Tesla Stock Price Slumps Amid Search for Next Profit Driver

![]() 01/09 2025

01/09 2025

![]() 541

541

Preface:

On January 2, Tesla's stock price plummeted, with intraday losses nearing 7%.

By market close, the share price had dropped over 6%, wiping out over $70 billion in market value.

Since hitting an all-time high of $488.54 per share on December 18, 2024, Tesla's stock has declined on 8 out of the following 10 trading days, accumulating a loss of over 20%.

Author | Fang Wensan

Image Source | Network

Tesla Encounters First Sales Decline

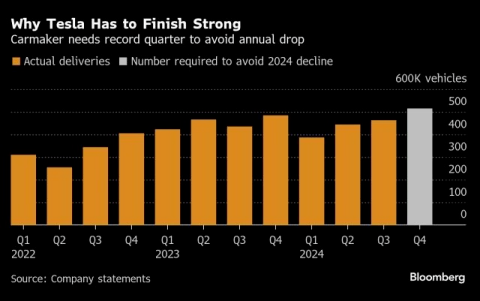

Tesla Motors reported on January 2 that sales for 2024 totaled 1.79 million vehicles, a 1.1% decrease from 1.81 million in 2023, marking the first annual sales decline since 2015.

This figure fell short of market analysts' consensus forecast of 1.8 million vehicles.

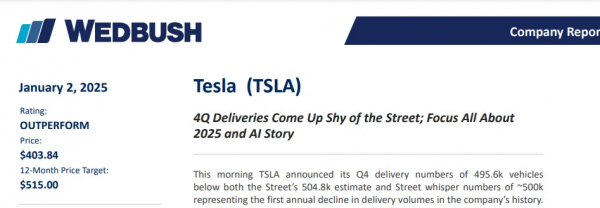

For the fourth quarter of 2024, Tesla produced 459,400 vehicles and delivered 495,600, setting a new quarterly high and growing 2.3% year-on-year.

Model 3 and Model Y deliveries totaled 471,900, while other models accounted for 23,600 units.

Energy storage product deployments reached 11.0 GWh, also a new record.

Despite this achievement, Tesla's fourth-quarter deliveries missed Wall Street expectations.

FactSet data previously indicated analysts predicted 498,000 deliveries.

Tesla's deliveries declined year-on-year in the second and third quarters of 2024 for the first time since 2020, contributing to a sustained drop in its stock price.

The company announced it will release its fourth-quarter 2024 financial results after market close on Wednesday, January 29, 2025.

Wall Street generally anticipates fourth-quarter revenue to reach a record $99.7 billion, but net profit may only be $8.1 billion, marking the worst quarter for profitability since 2021.

Tesla Faces Bottlenecks Amid Slowing Global Market Growth

Tesla's Shanghai factory delivered 916,700 electric vehicles last year, down 3% from the previous year, marking the first decline since it started operations in 2020.

More concerning for investors is that Tesla's sales in the U.S., Europe, and China have all declined to varying degrees.

Cox Automotive forecasts Tesla's U.S. sales to decline by about 6%, with a market share of only 4%.

Signs suggest that amid slowing global demand growth for electric vehicles, Tesla's sales growth potential has hit a bottleneck.

Due to adjustments in electric vehicle subsidy policies, the European market's pure electric vehicle sales growth rate was in the single digits in 2024.

In Germany, Europe's largest automotive market, the government abruptly eliminated electric vehicle subsidies at the end of 2023, directly impacting sales.

By November 2024, pure electric vehicle sales in Germany had fallen by 21.8%, reducing its market share to 15%.

In the U.K., while electric vehicle sales set a new high in 2024, they did not meet government targets.

The Society of Motor Manufacturers and Traders warned that reaching the government's 28% target by 2025 will become more challenging due to doubts about the sustainability of incentives and the need for heavy investment in R&D.

In the U.S., investors doubt Musk's goal of increasing Tesla sales by 20% to 30% in 2025, considering the incoming Trump administration may eliminate electric vehicle tax credits and continued competition from Chinese rivals like BYD.

Currently, Ford and General Motors, the two major American automakers, are shifting focus from pure electric vehicles to hybrids.

Clearly, after setbacks in their pure electric vehicle plans, they aim to capitalize on the hybrid vehicle market opportunity.

Like the Chinese market, consumers in Europe and the U.S. increasingly favor hybrid vehicles, including plug-in hybrids (PHEVs).

Musk's Focus Gradually Shifts to Emerging Business Areas

Foreign media predicts Tesla's investment in artificial intelligence (AI) infrastructure will exceed $11 billion in 2024.

Tesla's AI system includes Full Self-Driving (FSD), the Dojo supercomputer, the Cortex supercomputing cluster, and the humanoid robot Optimus.

Tesla's stock price rebounded significantly on January 4, potentially linked to Musk's advocacy for AI and the Starlink plan.

In October 2024, Tesla announced its commitment to accelerating AI investments, primarily to further train its autonomous driving system.

To achieve this, Tesla plans to significantly expand its AI server count at the Texas Gigafactory, from 29,000 to 50,000, a growth of over 70%.

Launched at the end of 2023, Tesla's FSD version 12 is the world's first end-to-end AI autonomous driving system, marking a significant technological advancement.

The FSD system processes camera image data within a single neural network and directly outputs vehicle control commands.

This end-to-end approach drastically reduces reliance on traditional programming, shrinking the code volume from over 300,000 lines to just 2,000.

As of the third quarter of 2024, FSD's (supervised) cumulative driving mileage exceeded 2 billion miles.

The Dojo supercomputer enhances Tesla's model training efficiency, capable of processing vast amounts of data for labeling and training without human intervention.

It autonomously processes sample sets through statistical analysis, improving training efficiency.

Currently, Dojo's neural network model running efficiency is several times that of NVIDIA's A100 and reduces GPU cluster service costs.

The Cortex supercomputing cluster can accommodate 100,000 H100/H200 graphics cards and is specifically designed for training Tesla's FSD system and the humanoid robot Optimus.

Elon Musk previously disclosed that the supercomputing cluster's computing power will be half-provided by NVIDIA and other suppliers like AMD, with the other half coming from Tesla's self-developed Dojo.

The humanoid robot Optimus is seen as the ultimate AI application carrier, with core competitiveness in large models, computing power, and data.

Musk stated on social media that Tesla plans to start small-scale production of Optimus for internal use next year, aiming for large-scale production for other enterprises in 2026.

Tesla's full-stack AI innovation approach, encompassing software, hardware, and manufacturing, has already positively impacted multiple fields and is expected to further drive profit growth beyond expectations.

Conclusion: Future Revenue and Growth Hinge on Unformed Businesses

Musk's launch of the Cybertruck autonomous taxi business in October 2024 garnered significant investor attention.

During Tesla's third-quarter 2024 earnings call, Musk revealed plans to deploy a small fleet of Cybertrucks in Texas in 2025, pending regulatory approval, with potential expansion in California.

He anticipates large-scale production to start in 2027, targeting an annual production capacity of 2 to 4 million vehicles.

Analysts cautiously assess Tesla's autonomous taxi business potential, assuming an average annual production of 100,000 vehicles by 2030.

Based on this forecast, it's expected that 600,000 autonomous taxis will be on the road by 2030, generating $105 billion in revenue.

Considering Tesla's autonomous taxis are driverless, analysts believe they should enjoy a higher net profit margin than traditional ride-hailing services, valuing the business at $473 billion using a 15% net profit margin and a 30x price-to-earnings ratio.

In an optimistic scenario, if annual production reaches 150,000 vehicles, the valuation increases to $709 billion.

Additionally, Tesla's Full Self-Driving (FSD) feature is also a focus for analysts.

According to third-party data, as of the third quarter of 2022, 15% of Tesla's electric vehicles sold were equipped with FSD.

Analysts predict that by 2030, the FSD adoption rate will gradually rise to 20%, generating $4.6 billion in revenue for Tesla.

Using a 30% net profit margin and a 50x target price-to-earnings ratio, the FSD valuation is $68 billion.

In an optimistic scenario, if the adoption rate reaches 30%, the value increases to $102 billion.

Some References:

U.S. Stock Research Institute: “Ambitious Tesla Faces Three Consecutive Stock Price Drops; Is This [House of Cards] About to Collapse?”

Auto K-Line: “Tesla: Are Pure Electric Vehicles a Bubble?”

DOLC: “Tesla Stock Price Under Pressure; Musk Loses Billions in a Single Day”

Everyday Economics Headlines: “Tesla’s Market Value Evaporates Over $570 Billion Overnight; Analysts: Never Simply Viewed It as a Car Company”

China Business News: “[Black Swan] Strikes! Giant Plunges, Market Value Evaporates Over $500 Billion Overnight”