Can Lenovo, a Hardware Giant, Successfully Navigate the Smart Agent Landscape?

![]() 12/12 2024

12/12 2024

![]() 672

672

"You don't just want to be the best in your field, but to find the one thing only you can do." This quote, attributed to Keith Rebois, a member of the 'Paypal Mafia' and a long-time colleague of Elon Musk, resonates profoundly in today's AI-driven era, where adaptation to future changes is paramount.

On November 28, Lenovo unveiled its Lenovo BAIYING smart agent, aimed at providing AI software support to SMEs. Concurrently, Dai Wei, Senior Vice President of Lenovo and General Manager of Lenovo China's Solution Service Business Group, announced plans to launch a smart agent 'marketplace' in the near future.

Why has Lenovo, traditionally known as a hardware manufacturer, suddenly ventured into AI software services?

Product-wise, BAIYING integrates AI applications (such as summarization and PPT creation) with AI enterprise services. Its overall capabilities are comparable to those of market-leading large models. What sets it apart for SMEs is Lenovo's offer of on-site IT operation and maintenance services at half the market price.

This product and pricing model suggest Lenovo's strategy of 'trading services for AI adoption'.

Faced with the apparent ceiling of hardware growth, Lenovo established the SSG (Solution Service Group) business in 2021, aiming to enter the enterprise service sector leveraging its IT and hardware expertise. However, the fragmentation of enterprise service scenarios and the high cost of customer acquisition have hindered Lenovo's scaling efforts.

Now, as AI agents accelerate AI application adoption in enterprises, Lenovo, after three years of anticipation, finally sees the dawn of software profitability.

Through BAIYING, Lenovo has devised a business model where SMEs can initially adopt AI, gradually increasing software fees as the smart agent evolves. This vision envisions software services not only consolidating and expanding the existing hardware base but also enabling Lenovo to tap into the lucrative enterprise service software market it has long coveted.

IBM has successfully transformed itself, capturing a significant share of the enterprise service market, with software revenue accounting for 43.59% of its total revenue. Huawei, meanwhile, has ventured from communication hardware to cloud and computing, carving out a growth trajectory that surpasses its predecessors.

So, will the path of AI + hardware + enterprise services be tailor-made for Lenovo?

Why is Lenovo creating a smart agent?

Lenovo's decision to launch a smart agent for enterprises is closely tied to its overall group strategy. In fact, the SSG business, where the smart agent resides, is currently Lenovo's most promising growth sector.

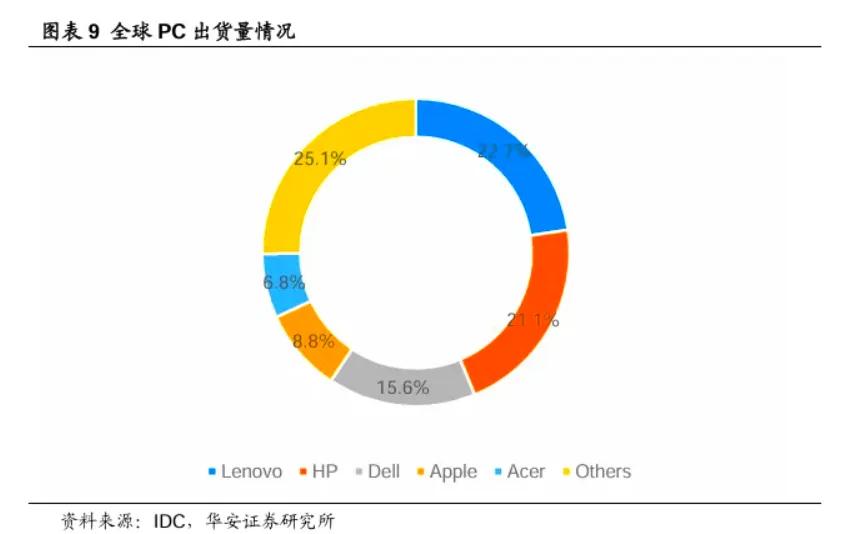

Lenovo's business is structured into three segments: IDG (Intelligent Devices Group, primarily PCs), ISG (Infrastructure Solutions Group, primarily servers), and SSG (Solution Service Group). While the structure is straightforward, the growth potential for IDG and ISG is visible.

On the IDG front, Lenovo's PC shipments have ranked globally for the past five years, forming an oligopoly with HP and Dell (combined share close to 60%). This situation ties IDG's growth closely to the overall market environment. In an era where PCs are ubiquitous, growth potential is largely determined by industry cycles.

On the ISG side, despite a 65% year-on-year growth in a single quarter for AI-upgraded servers, according to Lenovo's FY2024/2025 second fiscal quarter report (ending September 30), most shipments are custom-produced for cloud vendors under Lenovo's 'ODM+' strategy, rather than independent AI server sales. Given that ISG is still loss-making, future focus will likely shift to cost reduction and efficiency enhancement.

To circumvent hardware growth barriers, Lenovo has chosen to focus on the SME market through BAIYING.

In China's enterprise service sector, large projects are saturated, often operating at a loss. SMEs represent a broader, more decentralized long-tail market. Consequently, many enterprise service providers have pinned their growth hopes on SMEs in recent years.

In the era of large models, Dai Wei believes that "smart agents are the best entry point for SMEs to fully embrace AI." Thus, Lenovo BAIYING is a strategy to 'enter the enterprise service market through AI'.

In terms of AI functionality, Lenovo BAIYING is not particularly unique. Its main functions are mature AI application integrations, including AI marketing (smart customer service, smart recommendations) and AI office features (PPT creation, reading summaries).

The real value lies in Lenovo bundling IT operation and maintenance services into BAIYING's subscription. Compared to the annual cost of 6,000 yuan for temporary IT problem-solving, Lenovo offers 12 on-site visits per year for SMEs at 3,588 yuan (with unlimited online consultations).

"SMEs urgently need to break through in one area first and feel the impact of AI on productivity and efficiency," said Wei Dong, General Manager of Lenovo BAIYING, Lenovo China's SME Solution Service Business Group.

By addressing enterprise IT operation and maintenance needs, Lenovo aims to tap into the SME smart transformation market through AI.

After making an initial foray with a single point, Dai Wei announced that "within the next two to three months, Lenovo BAIYING will launch a 'marketplace' for smart agents."

This marketplace aims to create a platform (BaiChuang Platform) encompassing almost all large models and smart agents, allowing customers to create exclusive smart agents tailored to their specific business data. This is akin to platforms like Baidu Qianfan and ByteDance's Kouzi.

Through BAIYING, it's evident that Lenovo will focus on enterprise services as its next major development goal. It will first 'tempt' SMEs with cost-effective IT operation and maintenance services, then generate revenue from AI platforms and functional services. This will effectively open up a software revenue stream for Lenovo, building on its established hardware shipment advantage.

"In the era of smart agents, devices may not be the most shining aspect; instead, smart agents should be the soul, the soul of all devices and solutions," said Wang Chuandong, Vice President of Lenovo Group and Chief Marketing Officer of Lenovo China.

Relying on smart agent penetration, Lenovo hopes to shed its label as a pure hardware manufacturer. To achieve this, Lenovo has waited three full years.

In the AI era, both Lenovo and enterprise services have evolved

In April 2021, Lenovo announced the establishment of the SSG business alongside existing IDG and ISG operations.

That same month, at its annual motivation conference, Lenovo launched the Qiantian IT engine, focusing on enterprise mid-tier IT architecture transformation. In September, Yang Yuanqing, Chairman and CEO of Lenovo Group, announced the integration of the IT organization into SSG and the launch of the new 'TruScale' brand, providing technical support for multiple operation and maintenance modules, including IT operations, marketing management, and sales management.

The SSG business model is not new. Before Lenovo, many large companies had already restructured around the concept of IT integration.

For instance, in 2018, Tencent established CSIG (Cloud and Smart Industries Group) to integrate ToB products scattered across various BGs (Business Groups). In the same year, to enhance cloud business competitiveness for general enterprises, Huawei reorganized its public cloud, private cloud, AI, big data, computing, storage, IoT, and other IT industries into the 'Computing and Cloud' group. In 2020, Alibaba launched the 'Cloud and DingTalk Integration' strategy, hoping that its scaled Alibaba Cloud could 'lead' the then-unprofitable DingTalk through integration.

Looking back, not all tech giant integrations have been successful.

In 2023, after failing to generate long-term synergies, Alibaba finally untied DingTalk from Alibaba Cloud.

Huawei also split its Cloud and Computing BU into two major departments. In May 2021, Yu Chengdong was removed from his position as CEO of Huawei Cloud after only one month.

"The establishment of the Cloud and Computing BG was supposed to achieve synergy, but there was always conflict, and in the end, they had to separate," said Xu Zhijun, then-rotating Chairman of Huawei, discussing the repeated adjustments to the cloud computing organization.

The core issue with past unsuccessful IT resource integration efforts was that B-end customer problems were too diverse compared to the unchanging supply of IT resources (hardware, cloud).

The same applies to Lenovo. Even though Dai Wei emphasized the need for synergy and deep sector cultivation, stating that "it's impossible to do everything; we have to see if it can form a 'line,' and then we expand that 'line' into a track," in reality, the most frequently cited SSG projects after TruScale's launch were not its strongest suit in enterprise IT operation and maintenance. Instead, they involved marking apples in orchards with IoT devices and helping urban traffic management identify empty parking spaces.

Being bogged down in specific scenarios has long made the enterprise service business a 'lowland' in Lenovo's business model.

According to first principles, the fundamental design philosophy of enterprise services (especially SaaS subscription models) lies in 'continuous growth.' The ideal model envisions a company achieving a certain ARR (Annual Recurring Revenue), requiring only a CSM (Customer Success Manager) to maintain the ARR unchanged in the second year. As development progresses, revenue gradually increases, and the company's annual CAC (Customer Acquisition Cost) is gradually amortized, resulting in astonishing profit margins.

However, enterprise service providers are caught between large customers' privatized deployment needs and small and medium customers' customized development demands. To secure these 'one-off' projects, providers form dedicated teams for each, often emphasizing scale and industry familiarity while neglecting to mention business losses and CAC.

"We explored SME solutions and service businesses very early on, but it was difficult at that time, and we eventually had to pause," summarized Dai Wei. During the three years of implementing SSG, Lenovo also found that addressing the fragmented scenario needs of a large number of SMEs offered no significant scale.

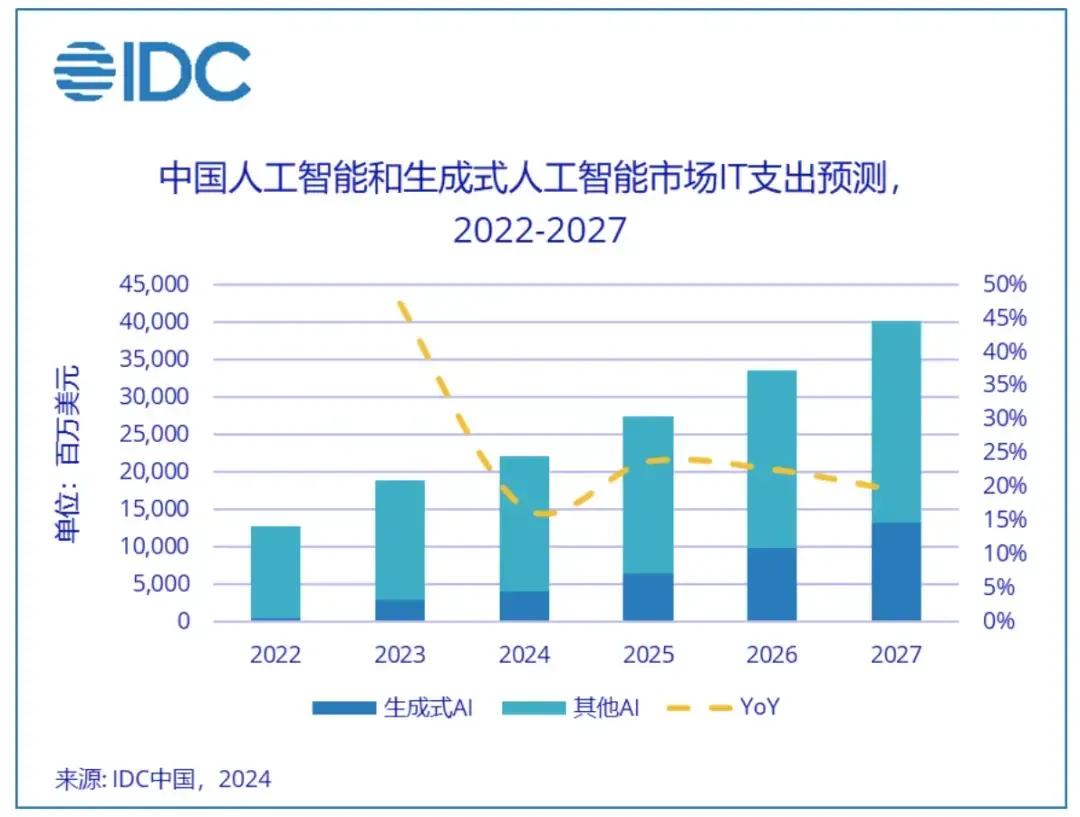

So why did Lenovo specifically launch BAIYING for SMEs? Dai Wei believes it's due to the transformation brought by AI, "Large models and smart agents have brought us hope."

Image: China's AI Market IT Spending Forecast, Source: IDC

Taking overseas star companies as reference, Bret Taylor, Chairman of the OpenAI Board, founded a company focused on Agent customer service, with a latest valuation of $4.5 billion. Capital values it highly because customers can 'self-serve,' utilizing large models' multi-turn dialogue capabilities to generate desired interaction effects. For fast fashion brands, customer service can adopt a casual tone, while luxury brands can use a London accent.

On the other hand, Palantir, founded by Peter Thiel, a former partner of Elon Musk, with customers primarily being the US government and enterprises, launched an AI application management platform in 2023, making a full transition to AI. Its net sales profit margin increased from a negative figure in the 2022 annual report to 19.18% in the 2024 third-quarter report. Compared to international SaaS giants like Salesforce (focusing on CRM) and ServiceNow (focusing on IT operation and maintenance), the latest quarterly report sales net profit margins are only 16.09% and 12.97%, respectively.

These changes prove that agents can quickly adapt to SME needs while significantly reducing cost pressures on enterprise service providers. This allows providers to truly move towards a business model of 'continuous profit growth,' achieving a healthy 'Rule of 40' (an industry investment metric where a good company should have a combined growth rate and profit margin exceeding 40%), escaping low personnel efficiency and achieving profit margin growth.

Seeing how AI disrupts the enterprise service business model, Lenovo designed the product logic of BAIYING. While Lenovo cannot currently win in enterprise services solely based on AI capabilities, it hopes to increase software value and amortize business costs through subsequent AI iterations.

"Lenovo BaiChuang smart agent is based on the logic of service. Customers use it first and provide continuous feedback during use, while Lenovo continuously iterates and refines it. In this process, it's equivalent to Lenovo and customers 'co-creating' together," said Dai Wei.

The BAIYING business strategy not only signifies a full AI transformation for the SSG business but also aims for synergy across other Lenovo businesses by grasping the AI main thread.

Can the hardware business be revitalized due to AI?

At Lenovo's Innovation Technology Conference this April, the company announced its 'Full-Stack AI' strategy.

In response to the transformations within IDG, ISG, and SSG businesses, Liu Jun, Executive Vice President of Lenovo Group and President of Lenovo China, provided detailed insights at the 2024 Shanghai Mobile World Congress (MWC). Essentially, each business unit is now anchored around the concept of 'general AI'.

On the SSG front, Lenovo aims to deploy an enterprise-grade large model and smart agent to support government and enterprise clients, small and medium-sized enterprises (SMEs), and consumers.

Turning to IDG and ISG, the shifts involve Lenovo's plan to integrate the Tianxi smart agent system (AI smart agent) across all its intelligent terminals, and leverage the 'Wanquan Heterogeneous Intelligent Computing Platform' to holistically manage servers, storage, data networks, software, hyper-converged infrastructure, and edge computing.

After nearly a year of restructuring, Lenovo's hardware business has largely attained native AI support capabilities. While it's true that, as an established hardware manufacturer, Lenovo's AI prowess doesn't quite match that of niche market leaders, in terms of functionality, the gap between Lenovo and its competitors is not substantial.

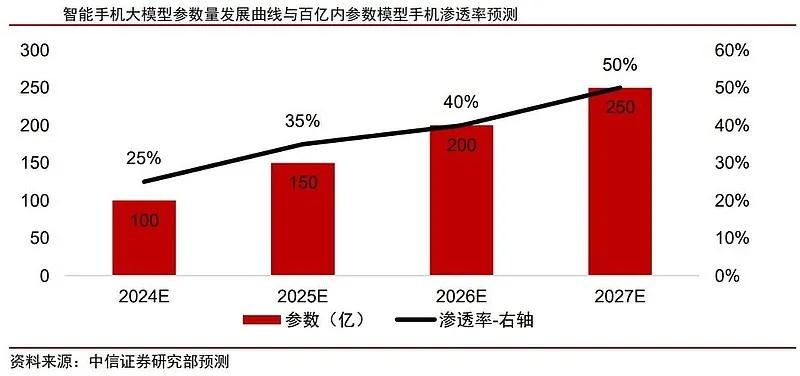

In the realm of intelligent terminals, Lenovo's AIPC has transcended the 'AI Ready' phase, moving beyond mere chip support to embedding AI applications (Xiaotian) into PC systems. Lenovo has now implemented a large end-side model on its tablet (YOGA Pad), with its signature 'Circle Search' feature, albeit currently limited to text recognition. Compared to the multi-modal recognition capabilities of end-side large models in the mobile phone industry, Lenovo's end-side large model (comprising 7 billion parameters) roughly aligns with AI phones from early 2024. Given the adoption rate of end-side large models in smartphones, Lenovo's implementation pace is commendable.

---

---

---

---

---

---

---

---