ASIC to Outperform GPU? Broadcom Anticipates Brighter Days Ahead

![]() 12/13 2024

12/13 2024

![]() 559

559

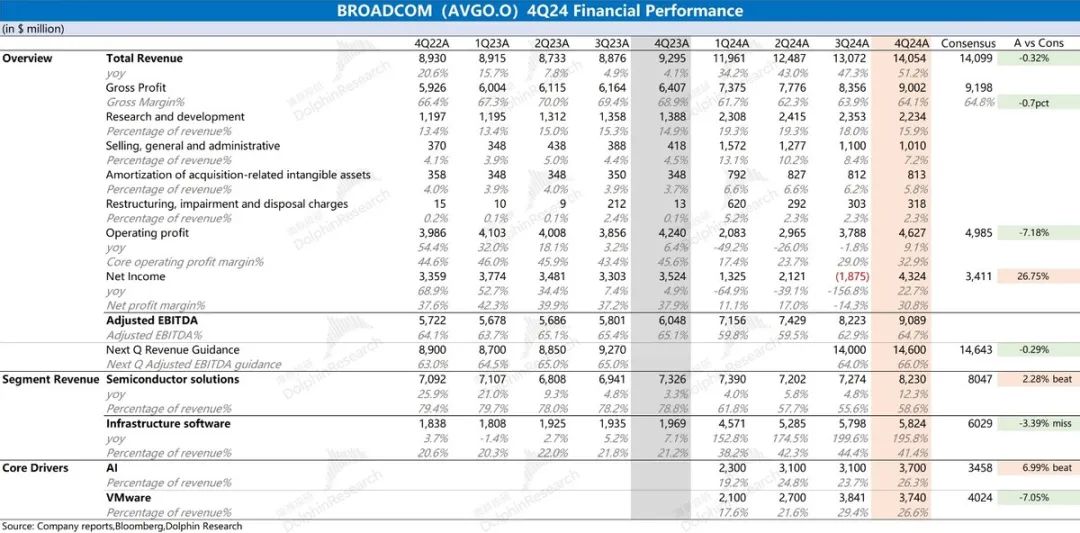

Broadcom (AVGO.O) released its fiscal Q4 2024 financial report after the US market closed on December 13, Beijing time:

1. Overall Performance: Record-breaking results with continued improvement in pre-amortization and depreciation profit margins. Broadcom (AVGO.O) achieved revenue of $14.05 billion in FY2024 Q4, representing a year-over-year increase of 51.2%, in line with market expectations ($14.1 billion). Quarterly revenue growth was primarily fueled by robust AI growth and the integration of VMware.

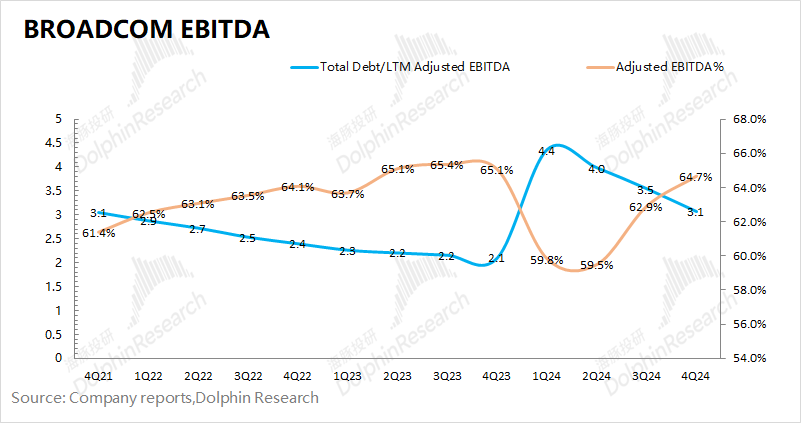

Broadcom recorded a net profit of $4.324 billion in FY2024 Q4, marking a significant increase. Profit growth was mainly driven by revenue expansion and a decrease in expense ratios, with business integration accelerating the realization of final profits. With the increase in EBITDA% (Earnings Before Interest, Taxes, Depreciation, and Amortization), Broadcom's total debt relative to Adjusted EBITDA over the past 12 months (a profit metric roughly equivalent to "cash" profits, reflecting real profitability unaffected by mergers, acquisitions, and debt interest payments) fell to 3.1 this quarter, and solvency continued to improve.

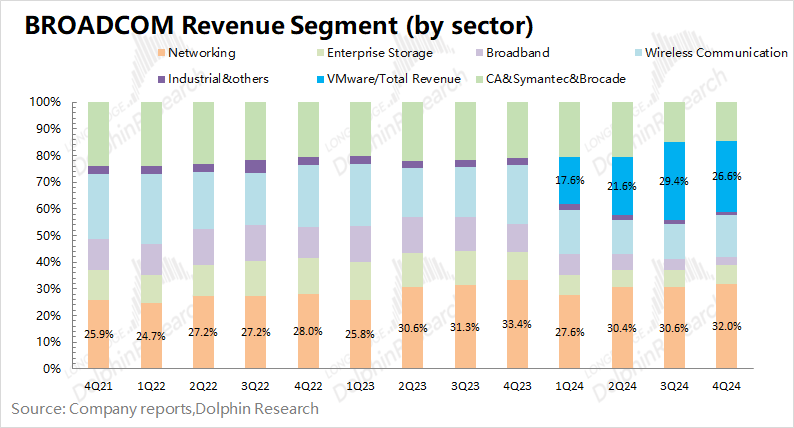

2. Business Segments: Dual drivers of AI and VMware. From the company's business segments, driven by the growth of the AI business and the integration of VMware, the company's network business and VMware business revenue accounted for 32% and 27%, respectively.

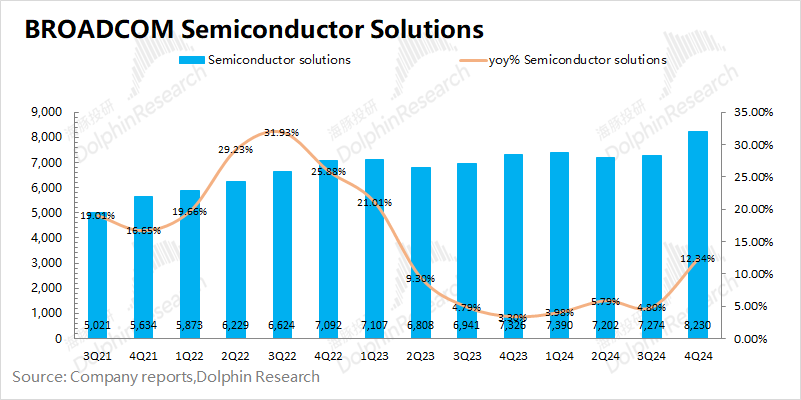

2.1 Semiconductor Solutions Business: Revenue for this quarter was $8.23 billion, a year-over-year increase of 12.3%, surpassing market expectations ($8.05 billion).

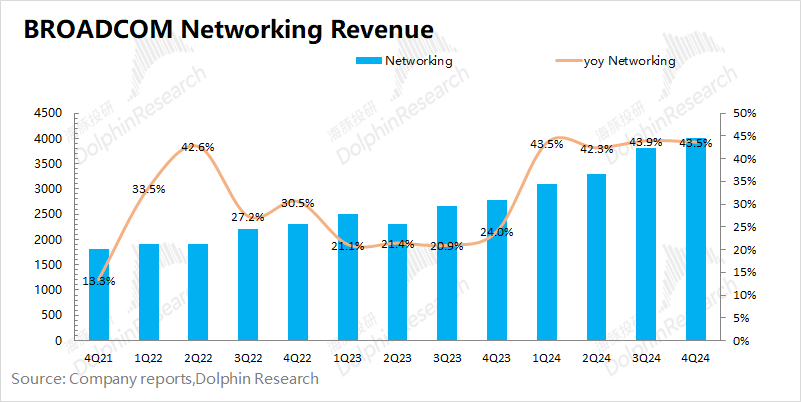

1) Network Business: The company's network business growth rate remained above 40% this quarter, primarily driven by the AI business. AI business revenue for this quarter reached $3.7 billion, a year-over-year increase of 150%, primarily driven by shipments to customers such as Google.

2) Other Semiconductor Businesses: Apart from the AI business, the company's other semiconductor businesses remained sluggish, experiencing another double-digit decline this quarter. From a structural perspective, storage and wireless businesses showed some recovery, while broadband and industrial and other businesses still exhibited significant declines.

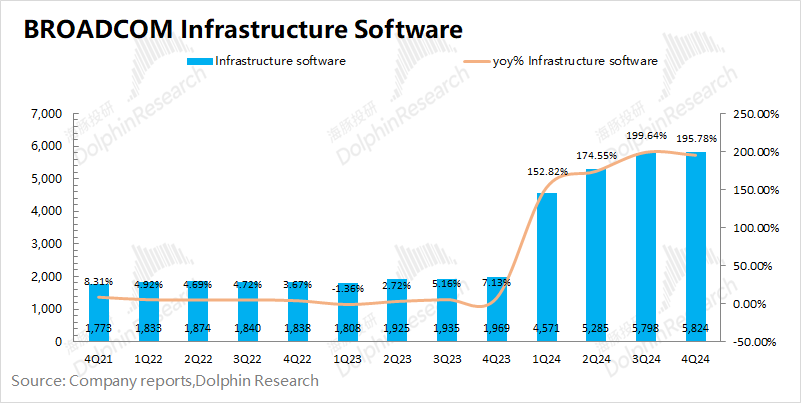

2.2 Infrastructure Software: Revenue for this quarter was $5.82 billion, a year-over-year increase of 196%, slightly below market expectations ($6.03 billion). Growth was primarily driven by VMware, while the original software business did not show significant growth.

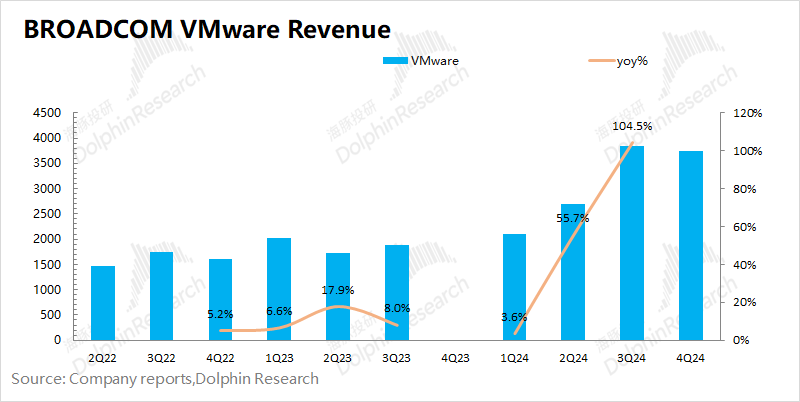

1) VMware Business: The company's VMware revenue for this quarter was $3.7-3.8 billion, a substantial year-over-year increase, primarily due to changes in pricing methods. However, there was no quarter-on-quarter growth, mainly due to the postponement of some revenue to the first quarter. With the increasing proportion of subscription SaaS customers, VMware is expected to continue growing.

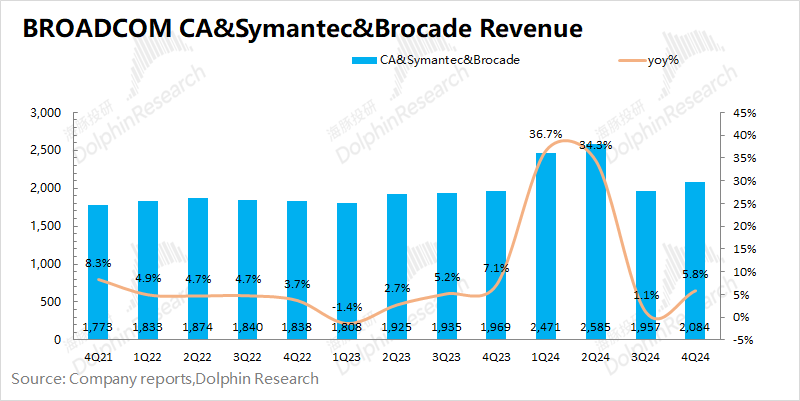

2) Other Software Businesses: Apart from VMware, the company's original software business remained stable at around $2 billion, maintaining steady single-digit growth.

3. Broadcom Performance Guidance: Expected revenue for FY2025 Q1 is approximately $14.6 billion, in line with market expectations ($14.64 billion). The company anticipates the adjusted EBITDA margin for FY2025 Q1 to continue rising to 66%. Growth in AI and accelerated VMware integration will further boost the company's performance.

Dolphin's Overall View: The company's financial report is robust, but management's confidence is even more impactful.

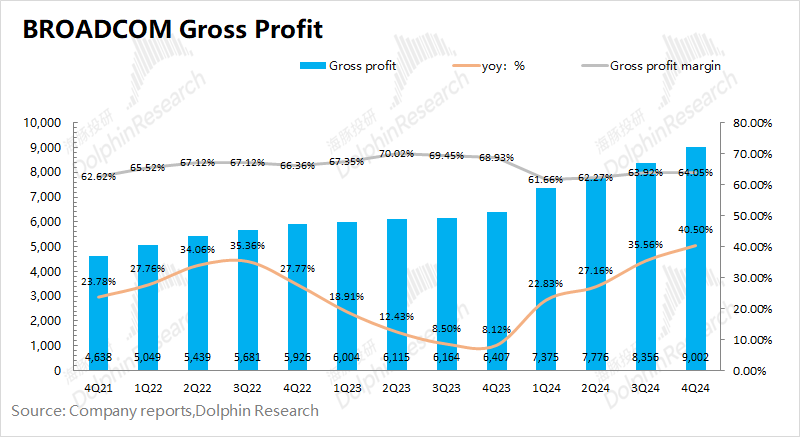

Broadcom's financial report for this quarter was impressive. Driven by AI revenue and VMware integration, the company's revenue and gross margin continued to increase. The gross margin increase slowed slightly, primarily due to the higher proportion of semiconductor business revenue with a lower gross margin segment this quarter.

In terms of operating expenses, the company continued to control costs. The company's R&D expense ratio and selling, general, and administrative expense ratio for this quarter decreased to 15.9% and 7.2%, respectively. The company's management also mentioned in previous communications that the current focus is on integrating R&D and related departments during VMware integration, reducing operating expenses, and thereby improving the company's operational efficiency. Through operational integration, the company's core profit continued to rebound this quarter, with the adjusted EBITDA% returning to 64.7%.

In terms of business, the market is most concerned about the company's AI business, VMware business, and wireless business: 1) The company's AI business achieved $3.7 billion this quarter, surpassing the company's previous guidance of $3.5 billion. The company's AI XPU shipments to hyperscale customers doubled, and AI connectivity revenue grew rapidly; 2) VMware revenue was $3.74 billion this quarter, with a slight quarter-on-quarter decline, primarily due to the postponement of some revenue to the first quarter; 3) Regarding rumors of Apple's in-house development, the company will continue to cooperate with customers on multiple technologies.

Looking solely at business conditions and the company's next quarter guidance, it can be seen that the company's AI progress is slightly better than expected, but overall, it represents a solid performance. However, the company's share price surged from a small increase after the financial report to a double-digit increase, primarily due to the confidence conveyed by management during the exchange meeting.

Dolphin believes the highlights behind this financial report are:

1) EBITDA%: The company's current business integration is progressing smoothly, with gross margin recovering and expense ratios declining, driving the company's adjusted EBITDA% back to 64.7%, with an expected increase to 66% in the next quarter. With the recovery in performance, the company's core solvency ratio (Total Debt/LTM Adjusted EBITDA) has fallen to 3.1 this quarter. Considering the company's history, at this pace, the company is expected to reduce the ratio to around 2 in the following year, making it possible to consider new acquisition targets again.

2) Outlook for the AI Business: Although the company's expectations for AI revenue in the next quarter are not high, at around $3.8 billion, Dolphin believes this is primarily due to the phased transition of the company's customers from TPU V6e to V6p. After V6p goes into mass production, it will further sustain the company's AI growth.

In addition, the company expects that by FY2027, the addressable market size for its hyperscale customers' XPU and network business will reach $60-90 billion. Combined with the company's belief that the addressable market size in FY2024 is $15-20 billion, the compound annual growth rate will exceed 50%, injecting a "booster shot" of confidence into the market once again.

Overall, Broadcom's current business growth primarily stems from the AI business and VMware. As VMware customers gradually shift from licensing to subscription SaaS fees, the corresponding growth rate will slow down. With high growth expectations for the AI business, it will become the main driver of the company's growth. Although it is challenging for cloud vendors to maintain a compound annual growth rate of capital expenditures above 50% in the next three years, Broadcom can achieve excess growth through market share gains and product category expansion. **** (For some valuation content, you can enter the Longbridge App and go to "Dynamics - Investment Research" to view the article with the same name and read the full content.)

Here is a detailed analysis:

I. Overall Performance: Record-breaking results with continued improvement in EBITDA%

1.1 Revenue Side

Broadcom (AVGO.O) achieved revenue of $14.05 billion in FY2024 Q4, a year-over-year increase of 51.2%, in line with market expectations ($14.1 billion). The company's growth this quarter was primarily driven by the increase in AI revenue and the integration of VMware. The integration of VMware contributed approximately $4 billion in additional revenue to the company this quarter. Additionally, AI revenue also doubled year-over-year this quarter.

1.2 Gross Margin Side

Broadcom (AVGO.O) achieved gross profit of $9.002 billion in FY2024 Q4, an increase of 40.5% year-over-year. The company's gross margin for this quarter was 64.05%, a year-over-year decline but a slight quarter-over-quarter rebound. This was primarily because after acquiring and integrating VMware, the company included some acquisition costs in the cost of sales. The recent rebound in gross margin was mainly due to the integration of VMware, which led to an increase in software and overall gross margin. In the medium to long term, the addition of software business will drive the overall increase in the company's gross margin.

1.3 Operating Expenses

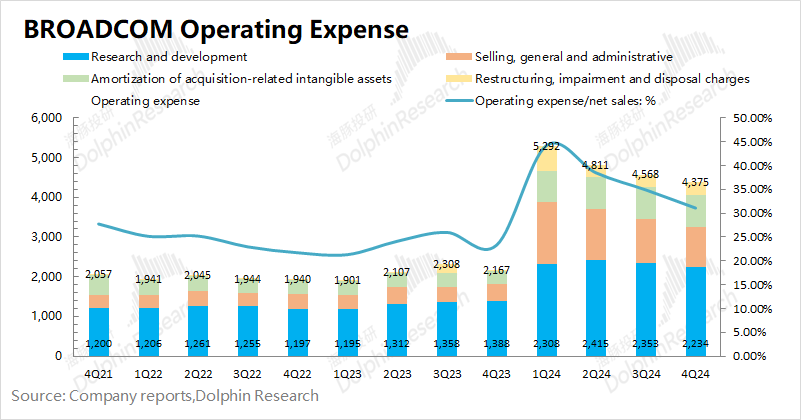

Broadcom (AVGO.O)'s operating expenses in FY2024 Q4 were $4.568 billion, showing a significant year-over-year increase due to the acquisition of VMware. Under the company's continuous cost control measures, operating expenses continued to decline quarter-over-quarter.

Specifically, in terms of expenses:

1) R&D Expenses: The company's R&D expenses for this quarter were $2.234 billion, a year-over-year increase of 61%, primarily due to the impact of VMware integration. With the company's internal integration, the company's R&D expenses have continued to decline quarter-over-quarter. The R&D expense ratio has currently fallen to 15.9%, approaching the previous range of 13-14%.

2) Selling, General, and Administrative Expenses: The company's selling, general, and administrative expenses for this quarter were $1.01 billion, a year-over-year increase of 142%. The rapid growth in selling expenses was also primarily affected by the acquisition and integration. With the advancement of VMware integration, the company's current selling, general, and administrative expense ratio has fallen to 7.19%, continuing to approach the previous range of 4-5%.

3) Acquisition and Related Other Expenses: The company's amortization expenses for intangible assets for this quarter were $813 million, and reorganization, impairment, and disposal expenses were $318 million. Both expenses were related to acquisitions and remained largely unchanged quarter-over-quarter.

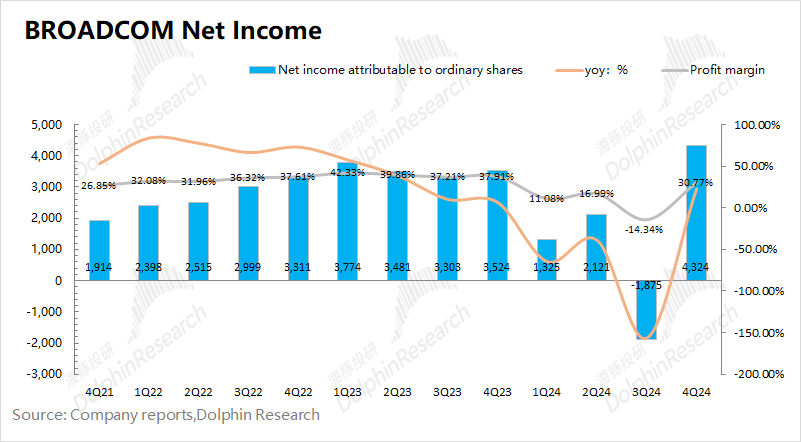

1.4 Net Profit

Broadcom (AVGO.O) achieved a net profit of $4.324 billion in FY2024 Q4, continuing to rebound. The company's loss in the previous quarter was primarily due to a one-time non-cash tax provision of $4.5 billion resulting from the transfer of certain intellectual property rights to the US within the group due to supply chain reorganization.

Excluding related impacts, the company's operating profit still showed significant growth, primarily due to the impact of revenue growth and decreasing expense ratios. Driven by AI growth and VMware integration, the company's quarterly revenue reached a record high. With enhanced integration and internal control, the company's operating expense ratio declined significantly.

From Dolphin's perspective of core operating profit (= gross profit - R&D expenses - selling, general, and administrative expenses), Broadcom achieved a core operating profit of $7.4 billion this quarter, a year-over-year increase of 47%.

1.5 Broadcom's EBITDA

As Broadcom excels in external mergers and acquisitions, the company usually uses adjusted EBITDA% as one of its operating indicators. Dolphin's calculations show that Broadcom's adjusted EBITDA% rebounded to 64.7% in FY2024 Q4, basically returning to the pre-acquisition range.

Further observing the company's solvency, the company's current total debt/LTM Adjusted EBITDA ratio continued to fall to 3.1. With the growth in performance, the company's ratio is expected to fall below 3 in the next fiscal year and return to pre-acquisition levels the year after that, after which it may start looking for new merger and acquisition opportunities again.

II. Business Segments: Dual drivers of AI and VMware

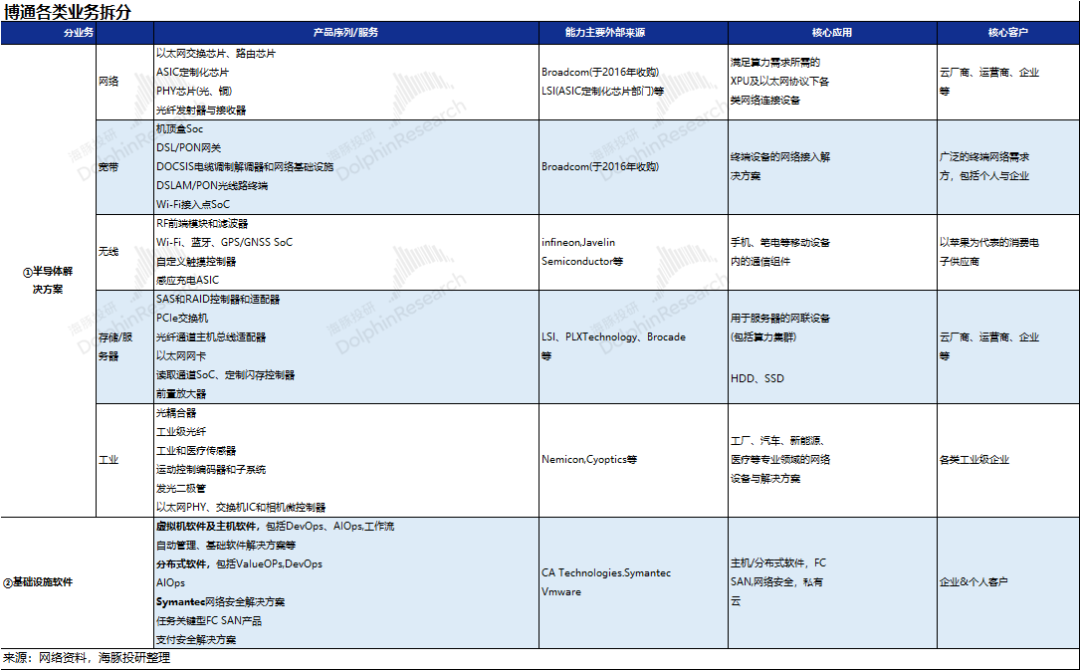

Broadcom's (AVGO.O) main businesses include semiconductor solutions and infrastructure software. With the completion of the acquisition and integration of VMware, the company's infrastructure software business's proportion has significantly increased, with software business revenue now accounting for 40%.

The two main business categories specifically include: 1) Semiconductor Solutions: Networks, wireless, storage connectivity, broadband, industrial, and others; 2) Infrastructure Software: VMware, CA, Symantec, Brocade, etc.

From the company's revenue structure, it can be seen that the network business in the semiconductor business and VMware in the software business account for the highest proportion of revenue, at 32% and 27%, respectively. These two businesses are also the most concerned parts of the market at present.

2.1 Semiconductor Solutions

Broadcom (AVGO.O) achieved revenue of $8.23 billion from its semiconductor solutions business in FY2024 Q4, a year-over-year increase of 12.34%. The growth of the company's semiconductor business this quarter was primarily driven by the AI business, while non-AI businesses still showed a double-digit decline year-over-year.

1) Networking Business

As the company's AI revenue is within the networking business, driven by AI, the networking business also achieved over 40% growth this quarter. Excluding the impact of AI, the company's non-AI networking business still saw a double-digit decline.

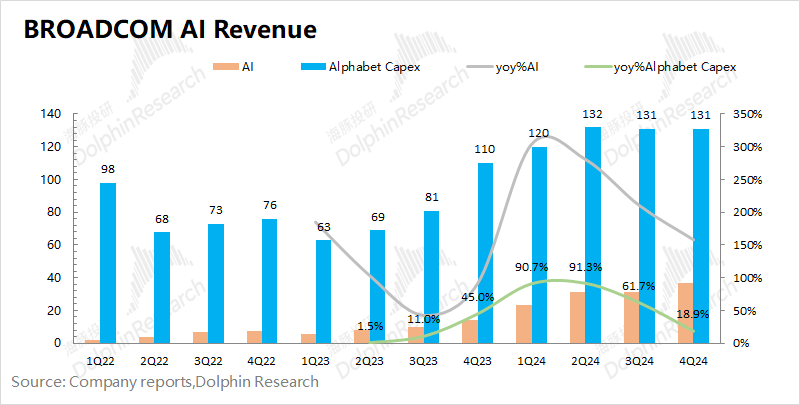

Market attention is keenly focused on the company's AI business, encompassing revenues derived from AI ASIC chips and associated networking components. In the current quarter, the AI business generated $3.7 billion in revenue, marking a year-on-year growth rate exceeding 150%, surpassing the company's initial projection of $3.5 billion. This robust growth has elevated AI's share of total revenue to 26.3%.

From both the company's and the industry's perspective, it is evident that approximately 60-70% of AI revenues stem from ASIC shipments. Currently, Google and Meta are the company's key ASIC customers, with Google accounting for the lion's share. Consequently, the company's AI revenues exhibit a strong correlation with Google's capital expenditures.

Dolphin's analysis of these two metrics clearly illustrates that when Google significantly boosts its capital expenditures, the company's AI revenues also accelerate. However, due to a slight slowdown in Google's capital expenditures in the fourth quarter, the projected AI revenues for the next quarter are anticipated to increase only marginally (approximately $3.8 billion, as guided by the company).

Concerning Google's reduced capital expenditures, Dolphin posits that this is mainly attributable to Google's transition from TPU v6e to TPU V6p, a phase that impacts the company's ASIC revenues. With the shipment of v6p anticipated in fiscal year 2025, the growth rate of the company's AI revenues is expected to regain momentum.

From a medium to long-term perspective, Broadcom's management offers a promising outlook for the AI business, forecasting that the addressable market size for hyperscale customers could reach $60-90 billion by fiscal year 2027, providing a significant boost of confidence to the market.

2) Other Semiconductor Businesses

Apart from its networking business, Broadcom's other semiconductor segments remain relatively sluggish, with year-on-year declines in the double digits. Among these, storage and wireless businesses show signs of recovery, whereas broadband, industrial, and other segments continue to experience notable declines.

Specifically:

① Server Storage Business: This quarter, the company reported revenues of $992 million, essentially flat year-on-year. A noticeable recovery has been observed since bottoming out six months ago.

② Wireless Business: This quarter, the company generated revenues of $2.2 billion, recording both year-on-year and quarter-on-quarter growth. The 30% quarter-on-quarter growth is primarily driven by seasonal factors, particularly Apple's new product launches in the second half of the year.

③ Broadband Business: This quarter, the company's revenues amounted to $465 million, marking a new low. This decline is mainly attributed to operators and others having already completed major investment phases, subsequently reducing product procurement. However, the company anticipates a recovery in the next quarter.

④ Industrial and Other Businesses: These segments constitute a relatively small proportion, accounting for only 1% of total revenues. This quarter, the company reported revenues of $173 million, a 27% year-on-year decline. The company expects a recovery in the second half of fiscal year 2025.

Overall, despite some signs of recovery in traditional semiconductor businesses, overall demand remains subdued. The revival of broadband, industrial, and other segments necessitates further observation. Regarding the wireless business, which garners market attention, management noted that the company maintains close ties with Apple, with a multi-year cooperation roadmap encompassing various cutting-edge technologies (including RF, Wi-Fi, Bluetooth, sensing, and touch).

2.2 Infrastructure Software

In the fourth quarter of fiscal year 2024, Broadcom (AVGO.O) achieved infrastructure software revenues of $5.824 billion, marking a year-on-year increase of 196%. This rapid growth is primarily attributed to the consolidation of VMware.

1) VMware

According to the company's financial report, Dolphin estimates VMware's revenue for this quarter to be approximately $3.74 billion, accounting for 27% of total revenues. Following the acquisition, Broadcom divested and adjusted VMware's business, selling non-core areas such as end-user computing.

Prior to its delisting, VMware's combined "licenses + subscription SaaS business" revenues totaled approximately $2 billion quarterly. However, post-acquisition by Broadcom, the licensing business was eliminated, and a full transition to a subscription SaaS model was implemented. With the increasing proportion of subscription customers, VMware's current quarterly revenues have reached $3.7-3.8 billion.

Despite this significant revenue increase, VMware did not experience quarter-on-quarter growth this quarter. Management stated that some software revenues were deferred to the first quarter but assured that this would not significantly impact fiscal year 2025.

Considering VMware's orders, the company's annualized billing value (ABV) for this quarter was nearly $3 billion, with quarter-on-quarter growth rebounding from 8% to 13%. This further indicates that VMware's revenues are anticipated to resume quarter-on-quarter growth in the next quarter.

2) Original Software Businesses Such as CA, Symantec, and Brocade

Excluding VMware revenues, we can estimate the performance of the company's original software businesses (CA, Symantec, and Brocade). Upon calculation, Broadcom's original software businesses generated revenues of $2.08 billion this quarter, marking a year-on-year increase of 5.8%. Evidently, the current high growth in software revenues is primarily fueled by VMware, while traditional software businesses exhibit relatively stable growth.

Related Dolphin Investment Research articles on Broadcom:

- In-depth: Company Insight on December 4, 2024, "Broadcom (AVGO.O): A Unique Winner in the Era of AI Computing Power with Both Hardware and Software"

- In-depth: Company Insight on September 13, 2024, "Broadcom: Paving the Way to 'Trillion' with a 'Buying Spree'? Tencent and Alibaba, Take Note!"

- Financial Report Review: Financial Report Review on September 6, 2024, "Is Broadcom 'Racing Ahead'? AI Can't Prop Up Collapsing Traditional Semiconductors"