Apple's 2024: Lukewarm Products, Struggling AI Ambitions, and Escalating Ecosystem Fragmentation

![]() 12/30 2024

12/30 2024

![]() 512

512

The most commendable products were the Mac and AirPods.

2024 marked a pivotal year for AI hardware innovation.

'Focus on applications, not parameters' has emerged as a consensus in the AI industry. On one hand, hardware manufacturers are aggressively integrating AI capabilities, sparking an explosion of AI hardware across diverse industries such as smartphones, PCs, home appliances, automobiles, cleaning devices, home furnishings, headphones, cameras, and storage solutions, all vying to harness AI effectively. On the other hand, AI is profoundly transforming software, with native AI applications like Wenxiaoyan and Doubao gaining popularity, and search engines, input methods, browsers, payment systems, office software, and e-commerce platforms being reshaped by AI.

AI has become a 'magic wand' for technological innovation, and this is merely the beginning.

In December, the 'Leitech·Annual' special issue was launched, featuring 'Focusing on 2024' to systematically review the companies, products, technologies, and personalities that stood out in the tech industry in 2024, and 'Looking Ahead to 2025' to preview exciting products and technologies anticipated for the coming year, paying tribute to innovation, documenting the era, and inspiring the future.

Please subscribe for updates.

2024 was a challenging year for Apple. The new iPad underwhelmed at the beginning of the year, the M4 MacBook failed to address the notch and Face ID issues in notebooks by mid-year, the Apple Watch has seen minimal significant improvements over the years, with the Ultra 2 merely introducing new color options, and the iPhone 16 series' camera button and AI promises received overwhelming negative feedback – not to mention the half-baked Vision Pro.

It's no exaggeration to say that, apart from the AirPods 4 and the M4 Mac mini, Apple did not have any noteworthy successful products this year. That said, despite persistent criticism, Apple continues to play a pivotal role in the industry. At least judging from Android brands' homage to the Dynamic Island and camera button this year, Apple's influence in the consumer electronics industry remains significant. Regardless, Apple is still Apple, and as part of Leitech's 2024 annual special, this article will review Apple's 2024 performance.

iPad: The tablet king that can thrive with minimal effort

In May 2024, Apple released the new iPad Pro alongside the new Apple Pencil Pro. From a hardware perspective, Apple did indeed give the iPad Pro a significant boost this year. The iPad Pro was the first to feature the new M4 processor, resulting in a leap in hardware performance.

However, this so-called leap in performance wasn't solely due to the M4 chip. After all, Apple skipped the iPad Pro lineup in 2023, meaning the M4 iPad Pro had to be compared to the M2 iPad Pro released two years ago. Judging from the performance gap between the M4 MacBook Pro and the M3 MacBook Pro, the performance leap between M4 and M3 wasn't that significant.

Image source: Apple

Apart from the improved chip performance, the iPad Pro also made some enhancements to the screen material and body thickness. However, the lack of professional iPadOS applications, which is the real shortcoming of the iPad Pro, has been the core reason hindering iPad Pro sales in recent years. Since the M1 iPad Pro, the iPad Pro lineup has entered a stage where the hardware outperforms the software. After an in-depth experience with the M4 iPad Pro, Leitech also believes that this product is 'all brawn and no brains.' To this day, numerous users on Weibo still express that their M1 iPad Pro can still hold its own.

Image source: Apple

Although the high-end iPad Pro failed to attract existing users to upgrade, the iPad Air and iPad mini, released in October 2024 and targeting the mid-range market, performed well. In terms of hardware, the new iPad Air finally received the M2 chip, and the addition of a 13-inch screen further closed the gap between the iPad Air and the previous-generation iPad Pro. It can be said that apart from the high refresh rate and Face ID, the new iPad Air outperforms the most prevalent 2018/2020/2021 iPad Pro models in terms of performance, becoming a 'budget iPad Pro alternative.'

Image source: Apple

Moving on to the larger-screen iPad Air, let's discuss the seventh-generation iPad mini with its smaller screen. Although it lacks a high refresh rate screen, 8GB of 'AI RAM,' or an M-series chip, as we previously discussed regarding small-screen tablets, the iPad mini has found a new niche as a 'gaming tablet.'

Using the standards of gaming phones, the iPad mini doesn't have a high refresh rate screen, but its powerful A17 Pro chip and tablet-level heat dissipation capabilities allow it to run mobile games at extremely stable frame rates. Coupled with exclusive optimizations for iOS devices by game developers, the success of the iPad mini seems inevitable to me.

As for the iPad digital series, under the onslaught of the iPad Air, the plain digital series no longer has significant market competitiveness. Coupled with Apple's consistent market strategy of using the previous generation as an entry-level option in the secondary market, there is little room left for the pure digital iPad series. In my opinion, Apple maintains the digital iPad series targeting two main markets: semi-embedded commercial scenarios like smart checkout and educational scenarios for schools.

Image source: Apple

Semi-embedded commercial scenarios are straightforward, as there are numerous mature enterprise customization software and Apple's more mature MDM commercial device management. For educational scenarios, Apple also designed a special keyboard for the iPad digital series this year, which I believe will slightly narrow the gap with Chromebooks.

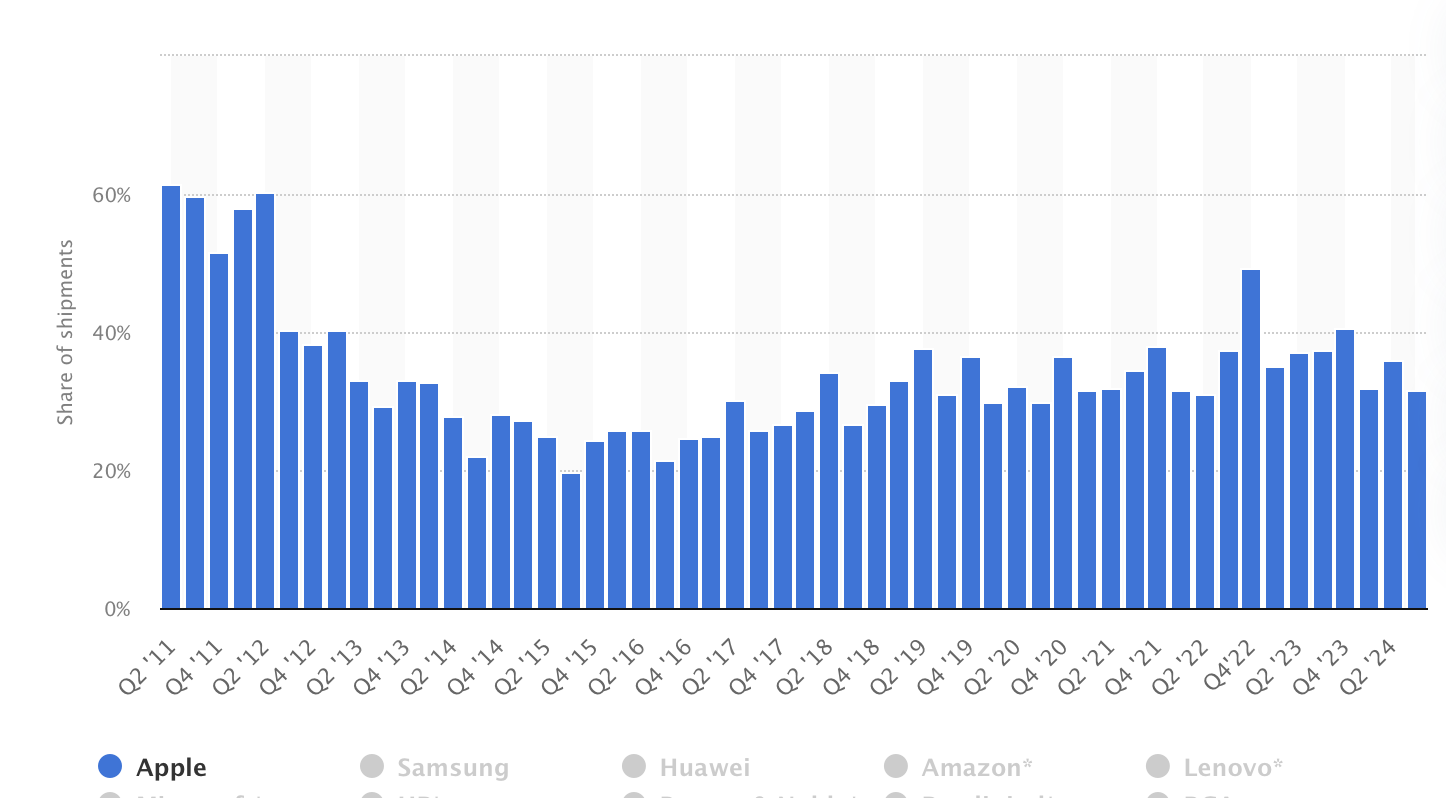

Image source: Statista

This is also reflected in Apple's Q4 2024 financial results and shipments. According to the Q4 financial reports of the past three years, iPad revenue was $7.17 billion, $6.4 billion, and $6.9 billion in Q4 of 2022, 2023, and 2024, respectively, accounting for 7.95%, 7.15%, and 7.32% of annual revenue. In terms of shipments, the total shipments for 2022 and 2023 were 63 million and 50 million units, respectively, clearly showing the impact of the 'performance stall' in 2023 on iPad sales.

iPhone: Why not slack off and paint the sky blue? Apple fans adapt

In September 2024, Apple released the iPhone 16 series. Regarding the hardware changes in the iPhone 16 series, Leitech has already produced extensive related content. In summary, there are two major hardware changes in the iPhone 16 series: a new dedicated camera control button and 8GB of RAM for AI capabilities.

Image source: Apple

The iPhone 16 series also features minor improvements, such as narrower screen bezels on the Pro series, increasing the screen sizes from 6.1/6.7 inches to 6.3/6.9 inches, finally aligning with the Android standard. As for imaging and fast charging, Apple phones have never been competitors to Android. The upgrades in the iPhone 16 series are hardly noticeable.

Image source: App Economy Insights

Even so, of Apple's $94.93 billion revenue in the fourth quarter of fiscal year 2024, $46.2 billion was contributed by the iPhone. In other words, the iPhone accounted for 48% of Apple's revenue in the fourth quarter of fiscal year 2024, serving as a pillar of Apple's income. However, considering the impressive performance of domestic mobile phone brands during the Double 11 shopping festival this year, if Apple fails to resolve the issue of AI implementation in China around the new year in 2025, iPhone sales in the Chinese market are likely to face even greater challenges.

Apple Watch: Almost no upgrades, but significant regressions

During the iPhone launch event, Apple also unveiled the Apple Watch Series 10. Perhaps due to years of 'incremental' updates causing consumer backlash, Apple finally made 'minor changes' to the Apple Watch's design this year: the new Apple Watch screens are slightly larger, the body is slightly thinner, and even the chip model has been 'upgraded,' from S9 to S10.

Image source: Apple

But compared to these insignificant upgrades, the regressions in this year's Apple Watch are more noteworthy. Due to wireless standard limitations, new watches like the Apple Watch Series 10 and Ultra 2 no longer support wireless fast charging. What was once '80% charge in 45 minutes' has become '100% charge in 90 minutes.' In essence, there were minimal upgrades but significant regressions. Because of the Apple Watch Series 10's almost 'slacking off' performance, many consumers on social media have expressed a preference for buying older models rather than the new Series 10.

Considering that Apple Watch global shipments in the first three quarters of 2024 were surpassed by Huawei's smart wearable products, the decade-old Apple Watch urgently needs an Apple Watch X, akin to the groundbreaking iPhone X, to revive sales.

AirPods: King of TWS, first choice for Apple fans

Compared to the Apple Watch Series 10, the simultaneously released AirPods 4 showed more sincerity. Thanks to the new AI chip, Apple brought active noise cancellation to the semi-in-ear AirPods 4 (ANC). Apart from noise cancellation, the sound quality upgrade of the AirPods 4 (ANC) is another highlight:

Compared to AirPods 3, AirPods 4 have significantly improved both in soundstage performance and low-frequency texture. While they still lag behind true HiFi headphones and flagship wireless headphones from professional audio manufacturers, within the AirPods product line, the sound quality of AirPods 4 is second only to AirPods Pro 2.

Image source: Apple

However, considering the overall headphone market environment, Apple's adherence to the AirPods form factor and transparency mode has caused it to miss out on the new open-ear headphone category. Of course, considering Apple's cautious approach to new products and its consistent strategy of covering the largest market with the minimum number of products, I believe Apple will not introduce any products related to open-ear headphones in the short term. After all, according to Canalys' Q3 2024 global TWS market shipment research, Apple still leads with a 21% market share – 'If the product is still selling, why innovate?'

Image source: Canalys

Mac: Apple's most successful product in 2024 was a PC?

In November 2024, Apple released multiple Macs equipped with the M4 chip. Apart from the entry-level MacBook Air and professional-oriented Mac Studio, Mac Pro, all other products adopted the M4 chip.

In terms of performance, the M4 chip undoubtedly shows significant improvement. However, like the iPad Pro, the M4 Mac also faces the issue of software dragging down hardware. Simply put, macOS's unique application ecosystem divides Mac users into two categories: casual users with minimal performance requirements and professional users with extremely high performance requirements, with no middle ground in between.

Image source: Apple

Casual users have extremely low performance requirements for Macs. The performance boost from switching from Intel to M1 chips alone is sufficient for their daily use, and subsequent performance upgrades with M2/M3/M4 chips do not constitute a compelling reason for these users to upgrade their computers. This viewpoint was also mentioned in some overseas tech media reviews of the M4 Mac mini.

Professional users, on the other hand, have higher requirements for device performance and stability. Unless their workflow changes, they will not easily change their work equipment. This is also the reason why the Mac Studio, which targets the high-end market, has so far remained with the M2 Ultra chip.

Image source: Apple

With existing users difficult to sway, Mac's breakthrough point naturally shifts to new users. However, the ultra-low cost-effectiveness of Mac entry-level products makes it difficult to attract Windows users who have never tried macOS. In response, Apple decided to "test the waters" with the Mac mini. The 2024 M4 Mac mini uses a brand-new mold, significantly reducing the product size and fully showcasing the low power consumption and high performance characteristics of the M4 chip. Considering the sharp decline in Apple's Mac shipments in the middle of the year, it is understandable that Apple chose to use the Mac mini to test the waters with its "high cost-effectiveness".

Moreover, given Apple's AI's 16GB memory threshold requirement for computers, this year's entry-level Mac mini also benefited from a "complimentary upgrade" to 16GB of RAM, eliminating the previous necessity to spend an additional 1500 yuan for memory enhancement, thereby significantly boosting the Mac mini's cost-effectiveness. Coupled with educational discounts and government subsidies, the Mac mini stands out as the most economical option across Apple's entire product line, simultaneously emerging as the brand's "dark horse" of the year.

AI: A Promising Future or a Distant Dream?

As Apple's AI is currently unavailable in China, I am unable to evaluate its actual performance. However, based on recent feedback from international users, there is still considerable room for improvement in the Apple AI experience.

Image source: Apple

Some overseas netizens have bluntly pointed out that in Apple's AI, "it's nearly impossible to find any feature that allows Apple Intelligence to compute on large end-side models or large cloud models," with all queries being redirected to GPT chat. Another user remarked that after Siri's name change to Apple Intelligence, its functionality is akin to that of a mediator. When users pose a question, it simply redirects to ChatGPT. However, Siri lacks sophistication, and ChatGPT's stability is questionable. Combining these two drawbacks results in an inferior experience compared to directly querying ChatGPT.

Image source: Apple

Furthermore, during the launch event, Apple pledged to introduce Chinese AI by early 2025, but it remains unclear when Chinese users will gain access to Apple's intelligence. Under relevant regulatory requirements, the most ideal and swift path for Apple's AI to enter China would be through collaboration with local AI large model providers. However, given recent rumors about Apple's contacts with multiple local AI providers, it is evident that Apple's AI efforts in China are still in their nascent stages.

In the era where AI is pervasive, this delayed AI progress signifies that Apple has transitioned from being an industry leader to a follower. Admittedly, Apple can still rely on the iPhone and its brand reputation to uphold its position in the domestic market. Nevertheless, smartphones will undoubtedly compete based on "automation systems" in the future. The extent to which Apple can keep pace with domestic competitors will become evident when Apple's AI becomes available next year.

Crisis Lurks Beneath Apple's "Glamorous" Façade

While hardware sales uphold Apple's glamorous image, the substantial failure of its car manufacturing plan and the uncertain future of Vision Pro represent the other side of Apple in 2024.

As early as 2014, Apple unveiled its automotive ambitions with Project Titan. The outside world anticipated it would bring Apple's robust hardware integration capabilities and software ecosystem advantages to the automotive industry, charting a new course in the realm of smart electric vehicles. However, after numerous years, Apple has yet to present a viable solution. Instead, internal teams have frequently undergone restructuring, and senior executives have successively resigned. What was once a dynamic car manufacturing plan has degenerated into a developmental quagmire devoid of a clear objective, squandering funds without apparent justification.

Image source: Apple

Ultimately, a decade after Project Titan's exposure, Apple decided to terminate it. According to Bloomberg, Apple's Chief Operating Officer Jeff Williams and Kevin Lynch, the vice president in charge of the project, jointly decided to scrap the initiative. The 2,000 employees involved will be transferred to the AI department, with their future focus shifting to generative AI and other projects. This colossal and costly undertaking, spanning over a decade, has now "fallen from grace".

Similarly, akin to the car manufacturing project, Vision Pro also harbored Apple's expectations for its "next blockbuster." From its inception, it was viewed as a significant step for Apple in exploring spatial computing, a groundbreaking product following the iPhone and iPad.

Image source: Apple

Contrary to expectations, Vision Pro's exorbitant computing power and luxurious sensor configuration resulted in a stunningly high cost. Even loyal Apple enthusiasts found it challenging to easily part with tens of thousands of dollars to "give it a try." To make matters worse, Vision Pro's steep price and stringent real-device testing conditions necessitated a "cold start" for this iOS-derived hardware device.

Although users can run some software from the iPad and iPhone on Vision Pro, relying solely on streaming services is clearly insufficient to sustain a vast market. Ultimately, ordinary users couldn't justify paying for this overly pricey device.

Image source: Medium

In terms of buzz, Vision Pro lost nearly all its heat just a month after its domestic launch. What was once a challenging appointment for a Vision Pro in-store experience has now transformed into a deserted scene—all time slots can be directly selected on the Apple Store reservation page.

Image source: Apple

Can Apple Continue to Defend Its Territory with Its Ecosystem in 2025?

Compared to the past, Apple's performance in 2024 can be considered barely satisfactory in my opinion: most new products were unremarkable, and the flagship iPhone 16 series was characterized by "underwhelming hardware and hollow software promises." The only noteworthy devices throughout the year were the AirPods 4 (ANC) and the highly cost-effective M4 Mac mini, largely due to government subsidies.

However, I must admit that Apple's business strategy remains highly successful at the commercial level—despite its significantly diminished product competitiveness, it still stabilized its Q4 revenue at $94.9 billion, even surpassing the results of 2022 Q4 and 2023 Q4.

Image source: Apple

Looking ahead, Apple is likely to maintain its conservative product strategy in 2025, continuing its deeply intertwined hardware, software, and services business model, locking users into the Apple ecosystem through the "Apple Ecosystem." As the global smart device market gradually reaches saturation, users will inevitably slow down their phone replacement frequency. This is certainly good news for Apple, whose competitiveness has declined—even without competitiveness, Apple can still rely on user habits and ecosystem bundling to maintain stable revenue.

However, the issue lies in the fact that many domestic mobile phone brands have already commenced research on compatibility with the Apple ecosystem, with Xiaomi, OPPO, vivo, and other brands successively introducing compatibility kits tailored around the Apple ecosystem. With frequent setbacks in AI implementation and the impending domestic ecosystem, Apple's 2025 is poised to be a tumultuous year.

Source: Leitech