As 2025 Approaches: Who Remains in the Robot Vacuum Cleaner Market?

![]() 12/11 2024

12/11 2024

![]() 755

755

Author | Lu Shiming

Editor | Da Feng

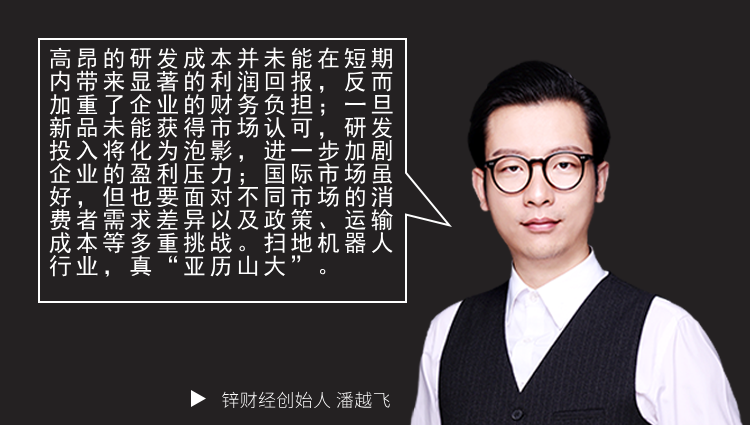

The robot vacuum cleaner industry, once a "star" sector in the smart home landscape, has captured the attention of numerous investors. However, over the past two years, the industry has encountered unprecedented challenges, marked by declining profits and waves of layoffs. Players are now seeking new growth avenues and accelerating their overseas expansion. Recently, Narwal Robotics initiated a large-scale layoff plan affecting multiple departments, including R&D and sales, with some teams experiencing layoffs exceeding 50%. Earlier, Roborock also made headlines due to a nearly 50% drop in net profit and the founder's perceived "irrelevant activities".

Source: Sina Finance

From a flood of capital to a collective decline in profits for industry leaders, what has caused the "fading" of the robot vacuum cleaner sector? Primarily, the issues lie with the products themselves. Due to insufficient intelligence, poor cleaning performance, and high failure rates, robot vacuum cleaners are often referred to by consumers as "intelligence tax" products. From a broader perspective, this can be seen as an inevitable outcome of the entire industry accelerating its "internal competition".

Under the current circumstances, a new round of "elimination races" has begun. How players navigate overseas markets and diversify their product offerings will determine who stays and who is eliminated.

Profit Collection "Fades"

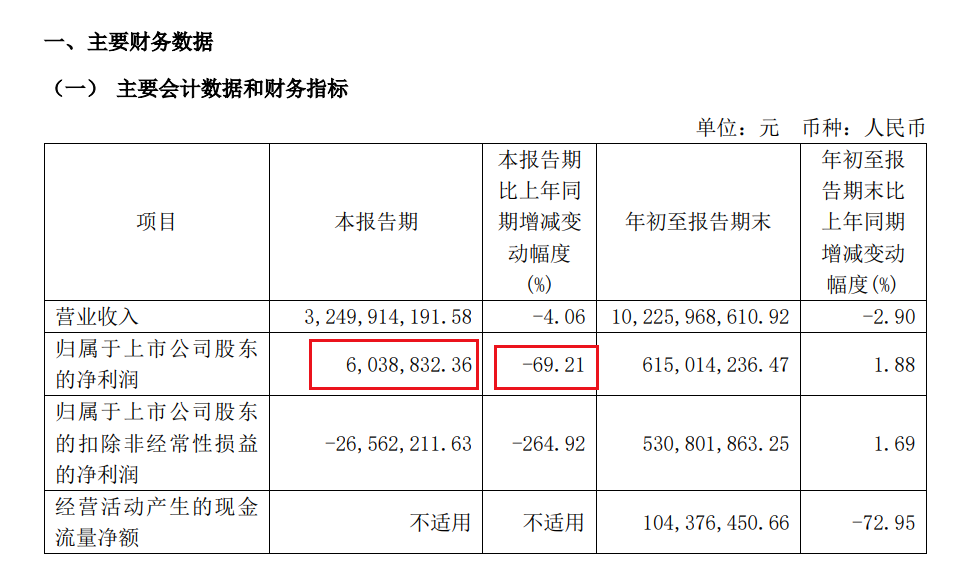

The robot vacuum cleaner market has experienced explosive growth in recent years, but as the market gradually becomes saturated, growth rates have begun to slow. According to AVC Revo, sales of cleaning appliances in the first half of 2024 amounted to 16.5 billion yuan, a year-on-year increase of 9.8%, with sales volume reaching 12.41 million units, up 13.6% year-on-year. Specifically, robot vacuum cleaners led the way, with new products significantly driving sales and leading the overall cleaning market, achieving double-digit growth in both sales volume and revenue, with a year-on-year increase of 18.8% in sales revenue and 11.9% in sales volume. Although these figures still demonstrate growth potential, being able to sell does not necessarily mean earning more. Along with the increase in sales volume, the robot vacuum cleaner industry has experienced the "anomaly" of significantly declining profits. Ecovacs and Roborock, as the two giants in the robot vacuum cleaner industry, have seen particularly notable declines in net profit in the recent quarter. Taking Ecovacs, known as the "sweeper king," as an example, in the first three quarters of this year, its operating revenue was 10.226 billion yuan, a year-on-year decrease of 2.9%; its net profit after deducting non-recurring gains and losses was 531 million yuan, a year-on-year increase of 1.69%. However, looking solely at the third-quarter report, it is evident that Ecovacs' net profit in the third quarter of 2024 was only 6.04 million yuan, a near 70% year-on-year plunge.

Source: Ecovacs 2024 Third-Quarter Report

Roborock is not faring much better. According to Roborock's financial report, the company's operating revenue in the first three quarters of 2024 was 7.007 billion yuan, a year-on-year increase of 23.17%; its net profit after deducting non-recurring gains and losses was 1.186 billion yuan, a year-on-year decrease of 5.40%.

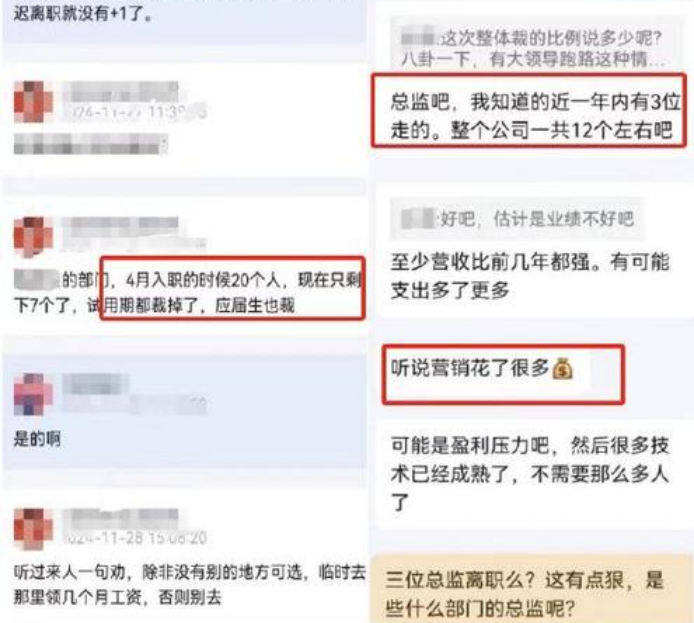

If particular attention is paid to the third quarter, the decline in Roborock's net profit growth rate is particularly significant. Specifically, the net profit attributable to shareholders of the listed company was 351 million yuan, a decrease of 43.40% compared to the same period last year and a decrease of 51.32% compared to the previous quarter. Simultaneously, the net profit after deducting non-recurring gains and losses was 325 million yuan, a year-on-year decrease of 45.25% and a quarter-on-quarter decrease of 37.42%, marking the largest single-quarter decline since 2021. Although not yet listed, Narwal Robotics has recently become the focus of industry attention. According to Sina Tech, the company is implementing a large-scale layoff action, affecting a wide range of business departments including development and testing, with entire teams being reduced in size. Some teams have been halved in size, and in extreme cases, the layoff ratio has reached 65%.

Regarding the reasons behind these layoffs, insiders speculate that although Narwal's product sales performance has been impressive, the sharp rise in marketing costs has led to operating profits failing to meet expectations, forcing the company to take urgent cost control measures. Sales volumes continue to climb, yet profits are collectively declining. Behind the inability of robot vacuum cleaners to "earn," lies the inevitable outcome of changing consumer demands and internal competition within the industry.

Weak Products, Intense Industry Competition

As the robot vacuum cleaner market gradually matures, consumer demand for products is also evolving. Many people are no longer satisfied with basic cleaning functions but are paying more attention to the intelligence level, cleaning efficiency, and user experience of products. However, robot vacuum cleaner products on the market have not formed significant advantages in terms of functionality and technology, which directly leads to consumers losing the desire to try them out and the impulse to pay for "high-priced items." One consumer told TMTpost, "If there are slightly larger particles on the ground, like soybeans, it simply can't suck them up. Not only does it fail to suck them up, but it also pushes the garbage all over the house, often driving large pieces of trash into corners or hiding them where I can't see, and then it just leaves."

"Another consumer angrily said, "I can easily wipe away stains with a cloth, but it just spins around them several times and leaves them untouched. What's even more infuriating is that if it rolls over sticky dirt, like soup, it leaves a long trail behind." Besides concerns about cleaning effectiveness, other issues include frequent getting stuck, showing a lack of intelligence; short battery life, needing to be charged every half-hour; and the need for manual cleaning of both the internal and external parts, demonstrating a lack of automation... Apart from the various product issues that dissuade consumers, the robot vacuum cleaner industry has also seen an endless stream of price wars, talent wars, and patent wars in recent years. The intensification of competition has led to a continuous increase in players' operating costs.

This year has been called the "year of internal competition" by insiders in the robot vacuum cleaner industry, with two particularly notable actions: the increasing number of new products and the intensifying price war. It is understood that Ecovacs, Roborock, Dreame, Narwal, Xiaomi, and others have all launched more than one new product this year, and at not inexpensive prices. Among them, Roborock is the most competitive, having launched 8 products in the first three quarters, double the number from last year.

Source: Roborock Official Website

The direct consequence of the high speed of new product launches is an increase in R&D and sales expenses. In terms of R&D costs, Ecovacs' costs decreased from 10 billion to 9.6 billion in the first three quarters, with R&D expenses increasing from 605 million to 657 million yuan. Roborock's costs increased from 4.3 billion to 5.6 billion yuan, with R&D expenses rising from 448 million to 640 million yuan. At the sales cost level, Roborock's sales expenses in the first three quarters increased by 46% year-on-year to 1.6 billion yuan, accounting for 22% of operating revenue. Although Ecovacs' sales expenses in the first three quarters decreased year-on-year, Founder Securities' research report shows that Ecovacs' sales expense ratio for the third quarter was 36%, an increase of 2.97 percentage points year-on-year. In the fiercely competitive market, price wars have also become a common competitive tactic. Players like Ecovacs stimulate market demand through price reductions and promotions. Although this approach can temporarily boost sales, it also represents an increase in marketing investments and promotional efforts for peers, which undoubtedly further increases operating costs and compresses profit margins for enterprises.

Product Diversification, Overseas Market Expansion

In the current highly competitive robot vacuum cleaner market, players must attempt diversified development and expand new product lines to ensure sustained growth. For example, Roborock has launched a series of washing machine products, while Ecovacs has chosen lawn mowers. In May this year, Roborock founder Chang Jing announced that the company had established a washing machine division and would concentrate resources to create a second growth trajectory, aiming to "open the market in 2024 and improve product categories in 2025." According to the Roborock official website, it currently has a total of 9 series of washing machine-related products, including 5 12kg wash-and-dry all-in-one machines and 4 mini wash-and-dry all-in-one machines. However, the washing machine market is also highly competitive, filled with domestic brands like Haier and Little Swan, as well as international giants like Siemens.

Given that the washing machine market is already highly mature, for Roborock to gain a share in this field, it must build unique technological barriers, which is obviously not an easy task. It is worth mentioning that as the founder of Roborock, Chang Jing has recently been questioned by the market for his frequent participation in "desert off-road" activities and the release of related videos, raising doubts about his "irrelevant activities." Against the backdrop of Roborock's share price pressure and underperforming financial results, Chang Jing's dedication of significant energy to the automobile manufacturing business has also caused dissatisfaction among many investors. TMTpost understands that since the launch of Chang Jing's Jishi Auto project, market response has been mediocre, with monthly sales yet to exceed 1,000 units.

Douyin Screenshot

Besides products, to find new growth points, many robot vacuum cleaner enterprises have also begun to look towards overseas markets. As early as 2018, companies like Roborock, Ecovacs, and Dreame Technology began laying out their overseas expansion strategies, although the domestic market was still the main battlefield at that time. However, since last year, many enterprises have accelerated the expansion of their overseas teams, gradually establishing a place for Chinese robot vacuum cleaners in the global market. Especially since 2023, the sales of robot vacuum cleaners in the European market have recovered strongly, with Chinese brands demonstrating significant advantages. As an early entrant, Ecovacs has consistently ranked third in market share, while the newcomer Roborock has risen rapidly to rank second.

However, the overseas market is not without challenges. Compared to the domestic market, the overseas market is more complex in terms of policies, transportation costs, exchange rate fluctuations, and product localization. For domestic brands to establish a foothold in overseas markets, they not only need to possess strong product competitiveness but also need to establish a sound sales network and after-sales service system. These require significant capital investment and time accumulation, posing a significant test to a company's profitability. Whether it's technical issues with the products themselves, the intensifying degree of internal competition within the industry, or the difficulty in quickly achieving "explosive" sales of new products and high-speed growth in overseas markets, the robot vacuum cleaner market will become increasingly "concentrated" under layers of screening. So, who will remain, and who will be eliminated? Let's wait and see.