HPE Q4 FY2024 Financial Report: Remarkable Achievements in AI and Hybrid Cloud Deployments

![]() 12/11 2024

12/11 2024

![]() 447

447

Produced by Zhineng Zhixin

HPE unveiled an impressive Q4 FY2024 financial report, showcasing substantial growth and innovation:

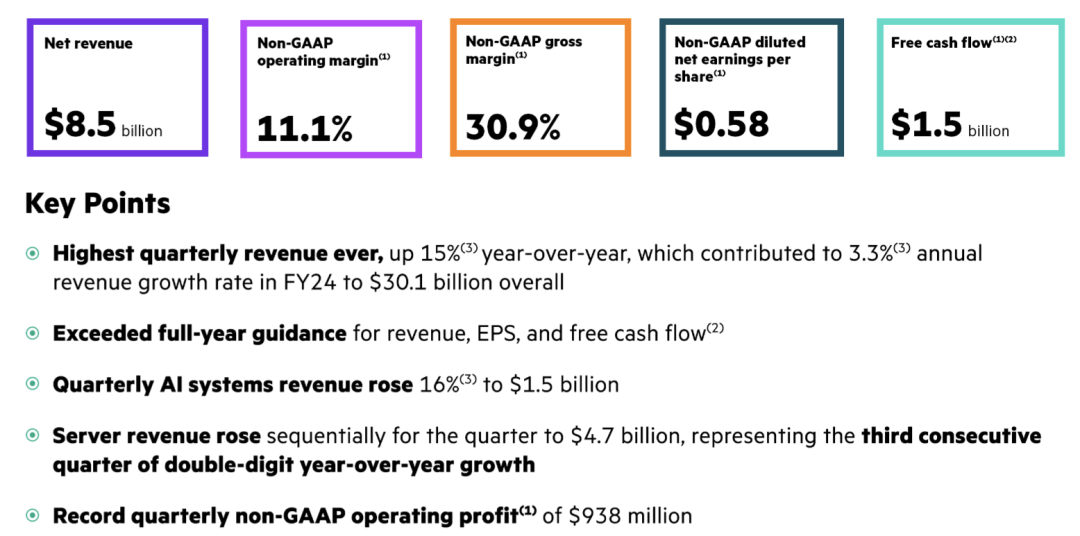

● Total revenue reached $8.46 billion, a 15.1% increase year-on-year;

● Operating revenue surged 36.7%;

● Full-year revenue amounted to $30.1 billion, marking a 3.3% increase.

Revenue from AI systems soared 4.1 times year-on-year to $1.5 billion, while the server division set a new quarterly revenue record, reflecting HPE's strategic success in AI, hybrid cloud, and networking.

Looking ahead, HPE plans to further enhance its AI systems, networking technologies (including the forthcoming completion of the Juniper Networks acquisition), and the GreenLake hybrid cloud platform, paving the way for continued growth.

Part 1

HPE Q4 Financial and Business Core Data Analysis

● HPE achieved remarkable success in Q4 FY2024:

◎ Quarterly revenue hit a record $8.46 billion, up 15.1% year-on-year, driving full-year FY2024 revenue to $30.1 billion, a 3.3% increase;

◎ Operating revenue rose to $693 million, a 36.7% increase;

◎ Net income benefited from a $733 million gain from selling equity in China's H3C partnership;

◎ Net income surged 2.7 times to $1.34 billion.

● HPE demonstrated robust financial performance in Q4 FY2024:

◎ Quarterly revenue: $8.46 billion, a 15.1% year-on-year increase.

◎ Full-year revenue: $30.1 billion, up 3.3%.

◎ Quarterly non-GAAP operating profit: $938 million, a new high.

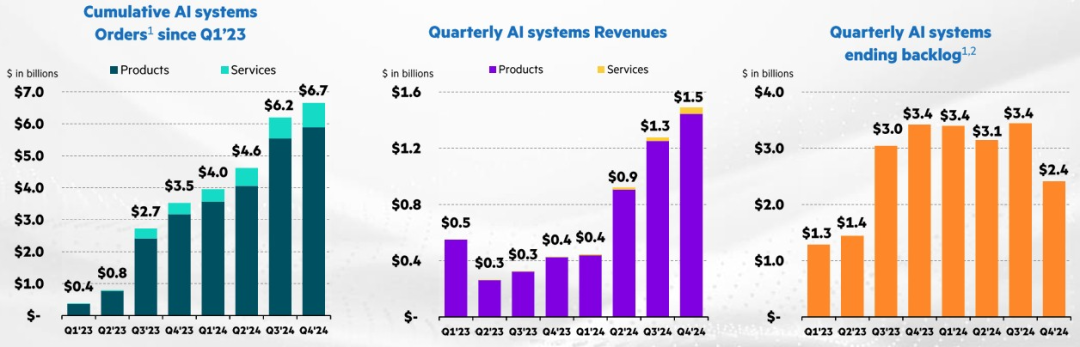

◎ AI system revenue: $1.5 billion in the quarter, a 4.1-fold year-on-year increase; new orders totaled $1.2 billion for the full year.

◎ Server division revenue: $4.71 billion, up 31.7% year-on-year, marking the third consecutive quarter of double-digit growth.

◎ Hybrid cloud division revenue: $1.58 billion, an 18% year-on-year increase.

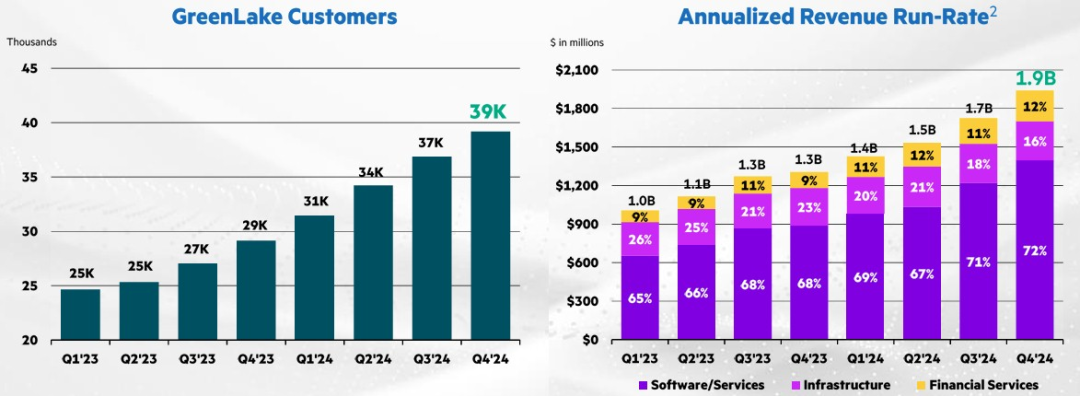

◎ New GreenLake platform customers: 2,000, bringing the total to 39,000.

● Revenue Analysis by Business Segment

◎ AI Systems: Quarterly AI system revenue grew 16% to $1.5 billion, with a backlog of $3.5 billion. Over the past eight quarters, AI system sales totaled $5.54 billion. Despite a slow start, the market is expanding from secondary clouds and large AI startups to governments and enterprises. Strong demand for high-performance accelerators like Nvidia Hopper H100 and AMD MI300X fueled explosive growth in AI system revenue.

◎ Servers: Sales hit a record high, with revenue growing 31.7% to $4.71 billion, a 10% increase quarter-on-quarter.

Traditional server sales were $3.2 billion, with about two-thirds coming from ProLiant Gen11 devices, which saw double-digit order growth. AI system revenue drove server business growth, leading to three consecutive quarters of double-digit expansion.

◎ Hybrid Cloud: Sales reached $1.58 billion, up 18%, with operating revenue of $122 million, a 2.4-fold increase year-on-year.

3,000 Alletra MP storage arrays were sold, and 2,000 new customers joined the GreenLake business, bringing the total to 39,000. HPE GreenLake platform ARR (Annual Recurring Revenue) grew 48% year-on-year.

◎ Intelligent Edge (Networking-related): The demand environment is improving, and the upcoming acquisition of Juniper Networks will provide comprehensive networking solutions, enhancing competitiveness in the networking field.

HPE Aruba Networking introduced several new features, such as AI-driven network optimization and device monitoring. HPE plans to complete the $14 billion acquisition of Juniper Networks, further consolidating its market position in modern networking solutions.

Part 2

HPE Business Details and Future Outlook

● AI Development Details and Outlook

HPE continues to innovate its AI products, launching the HPE Private Cloud AI solution and expanding its partnership with Deloitte to help enterprises deploy tailored AI solutions. Its 100% fanless direct liquid cooling system architecture empowers customers to leverage next-generation GPUs and CPUs, enhancing peak performance.

While the AI systems business has yielded results, with past customers mainly in hyperscale enterprises and cloud builders, future expansion into government and enterprise markets is anticipated, especially as enterprises adopt GenAI, potentially generating more profits through numerous small transactions.

However, caution is advised when assessing customer risks during this expansion, as evidenced by the abandoned $700 million AI deal, which, while not immediately impacting the business, underscores the importance of customer credit risk assessment.

● The AI Systems Business is a Key Growth Engine for HPE:

◎ Market Demand Changes: Although HPE abandoned a high-risk $700 million AI deal, its $1.2 billion in new orders compensated for the loss, showcasing robust AI market demand.

◎ Product Innovation: HPE's 100% fanless direct liquid cooling architecture achieves breakthroughs in energy efficiency and performance management, providing an ideal solution for AI and high-performance computing.

◎ Customer Expansion: Currently, HPE's AI system customers are primarily hyperscale enterprises and startups, with future growth expected in the enterprise and government sectors, enhancing profitability through small, high-frequency transactions.

● Growth Momentum in Hybrid Cloud and GreenLake: HPE VM Essentials helps customers reduce virtualization costs by up to 5 times, driving significant user growth for the GreenLake platform.

The GreenLake platform's utility pricing model is favored by customers, and the growth in ARR further solidifies its position in the hybrid cloud market. As demand for private clouds rises, HPE's technological leadership in the hybrid cloud market will be further amplified.

● Strategic Advancement in Networking: HPE Aruba Networking's AI-driven capabilities have been significantly enhanced, with new features providing customers with more efficient and secure network management tools. Juniper Networks' technology will complement Aruba Networking, enabling HPE to offer a comprehensive suite of modern networking solutions tailored to diverse needs, from enterprises to government agencies.

● Strategic Challenges and Opportunities: HPE's decision to abandon high-risk AI deals demonstrates its prudent financial management. With diversifying market demands, HPE is poised for growth opportunities in more vertical fields. As the supply of high-end chips from Nvidia and AMD gradually improves, direct competition among OEM manufacturers will intensify, necessitating HPE to strengthen product differentiation and customer service capabilities.

HPE demonstrated strong growth momentum in Q4 FY2024, particularly in AI systems, hybrid cloud, and networking. Through continuous innovation and precise market positioning, HPE has successfully seized market opportunities while mitigating potential risks from high-risk transactions. HPE is expected to further enhance its market competitiveness through the following measures:

● Strengthen the AI Systems Business: Further consolidate leadership in AI systems by accelerating product innovation and expanding the customer base.

● Promote Hybrid Cloud Services: Capture a larger share of the enterprise cloud transformation market through continuous optimization and expansion of the GreenLake platform.

● Deepen Network Integration: Provide comprehensive networking solutions to meet diverse needs post-Juniper Networks acquisition.

Conclusion

Since splitting from HP, HPE has pursued a clear and executable growth strategy, laying a solid foundation for sustained growth through dual efforts in technology and market development.

Zhineng Zhixin will continue to monitor developments in the AI cloud services sector, which is closely linked to AI chips.