Why NVIDIA, AMD, and Intel, the Three Chip Giants, All Bet on the Same AI Unicorn?

![]() 12/20 2024

12/20 2024

![]() 669

669

Author | Eric, Editor | Manman Zhou

"Revolutionizing Chip Industry Computing Power: Swapping Electricity for Light."

NVIDIA, AMD, and Intel, three fierce competitors in the industry, have unexpectedly joined forces to support a startup.

On December 13, Ayar Labs, a Silicon Valley-based optical I/O chip design company, announced the completion of a $155 million Series D funding round led by Advent International and Light Street Capital, achieving a valuation exceeding $1 billion and officially entering the unicorn club.

Multiple strategic investors participated in this funding round, including NVIDIA, AMD, Intel, GlobalFoundries, VentureTech Alliance (which has a strategic partnership with TSMC), and the American machinery manufacturing giant 3M.

What makes Ayar Labs so attractive to chip giants like NVIDIA, AMD, and Intel? What significance does optical I/O technology hold for the current AI era?

#01 Why Did the Three Giants Bet on Ayar Labs?

To understand why Ayar Labs is favored by these giants, one must first grasp the current AI landscape.

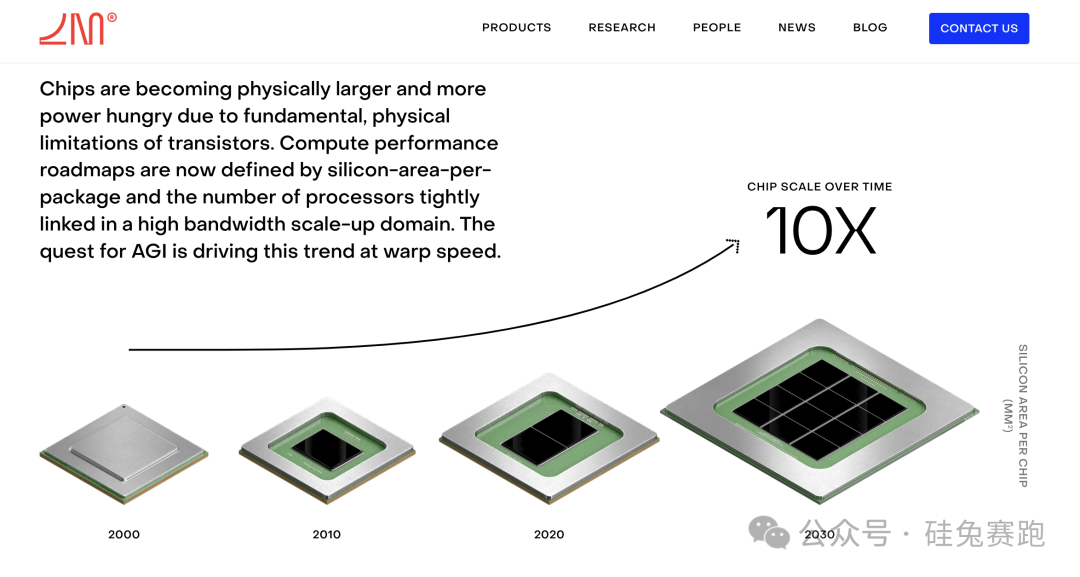

As demand for artificial intelligence grows, its systems are becoming increasingly complex and extensive, revealing significant efficiency declines. For instance, while a single GPU might operate at 80% efficiency, 64 GPUs might only operate at 50%, and 256 GPUs at just 30%.

Part of this inefficiency stems from traditional electrical I/O technology, which limits GPU data transmission performance and utilization through copper wire-transmitted electrons. Issues like high energy consumption and signal attenuation further exacerbate the problem.

Founded in 2015 and headquartered in San Jose, California, USA, Ayar Labs focuses on accelerating data center communication speeds and breaking data transmission bottlenecks through optical I/O technology.

In simple terms, optical I/O uses photons instead of electrons to transmit data, providing terabits per second (Tbps) of bandwidth, facilitating the easy transmission of large volumes of data. Unlike electrical signals, optical signals can be transmitted over long distances without significant bandwidth or signal integrity loss, and their power consumption is relatively lower.

Calculations reveal that in an ideal state, optical chips consume only 10% of the power of electronic chips, with latency at just 1%, while computing power under the same conditions can exceed 100 times that of electronic chips.

Optical I/O is pivotal to next-generation AI infrastructure, and Ayar Labs currently leads the industry in this technology.

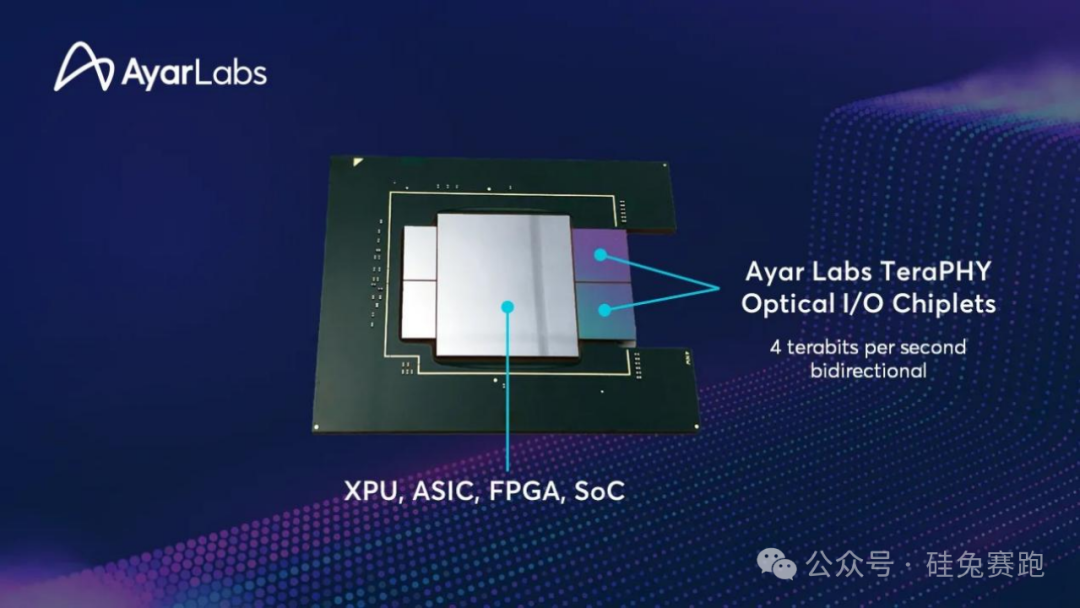

Ayar Labs is developing two products: the TeraPHY optical I/O chiplet and the SuperNova multi-port, multi-wavelength light source.

The compact TeraPHY optical I/O chiplet seamlessly integrates into advanced chip packaging, supporting up to 4 Tbps of bidirectional bandwidth with a latency of 5 nanoseconds per chiplet. Considering its speed, its power consumption of approximately 10W (5 picojoules per byte) is relatively low.

Designed to work seamlessly with TeraPHY, the SuperNova remote light source provides 16 wavelengths of light, supporting 16 ports and powering 256 data channels or 16 Tbps of bidirectional data. Compared to traditional interconnects like pluggable optics and electrical SerDes, the SuperNova offers 5-10 times higher bandwidth, 10 times lower latency, and 4-8 times higher power efficiency.

NVIDIA, AMD, and Intel's investment in Ayar Labs stems from their recognition of its technology, products, and commercial potential.

Take NVIDIA, for example. Over the past decade, it has accelerated AI a millionfold. For future growth, efficient data transmission technology is crucial to support increasing computing power demands. This necessitates new technologies like optical I/O to meet the bandwidth, power, and scale requirements of future AI/ML workloads and system architectures.

By investing in Ayar Labs, NVIDIA gains deep insights and priority access to its products and technologies, further optimizing its AI training platform, enhancing performance, and reducing costs. Additionally, Ayar Labs' technology aligns well with NVIDIA's existing roadmap, fostering a shared path forward.

For NVIDIA's competitors, Intel and AMD, leveraging Ayar Labs' technology to boost product performance and business prospects is even more crucial. Especially for Intel, its performance has significantly lagged behind NVIDIA and AMD.

Financial reports indicate that in the third quarter of fiscal year 2025, NVIDIA's revenue was $35.1 billion, a 94% year-over-year increase, with a net profit of $19.31 billion, up 109% year-over-year. In the third quarter of 2024, AMD's revenue reached $6.819 billion, an 18% year-over-year increase, with a net profit of $771 million, up 158% year-over-year.

In contrast, Intel's third-quarter 2024 revenue was $13.3 billion, a 6% year-over-year decrease, with a net loss of $16.639 billion, swinging from profit to loss. According to Bloomberg, Intel has already collaborated with Ayar Labs to integrate its technology into mass chip production.

While several industry players are involved in optical I/O, Ayar Labs stands out with scalable manufacturing capabilities and tangible commercial potential, attracting the three giants.

For instance, TeraPHY can enhance AI infrastructure computational efficiency and performance while reducing costs due to lower power consumption compared to traditional interconnects. It not only boosts AI product performance but also increases profitability through cost reduction.

Ayar Labs has already shipped around 15,000 units to some customers and plans mass production by mid-2026, aiming for annual shipments exceeding 100 million units by 2028 and beyond.

Despite its promising outlook, Ayar Labs faces stiff competition.

#02 Impressive Competitors

Capital investment in the optical I/O market has been frequent this year.

In September, Swiss optical interconnect startup Lightium AG completed a $7 million seed funding round. In October, US-based photonic computing and networking startup Lightmatter closed a $400 million Series D funding round, bringing its total funding to $850 million and valuing the company at over $4.4 billion. Also in October, another US-based photonic technology startup, Xscape Photonics, completed a $44 million Series A funding round, totaling $57 million in funding.

Founded in 2017, Lightmatter can be considered one of Ayar Labs' strongest competitors. After its Series D round, Lightmatter's valuation increased by about 3.7 times, making it one of the highest-valued optical chip startups.

After the Series D funding round, Lightmatter hinted that "this is likely the company's last funding round," suggesting it might be preparing for an IPO.

Lightmatter excels in attracting capital.

In terms of business, Lightmatter aims to enhance GPU or CPU chip interconnect layer efficiency, breaking modern data center bottlenecks. Its optical interconnect layer technology enables hundreds of GPUs to work synchronously, simplifying the training and operation of expensive and complex AI models.

Lightmatter's first product, Envise, is an AI-specific chip, while another product, Passage, facilitates chip data transmission interconnectivity, leveraging photons and electrons to improve operational efficiency.

Besides Lightmatter, other optical I/O startups also perform well. For example, Xscape Photonics' photonic solutions optimize AI data center network architecture, increasing GPU "escape bandwidth" by 10 times and reducing energy consumption by 10 times.

Notably, NVIDIA also invested in Xscape Photonics' Series A funding round, indicating its investments in multiple optical I/O market players, not just Ayar Labs, which underscores the significant potential of optical I/O.

Looking ahead, "swapping electricity for light" is revolutionizing chip industry computing power, representing a massive and rapidly growing market. According to Technavio's predictions, the global optical interconnect market will grow by $16.8 billion from 2023 to 2028, with a Compound Annual Growth Rate (CAGR) of 20.62%.

In this vast market, besides prominent startups like Ayar Labs and Lightmatter, established companies like Microsoft and Amazon are also making moves. Some media outlets even suggest that NVIDIA, known for its extensive investments, is developing optical I/O technology itself, hinting at tremendous industrial opportunities in this field.

References:

Optical chip interconnect startup Ayar raises $155M to bring light to AI workloads (siliconANGLE)

Nvidia, AMD and Intel Invest in Startup Bringing Light to Chips (Bloomberg)

Lightmatter's $400M round has AI hyperscalers hyped for photonic data centers (TechCrunch)