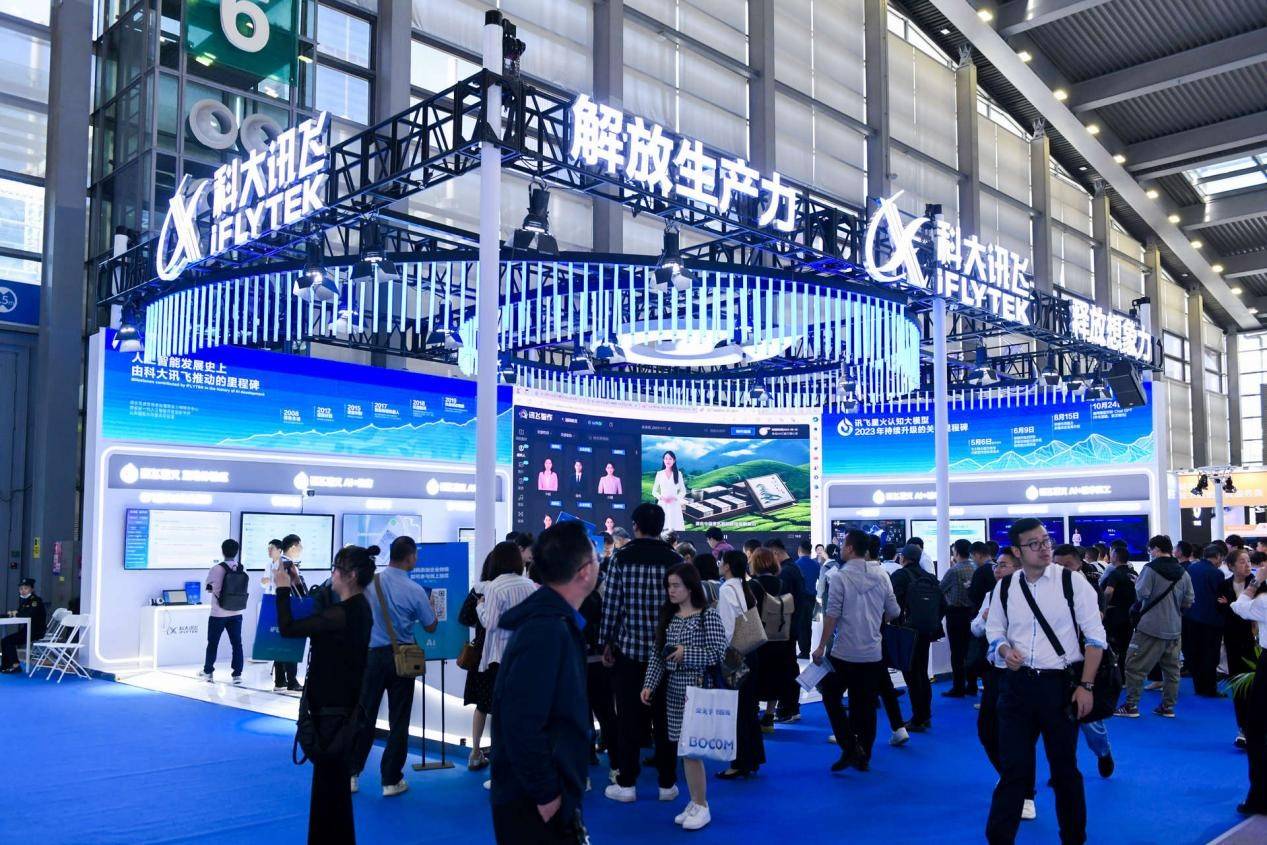

After the price war, the main competition in the large model market now seems to have shifted to a marketing battle. In densely populated white-collar areas such as subways, office buildings, and airports, slogans from Baidu Wenxin, iFlytek Spark, Alibaba Tongyi, Tencent Yuobao, and Huawei Pangu compete for attention. Online, companies have also increased their investment in online advertising to promote their AI applications. Kimi, the flagship product of Darkside Moon, became popular through overwhelming advertising, catapulting the company to the forefront of domestic large models.

However, both the price war and the marketing war essentially reveal the predicament of domestic large models amid this technological wave. The price war erupted because the capabilities of various large models tend to be homogenized, with insufficient product capabilities that temporarily cannot create a significant gap. The marketing war more intuitively confirms the difficulties in commercializing large model technologies.

Under such objective circumstances, enthusiasm for large models has cooled. According to data from the third-party data agency Qimingpian, in the first nine months of this year, the total funding amount in the AI sector reached 37.15 billion yuan, more than doubling from the same period last year. However, the number of funding transactions only increased by about 10%, indicating that most of the funding went to leading startups. Moreover, starting from the second half of the year, capital has been attracted to other sectors such as embodied AI, and the number of fundings for large models has slightly declined compared to last year.

In addition to the difficulty in obtaining funding, the phenomenon of talent loss has become increasingly common among large model startups. A large wave of key talents have left the 'Six Little Tigers,' with some returning to large companies and others choosing to start their ventures.

When the concept of large models exploded last year, domestic companies rushed to launch their large model products, vowing to create the next 'ChatGPT.' However, after the price and marketing wars, the technological capabilities of large models still seem far from the intelligence we imagine. Furthermore, attempts to integrate large models into devices like smartphones and vehicles appear more like commercial gimmicks deliberately created by large model manufacturers, with no revolutionary experiences seen so far.

Before large models were integrated into AI glasses, the development of the smart glasses market, including AR/VR/MR glasses, was also disappointing to consumers. Technical bottlenecks in areas such as portability, display quality, battery life, and intelligent functions have prevented manufacturers from fulfilling the promises made at concept product launches in the mass consumer market, leading to a gradual decline in investment and entrepreneurial enthusiasm in this sector.

According to a research report released by Vision Research, global AR sales in the third quarter of 2024 were 106,000 units, a year-on-year decrease of 4%, marking the first year-on-year sales decline for AR glasses in recent years.

The application of large models in AI glasses this year has transformed smart glasses from a questioned 'electronic waste' into a 'new hope' for the commercialization of AI.

Using large models as a gimmick, AI glasses will not sell well

Unsurprisingly, the market may see dozens of AI glasses equipped with large models next year. According to an insider, there are currently about a dozen teams in China preparing to develop AI glasses, with at least 10 teams having officially entered the market. These include new entrants and large companies like Xiaomi and ByteDance. Even more enthusiastic are the companies behind the large models, which believe they have found the best platform for commercializing large models.

However, this optimism may be misplaced. In 2023, the second-generation Meta glasses were released alongside the Quest 3, but Meta did not place excessive emphasis on the Meta glasses; instead, it favored the Quest 3 and the then-mysterious AR product Orion. The popularity of Meta glasses and their sales success seem more like an unexpected outcome.

More crucially, is the popularity of Meta glasses due to the upgraded AI functions brought by large models? No. Foreign media tested Meta AI and concluded that its main functions are not significantly different from those of most AI hardware: voice interaction, support from large models, and a 'GPT' on the nose bridge. Compared to large models, Meta's focus on making the AI glasses lightweight, comfortable, and fashionable is the root cause of its purchasing boom.

In terms of functionality, first-person shooting is more appealing to consumers than flashy AI features such as smart assistants, Q&A, and real-time translation. Many potential consumers of AI glasses indicate that they primarily want the shooting function and are not interested in other AI features.

This is also a problem facing domestic internet giants and entrepreneurs: After experiencing smart products like large mobile phone models, Ai Pin, and Rabbit R1, which are touted as new-era innovations, consumers have become disillusioned with the underwhelming or disappointing intelligent experiences, leading to a rejection of marketing buzzwords like 'disruption,' 'transformation,' and 'creativity.' The more hype, the greater the likelihood of disappointment.

Currently, the integration of AI glasses and large models does not reach a level that can be considered intelligent. The functions that can be realized are relatively basic, such as voice assistants, real-time translation, navigation reminders, and object recognition. There is still significant room for improvement in the sensitivity and accuracy of capturing information.

Among the AI functions prominently promoted under the banner of large models, a superficial issue is that Q&A, translation, meeting minutes, etc., correspond to low-frequency scenarios with limited demand, which may not stimulate widespread consumer demand. A deeper issue is whether the homogeneity problem inherent in domestic large models will lead to the homogeneity of the hardware products they are implemented on if large models are used as a selling point.

Of course, the popularity of Meta glasses has provided successful experience for domestic participants entering the AI glasses market, namely, achieving a balance between performance, weight, and price while highlighting strengths in a particular area. However, it remains questionable whether domestic companies can successfully replicate a product comparable to Meta glasses.

Large models cannot rely solely on AI glasses

Before Meta glasses became a hit, AI glasses equipped with audio modules and translation functions already existed, but their sales were unimpressive. For example, Hive Technology's Jiehuan AI audio glasses sold over 2,000 units on JD.com's self-operated flagship store, while Starmeizu's Star Air2ar glasses only sold around 1,000 units. Even Huawei, which has successively launched multiple AI glasses, has not driven this market.

However, relying solely on the success of Meta glasses to conclude that AI glasses are the best platform for implementing large models seems premature.

Firstly, AI glasses are not the ultimate form of smart hardware devices; they are more like a transitional product for AR glasses. In the past few years, the development of AR glasses has been greatly restricted due to their limited application scenarios, lack of irreplaceability, and scarcity of content ecosystems, making them relatively niche in the wearable device field. Therefore, AI glasses without display functions can be seen as an immature product of AR glasses.

Regarding the choice between AR glasses and AI glasses, Meta clearly prioritizes the former. At Meta Connect 2024, Zuckerberg set aside the highly popular Ray-Ban Meta to focus on Orion, the company's first AR glasses developed at a cost of several billion dollars, describing it as 'the most powerful on the planet.'

Secondly, the success of Meta glasses tells the market that whether it's AR glasses or AI glasses, resolving issues related to comfort and convenience is crucial to gaining consumer recognition. In other words, regardless of how AI functions evolve and increase, it is essential to ensure that the glasses are normal eyewear first, which actually poses limitations on the implementation of technology in AI glasses.

The more AI functions and enhancements, the greater the challenges to product lightweighting and battery life.

In this hardware trend ignited by Meta glasses, AR-related startups and mobile phone manufacturers undoubtedly see new possibilities in AI glasses. The price war among large model manufacturers has significantly reduced the cost of integrating this hardware with large models, emboldening them to take risks. However, for large model manufacturers aiming to showcase their capabilities on AI glasses, this is both an opportunity and a challenge.

Currently, domestic large models have all entered the application stage, but merely releasing a free application does not directly benefit the company or gain technical recognition. The growth of these applications' C-end user base is slow, and customer acquisition costs have significantly increased. If AI glasses featuring large models fail to succeed in the domestic market, external doubts about domestic large models will only intensify.

It is worth mentioning that the entire smart glasses market is still in its early stages of development with relatively low penetration. According to GIR data, global smart glasses shipments climbed from 193,800 units in 2014 to 6.7553 million units in 2023. However, the global penetration rate of smart glasses remains below 1%.

Certainly, smart glasses are not lacking in imagination; they just need more innovative, market-disrupting products to support them. The domestic company that creates the next well-received and high-selling 'Ray-Ban Meta' will be the first to stand out from the crowd.

Dao Zong You Li, formerly known as Waidaodao, is a new media outlet focusing on the internet and technology industry. This article is original and any form of reprinting without retaining the author's relevant information is prohibited.