IFLYTEK Faces Unprecedented Competition

![]() 12/17 2024

12/17 2024

![]() 506

506

By Cheng Du

Edited by Yang Xuran

With full-stack in-house development, IFLYTEK has trained the first large model based on a domestic computing power platform. Collaborating with Huawei to build 'Feixing No.1' and 'Feixing No.2', the company aims to benchmark and surpass OpenAI, emphasizing self-controllability and its role as part of the national team.

These are key phrases that IFLYTEK must highlight in all external promotions following its transition to general AI.

Starting with intelligent voice recognition, deepening its roots in education, and then advancing into AIGC, aligning with the global trend of large language models, IFLYTEK is currently in the most thrilling and challenging period in its 25-year history.

Keeping pace with generative AI could potentially spark the next round of growth, ushering in a new development phase. Otherwise, it risks missing out on the benefits of this transformational era and becoming collateral damage in the chaos of large models.

Robin Li once predicted that 99% of 'pseudo-innovations' would be eliminated in the AI wave, with only 1% of enterprises thriving. IFLYTEK's stature in China's tech sector underscores that failure is not an option.

Currently, it's too soon to declare IFLYTEK's harvest period. The company experienced its first net loss since financial reporting began in 2005, with operating cash flow turning negative and excessive dependence on G-end (government and enterprise clients) leading to record-high accounts receivable.

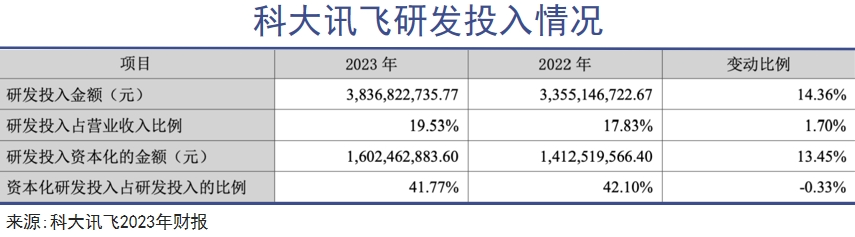

However, the rapid advancement of AI doesn't wait for anyone. IFLYTEK must continue to strengthen its R&D investment. In 2023, it invested 3.84 billion yuan in R&D, exacerbating its financial pressure. With only 2.751 billion yuan in cash on hand and increasing interest-bearing liabilities, IFLYTEK has reached a critical moment for investment returns as a listed company.

Turning Point Emerging

Business model transformation.

Every technological breakthrough in history can initially stimulate capital, but reality often brings harsh realities.

Since OpenAI released its generative AI model on November 30, 2022, the Chinese AI large model startup wave has swiftly transitioned from a funding boom to an elimination round.

OpenAI recently launched groundbreaking products like Sora but is projected to lose 5 billion dollars this year. A recent controversy involving the arbitration of a former investor in Dark Side of the Moon, a new elite in the industry, underscores the bumpy commercialization path for large model vendors.

On one hand, investment institutions are becoming increasingly cautious. According to Juzi IT statistics, there have been 439 financing cases in the domestic AI field this year (as of December 5), totaling over 56.4 billion yuan, approximately 80% of last year's total. Worryingly, this round of large model startups seems to be fading faster, making it difficult to find investors willing to spend lavishly.

On the other hand, the industry is engaged in a price war, making commercialization more urgent.

As an A-share listed company, IFLYTEK faces greater financial and commercialization pressures.

Starting in 2022, the company's R&D expenses surpassed 3 billion yuan for the first time. In 2023, it invested over 2 billion yuan in developing the iFLYTEK Spark cognitive large model, with total annual R&D investment reaching 3.84 billion yuan and 3.037 billion yuan in the first three quarters of this year, totaling 10.2 billion yuan.

Investments exceeding 10 billion yuan have eroded the company's profits. In the first three quarters of this year, there was a loss of 344 million yuan, a year-on-year decrease of 445.91%, and a non-GAAP loss of 468 million yuan after deducting non-recurring items.

Positively, the third quarter achieved a profit of 56.96 million yuan, with a net operating cash flow of 715 million yuan, a year-on-year increase of 100.09%, indicating a strategic focus on the core business of the Spark large model. However, without a government subsidy of 90.7256 million yuan, the third quarter would still have shown a loss.

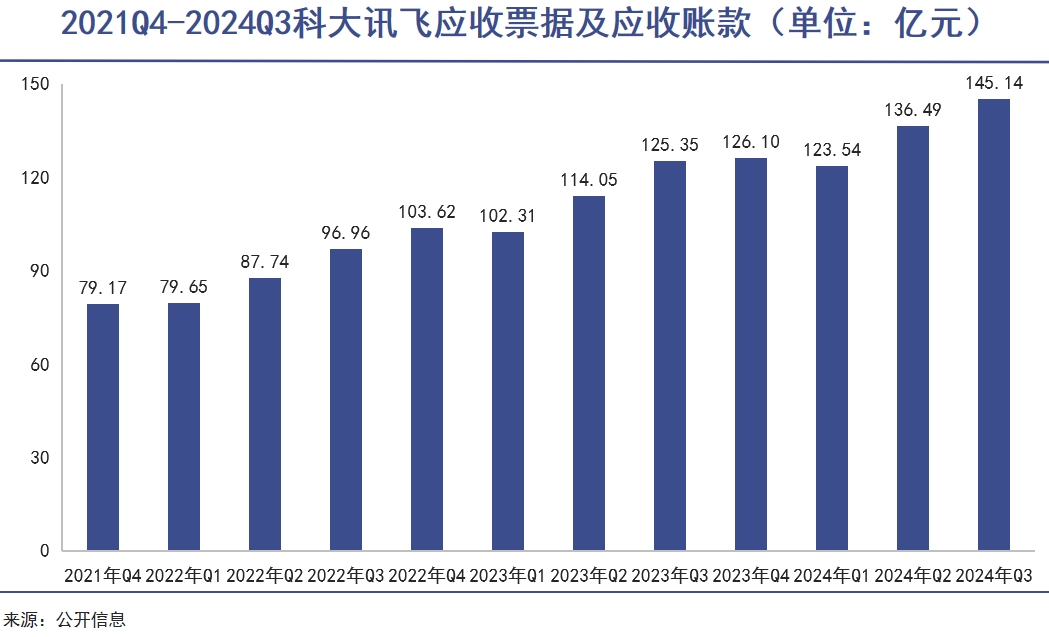

For IFLYTEK, long-standing issues with G-end business have led to persistently high accounts receivable (plus bills), exceeding 14.5 billion yuan in the first three quarters of this year, a significant hindrance to its long-term development.

Transitioning to general AI is crucial for IFLYTEK's business model transformation. With AI support, the company has called for a shift from G-end to C-end and B-end. In particular, C-end businesses like learning machines, smart cars, consumers, and open platforms have seen rapid growth, further improving the company's business structure.

For instance, C-end learning machine sales have doubled, intelligent hardware revenue has increased by 41%, and open platform revenue has risen by 50%. The smart car business has grown by 49%, effectively offsetting the decline in G-end business.

Chaos of Competition

Surviving enterprises clean up the mess.

'Fewer people are talking about AGI (Artificial General Intelligence), and more are pursuing ROI (Return on Investment).'

Despite differences in technological trends and application scenarios, the current AI venture capital industry has become pragmatic.

In just two years, AI large models have experienced exponential growth. According to the "Global Digital Economy White Paper" released by the China Academy of Information and Communications Technology, there are 1,328 global AI large models, with nearly 480 in China, accounting for 36% and ranking second only to the United States with 44%.

From initial scrambles for opportunities to now focusing on survival, the industry has cooled down faster than anticipated.

Moreover, investment in large models is substantial. Recently, Larry Ellison, the founder of Oracle, boldly stated that the entry price for cutting-edge large models is 100 billion dollars!

After experiencing a funding winter in the internet industry, institutions have become more cautious and rational. They will not invest merely to seize market share but will repeatedly discuss, evaluate, and calculate the ROI for projects internally. The prolonged return period, uncertain commercial prospects, and intensified competition have strained investor-entrepreneur relations.

Furthermore, unlike the United States, China's software industry lacks a culture of paying for software, whether ToB or ToC. In users' eyes, 'whoever is cheaper gets used, or even better, free.' Therefore, Chinese enterprises must navigate how to survive in this fiercely competitive market.

These factors determine that China's AI journey will be a bumpy long-distance trip.

IFLYTEK's stock performance (since June 2023)

In May this year, to attract users, cloud vendors engaged in a price war for large model inference computing power. ByteDance's Volcano Engine, Alibaba Cloud, Baidu Intelligent Cloud, Tencent Cloud, and IFLYTEK successively joined the price reduction ranks, directly reducing the price of large model inference computing power by 90%.

The recently popular ByteDance Doubao priced its 32K main model (performing on par with GPT-4) at 0.00008 yuan per thousand tokens, 99.3% cheaper than the industry average.

After a period of chaos, the AI competition has evolved from competing on computing power, technology, and ecosystem to the pragmatic stage of 'acquiring customers.' The current 'Hundred Models War' mirrors past battles in various industries.

When the war ends, many enterprises will perish, and the survivors will clean up the mess.

After the price reduction wave, domestic model prices are only 20%-50% of those of OpenAI for models of the same specifications. According to Caijing, after major manufacturers' price reductions in May, the gross margin of inference computing power fell to negative.

Amidst the chaos, ERNIE Bot (Baidu), Tongyi Qianwen (Alibaba), Hunyuan (Tencent), and Volcano Engine (ByteDance) can rely on their parent companies. The emerging 'Six Little Tigers' of domestic large models - Zhipu AI, BaiChuan Intelligence, Lingyi Wanwu, Dark Side of the Moon, Minimax, and Jieyue Xingchen - each have unique characteristics. Coupled with continuous new entrants, the competitive environment faced by IFLYTEK is far more brutal than in the previous era of voice intelligence.

Additionally, with the US blockade on high-end computing power, IFLYTEK faces immense pressure.

Determination to Break Through

Representing China's second option for the world.

On December 5, Sam Altman officially announced that OpenAI would conduct a 12-day Christmas surprise live stream event.

Currently, the event is more than halfway through. Notably, the AI video generation model Sora, officially opened to users, overwhelmed the server, causing the website to crash.

Every overseas development spurs Chinese entrepreneurs to catch up. This year, new models from 'big factories' and the 'AI Six Little Tigers' have claimed to 'match' or even 'surpass' GPT-4. Both BaiChuan Intelligence and Lingyi Wanwu's Yi-Large and Baichuan 4 have achieved capabilities beyond GPT-4 while benchmarking it. Jieyue Xingchen released the Step-1.5V multimodal large model, and Zhipu's GLM-4-Plus is on par with GPT-4, even preemptively launching a beta version of its Her video calling feature.

Liu Qingfeng, Chairman of IFLYTEK, is also confident. Each iteration of the iFLYTEK Spark large model challenges GPT. On October 24, IFLYTEK released Spark 4.0 Turbo, claiming that its seven core capabilities comprehensively surpass GPT-4 Turbo, with superior mathematical and coding abilities. It also unveiled multiple new technologies, including multimodal vision and super-humanoid digital human interaction.

However, being powerful at the 'parameter level' doesn't guarantee market success. Only being user-friendly, practical, and addressing market pain points can win over users. Kimi gained popularity by utilizing 2 million words of long text.

Almost simultaneously, Tongyi Qianwen and 360 Brain followed suit, successively opening up the ability to process 1 million words of long text and testing 5 million words. Baidu's ERNIE Bot can process 2 to 5 million words of long text.

In the industry's nascent stage, large model products haven't yet formed a brand moat. Users constantly try different products, and no one cares which 'GPT brand' others use. Therefore, some believe that enterprises with strong user stickiness like Apple are unlikely to emerge in the AI era.

Amidst fierce competition, full-stack in-house development and complete self-controllability distinguish IFLYTEK from other large model vendors.

Due to the US blockade, IFLYTEK has full self-controllability across the entire industry chain. On October 24, 2022, IFLYTEK and Huawei jointly launched the first domestic 10,000-card computing power cluster platform, 'Feixing No.1.' A year later, 'Feixing No.2' was introduced. Liu Qingfeng stated that Huawei's GPUs are comparable to NVIDIA's, and iFLYTEK Spark represents China's second option for the world.

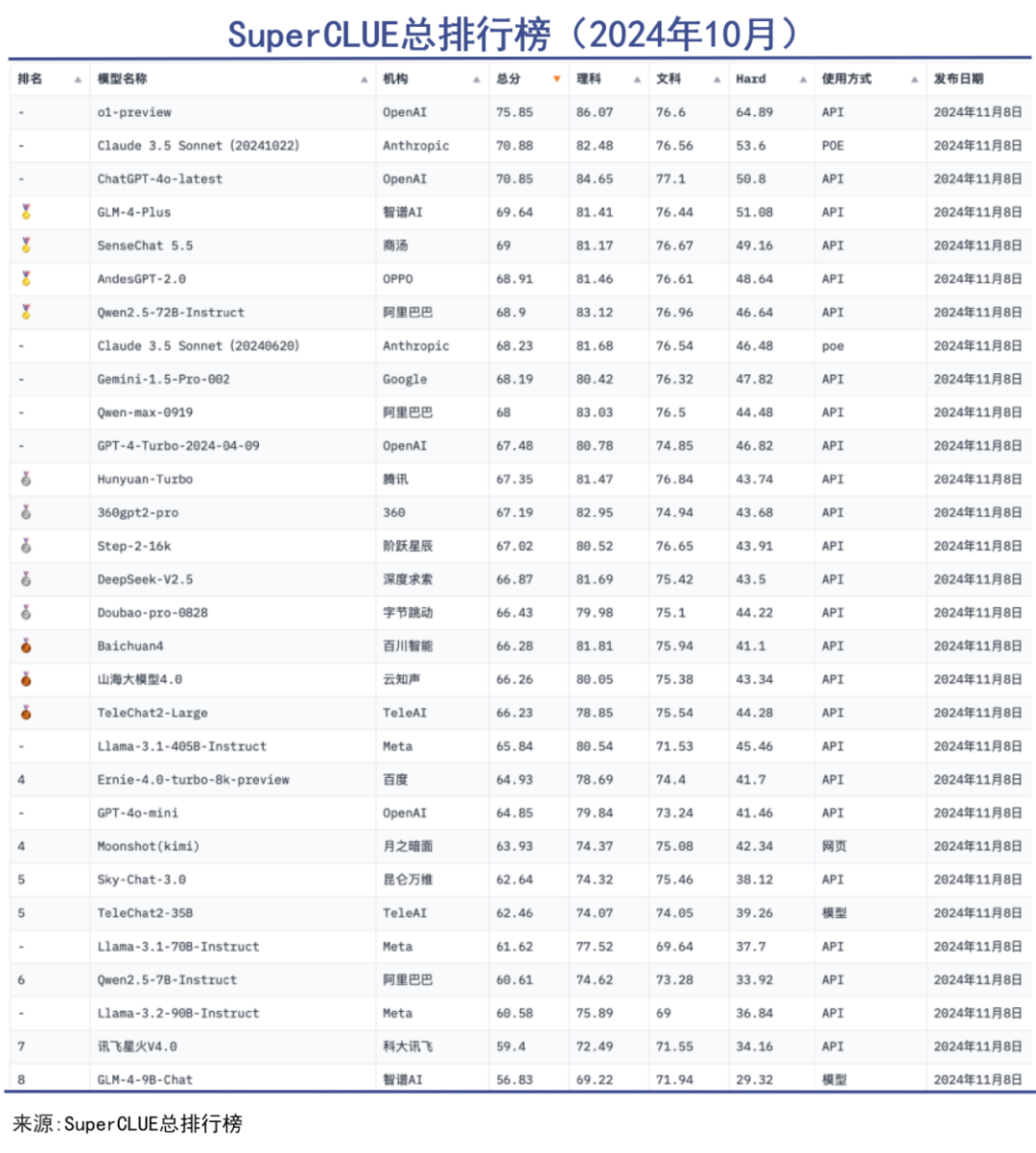

Due to the lack of NVIDIA AI chips, iFLYTEK Spark strives to catch up by relying on the domestic industrial chain. According to the SuperCLUE overall ranking (October 2024), iFLYTEK Spark V4.0 ranks seventh with a total score of 59.4.

As part of the 'national team,' IFLYTEK has gained favor from major financial institutions, large state-owned enterprises, and government departments. 'Domestic substitution' has become a prominent comparative advantage for IFLYTEK, ranking first in bids this year due to full-chain self-controllability, securing numerous orders.

Currently, large models seem to have fallen into the same trap as online education in the past. In the third quarter of 2024, Kimi invested up to 150 million yuan in market launch alone, with 110 million yuan invested in the first 20 days of October.

Backed by ByteDance, Doubao is even more financially endowed. Insiders have revealed that at its peak, Doubao spent 600,000 yuan per day on TikTok advertising alone. AppGrowing shows that in June, Doubao's advertising investment reached a staggering 140 million yuan, spending 4.67 million yuan per day on advertising.

The results were evident. The Doubao APP soared from 112th place in the free chart to the top 10 in just six days and reached the top of the overall free chart in June.

IFLYTEK is no exception, incurring sales expenses of RMB 2.553 billion in the first three quarters. This starkly illustrates the industry's consensus that the current stage of development necessitates a period of "lavish spending to foster miracles."

Concluding Remarks

Currently, participants in China's AIGC industry can be broadly categorized into several groups: leading tech giants like Baidu, Alibaba, and Tencent; the "Six Little Tigers" comprising companies such as Baichuan Intelligence and Zero-One Everything; publicly listed firms including iFLYTEK, 360, SenseTime, and Tianjin University's Large Model (Kunlun Wanwei); hardware technology companies like Huawei, vivo, and OPPO (with the Andes Large Model); state-owned enterprises like China Telecom (Xingchen Semantics TeleChat2); and academic institutions like Tsinghua University.

When compared to the financial muscle of major tech companies, the status of state-owned enterprises, and the funding prowess of the "Six Little Tigers," iFLYTEK distinguishes itself with unique advantages, bolstered by Huawei's support in underlying chip technology. Its comprehensive in-house research and development capabilities, coupled with secure and controllable solutions, are prominent strengths that address industry pain points.

In the vast landscape of AI development, these are iFLYTEK's most dependable assets. Amidst the intense competition for survival, seizing advantageous positions first can pave the way for replicating Kingsoft's successful turnaround.

Having invested over ten billion yuan, iFLYTEK now faces stronger competition than ever before, leaving it with fewer retreat options.