Li Dongsheng Aims High with TCL's AI Push

![]() 12/24 2024

12/24 2024

![]() 689

689

In 1985, Warren Buffett liquidated Berkshire Hathaway's textile business.

Over the past two decades, Berkshire Hathaway underwent mergers, reorganizations, and significant investments. Initially, these efforts seemed economically viable, but as competition intensified, they yielded meager returns. Realizing they couldn't establish a competitive edge, Buffett admitted in his shareholder letter that year that he had "learned a lesson":

"When confronted with a sinking ship, it's better to seek a better vessel than to constantly bail out the water."

Berkshire Hathaway's transformation serves as a metaphor for manufacturing companies grappling with internal competition.

With China already established as the world's factory, numerous players seek to deviate from predetermined paths. In the home appliance industry, while Haier continues its steady global operation of "home appliance department stores" and Midea ventures into industrial automation, TCL aims to transform itself through AI.

On December 11, TCL announced 16 technological advancements at the Global Technological Innovation Conference, including five AI applications. Among them, AI intelligent operations and AI simulation focus on smart manufacturing software; the Xingzhi X-Intelligence 2.0 platform serves as TCL's internal AI database; the XiaoT AI Control Hub is an AI assistant for TVs; and AI filmmaking utilizes large AI models to create movie trailers.

From an AI application perspective, TCL's achievements don't represent a groundbreaking product upgrade. However, TCL believes that by focusing on AI, it can stay ahead in the next era.

"The rise of AI is driving industrial transformation, and the disruption of old and new technologies profoundly impacts the global economy. Currently, technologies like large models and generative AI are rapidly evolving, expanding into various fields. Although AI technology and business models are still maturing, AI could see explosive growth opportunities in some fields over the next three to five years," said Li Dongsheng, founder and chairman of TCL.

Just five months ago, Li Dongsheng was inspecting TCL's progress in various markets, essentially "circumnavigating the globe." As a manufacturing giant that ventured overseas over 20 years ago, TCL has a presence in over 160 countries and regions. Its expanded photovoltaic business in 2020 ranked first in silicon wafer shipments in the first three quarters of this year.

Why is TCL focusing on AI when its business is thriving?

Perhaps it's because Li Dongsheng recognizes the limitations of manufacturing in internal competition. The panel industry has just recovered from overcapacity this year. In the photovoltaic sector, TCL has resorted to price reductions, effectively giving "red envelopes" to downstream enterprises for an entire year.

Emphasizing AI may be TCL's attempt to emulate Berkshire Hathaway's transformation. But can TCL truly break the internal competition in manufacturing with AI?

What new tricks can TV + AI bring?

Since TCL rolled out its first color TV in Huizhou in 1993, it has built an empire centered around TVs. Today, through TCL Industries and TCL Technology, TCL focuses on two main avenues: smart terminals (primarily TVs) and semiconductors (primarily panels + photovoltaic silicon wafers).

Focusing on the AI applications announced this time, TCL has decided to enhance its industry competitiveness with AI by focusing on content, viewing experience, and manufacturing optimization around TVs, its core display product.

In terms of content, there's AI filmmaking. Since 2024, AI video has entered the commercialization stage. In July this year, a sci-fi short film produced by Bytedance's video generation tool Jimo, "Sanxingdui: Revelation of the Future," garnered 140 million views shortly after release, proving consumers are willing to pay for AI videos. On the other hand, in terms of creativity and artistic aesthetics, Kuaishou's K-Studio, in collaboration with nine film directors, demonstrated that AI videos can not only stabilize images but also achieve special effects at minimal cost.

The achievements of these two short video platform companies in AI video are underpinned by a battle for users' screen time. Similarly, in the context of watching TV programs, TCL, which offers streaming services, is keeping pace with Netflix.

Currently, TCL has premiered five short films created using its AI content creation platform in Hollywood. In 2025, TCL will also release a 90-minute AI film in North American theaters. Specific details about the film are currently unknown, but from some clips, TCL's AI films exhibit a variety of artistic styles, reminiscent of "Love, Death & Robots."

In terms of viewing experience, TCL has also introduced a TV AI assistant through the XiaoT AI Control Hub. In terms of interaction effectiveness, TCL's XiaoT AI Control Hub isn't particularly powerful, essentially performing at the level of an ordinary smart TV, capable of responding to multiple rounds of vague voice commands. Compared to Hisense's Xinghai large model, which offers real-time movie interaction and split-screen query functions, TCL's interaction tends to follow a "command-execute" model.

The slightly weaker capability of TCL's large model may be due to its deployment on the client side. During the conference, Yan Xiaolin, CTO of TCL Technology, mentioned that the model has been compressed, making the interaction cost very low. "With basically unchanged performance, a smart TV can interact infinitely, costing only a few cents per interaction, providing consumers with both affordable and user-friendly experiences." Additionally, TCL demonstrated an AI blogging application comparable to Google's NotebookLM, which can convert web pages in various languages into AI podcasts and support multilingual translation.

Image: TCL TV AI Assistant Source: Internet

In terms of visual experience, TCL has also released an AI-based picture optimization solution this year. Fundamentally, as TV sizes increase and resolutions get higher, to ensure exquisite display on every inch of the screen, the entire image needs to be processed in zones. To achieve more precise display effects in each zone, many manufacturers have introduced AI to assist in image control.

Among them, Hisense and Samsung equip their TVs with AI image quality chips that use AI for light control and computational optimization of images (e.g., upscaling 2K images to 4K). While TCL hasn't ventured into AI image quality chips, it can still use algorithms to optimize audio and video through its Fuxi AI large model.

In terms of viewing experience, TCL's AI functionality is slightly inferior to its competitors. However, as one of the few players in the industry that manufactures its own panels (others include LG and Samsung), TCL is also using AI to improve manufacturing quality.

The AI intelligent operations and AI simulation announced by TCL this time primarily use AI to optimize industrial manufacturing processes. Additionally, in AI industrial applications, TCL has updated its Xingzhi X-Intelligence, which it collaborated on with Zhipu AI last year, to version 2.0. Regarding the initial results of AI application in manufacturing, Li Dongsheng introduced that "this year, TCL generated an additional benefit of 540 million yuan through AI applications." Next, TCL will further apply AI in research and development, manufacturing, and other fields.

Overall, TCL's latest AI applications don't represent sufficiently differentiated achievements. Many of its functions and application directions are already common knowledge among industry players. TCL's AI development, which largely follows industry trends, seems insufficient to match the height of its next "decade-long strategy."

"The next decade will witness rapid development in artificial intelligence. All products deserve to be redeveloped using AI, and intelligence will become a critically important technological strategy. TCL's products, whether white goods or black goods, are actively embracing AI," said Sun Li, CTO of TCL Industries.

In fact, TCL's AI strategy stems from a "worry" that has persisted for over 20 years.

Will AI upgrade TCL's industry?

TCL's strategic emphasis on AI originates from a "pain point" 20 years ago.

At the end of 2004, Li Dongsheng heard in Paris that the company had incurred a loss of 30 million euros and had to juggle the sharp decline in the mobile phone business upon his return to China. During the most difficult year of 2005, TCL sold two of its businesses to the French company La Grand Equipe to make up for losses incurred from overseas mergers and acquisitions.

TCL's difficult times were a result of its previously "too smooth" development. In China, a market with enormous domestic demand, early manufacturing players only needed to focus on production volume to reap substantial profits. With sufficient cash flow from their main business, business operators tended to prefer mergers and acquisitions and new business ventures over research and development.

This operating model has cost China's home appliance industry dearly. The extensive production capacity resulting from these mergers and acquisitions and emerging markets couldn't quickly adapt to market demand for technological iteration. Previous lack of attention to technology may have led companies astray.

Focusing on TCL, it was unclear which direction to take amidst the intergenerational shift in display technology. The only option was to merge and acquire to "gamble" on securing a "ticket" for the next era.

"When we merged, there was one thing we didn't get right, which was the future direction of televisions. Would it be plasma or LCD? At the time, more people believed in PDP plasma. Thomson had strong DLP technology, and we believed their rear-projection DLP was superior to plasma," Li Dongsheng recalled of the 2003 merger.

In retrospect, TCL made the wrong choice with its 90 million euro gamble that year. After reflection, Li Dongsheng established the TCL Industrial Research Institute on July 1, 2005.

As Li Dongsheng emphasized at the innovation conference, "In the current market competition, low-price competition has no way out and will only lead to endless 'internal competition.' To surpass competitors, we must strive for more breakthroughs in mid- to high-end products." After "struggling" with technology for 20 years, TCL is eager for an industrial upgrade.

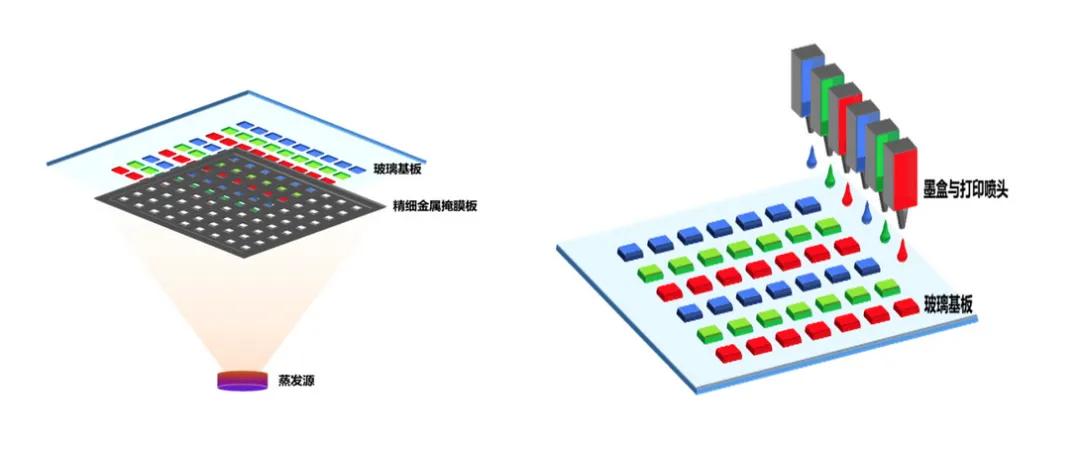

In the panel display market, TCL's main competitors are Samsung and BOE. (The top three global TV market share holders are Samsung, TCL, and Hisense, with Hisense's panels primarily sourced from BOE.) In the manufacturing process, TCL successfully mass-produced printed OLED in November this year. Compared to BOE and Samsung's OLED evaporation process, the organic material utilization rate of the printing process is as high as 90%, double that of the evaporation process. Additionally, since printed OLED doesn't require a demanding high-temperature vacuum environment, the overall manufacturing cost is lower. This is expected to further widen the net profit margin gap with BOE.

In the first three quarters of 2024, TCL Huaxing Semiconductor Display generated revenue of 76.956 billion yuan and net profit of 4.443 billion yuan, with a net profit margin of 5.8%. BOE didn't disclose a breakdown, but considering that display business revenue accounted for over 80% of total revenue, its net profit margin based on net profit attributable to shareholders was 2.3%.

Image: OLED Evaporation and Printing Processes

In optimizing the manufacturing process, TCL has simultaneously implemented AI-optimized industrial software within its internal manufacturing. Next, TCL is attempting to turn its experience into industry solutions.

As He Jun, Vice President of TCL Industries and CEO of Getech, said, "In manufacturing, AI is converging with industrial software and production equipment." AI can not only accelerate the iteration of industrial software but also reduce the time cost for manufacturing system development and engineer learning. Drawing inspiration from the application of mobile AI agents, TCL is attempting "AI automation" in the industrial field by introducing natural language into software development, enabling all employees to better manage materials, energy, supply chains, and other platforms.

It's evident that after 20 years of development, TCL's business expansion logic hasn't changed substantially. Whether it's panel technology or AI industrial software, TCL still adheres to the mass production mindset of the manufacturing industry. The difference lies in TCL's transition from a technological "novice" to a player with sufficient differentiation. Combining the results of AI applications, TCL has also embarked on a business expansion path different from its past hardware manufacturing.

Perhaps TCL's current AI capabilities aren't yet sufficient to bring about a qualitative change in the company. However, TCL is already convinced that it will find greater opportunities in AI.

TCL is seeking its fourth growth curve

From a corporate development perspective, AI is the clue TCL is following to find its "fourth growth curve."

As TCL sought new growth spaces beyond TVs and panels, it also considered AI. Starting in July 2017, TCL began a series of investments in semiconductor companies, covering flash memory, chip design, chip testing, and even navigation chips. The two AI-related investments were in SenseTime in July 2017 and Cambricon in June 2018.

This exploration of the "third growth curve" eventually culminated in TCL's acquisition of Zhonghuan Semiconductor in 2020. In June 2020, TCL "acquired" Zhonghuan and entered the photovoltaic sector. Subsequently, in 2022, TCL's semiconductor exploration shifted to power semiconductors (TCL Microchip Technology).

From a broader perspective, TCL's acquisition was an unequivocal success. In terms of business synergy, photovoltaic silicon wafers are essentially low-purity chip raw materials. TCL's entry into the photovoltaic industry not only complemented its existing chip investments but also aligned with the semiconductor + display + photovoltaic industry model adopted by global panel giants like Samsung, LG, and Sharp. Furthermore, although Zhonghuan's performance was not industry-leading at the time, TCL's expertise in capacity expansion and cost reduction, coupled with the burgeoning Chinese photovoltaic industry, propelled Zhonghuan's 2022 revenue to surpass the combined totals of the previous two years.

However, TCL's photovoltaic business did not sustain its initial success for long. As global players raced to expand capacity, by the end of 2023, the entire photovoltaic industry chain was plagued by severe overcapacity. For instance, China's polysilicon capacity in 2023 even surpassed projected demand for 2025.

Image: TCL Photovoltaic Products Source: TCL

Amid industry overcapacity, TCL is adjusting its technology roadmap and introducing thinner products with higher photoelectric conversion efficiency. However, in the practical implementation of photovoltaic projects, the overall cost consideration outweighs detailed advantages. A higher photoelectric conversion efficiency alone does not necessarily signify technological superiority, as this metric is frequently updated across the industry.

Admittedly, TCL currently holds the top spot globally in comprehensive silicon wafer market share. Nonetheless, according to the 2024 third-quarter report, revenue decreased by 53.6% year-on-year, and the net profit attributable to shareholders widened to a loss of 2.998 billion yuan in the third quarter. In this phase of industry resilience, TCL has secured its leading position with substantial investments.

With TCL's "third growth curve" at a standstill, how are its panel and TV businesses faring? In summary, TCL operates steadily, but the industry itself offers limited room for high growth.

On the panel front, the industry overcapacity that emerged in early 2024 has now subsided. Industry growth primarily stems from the transition from LCD to OLED (high-end) technology. However, with recent moves by BOE, such as its foray into smart healthcare (including building hospitals), and TCL's acquisition of LG's production capacity, the panel industry remains relatively stable. On the TV side, for this long-established product, industry dynamics are heavily influenced by replacement cycles.

In other words, TCL is once again at a crossroads, seeking its "fourth growth curve." This time, TCL has chosen AI as its general direction.

In the home appliance sector, TCL has fully integrated Homa Appliances, renowned for its refrigerator business. Combined with TCL's recently released central control large model, the company aims to establish a smart home layout comparable to that of Haier Smart Home. Additionally, according to PR Newswire, TCL will be the largest Chinese exhibitor at CES 2025. Besides TVs and gaming monitors, TCL will showcase a range of smart home products, including companion AI products, air conditioners, refrigerators, washing machines, smart door locks, security cameras, routers, photovoltaic technology, and automotive smart cockpit solutions.

Amid the AI hardware trend that emerged towards the end of 2024, TCL was well-prepared. For the upcoming battle of AI glasses in 2025, TCL has launched its ThunderBird AR glasses, priced starting at 1,699 yuan. Although TCL's AR glasses currently do not incorporate AI, considering TCL's successful implementation of end-side large models and the industry's ability to rapidly deploy AI large models through collaborations, it is evident that TCL will also play a significant role in the AI glasses market.

Overall, in the era of AI large models, TCL intends to leverage its manufacturing prowess to reignite the "capacity" competition within the AI hardware sector.

As Li Ka Shing advises, "You need a business that can make money even if the sky falls. Only then can you thrive in other ventures." Like many Chinese manufacturing companies, TCL is constantly on the quest for new growth curves from a main business that has reached a plateau.

Perhaps these new growth curves will not drastically transform the company. Similar to GoerTek, which produced PICO and remains intertwined with the "Apple chain," or Haier, which nurtured ThundeRobot computers but has yet to penetrate the consumer electronics market, TCL's AI exploration is merely another building block in its manufacturing empire.

However, all industry models in the AI era brim with imagination. Many AI hardware products have demonstrated smartphone-like potential for widespread adoption. This suggests that, drawing inspiration from BBK Electronics' approach to mobile phones, manufacturing companies excelling in AI hardware have the potential to emerge as the next OPPO or vivo.

After all, the era of AI applications is just beginning, and TCL, which is both walking and watching, is poised for the future.