Baidu AI's Struggle Exposes Domestic Large Models' Vulnerability in the Face of Apple

![]() 12/20 2024

12/20 2024

![]() 474

474

Rumors circulated as early as March this year that Baidu would provide AI functionality for Apple's China-specific iPhone 16, Mac system, and iOS 18, while Google's Gemini and OpenAI's ChatGPT would support AI for other markets. Now, while the collaboration with Apple has largely been confirmed, the process appears to have encountered challenges.

According to foreign media reports, an insider involved in optimizing the large language models of both companies revealed that Baidu's ERNIE Bot has struggled to understand prompts and accurately respond to common scenarios posed by iPhone users. This news has gained significant traction on social media.

Baidu, which has been relatively quiet in the public eye, last garnered widespread attention six months ago due to an incident involving its former PR head, Qu Jing.

Baidu's focus on AI began years ago. Although it didn't pioneer the trend, its strength and heritage have consistently placed it among China's top tiers.

With the advent of large models, Baidu has remained at the forefront, particularly since the upgrade of ERNIE Bot to version 4.0 last year. Numerous accolades and reports have attested to its competitiveness with international top-tier large models.

At the recent Baidu World Conference, Robin Li proudly announced, "Large models have dispelled basic illusions, improved answer accuracy, and prepared the industry's basic model capabilities." However, the current collaboration issues with Apple seem to contradict this claim.

This also raises doubts about Baidu's aggressive launch of 2B and 2C AI products. If large models lack practical capabilities, no matter the number of AI applications, it's impossible to conceal their underlying vulnerabilities.

True AI isn't afraid of peer competition.

A few days ago, the China Internet Network Information Center (CNNIC) released the "Generative AI Application Development Report (2024)." The report revealed that as of June 2024, China's generative AI user base reached 230 million, accounting for 16.4% of the population. Within this market, Baidu's ERNIE Bot ranks first in domestic internet user utilization of generative AI products, with a share of 11.5%.

The latest data shows that ERNIE Bot's daily average call volume reaches 1.5 billion, processing over 1.7 trillion tokens.

However, impressive data is only part of the story. "The proof of the pudding is in the eating."

At the Passat Pro launch event on September 10, Fu Qiang, Executive Vice President of Sales and Marketing at SAIC Volkswagen, conducted an on-site demonstration. He asked, "What's the story behind Yunnan's Guoqiao Rice Noodles?" However, the Passat Pro equipped with ERNIE Bot remained silent for several seconds before providing irrelevant answers, creating an awkward scene.

Baidu also collaborated with Samsung this year. For Samsung's latest S24 series, Google's Gemini supports AI for regions outside mainland China, while mainland China uses a group of Chinese large model companies led by Baidu and Meitu. Among them, Baidu dominates the instant search function. According to media reviews, Gemini's database includes all web pages searchable on Google, while ERNIE Bot's database only includes Baidu Baike, resulting in less accurate search results.

It's worth mentioning that although Samsung has launched the Galaxy S24 series equipped with Baidu AI, according to Counterpoint Research data, these features haven't improved Samsung's market performance in China, with its market share falling from 0.8% in January to 0.7% in February.

If previous ERNIE Bot collaborations were trials, Apple's choice of Baidu as the provider of third-party AI large models represents Baidu's chance to shine. Overseas, Apple has chosen OpenAI, a large model market "superstar," while Baidu has benchmarked against OpenAI, claiming that the gap between ERNIE Bot and GPT is shrinking and that "it's no less impressive in comparison."

Is this true? Judging from the Passat launch incident, ERNIE Bot has significant issues with semantic understanding and quick response, and foreign media reports have also pointed out Apple's dissatisfaction. Apple values transforming Siri and enhancing its natural language-based conversational capabilities, which ERNIE Bot may not significantly assist with.

For instance, Apple hopes that when iPhone users ask for restaurant recommendations, AI can base recommendations on their phone usage data to provide more personalized answers. However, ERNIE Bot can only provide answers based on conversation history, which doesn't meet Apple's requirements.

A few days ago, Apple rolled out the iOS 18.2 RC version system update to iPhone users, integrating ChatGPT into the new Siri. For user questions, Siri will call ChatGPT to answer. However, due to setbacks in the collaboration with Baidu AI, domestic Apple users can't use the new AI functionality.

In a sense, Apple serves as a "touchstone" for Baidu's ERNIE Bot capabilities. If the collaboration is pleasant and mutually beneficial, if Baidu loses Apple, the image of a "leader" in domestic large models that Baidu has cultivated will be shattered, dealing a fatal blow to Baidu's AI-focused future.

For domestic large models, this is also a crucial battle for confidence.

Large models struggle to "save" Baidu Search.

When ChatGPT gained popularity last year, domestic and foreign giants first considered applying this technology to search. Many believed the technological revolution would start from search, a basic entry point. However, after integrating large models, Baidu's erosion in the search market hasn't changed.

According to Statista data, in May 2024, Baidu still ranked first in China's search market but with a declining market share of 55.85%. In comparison, in November 2021, Baidu's share of China's search market was as high as 86.82%.

Interestingly, industry insiders have pointed out that Xiaohongshu's average daily search volume within the station has reached 600 million, exceeding half of Baidu's search volume (approximately 1 billion). At the current growth rate, Xiaohongshu will surpass Baidu, China's largest domestic search engine, in a few years. More interestingly, Douyin's average daily search volume exceeds 2.7 billion, far surpassing Baidu. However, neither platform seems interested in the title of China's largest domestic search engine.

Since last year, Baidu has been transforming its business using its self-developed large language model, ERNIE Bot, with search being crucial. According to Baidu, AI functionality on the Baidu APP currently covers 70% of monthly active users, and over 20% of search result pages on Baidu Search contain AI-generated content. In September this year, Baidu renamed ERNIE Bot to "Wen Xiaoyan," positioning it as an intelligent assistant for "New Search."

From Baidu's disclosed data, it seems the transformation and upgrade of its products through generative AI have yielded results. However, these changes haven't significantly increased Baidu's traffic or user activity, let alone reversed Baidu Search's reputation among users.

According to QuestMobile's "2024 China Mobile Internet Half-Year Report," top apps have continued to deploy AI functionality, with most embedding features covering intelligent shopping guides, assistants, searches, and wizards. Among the top 20 in monthly active user scale, the Baidu APP, supported by intelligent search, ranks eighth. Additionally, in navigation products, Baidu Maps has been surpassed by Gaode Maps and ranks second, while in input methods, Baidu Input Method has consistently lagged behind Sogou Input Method.

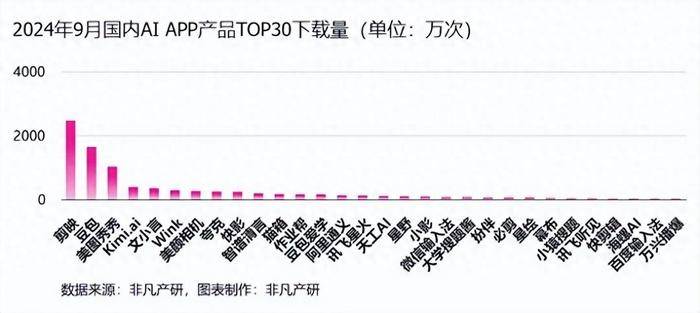

Furthermore, in the September 2024 AI mobile application market download rankings, Jianying, Doubao, and Meitu Xiuxiu ranked among the top three domestically. These three apps also topped the list of domestic APP monthly active user scales, with Wen Xiaoyan coming in fifth.

This underscores a harsh reality: Baidu, which has long focused on AI, hasn't regained user attention in the mobile internet market through generative AI and has lost search market traffic to other AI search applications and content platforms with built-in search tools.

According to the "AI Product Ranking's" domestic AI product visit volume rankings, the most popular product in March was AI chatbots, with products from major companies like Baidu, Alibaba, and ByteDance ranking top. However, by May, more scenario-based products began to emerge, including 360 AI Search, Meta AI Search, and Tiangong AI, which posed a threat to Baidu Search with their growth.

A similar scenario is playing out overseas. According to eMarketer's forecast, by 2025, Google's share of the U.S. search advertising market will fall below 50% for the first time, shaking its dominant position.

Ultimately, the changes generative large models have brought to Baidu Search are subtle and not obvious. Meanwhile, Baidu Search's "chronic illness" and user pain points are deeply rooted. Therefore, Baidu can't rely on large models to reshape search and regain user trust in the short term.

Is this a technical or genetic issue? For Baidu, new, minimalist, efficient, and personalized search services could disrupt its previous profit model based on pay-per-click ranking. Before Baidu finds a successful AI commercialization model, this is the last thing it wants to see happen.

A "dream" of ten years: Is Baidu still essentially a traditional advertising company?

2014 was a highlight for Baidu, the year it significantly invested in artificial intelligence, achieving notable accomplishments. If 2014 marks the beginning of Baidu's AI era, it's been ten years since Baidu began heavily investing in AI.

However, after ten years, Baidu doesn't seem to have successfully transformed into a leading AI company and is still in a gradual phase of change.

Currently, Baidu still earns most of its money from internet advertising. According to Baidu's third-quarter 2024 financial report, the company generated revenue of 33.557 billion yuan, a year-on-year decline of 3%. Baidu's main business comprises two segments: Baidu Core and iQIYI. The former includes online marketing revenue and non-online marketing revenue, with online marketing revenue accounting for 71% of core revenue at 18.8 billion yuan, a year-on-year decrease of 4%.

Online marketing revenue, centered on advertising services, accounts for over 70% and remains Baidu's core source of income. Looking at AI, the incremental revenue it brings to Baidu is limited. In the same quarter, Baidu Cloud revenue was 4.9 billion yuan, a year-on-year increase of 11%. Among this, 11% of cloud revenue came from external customers using large models and generative AI-related services. Based on this, generative AI contributed approximately 539 million yuan to Baidu Cloud's revenue during the quarter, negligible compared to total revenue.

This financial report shows that Baidu still struggles to monetize its AI technology, and the transition from search advertising to AI-driven revenue streams has encountered difficulties.

Financial figures are just one aspect. The key to transforming from an internet company to an AI-technology company lies in innovation capabilities. Whether it's technological breakthroughs or implementations, innovation is crucial. However, Baidu seems inherently lacking in the spirit of innovation and change. For a long time, it has held onto the important search entry point and become accustomed to easy profits in the PC era, causing it to miss the best mobilization opportunity and gradually fall behind in the mobile internet wave.

Although Baidu is now ahead of other major companies in embracing the AI trend, this trend seems to have come by chance rather than through innovation. The innovation gap doesn't seem to have been bridged.

In this wave of large model technology, from general to reasoning large models and from generative AI to intelligent agents, Baidu's actions have followed trends, announcing what's popular at the time. This has made its AI field layout chaotic and fragmented.

Specifically in applications, Baidu has also faced questions. After launching "Free Canvas," jointly developed by Baidu Wenku and Baidu Netdisk, the founder of an AI startup accused it of plagiarism, sparking widespread public discussion.

This is not the first instance where Baidu has been accused of plagiarism. Previously, Youdao Manual Translation took to Twitter to accuse Baidu Manual Translation of copying its interface design, service process, and page copywriting, demanding the removal of the plagiarized content and an apology. Similarly, Dianping sued Baidu Maps and Baidu Zhidao for stealing a substantial amount of user review information and presenting it to users, leading to Baidu paying a compensation of 3.23 million yuan.

The doubts surrounding Baidu primarily stem from skepticism about the authenticity of its technical prowess in the field of AI. To truly turn the tide, Baidu must either demonstrate genuinely cutting-edge technology or create innovative, groundbreaking applications.

Until that day arrives, Baidu can only wait anxiously.