Edge AI: Unveiling the Most Profitable Enterprises

![]() 01/22 2025

01/22 2025

![]() 461

461

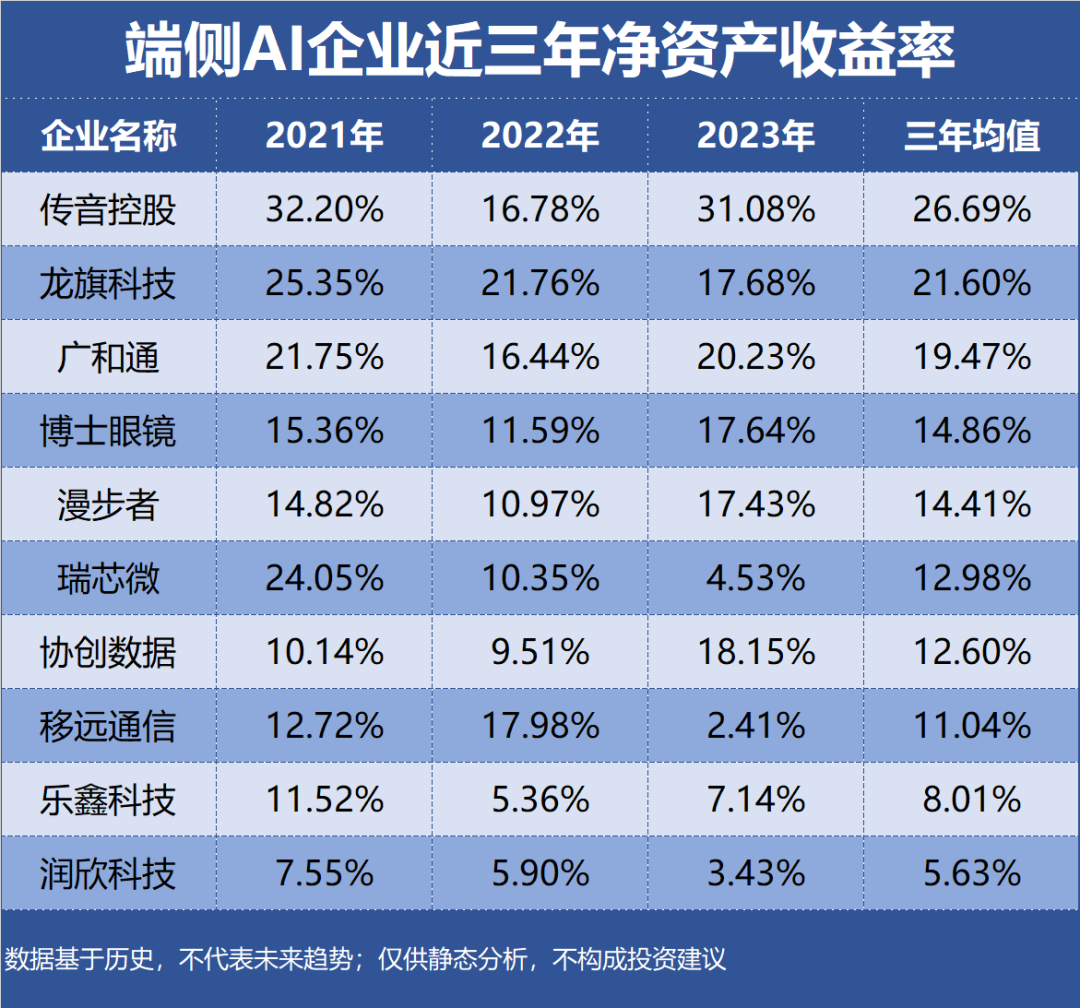

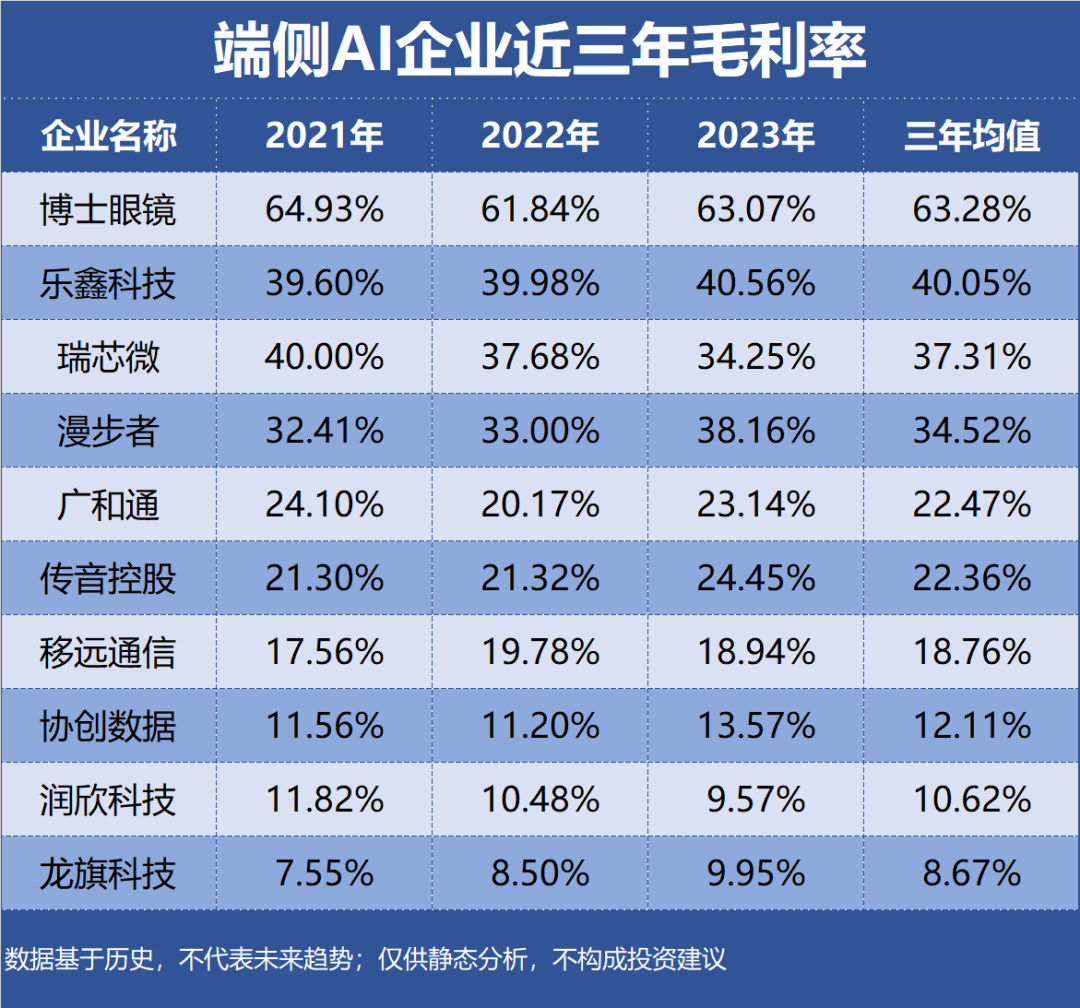

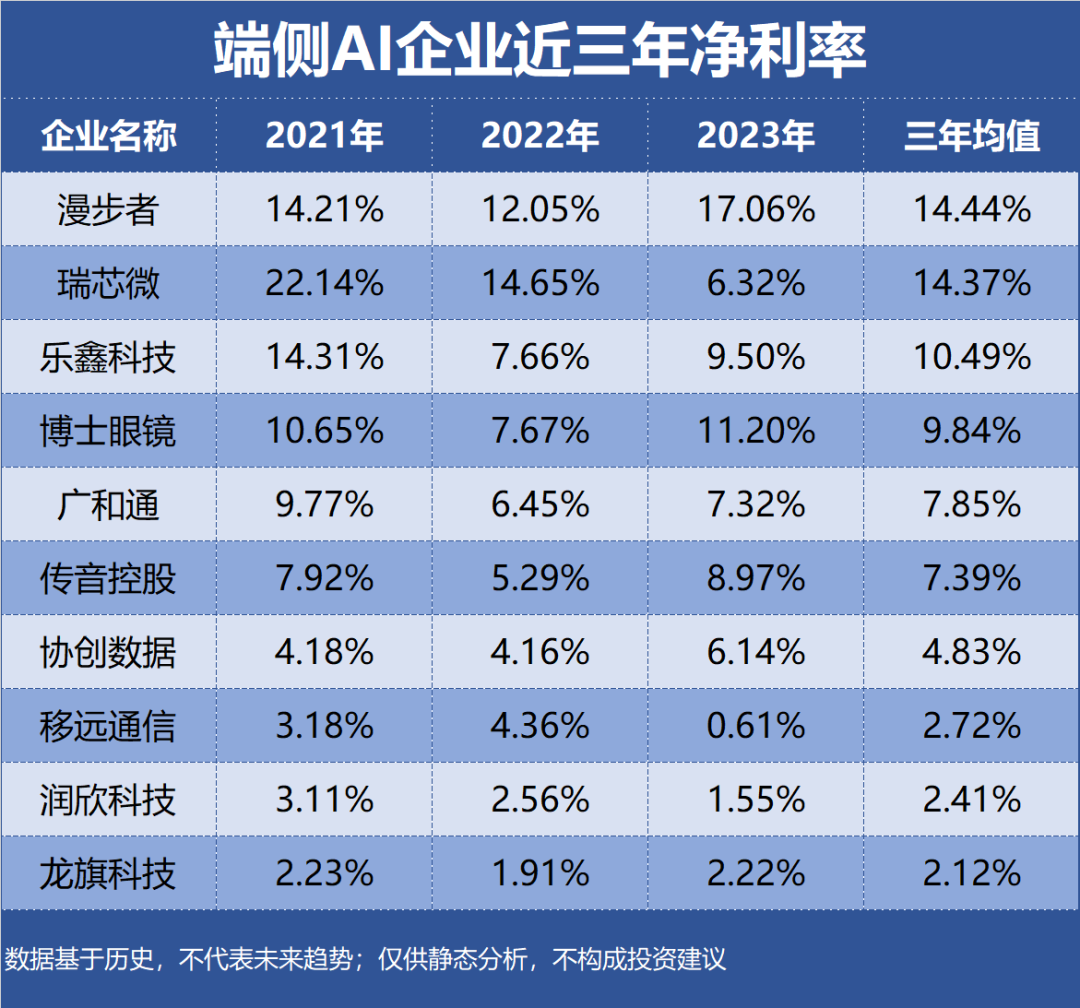

Edge AI represents the technology that executes and processes AI algorithms directly on terminal devices, bypassing the need to transmit data to the cloud or server. Profitability, typically gauged by the volume and level of corporate earnings over a specific period, involves a detailed examination of a company's profit margins. This article serves as the [Profitability] chapter of our enterprise value series, examining a total of 36 edge AI enterprises. It utilizes metrics such as ROE, gross margin, and net profit margin for evaluation. Please note that the data presented is historical and does not predict future trends; it is intended for static analysis and does not constitute investment advice.

Top 10 Profitable Edge AI Enterprises:

10th. Fortune Tech

Industry Segment: Other Electronics

Profitability: ROE 5.63%, Gross Margin 10.62%, Net Profit Margin 2.41%

Performance Forecast: ROE has steadily declined to 3.43% over the past three years, with the latest forecast averaging 9.98%

Main Products: Digital communication chips and system-level application products contribute significantly to revenue, accounting for 18.78% with a gross margin of 6.26%

Company Highlights: Fortune Tech's SOC chips and near-field loudspeaker devices in the smart wearable sector are integrated into customers' AR glasses and A glasses products.

9th. Longcheer Technology

Industry Segment: Consumer Electronics Components and Assembly

Profitability: ROE 21.60%, Gross Margin 8.67%, Net Profit Margin 2.12%

Performance Forecast: ROE has gradually decreased to 17.68% over the past three years, with the latest forecast averaging 12.43%

Main Products: Smartphones are the primary revenue driver, accounting for 80.97% with a gross margin of 5.06%

Company Highlights: In the realm of AI glasses, Longcheer Technology has collaborated consistently with global internet leaders on two generations of smart glasses products.

8th. Quectel

Industry Segment: Communication Terminals and Accessories

Profitability: ROE 11.04%, Gross Margin 18.76%, Net Profit Margin 2.72%

Performance Forecast: ROE has fluctuated between 2%-18% in the last three years, with the latest forecast averaging 12.82%

Main Products: Modules and antennas constitute the primary revenue source, accounting for 99.06% with a gross margin of 18.08%

Company Highlights: Quectel specializes in wireless communication modules and solutions for the IoT, offering one-stop solutions encompassing wireless communication modules, antennas, and software platform services.

7th. Fibocom

Industry Segment: Communication Terminals and Accessories

Profitability: ROE 19.47%, Gross Margin 22.47%, Net Profit Margin 7.85%

Performance Forecast: ROE has ranged between 16%-22% in the last three years, with the latest forecast averaging 20.20%

Main Products: Wireless communication modules are the main revenue generator, accounting for 98.93% with a gross margin of 21.16%

Company Highlights: Fibocom's edge-side modules are equipped with high-performance processors, such as the SC208 with an 8-core processor reaching up to 1.8GHz, capable of efficiently handling diverse data and tasks.

6th. Espressif Systems

Industry Segment: Digital Chip Design

Profitability: ROE 8.01%, Gross Margin 40.05%, Net Profit Margin 10.49%

Performance Forecast: ROE has varied between 5%-12% in the last three years, with the latest forecast averaging 15.62%

Main Products: Modules and development kits are the primary revenue stream, accounting for 57.80% with a gross margin of 38.91%

Company Highlights: Espressif Systems has acquired a stake in Mingzhan Information Technology (M5Stack), whose portfolio includes controllers and other hardware modules essential for IoT application solutions.

5th. Rockchip

Industry Segment: Digital Chip Design

Profitability: ROE 12.98%, Gross Margin 37.31%, Net Profit Margin 14.37%

Performance Forecast: ROE has continuously declined to 4.53% over the past three years, with the latest forecast averaging 14.52%

Main Products: Chip sales revenue is the primary revenue source, accounting for 99.25% with a gross margin of 35.70%

Company Highlights: Rockchip focuses on smart terminal chips and power management chips, possessing SoC design technologies such as ultra-high-definition video codec and CPU/GPU multi-core integration.

4th. Edifier

Industry Segment: Branded Consumer Electronics

Profitability: ROE 14.41%, Gross Margin 34.52%, Net Profit Margin 14.44%

Performance Forecast: ROE has fluctuated between 10%-18% in the last three years, with the latest forecast averaging 17.75%

Main Products: Headphones are the main revenue driver, accounting for 64.25% with a gross margin of 41.56%

Company Highlights: Edifier has launched multiple Bluetooth smart speakers, including desktop models like R201T, R101BT, R1080BT, and portable smart Bluetooth speakers such as M201, bun, M100, M10, among others.

3rd. Dr. Optical

Industry Segment: Professional Chain

Profitability: ROE 14.86%, Gross Margin 63.28%, Net Profit Margin 9.84%

Performance Forecast: ROE has ranged between 11%-18% in the last three years, with the latest forecast averaging 16.67%

Main Products: Optical glasses and fitting services are the primary revenue source, accounting for 64.11% with a gross margin of 68.42%

Company Highlights: Dr. Optical has collaborated with brands such as Star Realm Meizu, LeBird Innovation, XREAL, Jiehuan, Li Weike, and ROKID in the smart glasses industry.

2nd. Transsion Holdings

Industry Segment: Branded Consumer Electronics

Profitability: ROE 26.69%, Gross Margin 22.36%, Net Profit Margin 7.39%

Performance Forecast: ROE has fluctuated between 16%-33% in the last three years, with the latest forecast averaging 25.29%

Main Products: Mobile phones are the main revenue generator, accounting for 92.54% with a gross margin of 20.84%

Company Highlights: Transsion Holdings' brands have introduced multiple mobile phones equipped with AI features, including the second-generation foldable flagship PHANTOM V Fold 2 from the PHANTOM series.

1st. Synology

Industry Segment: Consumer Electronics Components and Assembly

Profitability: ROE 12.60%, Gross Margin 12.11%, Net Profit Margin 4.83%

Performance Forecast: ROE has varied between 9%-19% in the last three years, with the latest forecast averaging 24.65%

Main Products: Data storage devices are the primary revenue stream, accounting for 64.76% with a gross margin of 11.82%

Company Highlights: Synology specializes in IoT smart terminals and data storage devices within the consumer electronics sector. Below are the ROE, gross margin, and net profit margin figures for the top 10 profitable edge AI enterprises over the past three years: