Big Model Battleground

![]() 12/11 2024

12/11 2024

![]() 508

508

Written by | Hao Xin

Edited by | Wu Xianzhi

On November 29, following the Agent OpenDay event hosted by Wisdom Spectrum, CEO Zhang Peng fielded a question from a reporter on-site: "How is the progress on the To B front?"

"It's alright," Zhang Peng replied succinctly.

This year, Wisdom Spectrum, a star AI company, has been deeply entrenched in the fierce competition for big models, with formidable rivals such as Baidu, Alibaba, Tencent, and ByteDance. The fate of Wisdom Spectrum and other AI startups is similar; being shortlisted often feels like winning a 'consolation prize,' often culminating in mere 'participation.'

The battle against the giants is incredibly challenging. As of December 3, searching for the keyword 'big model' on the China Bidding Public Service Platform yields approximately 200 winning bids for big models. According to incomplete statistics from Photon Planet, the aforementioned four cloud providers have won 98 bids, accounting for nearly 50% of the total orders; the total amount for big model and AI-related orders alone amounted to 1.112 billion yuan, capturing a significant portion of the state-owned enterprise and government-enterprise markets.

AI companies seem to have fallen into a trap of self-verification, needing to constantly generate buzz through press conferences and new product launches to attract B-end customers. However, none of this can compete with the inherent advantages of cloud giants: the price of computing power orders is overwhelmingly low in the market; pure big model functions do not command a high price, but when packaged with cloud, database, and SaaS solutions, they can not only spread out cloud infrastructure costs but also increase negotiation leverage; customers are path-dependent, often directly offering contracts to cloud vendors they have worked with based on usage habits.

A more severe reality is unfolding. In the To B market, cloud vendors are also leading the price war, offering more without increasing prices, with orders won at less than half the price of competing vendors. Additionally, the first-mover advantage of AI startups is gradually fading, with service homogenization among competitors and insignificant gaps or even being surpassed by larger factories.

At this juncture, the 2024 big model To B market landscape is clear: cloud giants feast, while AI companies scrape by with leftovers.

AI Revenue Written into Financial Reports

Since last year, various cloud giants have successively elevated AI and big models to a strategic level.

Each company has a distinct approach. Alibaba Cloud has implemented the MaaS concept, with the core objective of driving cloud revenue through big models and AI products. Currently, Alibaba Cloud's related revenue comprises five parts: revenue generated from internal business calls to Tongyi Qianwen within the Alibaba ecosystem, revenue from Alibaba-related products such as DingTalk and their customers' procurement and consumption of cloud services, revenue from AI companies invested in by Alibaba and their customers, revenue from developers calling big model tokens, and revenue from To B market orders.

Alibaba Cloud is currently the vendor with the broadest reach, offering the most comprehensive cloud service form, with both open-source and closed-source options being tested in the market. Driven by the above revenue modules, Alibaba Cloud has achieved double-digit growth in both revenue and profit. From Q1 to Q3 of 2024, its revenue increased from 25.595 billion yuan to 29.61 billion yuan; adjusted profit increased from 1.432 billion yuan to 2.661 billion yuan, a year-on-year increase of 89%. Unfortunately, Alibaba Cloud has not yet achieved its goal of double-digit year-on-year growth.

Baidu is aggressive in AI and big models, leading the way from releasing big models to AI transformation. Baidu's accumulation in the IaaS and PaaS layers is not as deep as Alibaba's, so it realized that infrastructure building was not the way forward and focused on big models and AI applications. Baidu Cloud's revenue mainly consists of three parts: revenue from tokens generated by developers calling the Wenxin model, revenue from licensed API interfaces, and revenue from To B market orders.

Unable to generate economies of scale at the infrastructure level, Baidu has been particularly aggressive in exploring the B-end business. Several entrepreneurs have told Photon Planet that Baidu's marketing department actively reaches out to them and facilitates cooperation with other startups to quickly secure orders and drive up the token calls for the Wenxin model.

Catching this wave of big model enthusiasm, Baidu Cloud's growth has been the most apparent. The Q3 2024 financial report shows that the proportion of AI revenue has increased to over 11%. This growth is primarily driven by high demand for model training and inference in industries such as the internet, education, and finance. Among them, incremental revenue from mid-tier enterprise customers increased by 170% quarter-on-quarter.

However, as similar products continue to emerge in the market, Baidu's irreplaceability has diminished. Although big model and AI revenue continue to rise, the growth rate has slowed significantly. Baidu Cloud's Q3 quarter-on-quarter growth rate fell from 14% to 11%, and generative AI cloud revenue fell sharply from 95% to 17% quarter-on-quarter.

Tencent tends to be conservative, preferring to enter when the industry landscape becomes clearer, which is also the case for big models, AI assistants, AI-generated images, and AI videos. Unlike Alibaba and Baidu, which focus on acquiring new customers, Tencent Cloud thinks about how to use AI to meet existing business needs. Therefore, integrating AI into its ecosystem has become a must for Tencent.

Tencent Cloud's AI revenue is scattered across various businesses, like stones thrown into a pond, creating ripples that spread gradually, making it difficult to quantify revenue in a short period.

Tencent's Q3 2024 financial report revealed that growth in the marketing services segment was driven by video numbers, mini-programs, WeChat search advertisements, and AI technology. Currently, AI-related revenue accounts for about 10% of Tencent Cloud services, and the AI business is expected to generate significant free cash flow next year.

Cloud Giants Feast

The underdeveloped Chinese big model market is fraught with uncertainties. Customers are hesitant, the infrastructure for adapting big models and AI functions is incomplete, and developers are constantly shifting their focus. At this stage, in the Chinese context, the real, sustained, and stable demand for big models comes from government and enterprise clients. When vendors say To B, they essentially mean To G.

For cloud vendors, channels, experience, and customers in the G-end market are readily available. It's just a matter of following the process from the previous stage, with the protagonist shifting from SaaS and cloud to big models and agents. As a result, securing orders has become the cloud giants' crazy scoring method this year.

Based on public data from the China Government Procurement Network, the China Bidding Public Service Platform, and other platforms, Photon Planet tracked the winning bids related to big models by Baidu Cloud, Alibaba Cloud, Tencent Cloud, and Huoshan Cloud as of December 3, 2024. It should be noted that only orders generated by big models and generative AI are counted. Big model application services typically refer to big model application platforms, tools, software, etc., while big model deployment and training usually refer to model training, inference, tuning, etc. The statistics may have omissions, and undisclosed bid amounts are not included in the statistics.

Baidu Cloud won 34 bids, leading in both quantity and industries covered. Among them, the financial industry had the most bids, followed by communications, electricity, education and research, the environment, and public facility management. Baidu Cloud secured orders totaling 446 million yuan, with the majority coming from computing power (216 million yuan) and big model application services (170 million yuan), accounting for 49% and 38% of the total amount, respectively. Perhaps due to its prominence in the field of AI search, only Baidu Cloud won orders, although the unit price was not high, with individual orders not exceeding 2 million yuan.

(Diagram by Photon Planet)

Alibaba Cloud won 18 bids, with finance, education and research, and government affairs as its main areas. Although it lagged behind Baidu in quantity, Alibaba Cloud secured a total of 426 million yuan in orders, including 396 million yuan in smart computing orders, almost equaling Baidu Cloud in total bid amount. Besides computing power, there were 12.96 million yuan for big model training and deployment and 7.69 million yuan for big model application services.

Upon review, Alibaba Cloud's strong areas are still its old cloud business, such as cloud expansion, public cloud, databases, middleware, hardware procurement, etc. New businesses like digital humans, smart customer service, and AI programming account for a relatively low proportion, and Alibaba Cloud does not have a significant advantage in big model training and deployment. The procurement source for the Tongyi Qianwen big model comes from the 'Zhejiang Lab,' a research institution co-founded and funded by Alibaba.

(Diagram by Photon Planet)

Tencent Cloud won a total of 24 bids worth 180 million yuan, concentrated in the media and communications sectors. By reviewing the orders, Photon Planet found that government and enterprise clients have the clearest understanding of Tencent Cloud and its Hunyuan series products, including keywords like digital humans, multimodal, and big models, which may be related to Tencent Hunyuan's 'MoE tagging' and open-source approach. This resulted in a 72% share of big model training and deployment bids, with the Shenzhen Bao'an District Government directly adopting Tencent Cloud and the Hunyuan big model. Additionally, radio and television stations and news media have expressed interest in fine-tuning vertical models and upgrading platforms.

(Diagram by Photon Planet)

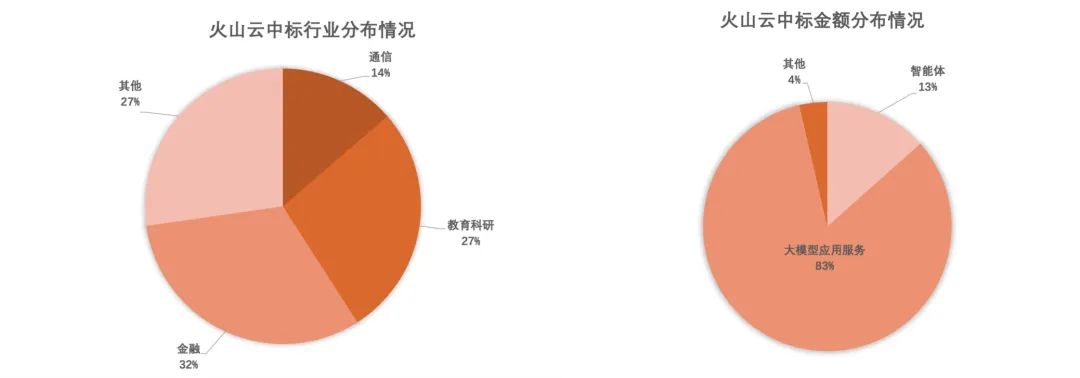

Huoshan Cloud won a total of 22 bids but with a total amount of only 61.59 million yuan. Huoshan Cloud basically won all orders in the agent segment due to the relatively low complexity and customization difficulty of agents, resulting in fluctuating unit prices based on R&D volume.

Among the five agent orders, the lowest was 480,000 yuan and the highest was 4.2 million yuan, with a relatively low unit price. Huoshan Cloud's winning bids reflect its marketing strategy, showing that it is accelerating its shift from the C-end to the B-end, taking on the role of connecting big models and To B business. Additionally, Doubao Model's audio and video capabilities have also attracted attention.

(Diagram by Photon Planet)

In most cases, the four cloud vendors compete on the same stage, resulting in similar bid-winning industries and amount distributions. At this stage, besides large computing power orders, it's hard to say which vendor has an overwhelming advantage. A common problem faced by everyone is the scarcity of resources, with a low unit price for big model and AI-related orders when computing power is excluded.

Excluding computing power, the average unit price for Baidu Cloud is approximately 7.42 million yuan, about 2 million yuan for Alibaba Cloud, about 7.5 million yuan for Tencent Cloud, and about 2.8 million yuan for Huoshan Cloud. Behind this may also involve profit distribution issues. According to the usual practice of large factories, one order is split into multiple parts and subcontracted to different companies.

AI Vendors Scrape By

In many winning bids, the procurement announcements state 'single procurement source,' with cloud vendors often emerging victorious in the bidding process. This means that from the outset, many AI vendors lose the qualification round.

This reflects the long-term resource monopoly of cloud vendors in this sector and the inherent characteristics of the cloud. To pursue security, continuity, and stability while reducing migration and development costs, many state-owned enterprises choose to continue using big model and AI product services on the cloud platform they are already using.

Whether To B or To G, the ultimate goal is to solve problems, with projects as the unit of tender. The demand is complex. B-end clients may require both hardware and cloud services, as well as big model inference training and agent application development services, demanding a customized solution integrating hardware and software.

For example, in an order for education digitization, the procurement list includes cloud expansion, customized big model invocation services, document tools, office software, and data analysis. For startups new to the industry, their products and services alone cannot meet the requirements of such orders, automatically excluding a portion of the market.

Opportunities for AI vendors to compete with cloud giants arise from their outstanding individual capabilities. For example, when a bid is divided into multiple components such as text-to-image, image-to-image, text-to-music, and text-to-video, the purchaser will compare the same functional effects between startups and large factories. Although Wisdom Spectrum does not perform well on comprehensive orders, it has still secured some orders for multimodal, big model training and tuning, pre-training of big models, and AI videos, despite being surrounded by large factories.

This implicitly steers AI vendors towards achieving 'completeness.' Currently, nearly all first-tier AI startups are engaged in mainstream areas such as large model training, inference, AI search, AI-generated images, and AI videos. As they become increasingly similar, the gap between them and large factories is narrowing. Large factories offer what startups do, but with more standardized and stable service outputs. This year, cloud giants have secured nearly half of the large model and AI market orders, with Wisdom Spectrum barely hanging on, while others have merely glimpsed opportunities, facing even greater challenges ahead.

The long delivery cycle and slow payment collection for To G projects alone are sufficient to exhaust a multitude of AI companies on the brink of survival. For large factories, large model orders are a bonus; for startups, they are a critical source of income, reflecting a stark difference in nature. Financially robust cloud giants can afford such engagements and even engage in price wars.

Cloud giants share some responsibility for the low unit prices of large model and AI-related orders. In competition with other bidders during the same period, they reduce prices to secure orders. During a bid for a 'localized intelligent assisted programming service project' this year, iFLYTEK quoted 980,000 yuan, Tonghuashun quoted 560,000 yuan, and Alibaba Cloud halved the price to secure the order at 350,000 yuan.

Startups face only two options in competition: withdraw or offer a lower price. In another procurement for AI programming research and development, Baidu Cloud offered 660,000 yuan, Tencent Cloud offered 330,000 yuan, and a software startup offered an even lower price of 280,000 yuan, ultimately securing the order.

Consequently, a vicious cycle has emerged in the large model To B market. The strong continue to grow stronger, while AI companies find their options dwindling.