NVIDIA Chip Buyers Unveiled: Microsoft Leads, Followed by ByteDance

![]() 12/23 2024

12/23 2024

![]() 617

617

Text/Yang Jianyong

Undoubtedly, NVIDIA stands as the paramount beneficiary in the era of generative AI. It's no exaggeration to state that the prowess of a company's AI large models is a direct reflection of the number of NVIDIA cards they possess. In the realm of high-performance AI chips, NVIDIA enjoys a near-monopoly, with an estimated market share exceeding 80% and potentially reaching 90%.

To build robust AI infrastructure for training large models, technology giants invest heavily. The top four tech giants—Meta, Google, Microsoft, and Amazon—alone have poured up to $200 billion into artificial intelligence. Billions have been spent on acquiring NVIDIA chips to bolster their AI capabilities.

Amid this buying spree, NVIDIA chips have become scarce and highly sought-after, propelling exponential performance growth.

For the fiscal third quarter of 2025 (ending October 27, 2024), NVIDIA reported revenue of $35.082 billion, marking a 94% year-on-year increase. Data center segment revenue amounted to $30.8 billion, a 112% surge compared to the same period last year, with annual revenue projected to reach $140 billion.

It's noteworthy that NVIDIA chips, despite their high demand, also command premium prices. Consequently, NVIDIA has emerged as one of the world's most profitable tech companies. In the third quarter, its net profit was $19.309 billion, a 109% year-on-year increase.

As technology giants vie to acquire NVIDIA chips, who are the key buyers?

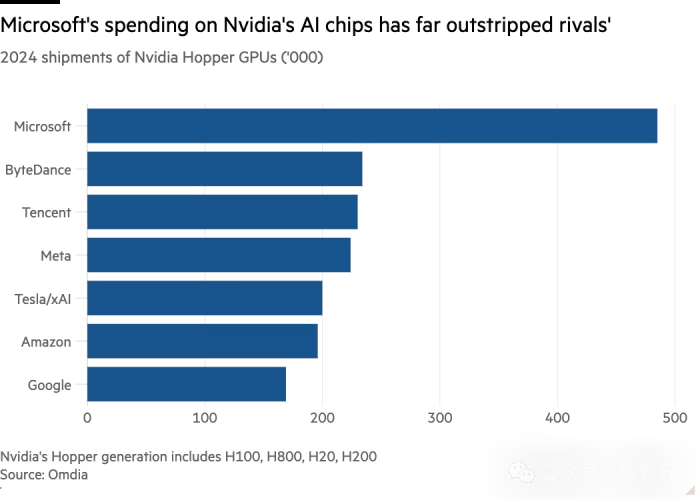

According to leaked data, Microsoft, ByteDance, Tencent, Meta, xAI, Amazon, and Google are prominent buyers, with Microsoft leading the pack.

Omdia estimates suggest that Microsoft purchased 485,000 Hopper chips this year, double the amount acquired by other buyers.

Microsoft's status as a major purchaser of NVIDIA GPUs is primarily driven by its cloud-first development strategy, which involves substantial investments in data center construction. These chips are primarily utilized to enhance the AI capabilities of its Azure cloud services.

Microsoft has dedicated itself to establishing Azure as the world's leading AI infrastructure, ranking as the second-largest public cloud provider globally. Its market share continues to grow, gradually closing the gap with Amazon.

In terms of revenue, Microsoft is the world's largest cloud service provider, encompassing IaaS, PaaS, and SaaS, and standing out in the entire cloud ecosystem.

For the fiscal first quarter ending September 30, 2024, Microsoft's cloud revenue reached $38.9 billion, a 22% year-on-year increase, accounting for 59% of total revenue. Within this, intelligent cloud revenue was $24.1 billion, up 20%, with Azure and other cloud service revenues growing by 33%.

Driven by AI, Microsoft's cloud business has exhibited robust growth, contributing to a record-high quarterly revenue. For the fiscal first quarter of 2025, Microsoft's total revenue was $65.6 billion, a 16% year-on-year increase, with a net profit of $24.7 billion, up 11% year-on-year.

Not only is Microsoft's revenue driven by AI, but the capital market has also thrived, consistently reaching new highs with a market capitalization exceeding $3 trillion, currently at $3.25 trillion. Evidently, Microsoft is also a winner in the generative AI era.

Among the global key buyers of NVIDIA chips, ByteDance and Tencent stand out as domestic manufacturers, ranking second and third, respectively. ByteDance, as the largest domestic buyer, has continued investing and become a significant large model vendor in China. Its Doubao large model is even engaging in a price war in the domestic market to capture share. The unit price of the Doubao visual understanding model has plummeted to RMB 0.003, 85% lower than the industry average, ushering in the era of "cent" pricing for visual understanding large models.

Finally, with the proliferation of large models, technology giants have embarked on a new round of large model competitions. However, AI large models cannot function without NVIDIA's high-performance chips. Both tech giants and startups developing AI large models rely on NVIDIA's AI platform. Overall, generative AI serves as a significant driving force for technological development, with NVIDIA at its core, playing a vital role in various AI applications across multiple fields.

Benefiting from the generative AI trend, NVIDIA has capitalized on its absolute advantage in the GPU field, achieving rapid growth and potentially becoming the first company globally to surpass a market capitalization of $4 trillion.