The First Year of AI Advertising Boom: Can XD.com Become the Next Applovin?

![]() 12/21 2024

12/21 2024

![]() 598

598

If 2023 marked the rise of large AI models, then 2024 is undoubtedly the inaugural year of the AI advertising explosion.

Across the pond, Applovin has turned its fortunes around with its intelligent advertising distribution engine, resulting in a stock price surge exceeding 30 times its initial value. It has emerged as a star in the AI field and even the entire U.S. stock market.

Meanwhile, XD.com, another company deeply engaged in game developer service platforms, has undergone a significant revaluation this year.

Since the beginning of 2024, XD.com's share price has been on an upward trajectory, rising from HK$10 at the start of the year to HK$26 currently. This forms a "U" shape compared to previous years' share price trends, marking a 90% increase.

With a double recovery in share price and performance, the TapTap platform has become a key factor favored by investors.

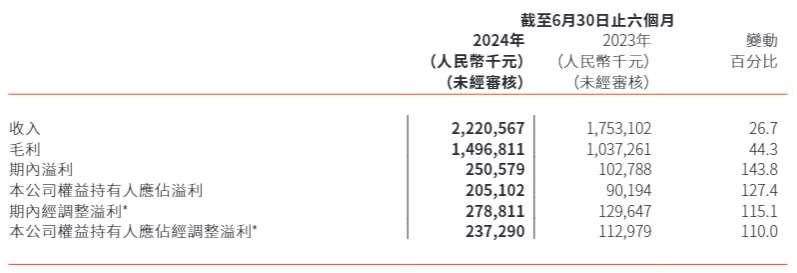

According to the latest financial report, XD.com's performance this year has been outstanding. The company achieved revenue of RMB 2.221 billion, a year-on-year increase of 26.7%, and net profit attributable to shareholders of RMB 205 million, a year-on-year increase of 127.4%. In the first half of the year, gross profit reached RMB 1.497 billion, a year-on-year increase of 44.3%, with a gross margin of 67.4%, an increase of 8.2 percentage points from the same period last year.

From a business breakdown perspective, the company's game business achieved revenue of RMB 1.486 billion, a year-on-year increase of 29.3%. Among them, online game revenue was RMB 1.426 billion, a year-on-year increase of 32.0%; paid game revenue was RMB 55 million, a year-on-year decrease of 14.5%.

The rapid growth of XD.com's game business is primarily attributed to the strong performance of several self-developed games this year. In January and May 2024, the company successfully launched "Departure: Muffin" in Hong Kong, Macau, Taiwan, and mainland China. After its launch, the game consistently ranked in the top 10 on the iOS game charts, driving revenue growth alongside "Sword of Lily" and "Torchlight: Infinite". In July, the self-developed game "XD Town" was launched in mainland China, sparking heated discussions on social media upon release and achieving over 25 million downloads in its first month.

In addition to the game business, information service revenue also achieved excellent results of RMB 734 million in the first half of the year, a year-on-year increase of 21.7%. Among them, user growth significantly contributed to revenue. It is reported that the average monthly active users (MAU) of the TapTap China app increased by 27.3% year-on-year to 43.2 million.

Benefiting from the dual drive of games and TapTap advertising, XD.com achieved a double recovery in share price and performance in 2024.

Simultaneously, multiple institutions have rated XD.com as a "buy," and most sell-side estimates have increased revenue by over RMB 100 million from last year's total revenue. Currently, based on the performance of XD.com's new games and the stable growth of TapTap, this goal is achievable.

Some investors argue that compared to other pure game companies, XD.com's greatest potential lies in TapTap, and pure game companies cannot be valued excessively high.

Guoyuan Securities also pointed out in its review of XD.com's 2024 interim report: The launch of new games has driven rapid performance growth, and the TapTap platform has become a key factor for investors to favor XD.com.

The value of TapTap is rapidly unleashed through products, markets, and policies.

The prominence of TapTap in XD.com's business value is closely related to the product itself, market demand, and favorable policies.

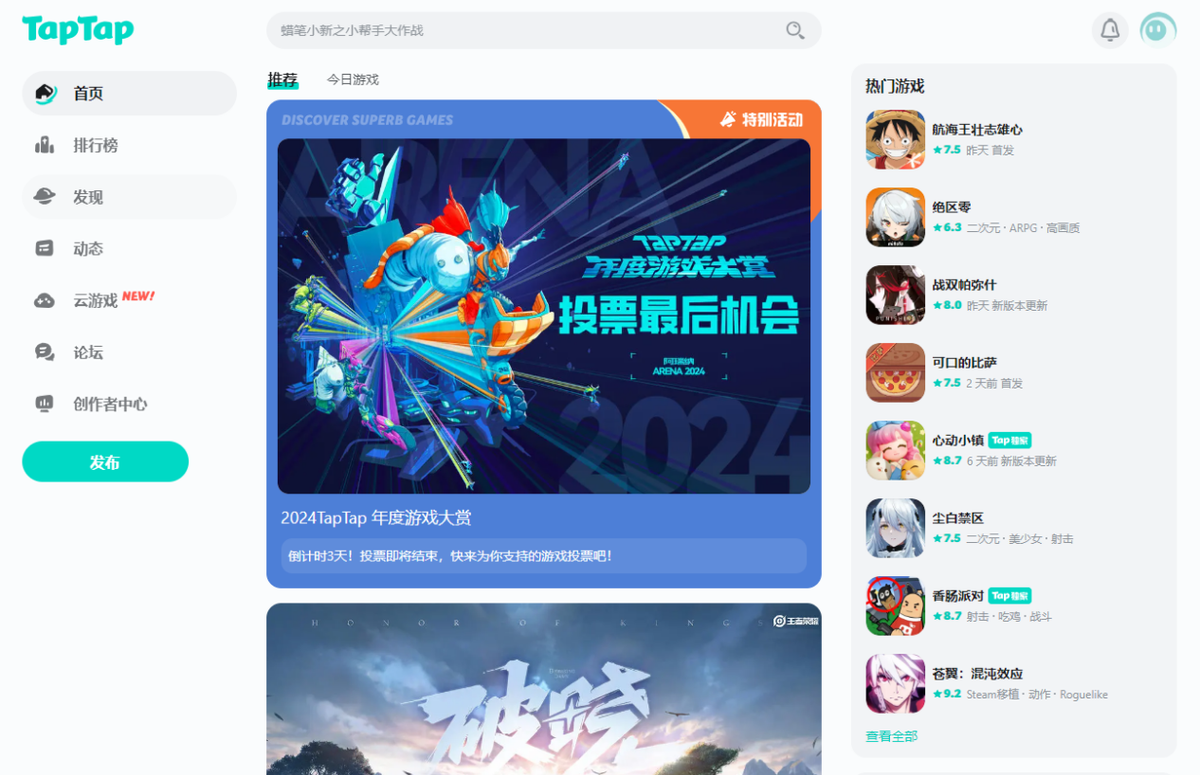

From a product perspective, TapTap excels in third-party game introduction, high-quality content mining, and operation mode.

TapTap first acquires exclusive content through self-developed games and then uses this high-quality content to attract organic traffic and achieve user growth. For example, the recently launched first-party game "Departure: Muffin" utilized thousands of materials, successfully driving an increase in TapTap user activity. After the first-party traffic enters, TapTap adopts a "no joint operation revenue sharing" model to attract third-party developers to settle in. Simultaneously, it has also launched a new developer service system (TDS), aiming to provide more detailed and effective services for third-party developers.

Such as "no joint operation revenue sharing": TapTap does not take a cut from the revenue of third-party developed games. It also provides third parties with comprehensive operational data packages such as basic services, testing, and updates, helping third-party developers develop content and operate communities on TapTap.

It is reported that as of March this year, approximately 270 exclusive games were included in TapTap, of which over 160 are available for trial downloads, including many exclusive game masterpieces.

Third-party developers use game forums for community marketing and content operation, further enriching TapTap's content and bringing fresh content to the platform, gradually forming a thriving vertical ecosystem. This community ecosystem further attracts user growth. Based on this, TapTap has formed a virtuous cycle of collaboration and symbiosis, shaping its unique competitive advantage as a "moat".

It is precisely such a viable business loop that allows TapTap to build its competitive advantage and gain the courage to enter the international market. The overseas version of TapTap has already been launched, and its responsible person revealed that there is currently no platform similar to TapTap overseas.

From a market perspective, TapTap is also highly sought after. From a third-party standpoint, for a game to become a breakout hit, in addition to the gaming experience, marketing and distribution are crucial. Compared to large game companies with high marketing investments, small and medium-sized developers do not have as much advertising budget. To make users aware of their games, they often rely on game forums or community marketing.

TapTap provides a low-cost distribution channel and can provide third-party developers with a finely operated game community, which is very friendly to games with unique gameplay. Game developers can build communities on TapTap and complete user operations, thereby establishing a reputation and acquiring new users.

On the other hand, users also need a game community with rich content, diverse types, and high quality to meet their selection needs.

According to iiMedia Research data, among Chinese game users' preferences for game types in 2023, 40.74% prefer casual and puzzle games, 28.71% prefer RPG role-playing games, 31.90% prefer STG shooting games, 18.28% prefer party and board games, and 29.69% prefer MOBA multiplayer online tactical arena games. A large portion of this group prefers two or more game categories simultaneously. A game community with diverse game types, each with unique characteristics and gameplay, can bring users different experiences.

Meanwhile, according to an iMedia Research survey of game users, current game users also value the convenience and flexibility of games. They hope to enjoy high-quality large games anytime and anywhere, without being restricted by devices.

When opening the TapTap game ranking page, there is a popular tag, including various game genres such as role-playing, simulation, strategy, card, and Roguelike.

Recently, TapTap also launched a cloud gaming function, which transfers the game's computing and storage processes to cloud servers, allowing players to play games across platforms and terminals without being limited by hardware performance.

From a policy perspective, TapTap has also welcomed a favorable period. As of November this year, the number of approved game licenses in China reached 1,281, including 1,184 domestic online game licenses and 97 imported game licenses, an increase of 206 game licenses compared to last year, undoubtedly sending a positive signal: Game license restrictions may be lifted.

The further decentralization of license restrictions has inevitably led to increased competition in the game market. Under this trend, TapTap, as a game advertising distribution service platform, has naturally become a sought-after option for game companies.

Based on a huge user base and synergies with new games, TapTap is highly "scarce" in the industry. Simultaneously, the precise delivery of AI advertising and timely user feedback also provide a strong development impetus for TapTap.

The first year of the AI digital advertising explosion, where are XD.com's opportunities?

This year, the capital market has witnessed a significant explosion in AI advertising. As one of the important growth engines of the TapTap platform, AI advertising brings broad prospects to XD.com.

A research report from China Securities noted that in 2023, driven by GPT, North American AI advertising, AI education, and data services saw significant gains; while in 2024, the commercial value of a new generation of productivity tools in North America began to stand out. Simultaneously, in China, AI productivity tools widely cover C-end users, and B-end users are more willing to pay, potentially leading the way in the explosion.

The senior management of XD.com is also keenly aware of the development potential of AI advertising and is actively deploying AI empowerment. It is understood that XD.com holds multiple weekly work meetings themed around AIGC, deploying and implementing strategies in various fields such as algorithms, products, and art.

It is reported that the ongoing reforms at the company include the art middle platform exploring and deploying a new workflow centered on AIGC, as well as training and production related to Stable Diffusion. Utilizing LLM and GPT API-related technologies, the company is upgrading, researching, and testing the forms of its existing products. AI advertising has become the focus of its research and application.

On the one hand, TapTap can analyze user discussions, game preferences, payment tendencies, and other information, using algorithms to recommend and accurately match game products, helping developers improve advertising efficiency. On the other hand, AI-empowered advertising can reduce advertising production costs and help third-party developers quickly generate advertising materials.

During 2023-2024, the proportion of advertising spend through oCPA bidding (smart optimization tool) has continued to increase. More and more developers are willing to transmit post-game link data back to TapTap, efficiently acquiring high-quality paying users through model learning and improving the advertising return on investment.

With XD.com's advantages in AI game advertising distribution, coupled with the explosion of China's AI industry, its flywheel and network effects are accelerating.

As of October 2024, advertising placements within TapTap have increased, with a year-on-year increase of 43% in exposure, accounting for 10% of the gaming industry's advertising market. As the number of game developers increases, more and more developers choose to advertise on TapTap when launching new games to increase user acquisition during the initial launch period.

Valuation increase, performance growth, XD.com is worth looking forward to in the long run.

Currently, XD.com's share price stands at HK$26.85, in stark contrast to the share prices of North American AI advertising service providers Applovin and The Trade Desk (TTD), which are as high as $313.07 and $127.93, respectively.

In the field of AI advertising applications, XD.com echoes the gradual recovery trend of Chinese asset valuations, demonstrating huge growth potential.

Relying on the unique advantages of its TapTap platform and strong self-developed game development capabilities, XD.com occupies a unique position in the capital market's gaming sector. Currently, XD.com is standing at a new starting point, ready to make strides forward.

In the future, the company is expected to realize double growth in share price and performance by deeply exploring the potential of AI advertising technology and actively promoting the internationalization of its gaming business.