Roblox: A Pseudo-AI Platform Struggling for Profitability Over Two Decades

![]() 12/20 2024

12/20 2024

![]() 520

520

First, let me clarify that, in my opinion, any AI that fails to significantly contribute to a company's revenue can be considered pseudo-AI.

Roblox (RBLX.US), the world's largest online game development platform listed on the U.S. stock market, is celebrating its 20th anniversary this year. During the 2021 metaverse boom, the company's shares surged as a concept stock. However, as the commercialization of the metaverse failed to materialize, even industry leader Meta retreated, causing Roblox's share price to plummet accordingly.

Currently, Roblox is hailed by many media outlets as an AI concept stock with promising development prospects. In terms of business, the company did introduce generative AI to its platform in early 2023. However, unlike highly profitable AI concept stocks like Applovin and Palantir, Roblox has not only failed to turn a profit with AI but has also seen its costs escalate.

It's worth noting that Roblox boasts a user base three times that of PlayStation, three times that of Switch, and twice that of Xbox. Despite such a large user base, the company still struggles to achieve profitability, even with the aid of AI. This raises the question of what exactly is preventing Roblox from becoming profitable.

I. The IKEA Effect

The IKEA Effect refers to the cognitive bias where individuals develop a deeper emotional attachment and higher satisfaction with objects they have assembled or created themselves.

This concept was jointly proposed by American behavioral economists Dan Ariely, Daniel Mochon, and others. It is named after IKEA because its products often require consumers to assemble them, fostering a special emotional bond and higher evaluation for the furniture.

Roblox, a global gaming platform, benefits from the IKEA Effect. Its defining feature is User-Generated Content (UGC).

On the platform, users can experience and create various games while interacting online. Similar to assembling furniture, users can showcase their skills and creativity. Here, users are both game developers and players.

For game developers, the platform provides free creation engines and hosting services, eliminating the need for local servers. Moreover, thanks to Roblox's platform settings, creators' games can seamlessly switch between iOS, Android, game consoles, PCs, and VR, ensuring cross-platform accessibility without the need for separate versions.

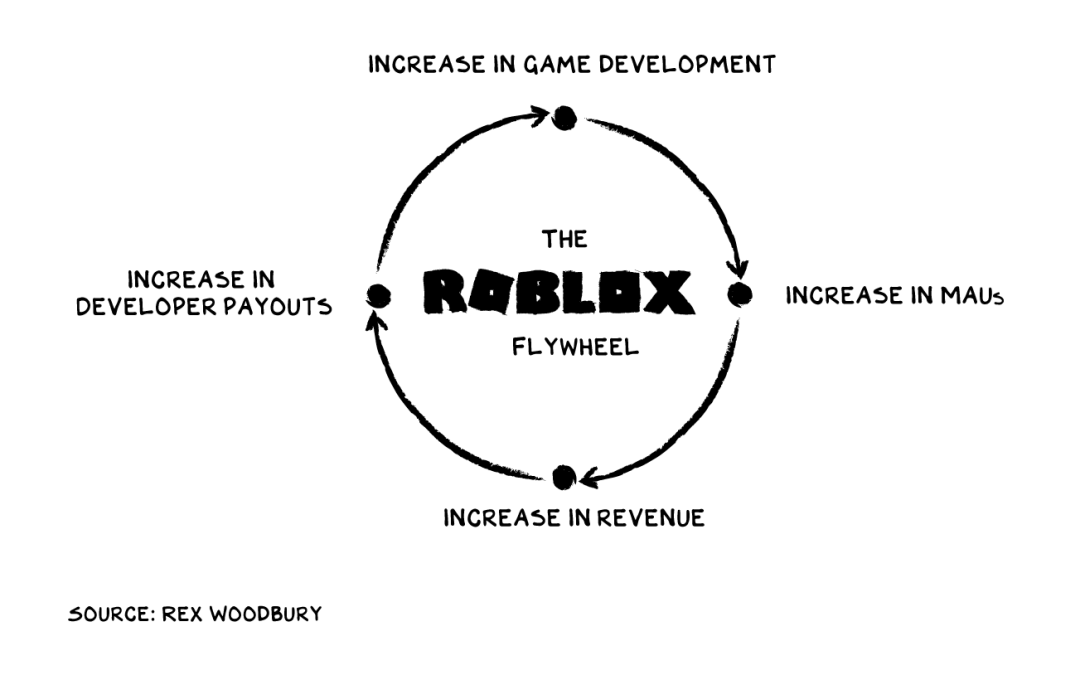

More importantly, Roblox has a robust incentive mechanism, typically paying one-quarter of its revenue to UGC developers. Since 2006, the company has distributed over $3 billion, with an annual distribution rate currently exceeding $800 million.

For players, the UGC orientation of the platform ensures continuous game updates and iterations. Currently, there are millions of games to choose from on Roblox, with players averaging 15 unique games per month, most of which are free, ensuring maximum freshness.

The low creation threshold and high-freedom development mechanism allow developers to immerse themselves in game development. The social attributes of online interaction and the endless supply of free games also keep players engaged. Roblox, embodying the attributes of UGC, has gradually become one of the world's largest gaming platforms.

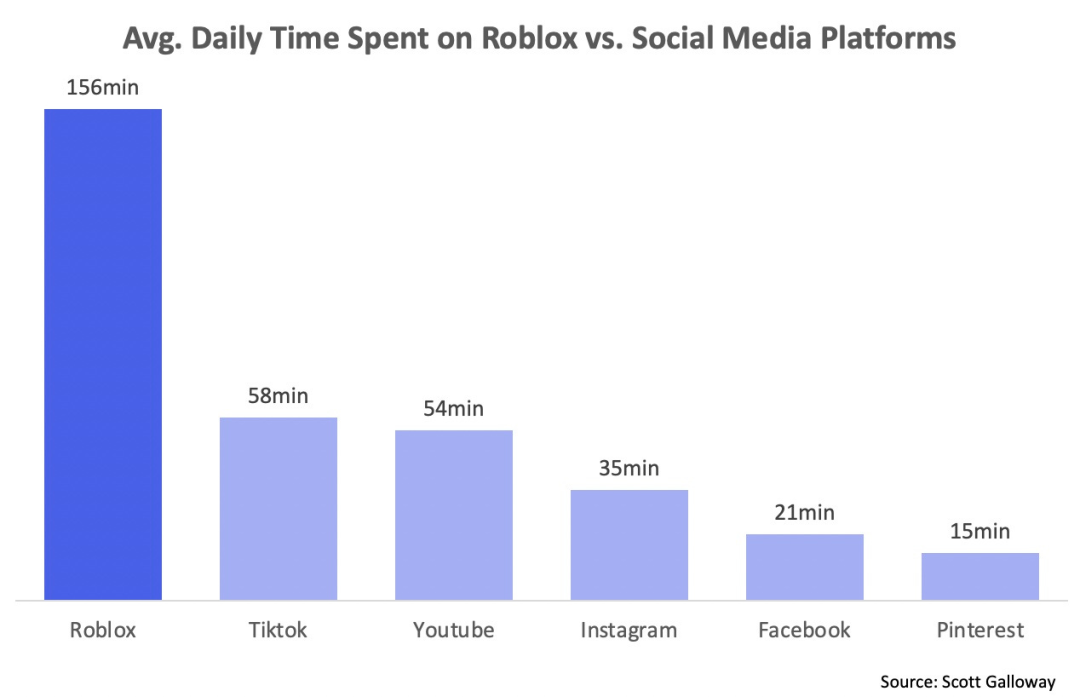

As of the third quarter of 2024, Roblox had over 88.9 million daily active users globally. According to 2023 data, the average time spent on Roblox was 155 minutes, significantly higher than on popular social media platforms like YouTube, TikTok, and Instagram.

This position is almost unassailable for Roblox.

Roblox's current scale and achievements are driven by the flywheel effect: more developers lead to more games, attracting more players and resulting in higher monetization and revenue sharing, which stimulates more development. This cycle forms a growth flywheel driven by both UGC and developers, creating a strong competitive advantage for Roblox.

With AI, UGC platforms can significantly improve creation efficiency. Creators can now complete parts of game scenes with just text prompts, further lowering the creation threshold and increasing platform activity.

Roblox recognized this potential and introduced AI services in the first quarter of last year. However, to date, AI remains an auxiliary tool rather than a performance driver. While AI+UGC enhances platform vitality, it may not necessarily lead to better monetization.

Roblox's business model focuses not only on stimulating player spending but also emphasizes advertising revenue. However, the core users attracted in the early stages with a low threshold have now become a hindrance to profitability.

II. A Barrier and a Drawback

Roblox's core users are young children with limited spending power and weak development capabilities. This has a devastating impact on the platform's two core revenue streams: advertising and user spending. The fundamental problem preventing Roblox from turning a profit in 20 years lies in its user base.

The significant difference in user engagement time compared to other platforms indicates that those spending so much time on games are predominantly internet-addicted teenagers. Statistics show that Roblox's primary users are American teenagers, with over half of all American children using the platform. Fifty-nine percent of players are under 17, and as high as 21% are under 9. These users spend at least 2 hours or more each day on Roblox.

Despite this loyal user base, Roblox has consistently shown good growth. In the third quarter of this year, platform activity reached an all-time high, with a net increase of 9.4 million DAU and a total user engagement time of 20.7 billion hours, a year-on-year increase of 29%.

Fortunately, nearly 80% of the new traffic came from youth/adult users over 13, indicating a positive trend in the platform's user structure. Expanding this user group with higher spending power is crucial for improving Roblox's monetization.

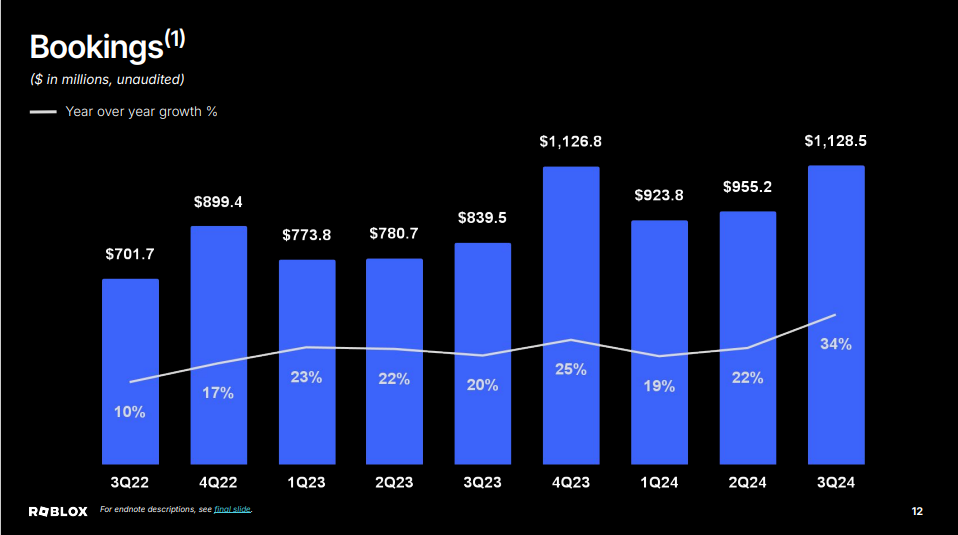

Meanwhile, bookings growth rebounded to 34% year-on-year. Compared to the second quarter, the growth in bookings in the third quarter was significantly higher than traffic growth. Older users' spending power is significantly higher, leading to a more pronounced increase in revenue when youth and adult users drive growth.

From this perspective, Roblox is undoubtedly successful. However, the problem is that it remains a children's platform. Currently, about 62% of daily users are under 17, and 42% are under 13.

These users ensure platform activity but have the drawback of limited spending power and development skills. It is almost impossible for Roblox to achieve high profitability with such a user base.

To get these players to spend money, parental consent is often required. Moreover, although the platform has a vast creator community, the development capabilities of such young ages cannot compare to professional teams, leading to uneven content quality and potentially affecting the retention and spending of premium users.

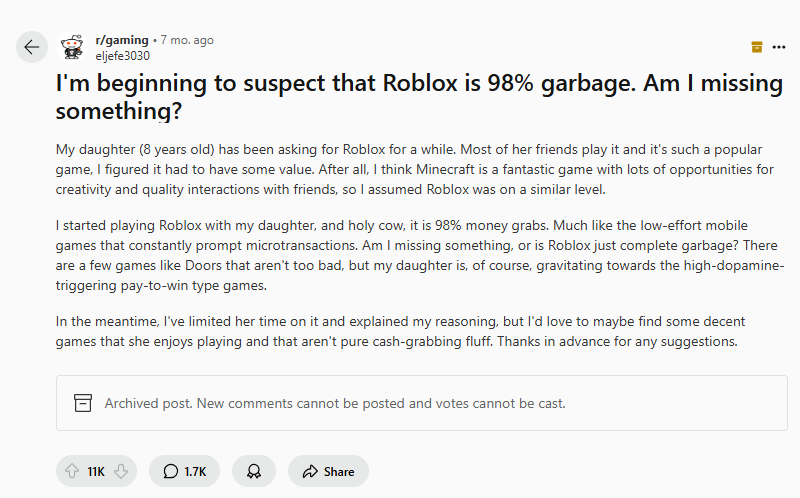

Many Reddit users have complained that most games on the platform are of poor quality.

The dominance of young users not only affects user spending levels but also hinders advertising revenue.

As a platform technology enterprise, Roblox is unique in that almost all its revenue comes from user spending rather than advertising. In contrast, YouTube, a platform with a strong advertising business, has 54.3% of its users aged between 18 and 34.

Obviously, target demographics largely determine a platform's commercial value.

Roblox's young users have limited purchasing power and are thus of little value to advertisers. Additionally, Roblox's online world offers an immersive experience. Prominent advertisements may interfere with gameplay, causing users to abandon the platform. This prevents aggressive overlay advertising and favors endogenous advertising.

However, endogenous advertising is distributed across users' creation experiences, reducing ad placement focus and effectiveness, further lowering advertisers' willingness to invest. To date, Roblox's advertising revenue is negligible.

By now, you may have noticed that Roblox is similar to Bilibili: both have loyal fan bases, are UGC platforms, and struggle with advertising. However, their gaming businesses differ slightly.

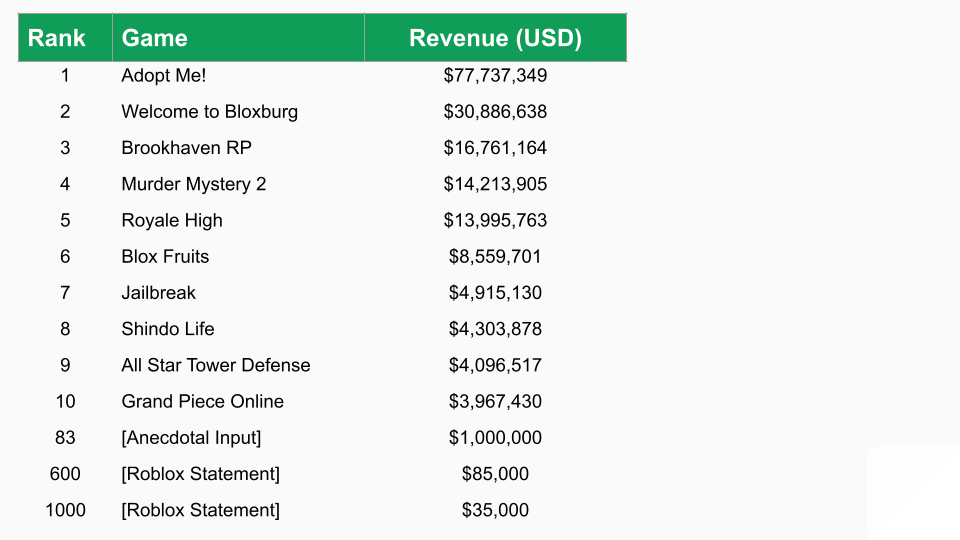

Roblox is a vertically integrated platform for game creation and distribution but does not develop games itself, leaving the creative aspect entirely to UGC users. The vast UGC user base provides millions of games, but high-quality content is scarce. "Adopt Me!" is a notable exception, developed by an independent studio, Uplift Games, with about 40 employees, and is one of the most popular games on the platform.

Source: naavik (By David Taylor)

This shows that Roblox's growth flywheel relies on a few top creators. The platform cannot function without professional teams, leading to high costs for game engines and creation tools due to their infrastructure requirements.

Roblox has many such uncontrollable costs, which, when combined, become a significant burden on profitability.

III. Inability to Profit and Dilution of Equity

It is predictable that with AI, professional teams on the platform can delegate art and graphic design tasks, simplifying the creation process and potentially increasing high-quality content supply, thus improving monetization.

However, the problem is that the costs of improving monetization far outweigh the benefits. Unfortunately, most of these costs are beyond Roblox's control.

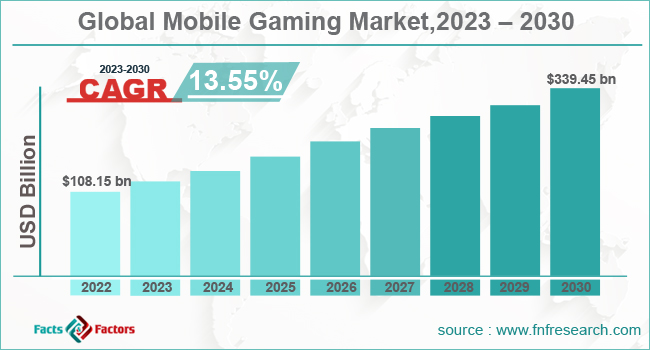

First, nearly 80% of the platform's users are on mobile devices, subject to the Apple tax. Financial statements reveal that about 23% of the company's revenue is consumed by various app store fees, such as those from the App Store. Although Apple has been ordered by the European Union to reduce its commission rate, app store fees remain a fixed cost that Roblox cannot reduce in the short term.

Additionally, infrastructure costs consume about 28% of revenue, another uncontrollable expense. The platform needs to provide free game engines and hosting to ensure creative vitality, resulting in a fixed service cost for every hour of operation.

Another 26% of revenue goes to UGC developers as revenue sharing. These are key users driving the flywheel, and any reduction in their share can affect revenue growth, making this cost difficult to cut.

The remaining 29% is spent on R&D. The company continuously invests in advanced tools like generative AI, raising this expense to its highest level in nearly a decade. Company executives have repeatedly stated that to enhance the platform's appeal, R&D costs will not decrease significantly in the coming years.

Generative AI indeed offers opportunities for the gaming ecosystem by simplifying the creative communication value chain. However, running AI is not cheap. Frequent use of GPT during creation consumes significant computing power. Adding a chatbot to a game may not guarantee increased player spending but will definitely increase the company's large model costs.

At this point, uncontrollable costs like the Apple tax, infrastructure, developer revenue sharing, and R&D expenses have completely eroded or even exceeded revenue. Over the past 12 months, Roblox has spent an average of $138 for every $100 of revenue. How can such a company achieve profitability?

Moreover, the encouraging growth in older users may not necessarily stem from improved platform competitiveness. The current trend in the gaming industry favors mobile and free-to-play games. To retain these premium users, the company's costs cannot be significantly reduced.

Even more concerning, from a cash flow perspective, while the company generates consistent free cash flow, employee compensation expenses are almost entirely offset by stock compensation. This dilutes investment value, a nightmare for investors.

Roblox currently has a price-to-sales ratio of 11.6x. While this valuation may not seem high among genuine AI stocks, given its questionable profitability potential, the current valuation remains risky, posing a significant risk of market value decline. In the event of a sharp drop, the investment value will undoubtedly accelerate its dilution due to the combined effects of declining market value and stock compensation expenses.

Conclusion

As a metaverse concept stock, Roblox has repeatedly garnered significant market buzz regarding its stock structure. Nonetheless, the company has yet to achieve profitability in this period.

Despite the promising potential of AI technology in future development, Roblox currently struggles to even generate revenue from its core business. Incorporating AI into its operations would only exacerbate its cost burden.

During this year's third-quarter earnings announcement, Roblox's management conceded that they had not witnessed any phased changes and did not foresee higher long-term growth rates. Instead, the company prioritizes security issues over high growth. Given that the platform's primary users are mentally immature children, the safety supervision of these users poses a significant global challenge that impacts Roblox's globalization efforts.

Amid limited profitability potential and regulatory risks, Roblox continues to raise funds through stock issuance. For existing shareholders, the value of their holdings has already been intangibly 'depreciated'.