Chinese AI Breakthrough Triggers US AI Bubble Burst, Nvidia's Market Value Plunges RMB 4.3 Trillion

![]() 01/29 2025

01/29 2025

![]() 584

584

On Monday local time, the US stock market experienced a dramatic decline, with AI-related companies bearing the brunt of the losses.

Notably, AI chip giant Nvidia plummeted 17%, erasing nearly US$600 billion (approximately RMB 4.3 trillion) from its market value. Other chipmakers, such as Taiwan Semiconductor Manufacturing Company (TSMC) and Broadcom, also saw significant drops of 13% and 17% respectively, dragging down the entire chip index by 9%.

Nvidia alone lost a staggering RMB 4.3 trillion, whereas China's domestic AI chip leader Cambricon boasts a market value of merely RMB 238 billion. This translates to nearly 20 Cambricons vanishing overnight.

This event marks a catastrophic chapter in the history of the US stock market, akin to a major crash in AI chip stocks, shaving off nearly US$1 trillion from the Nasdaq's total market value.

To comprehend the underlying reason behind this steep decline, one must mention a Chinese AI company, DeepSeek (Deep Exploration).

How did it manage to bring down the US AI chip industry? The answer is straightforward: it burst the AI bubble in the US.

Prior to DeepSeek, the success of any company in AI hinged on one crucial factor: acquiring a vast number of AI cards and investing heavily, often amounting to hundreds of millions or even billions of dollars.

In the AI realm, there was an unspoken rule: those with more AI cards and computing power held an advantage in developing large models. While computational prowess did not guarantee success, its absence certainly spelled failure for enterprises.

However, DeepSeek shattered this paradigm. With a computing power of approximately 50,000 H100 GPUs, it pales in comparison to giants like OpenAI.

Remarkably, DeepSeek's training costs amounted to merely US$5.5 million, less than one-tenth of OpenAI's. Moreover, the development time was strikingly short, with the model being created in just two months.

Furthermore, the team behind this model comprised graduates from domestic Chinese universities, devoid of any overseas study experience in the US.

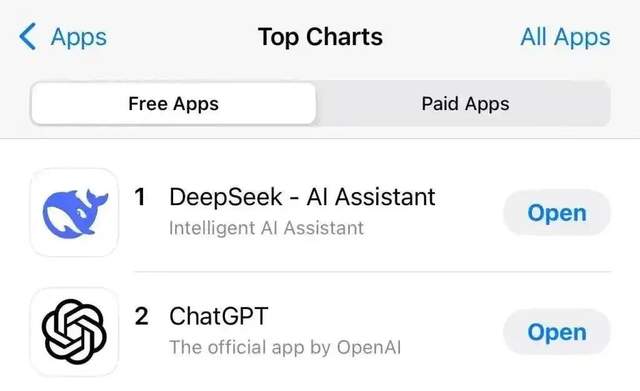

Despite this, their DeepSeek-R1 model outperformed OpenAI in numerous tests, propelling DeepSeek to the top of the free app rankings in the US Apple App Store.

What does this signify? The traditional scale of AI capital expenditure has been disrupted. It turns out that neither an abundance of AI chips nor massive investments are necessary, nor is the so-called American technology/experience.

It's noteworthy that companies like Nvidia previously relied heavily on selling AI chips for substantial profits, once becoming the world's largest company by market value, exceeding US$3 trillion. Similarly, TSMC also reaped significant benefits from AI chips.

Many US AI companies were convinced that computational power was paramount, leading the US to restrict the sale of advanced chips to China in an attempt to hinder the development of Chinese AI.

Ultimately, it was revealed that all these measures were futile. High-end chips, extensive computational power, and massive investments are not prerequisites. China too can develop top-tier AI models, explaining the current collapse of the entire US AI industry.