ByteDance Regains Momentum Through AI Innovation

![]() 12/19 2024

12/19 2024

![]() 904

904

"In recent years, ByteDance has grappled with expanding its horizons amidst fierce competition from industry giants. The deceleration in Douyin's e-commerce and advertising sectors almost signaled that ByteDance had 'exhausted its arsenal.'"

@TechNewKnowledge original

By the end of 2024, domestic AI applications had ushered in a new transformation.

Unquestionably, ByteDance adopted an aggressive approach. It first lured Zhou Chang, the core technical lead of Alibaba's Tongyi Qianwen, with a lucrative salary. Subsequently, rumors circulated that ByteDance was lavishly spending on Doubao advertisements, even restricting Kimi's ads on Douyin to bolster Doubao's monthly active users.

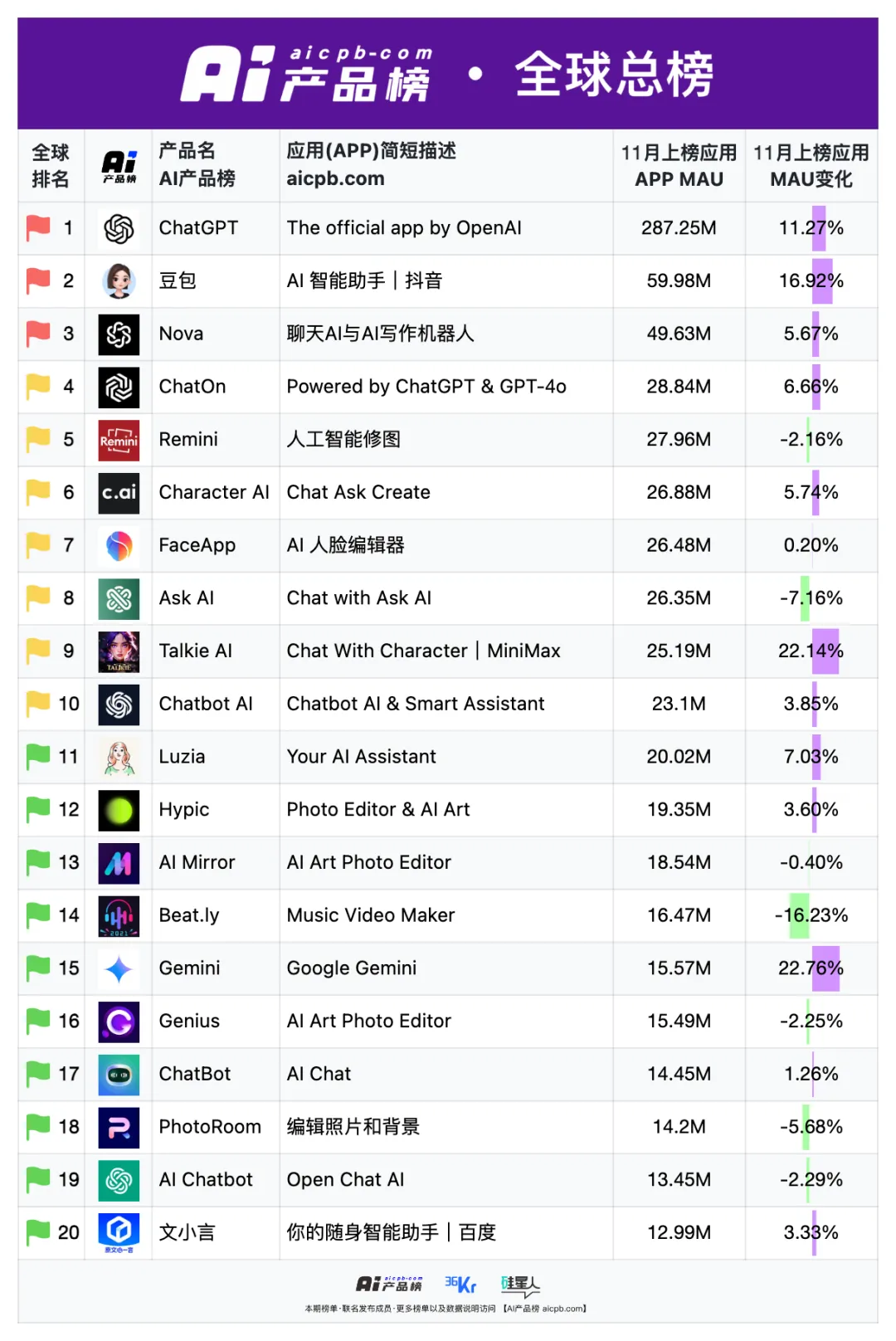

Through a series of combined strategies, ByteDance has achieved notable data outcomes. The most exaggerated reports claim that by the end of November, Doubao APP had surpassed 160 million cumulative users in 2024, with a stable daily new user download rate of 800,000, making it the second-ranked AI app globally and the top-ranked in China.

Relatively, Alibaba's stance can be glimpsed through its investment focus and star enterprises like Kimi. As Kimi's largest shareholder, it has been burning money to fuel growth over the past few months, achieving 38 million monthly active users and swiftly replicating numerous OpenAI features, revealing Alibaba's shareholder intentions.

Charlie Munger's remark, "I didn't stop to realize it was still a damn retailer," once prompted Jack Ma to reflect and subsequently introduce the concept of "AI e-commerce." Looking back at Alibaba's actions over the past year, abandoning offline retail and embracing AI has been the main theme.

Specifically, Alibaba ventured into AI early with ambitious goals. On one hand, it emulated Microsoft by stockpiling large GPUs, dominating the computing power market. On the other hand, its Tongyi Qianwen aims to follow Meta's footsteps by transforming Alibaba Cloud into a large model application development platform.

In the existing AI application market, Alibaba is adopting a multifaceted approach. It has not only invested in numerous star startups like Kimi but also recently announced that its AI application "Tongyi" has officially been spun off from Alibaba Cloud and integrated into Alibaba's Intelligent Information Business Group.

This nearly directly announces that Alibaba will personally enter the fray, directly engaging in the to-consumer (to C) arena.

From an industry perspective, it's no surprise that this year-end competition has intensified. On December 14, Beijing time, at the NeurIPS 2024 conference, Ilya Sutskever, the former co-founder of OpenAI and founder of SSI, stated in his speech that pre-training, the initial phase of AI model development, is nearing its end. On the computing power front, the emergence of ASIC chips has also enabled giants to envision more cost-effective solutions.

Returning to China, as technology gradually transitions from a steep growth phase to a plateau, domestic AI applications foresee rapid market penetration potential. Competing for market share will undoubtedly become the main theme of the next stage.

Whether it's Ma Yun's proposed AI e-commerce or Zhang Yiming's focus on AI's potential in the content creation market, it signifies that company founders have already shifted their attention to AI applications.

From a hardware and product perspective, Alibaba and ByteDance will undoubtedly be the main players in this competition. Both parties have their respective advantages and possess leverage that can "strangle" each other. The real battle may have just begun, and it remains unclear who will emerge victorious.

01

ByteDance's Counterattack

The onset of this competition appears rooted in ByteDance's reaffirmation of AI as its core focus.

On the morning of November 13, news swiftly spread in the AI circle that Alibaba had decided to seek arbitration against Zhou Chang, a former Tongyi large model employee, for breaching a non-compete agreement. Zhou Chang, the protagonist of the incident, merely unveiled the tip of ByteDance's talent poaching iceberg in the AI sector.

According to reports, ByteDance's demand for AI talent has been continuous since mid-2023. "The targets primarily include Alibaba's Tongyi team, Baidu's ERNIE Bot and PaddlePaddle team, as well as the 'AI Six Dragons' comprising Moon Dark Side and AI Spectrum, among others."

Interestingly, such intense development has apparently also alarmed OpenAI across the ocean. The Verge reported in December 2023 that OpenAI had shut down GPT accounts for certain ByteDance products, suspecting ByteDance was using GPT to train its large models.

However, ByteDance remained unaffected and has instead reaped substantial benefits. Since 2024, ByteDance has launched nearly 20 AI applications, with Doubao currently being the most popular native AI in China with the largest user base. Mature product paths and vast traffic resources are the foundation for the rapid development of ByteDance's AI applications. At the same time, they will also become key variables in this competition.

According to media reports, Doubao is not only replicating the expansion path of buying traffic and burning money but also restricting competitors like Kimi's advertisements within Douyin, pushing the competition to a fierce stage.

AI applications exist within the consumer (C) ecosystem. Restricting them directly in the largest traffic pool deals a heavy blow to products still needing popularization and having strong substitutability.

However, for Alibaba, there seems to be a solution. Among the invested enterprises, many have developed unique characteristics. For example, Kimi has the ability to swiftly replicate OpenAI technology. Whether it's the "chain of thought" reasoning technology showcased in the Kimi Explorer edition or the visual thinking model K1, users can experience differentiated product capabilities.

From a broader perspective, according to industry experts, Alibaba Cloud imported a vast number of NVIDIA large GPUs (H-series, A-series) before chip sanctions tightened, totaling over 100,000 (including cards from its overseas branches). This signifies that Alibaba Cloud holds an absolute leading position in China's computing power market.

Part of this computing power is utilized for internal training, while much of it is rented out. According to industry insiders, Volcano Engine, a subsidiary of ByteDance, is the largest renter of Alibaba Cloud's large GPUs. Since Alibaba Cloud and ByteDance's large GPUs significantly overlap, excluding the cards rented from Alibaba Cloud, Volcano Engine's large GPUs number at most in the tens of thousands. This amount of computing power is, to some extent, insufficient to support the rapid development of ByteDance's AI applications.

Simultaneously, this also implies that if Alibaba and ByteDance engage in a stock game today, it becomes questionable whether computing resource priority will still be open to the outside world.

Looking at the current situation, ByteDance seems to be seeking alternative computing power solutions. In June, rumors circulated that ByteDance was developing AI chips with Broadcom, which were later denied by ByteDance. Recently, media reported that Broadcom CEO Hock Tan mentioned in an earnings outlook that the company's AI revenue would reach $60-$90 billion by 2027. According to Hock, the three main demanders will contribute $60-$90 billion, including Google, Meta, and other Silicon Valley giants, as well as ByteDance. This implies that ByteDance will have AI chip procurement demands (ASIC + networking) of $20-$30 billion by 2027.

From this, it's evident that ByteDance's counterattack may be underway.

02

The Dilemma of the APP Factory

From an event-driven perspective, whether it's offering eight-figure annual salaries to recruit AI talent, burning money to intensify advertising for AI applications like Doubao, or restricting competitor Kimi's advertisements, ByteDance has demonstrated a heightened degree of aggressiveness.

This aggressiveness seems to stem from the culmination of accumulated internal and external pressures. Historically, in recent years, ByteDance has struggled to expand its horizons amidst giant competition.

In the gaming sector, Moonton and Zhaoxi have undergone years of development but ultimately faced significant contraction. ByteDance invested tens of billions yet barely made a dent in leading companies like Tencent, NetEase, and miHoYo. In the local lifestyle sector, a similar outcome was observed. ByteDance changed its leaders multiple times, achieving some gains in on-site services and hotel and travel, but overall, it still struggled to challenge Meituan's dominance.

Entering this year, the deceleration in Douyin's e-commerce and advertising sectors almost signaled that ByteDance had "exhausted its arsenal."

According to LatePost, in the first three quarters, ByteDance's quarterly advertising growth rate in China fell from around 40% to less than 17%, failing to meet the set targets in the past two quarters. In e-commerce, from January to February this year (typically combined due to the Spring Festival holiday), Douyin e-commerce achieved a total GMV of nearly RMB 500 billion, with a cumulative year-on-year growth rate exceeding 60%. However, the year-on-year growth rate in March fell below 40%. After the second quarter, the growth rate further dropped to below 30%. In 2023, Douyin e-commerce's monthly growth rate generally maintained above 50%.

From a business layout perspective, TikTok, which was originally highly anticipated, continues to face pressure after multiple rounds of negotiations. On December 6, local time, the U.S. Federal Court of Appeals issued a ruling. A panel of three judges unanimously upheld the act signed by U.S. President Joe Biden in April. The ruling banned TikTok on national security grounds, complying with the First Amendment of the Constitution, and rejected TikTok's application to overturn the forced sale act.

ByteDance's internal and external pressures seem to have converged on Zhang Yiming this year. The original APP factory appears to need to shift its previous strategic path and find a less resistant direction. At this juncture, AI applications are undoubtedly another better choice.

From an environmental perspective, it's undeniable that technological change is slowing down.

On December 4, OpenAI CEO Sam Altman revealed on social media that the company would conduct a live stream every day for the next 12 working days. In total, 12 live streams would showcase some new products or prototypes. However, nearly a year has passed, and OpenAI still hasn't unveiled the legendary GPT-5. Zhu Xiaohu of Jinsha Jiang Venture Capital stated in May, "I think Altman is just boasting; GPT-5 is definitely not that close," which is gradually being verified.

On the other hand, leading AI application companies such as AppLovin, focusing on mobile advertising and game developer services in the U.S., and Palantir, primarily serving governments and enterprises, are rapidly growing by helping clients optimize decisions through big data analysis and AI technology. Not only have they achieved new revenue highs, but they are also favored by investors regarding future prospects.

Upon closer inspection of these companies' businesses, whether it's using AI to help developers enhance advertising efficiency or providing real-time analysis and decision support for enterprises and governments, they somehow align with ByteDance's existing businesses. Furthermore, ByteDance's aggressive layout may also possess some defensive attributes.

According to New Cortex reports, Zhang Yiming was aware of AI's huge potential in content distribution early on, evidenced by Douyin's prized algorithm. However, he may not have realized AI's even greater potential in content production, which could potentially disrupt the product form and competitive edge built on content distribution technology.

Currently, numerous startup projects are constructing a new generation of content communities based on generative AI, including text and image-based communities that could replace Xiaohongshu and short video communities that could disrupt Douyin and TikTok. If ByteDance cannot provide similar or superior content production technology, users are likely to shift to other platforms.

Whether it's catching up after hesitation, fear of missing out, or a solution to internal and external pressures, ByteDance seems poised to triumph in the AI applications field.

03

A New Frontier That Cannot Be Missed

On December 18, multiple media outlets simultaneously disclosed that Alibaba's AI application "Tongyi" had recently been spun off from Alibaba Cloud and integrated into Alibaba's Intelligent Information Business Group.

An insider revealed that this adjustment included Tongyi's To C product managers and related engineering teams, which have been transferred to Alibaba's Intelligent Information Business Group. After the adjustment, Tongyi's PC and App teams are on par with the intelligent search product "Kuake," while the original Tongyi Lab remains within the Alibaba Cloud system.

This move is seen as a step for Alibaba to streamline its internal AI To C applications.

On the same day, Volcano Engine unveiled a significant upgrade for the Doubao model. Among the various improvements, the price of Doubao's visual understanding model was slashed by a whopping 85%, heralding the dawn of the "cent era" for visual recognition technology.

Both entities appear to have chosen this moment to unveil their latest advancements, signaling that the competition in AI applications has officially escalated into a fierce battleground among industry giants.

Alibaba, having officially ventured into the AI-to-consumer market, faces considerable ground to make up. According to reports, Tongyi App has adopted a measured approach to customer acquisition, positioning its product more as an efficiency tool. According to QuestMobile data, as of October 2024, Tongyi's monthly web page visits stood at approximately 10.12 million. Moreover, Alibaba must also consider whether its computational prowess will be surpassed by emerging technologies.

For Doubao, retaining users acquired through substantial investments poses an urgent challenge. Enhancing user engagement and making the app more valuable to its users are crucial to addressing this issue. However, based on feedback across various social platforms, there is ample room for improvement within Doubao.

Today's rivalry among multiple giants echoes the frenzy of companies chasing trends during the mobile internet era. Nevertheless, the current competition in AI applications lacks the fertile ground that characterized the mobile internet era. While AI applications are favored by major tech companies, they have been embroiled in intense market competition from the outset.

In other words, if traditional search engines suffice, what incentive exists for users to explore large language model applications?

Furthermore, AI applications in China have yet to uncover high-margin, self-sustaining products. Driven by various business needs and strategic objectives, major tech companies have actively or passively joined this competition, but the ultimate direction of its practical impacts remains uncertain. As insiders have noted, AI development is fraught with uncertainties. Each day brings new advancements, and former leaders could be overtaken by technological progress.

As of today, whether the aggressive giants will achieve a favorable outcome remains a mystery.