Why China's AI "Trident" Under Blockade is Accelerating Innovation and Stirring Panic in Silicon Valley

![]() 01/31 2025

01/31 2025

![]() 501

501

Whether it's DeepMind's open-source model breaking the "monopoly on computing power" or Luobo Kuaipao outperforming Waymo at one-seventh the cost, the rise of Chinese AI is directly challenging the soft underbelly of American technological hegemony. While Silicon Valley engages in a capital-driven arms race, Chinese enterprises have pioneered a new path through engineering innovation and scenario-based implementation.

Once upon a time, in the wake of ChatGPT's emergence, many industry insiders predicted it might take five years or more to bridge the gap between China and the United States. However, just six months after the initial release of GPT 3.5, Baidu's ERNIE Bot fired the first shot in the large model field, aiming to "surpass Britain and catch up with the United States," thus initiating a wave of consolidation in the domestic "Hundred Models War." By the eve of the 2025 Snake Year Spring Festival, DeepMind, now renowned, indicated that domestic AI enterprises had surpassed Silicon Valley in terms of overall strength, both in performance and cost.

This historic process took just two years and one quarter, more than twice as fast as most people had anticipated.

In the more practical realms of autonomous driving and C-end paid applications, Baidu, an early industry pioneer with over a decade of deep involvement, has also achieved remarkable results. Whether it's Luobo Kuaipao, which rivals Google Waymo and Tesla, or Baidu Wenku's 40 million paid users, they have all used concrete market data to catch the attention and even stir anxiety among American counterparts.

As Baidu's founder and CEO Robin Li noted, "Major technological breakthroughs and disruptive innovations often result from large-scale applications." The "AI trident" represented by DeepMind, Luobo Kuaipao, and Baidu Wenku truly epitomizes China's technology industry in terms of engineering innovation on the technology side and large-scale application on the market side.

The "overt maneuver" of the Eastern power to overtake has the Americans in a panic.

In a sense, the intensity of the American reaction is directly proportional to the gold content of China's technological breakthroughs.

Four days after the launch of DeepMind-R1, on January 24 local time, the U.S. Navy issued a warning letter stating that, due to "potential safety and ethical issues," it had requested personnel to avoid using the DeepMind model of a Chinese company in any form. Four days later, multiple U.S. officials responded to the impact of DeepMind on the United States, labeling it "theft" and initiating a national security investigation into its implications.

DeepMind-R1's performance is obvious to all. It achieved a score of 79.8% on AIME 2024, slightly edging out OpenAI-o1-1217. On MATH-500, it obtained an astonishing score of 97.3%, performing comparably to OpenAI-o1-1217 and significantly outperforming other models.

The key differentiating technology here lies in the innovative training method of DeepMind-R1. For instance, the R1-Zero route used in the data training phase directly applies reinforcement learning (RL) to the base model without relying on supervised fine-tuning (SFT) or labeled data.

Moreover, DeepMind-R1 enhances training efficiency through high-quality data generated by data distillation technology (Distillation). This is pivotal to its performance being on par with OpenAI o1.

More importantly, this model is open-source. In contrast, OpenAI has become "CloseAI" since GPT-3, offering no substantial help to the open-source community beyond providing alternative evolutionary directions for AI development.

DeepMind's open-source approach, however, is comprehensive: it is not only fully open-source but also releases detailed technical reports; it not only open-sources its largest 671B R1 model but also aids in distilling and quantifying multiple size models ranging from 1.5B to 70B; it is not merely open-source in name but has also chosen the most permissive MIT License agreement, allowing anyone to use, modify, and distribute it freely, including for commercial purposes. This open mindset stems from the confidence bestowed by its efficient engineering innovation level, which has truly earned global respect.

At this juncture, DeepMind has become a true "OpenAI."

It should be noted that DeepMind is currently still a "base model" serving as infrastructure. Closer to ordinary households in the product and application layers, autonomous driving player Luobo Kuaipao and C-end product Baidu Wenku have long achieved true commercialization.

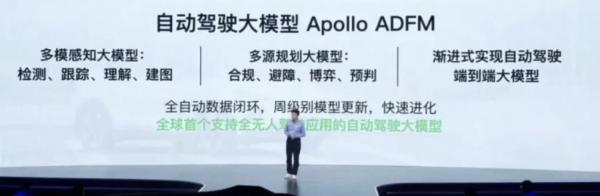

No one denies that autonomous driving is one of the natural landing scenarios for large models. According to official information, the self-developed large autonomous driving model Apollo ADFM equipped on the 6th-generation model of Luobo Kuaipao has achieved multimodal fusion combining point clouds and vision, enabling more accurate detection and understanding of obstacles in complex environments. This expands autonomous driving services to cross-district, cross-river, airport expressway, and other traffic scenarios.

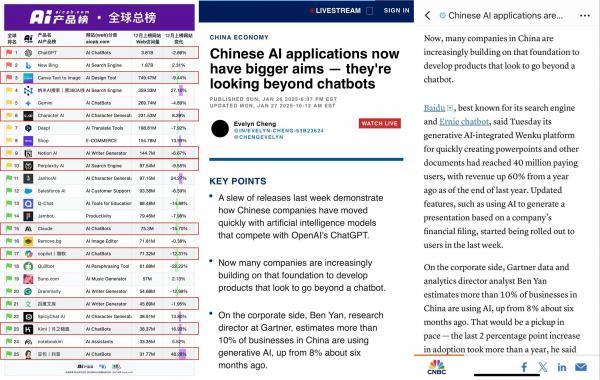

Another set of data indicates that Baidu's Wenku business has surpassed 90 million monthly active users for AI functions, exceeding Doubao's 70 million under ByteDance; among them, 40 million are paid users, ranking second globally and first in China, second only to Microsoft Copilot.

In other words, even without the emergence of DeepMind, China's AI-related products and services have already secured a seat at the global table.

Another batch of "top students" in AI from China

That being said, in the realm of autonomous driving, Luobo Kuaipao may be more "lonely" than DeepMind. On the international stage, it has to simultaneously face competition from several major intelligent driving giants such as Google and Tesla.

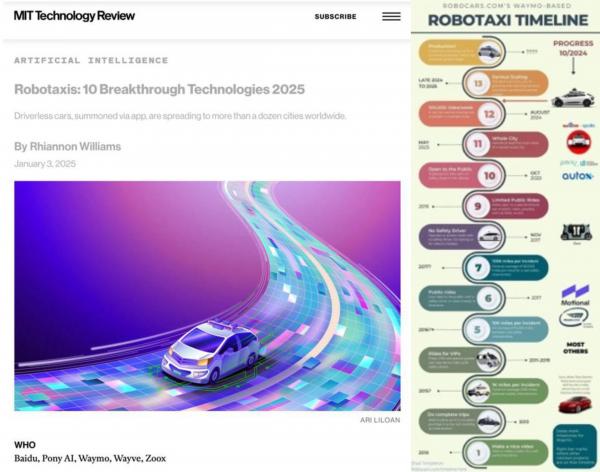

Although fully autonomous driving is far from being "popularized" thus far, the rapid deployment of smart in-vehicle infotainment systems on new energy vehicles has clearly signaled that this is the future! The competition between China and the United States in the application of autonomous driving is not merely a matter of short-term gains or losses but also a strategic game in the high-tech domain.

Luobo Kuaipao's overseas situation is strikingly similar to that of DeepMind: On January 14, 2025, the U.S. Department of Commerce issued regulations prohibiting Chinese autonomous driving companies from conducting autonomous vehicle tests in the United States and restricting the use of Chinese connected vehicle software, hardware, and complete vehicles in the United States on the grounds of "protecting U.S. national security." This ban will take effect in 2027.

However, amidst rapidly changing and high-pressure competition, Luobo Kuaipao has not only withstood the pressure but also achieved accomplishments that rival Waymo and Tesla:

Firstly, as early as this May, Baidu released Apollo ADFM, the world's first large autonomous driving model that supports L4 autonomous driving. Its safety surpasses human drivers by more than 10 times and achieves full coverage of complex urban scenarios. As of this June, Luobo Kuaipao has achieved zero major casualties in over 100 million kilometers of actual road testing.

Behind such achievements, Baidu's investment has been marathon-like and pressure-intensive – 12 years and 170 billion yuan of investment have made Luobo Kuaipao the only enterprise in China capable of conducting large-scale and regularized testing.

One outcome of long-term investment and large-scale application is that the cost of autonomous driving terminals has been "brought down."

In terms of vehicle costs, the sixth-generation Luobo Kuaipao costs only one-seventh of Google Waymo's vehicles and is even lower than Tesla's cybercab, which is announced to go into mass production in 2026. This is obviously beneficial for Luobo Kuaipao to achieve large-scale operations in China, even taking the lead over Google Waymo and Tesla. Forbes praised this as a "breakthrough in the industry."

Secondly, on this foundation, China's autonomous driving industry also possesses various "hard conditions" for going abroad. Another report indicated that Luobo Kuaipao is expected to test and deploy its self-driving taxis in Hong Kong, China, Singapore, the Middle East, and other regions.

These places have a high proportion of right-hand drive and left-side travel, making Hong Kong the most suitable "test field." On December 4 last year, Luobo Kuaipao successfully obtained Hong Kong's first pilot license for autonomous vehicles.

As the first autonomous driving test license obtained by Luobo Kuaipao in a region with right-hand drive and left-side travel, this is the first step towards its globalization. Once the testing is mature, the right-hand drive market, which accounts for one-third of the global market, will also be a potential market space for China's autonomous driving.

According to Frost & Sullivan's forecast, by 2030, the scale of China's Robotaxi market will reach 488.8 billion yuan, while the global market scale will reach 834.9 billion yuan. This is a market with sufficient growth potential and an important economic growth point in the future.

It is worth mentioning that in MIT Technology Review's list of the "Top 10 Breakthrough Technologies" of 2025, emerging industries such as autonomous driving and generative AI were selected. AI and autonomous driving enterprises such as Baidu and Google have also become important forces driving the development of global autonomous driving technology.

Now let's turn to Baidu Wenku. Under the reconstruction of large models, Baidu Wenku has transformed from an office tool to an AI-leading product for idea collision and inspiration, becoming a "one-stop AI content acquisition and creation platform."

Market data also shows that this decision has not only failed to reduce Wenku's revenue but has allowed it to stand out amidst the short-term, red ocean, and homogenized competition among AI products, becoming the second-largest C-end AI product after Microsoft Copilot. After AI reconstruction, Baidu Wenku's MAU reached 70 million, with paid users accounting for about 60% of active users.

In a sense, this is a concrete manifestation of Baidu's consistent philosophy in AI products. Both autonomous driving and Baidu Wenku start from user demand scenarios, providing users with "use value" and guiding user behavior from "being interested" to "really needing" and then to "paying for use value."

From blockade to self-improvement

History often seems strikingly similar: In the 20th century, the western blockade gave birth to "the two bombs and one satellite"; in the 21st century, the chip supply disruption forced Huawei to develop HarmonyOS and Kirin; nowadays, the encirclement in the AI field is nurturing a new generation of AI technology paradigms in China.

The blockade from the outside is precisely the highest "certification" of technological achievements. When the U.S. Department of Commerce erected a high wall against China's autonomous driving technology in the name of "national security," Silicon Valley may not have anticipated that this wall would instead become a crucible for Chinese technology enterprises to hone their "anti-fragility."

Whether it's DeepMind's open-source model breaking the "monopoly on computing power" or Luobo Kuaipao outperforming Waymo at one-seventh the cost, the rise of Chinese AI directly challenges the soft underbelly of American technological hegemony. While Silicon Valley indulges in a capital-driven arms race, Chinese enterprises have pioneered a new path through engineering innovation and scenario-based implementation.

Faced with the chip supply disruption, DeepMind trained a top-tier model with only a small amount of resources, proving that algorithm optimization can bridge the hardware gap; under the pressure of strong competitors in U.S. autonomous driving, Luobo Kuaipao greatly reduced the cost of lidar through multi-sensor fusion technology and independently developed the world's first large model that supports L4 autonomous driving, significantly enhancing the safety and generalization of the technology, laying the groundwork for layout in emerging markets such as the Middle East and Southeast Asia. Baidu Wenku, on the other hand, has torn open a commercialization gap among many competitors by leveraging the closed loop of "AI + ecosystem." These cases all confirm a logic:

The stricter the blockade, the more urgent the innovation, and the more thorough the breakthrough.

As Robin Li said, "Being at the forefront of technology also means taking greater risks, enduring a higher failure rate than peers, withstanding loneliness, and tolerating others' misunderstanding or even disdain."

When DeepMind's code is "starred" by developers worldwide on GitHub, when Luobo Kuaipao's self-driving cars drive on foreign streets, and when Baidu Wenku's inspiration function lights up the screens of millions of creators, the world will eventually see that the high wall of foreign blockade will ultimately only serve as a springboard for Chinese technology.

The more blockade, the more development; the more development, the stronger. This is not only a true portrayal of China's AI trident but also an eternal creed for China's technology industry as it strides towards the stars and the sea.