No Company Should Reach $4 Trillion Market Value!

![]() 01/31 2025

01/31 2025

![]() 456

456

On Christmas Eve in 2024, I received no apples, prompting me to "indignantly" pen an article on Christmas Day, December 25th:

Apple Represents the Largest Bubble in US Stocks!

Subsequently, I was met with a flurry of comments from individuals arguing the greatness of Apple Inc. and US stocks, deeming my views outdated. They insisted that Apple would be the first company to attain a market value of $4 trillion...

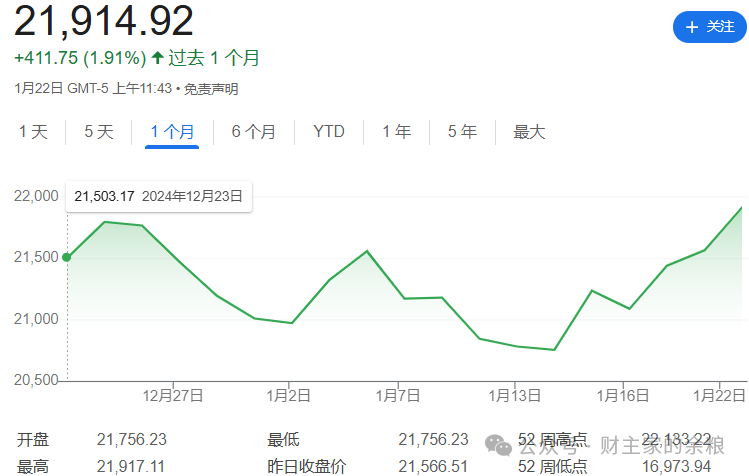

As US stocks fluctuated, dropping from their peaks and now hovering with signs of recovery, it's crucial to note that Apple Inc. has consistently declined. In fact, the day after my article's publication, December 26th, Apple hit an all-time high and has been on a downward trajectory ever since.

Despite Apple's decline, US stocks, much like a resilient cockroach, refuse to be extinguished...

When I published my article claiming Apple as the largest bubble in US stocks, Apple's market value stood at an astonishing $3.9 trillion, crowning it the top company in US stocks.

Within a month, Apple's market value plummeted to $3.35 trillion, while NVIDIA courageously ascended to the throne of the highest market value, currently totaling $3.6 trillion.

Some envision that, although Apple has yet to reach $4 trillion, NVIDIA might!

After all, with NVIDIA's current market value of $3.6 trillion, a mere 10% increase would propel it to $4 trillion. And considering NVIDIA's meteoric rise since the introduction of ChatGPT in 2023, such a 10% increase seems almost trivial in the AI era, doesn't it?!

However, in my opinion, the current global landscape simply does not justify a company worth $4 trillion.

No company deserves a $4 trillion market value!

First, let's contextualize what $4 trillion truly means.

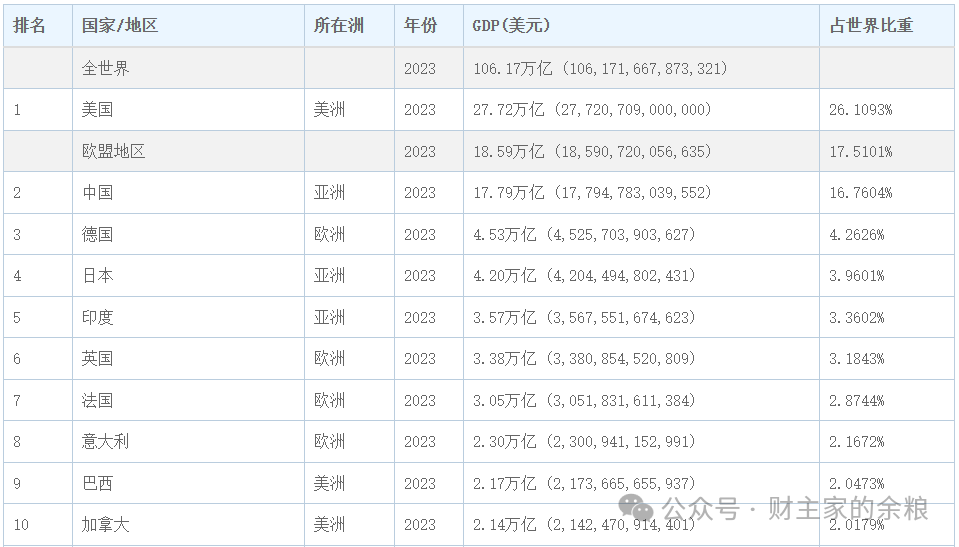

In 2023, Japan's GDP was approximately $4.2 trillion. Exceeding $4 trillion implies that a single company's market value rivals the world's fourth-largest economy, supporting a population of 130 million.

If comparing to a specific economy feels inappropriate, let's instead scale our perspective to the US and global GDP.

Using the most effective valuation metrics, the dot-com bubble of 2000 marked the zenith of the US stock market over the past 250 years.

At the peak of the dot-com bubble in March 2000, Cisco, analogous to today's NVIDIA as a "shovel seller," reached a peak valuation of $550 billion. Simultaneously, Microsoft, with its computer operating system controlling internet access points, much like today's Apple, also peaked at a market value of $550 billion.

In 2000, only Cisco and Microsoft held the top market values and were considered peers, much like today's Apple, Microsoft, and NVIDIA.

What were the US and global GDPs in 2000?

$10.3 trillion and $33.8 trillion, respectively.

This means the most valuable company at the time was roughly equivalent to 5.3% of US GDP and 1.6% of global GDP.

Fast forward to today: the US GDP in 2023 is $28 trillion, and the global GDP is $106 trillion.

You might argue that this is a new era with new dynamics, suggesting that the proportion of the highest-valued company to US or global GDP should be higher. Based on 2000 standards, can we double this proportion?

Cisco, then the leading network hardware supplier, aligns perfectly with NVIDIA's current status, while Microsoft, the dominant window operating system provider, enjoyed a stronger monopoly than Apple today...

Doubling the proportion of US GDP equates to 10.3% of US GDP or 3.2% of global GDP.

Theoretically, the highest-valued company in US stocks should be around $3 trillion based on doubled US GDP. For global GDP, this figure would be approximately $3.4 trillion.

Yet, both numbers fall significantly short of $4 trillion...

Moreover, in 2000, only Cisco and Microsoft surpassed $400 billion in market value. Today, there are three companies valued at over $3 trillion (Apple, NVIDIA, and Microsoft), along with Google and Amazon, both exceeding $2 trillion.

If we aggregate the market values of these five tech giants, the total would exceed $15 trillion, almost matching China's GDP and equivalent to one-seventh of global GDP.

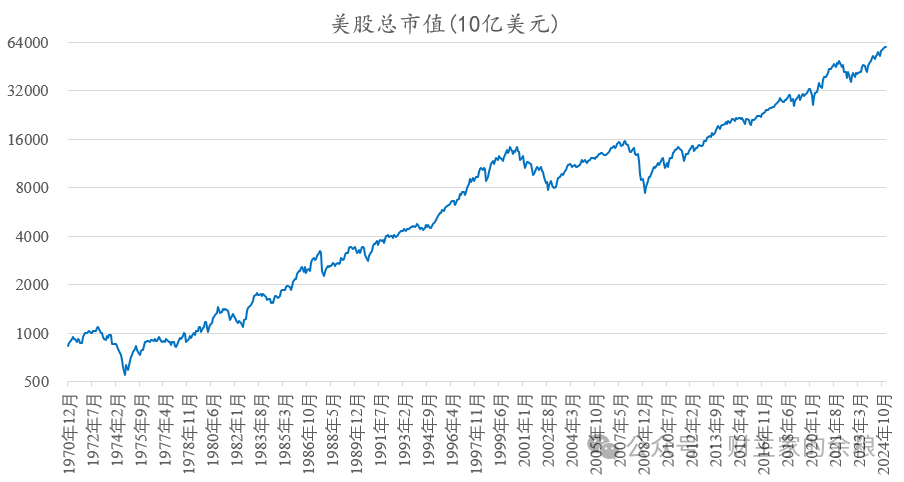

Looking further back, in 1970, the total market value of all US stocks was a mere $800 billion, a staggering contrast. By March 2000, this figure had grown to approximately $14.3 trillion, and now stands at $60.3 trillion!

Scaling based on the total market value of US stocks, if the highest-valued company in March 2000 represented 3.8% of the total market value ($550 billion out of $14.3 trillion), then with the current total market value of $60.3 trillion, the largest company should theoretically be valued at around $2.3 trillion...

Thus, I present a "one-sided and arbitrary" viewpoint: whether it's Apple or NVIDIA, it is highly unlikely for their current market values to surpass $4 trillion.

And if they do approach the $4 trillion mark?

They can only expect to decline!