Analysis of Autonomous Driving Technology Framework and Industry Prospects

![]() 02/05 2025

02/05 2025

![]() 580

580

As the cornerstone of future automotive advancements, intelligent driving is reshaping the global automotive landscape. Like any journey, there are multiple paths to reaching the destination, and the same applies to technological development. While intelligent driving has emerged as a consensus for the industry's future, differing opinions persist regarding its technological framework and potential implementation forms. Debates encompass single-car intelligence versus intelligent connectivity, LiDAR versus in-vehicle cameras, and the role of high-precision maps.

Overview of Intelligent Driving

1.1 Definition and Development Background of Intelligent Driving

Intelligent driving entails the realization of autonomous driving capabilities through the integration of advanced sensors, controllers, artificial intelligence algorithms, and high-performance computing platforms. Its primary goal is to reduce or eliminate human control, thereby minimizing traffic accidents, enhancing driving efficiency, and improving the overall travel experience. With the rapid advancement of big data, artificial intelligence, and 5G communication technologies, intelligent driving has transitioned from the lab to the market, becoming a significant driver of automotive development.

The evolution of intelligent driving dates back to the 1980s with autonomous driving research, but significant breakthroughs occurred after entering the 21st century, particularly with the maturation of electric vehicles and internet technology, which spurred the commercialization of intelligent driving technology. Companies such as Tesla, Baidu, and Google Waymo have continued to invest in this field, gradually making intelligent driving a reality and increasing the penetration of intelligent vehicles.

1.2 Three Major Transformations of Intelligent Driving on the Automotive Industry

The widespread application of intelligent driving technology not only enhances vehicle functionality but also profoundly impacts the entire automotive industry, especially in terms of vehicle structure, industrial chain, and business model.

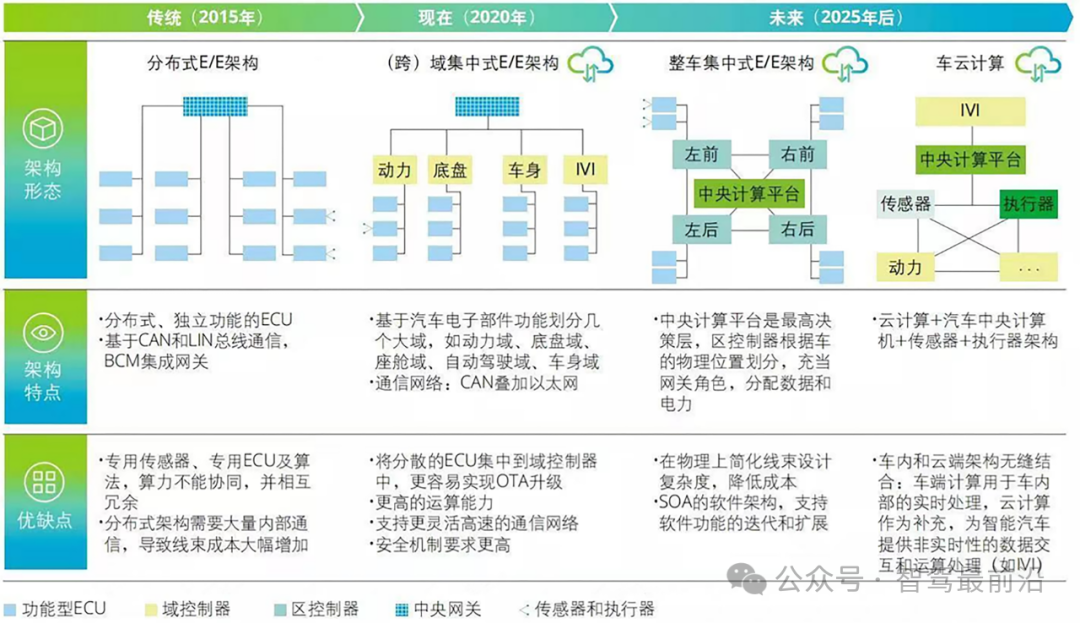

Firstly, the vehicle structure is transitioning from a traditional distributed electronic and electrical architecture (EEA) to a centralized architecture. In traditional automotive design, electronic control units (ECUs) for various functional modules are relatively independent, communicating via buses. However, with the proliferation of autonomous driving sensors and controllers, the traditional distributed architecture struggles to meet increasingly complex functional requirements. Consequently, automakers are centralizing control units, processing various vehicle operational instructions through a few powerful central computing platforms. This architectural shift not only improves system integration but also reduces wiring harnesses, lowering vehicle weight and production costs.

Upgrade Path Diagram of Automotive Electronic and Electrical Architecture

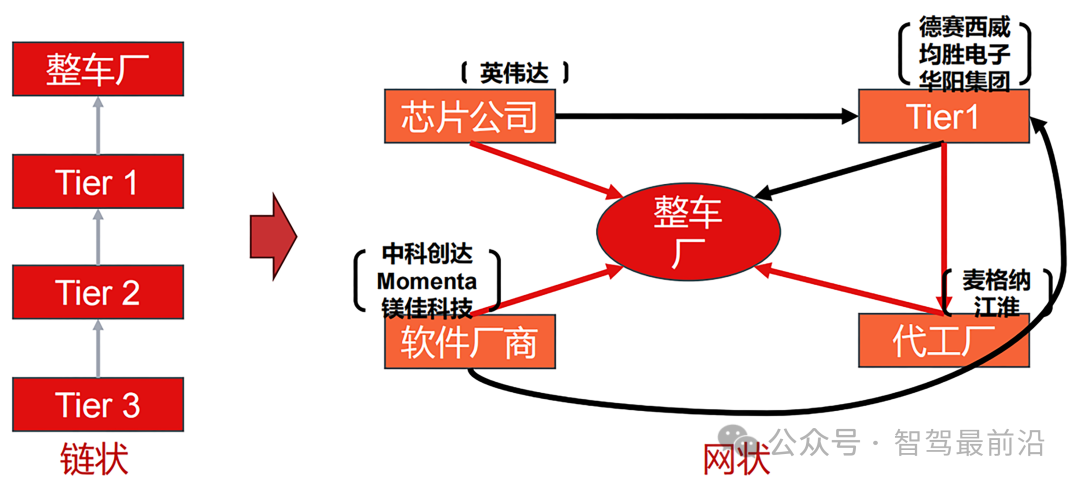

Regarding the industrial chain, intelligent driving technology has prompted a transformation from a linear structure to a mesh network, where companies with strong software capabilities enjoy higher added value. Historically, the automotive manufacturing industry relied heavily on original equipment manufacturers (OEMs) to control the entire production process. However, in the era of intelligent driving, close collaboration among OEMs, software suppliers, sensor manufacturers, cloud service providers, and other parties becomes crucial. Collaborations such as Tesla and NVIDIA, and Baidu and Huawei indicate that the future automotive industrial chain will be more interconnected, with cross-link collaboration becoming the core competitiveness of industry development.

Development of the Automotive Industry from a Chain to a Mesh

Intelligent driving has also spurred innovation in business models. Traditional automotive manufacturing primarily relied on vehicle sales and after-sales services for profit. However, in the era of intelligent driving, emerging business models such as software subscriptions, OTA (Over-The-Air) services, and data value-added services are gaining traction. For instance, Tesla provides autonomous driving software to users through phased unlocking and continuous upgrades. This subscription-based model not only enhances user loyalty but also generates a steady revenue stream for the company.

Classification of Intelligent Driving Technology

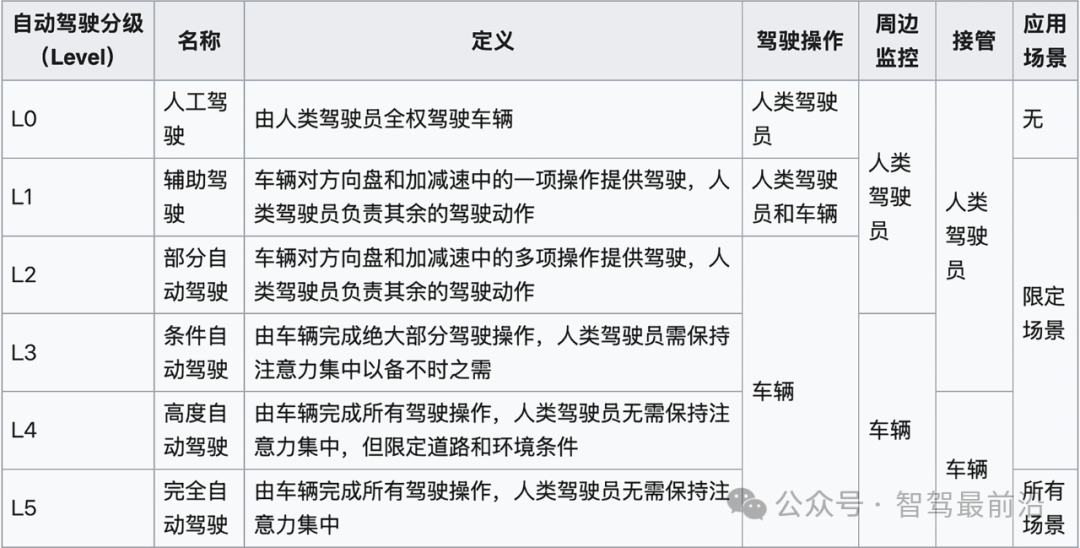

2.1 Classification Standards for L1-L5 Autonomous Driving Technology

To differentiate the varying degrees of autonomous driving capability, a globally adopted technical classification standard of six levels, L0-L5, was developed by the Society of Automotive Engineers (SAE). This system describes the degree of vehicle automation.

Level 0: No Automation. The driver fully controls all mechanical and physical functions of the vehicle, with only warning systems that do not involve active driving.

Level 1: Driver Assistance. The driver operates the vehicle, but individual devices like Electronic Stability Program (ESP) or Anti-lock Braking System (ABS) assist for enhanced safety.

Level 2: Partial Automation. The driver primarily controls the vehicle, but the system automates certain functions to significantly reduce workload. Examples include Adaptive Cruise Control (ACC) combined with automatic lane keeping, lane departure warning, and Automatic Emergency Braking (AEB) through blind spot detection and partial collision avoidance.

Level 3: Conditional Automation. The driver must be ready to take control at any time. During automated assistance, the driver can temporarily refrain from operation, such as during following another vehicle. However, when the vehicle detects a situation requiring driver intervention, it immediately returns control, which the driver must take over to handle.

Level 4: High Automation. The driver can allow the vehicle to drive autonomously under permitted conditions. After activating autonomous driving, the driver generally does not need to intervene. The vehicle can perform tasks like turning, lane changing, and accelerating according to set road rules (e.g., smooth traffic flow and standardized road signs on highways). Except in severe weather, unclear road conditions, accidents, or the end of autonomous driving segments, the system provides the driver with "sufficient transition time." The driver should monitor vehicle operation but can include functions like unattended parking (with steering wheel).

Level 5: Full Automation. The driver does not need to be in the vehicle and will not control it at any time. Such vehicles can activate the driving mechanism independently and perform all safety-related critical functions without being designed for specific road conditions. They can operate independently without driver control, including when no one is in the vehicle (without steering wheel).

Although automakers are developing and designing intelligent driving features, most mass-produced intelligent vehicles currently fall under L2 and below, with true L3 functionality yet to achieve widespread commercial use. While companies like Tesla and NIO have introduced vehicles with some L3 capabilities, regulatory and technological constraints still require time for full L3 popularization.

2.2 Current Status of L1-L5 Intelligent Driving Technology

L1-L2 autonomous driving technology is already widely used, with typical functions including adaptive cruise control, lane keeping assistance, and automatic emergency braking. For example, Tesla's Autopilot and NIO NOP'+s assistive driving systems can achieve automatic following, steering, and overtaking on highways, but the driver must still be ready to take over at any time. Therefore, these systems belong to L2-level assistive driving.

L3-level intelligent driving systems face greater technical challenges. The core feature of L3 is that the vehicle can drive autonomously under specific conditions, with the driver only required to monitor road conditions. While this seems ideal, L3 systems still have many uncertainties in practical applications. For instance, when the system encounters complex traffic conditions, how to request driver takeover within a short time and ensure a quick response remains unresolved. Additionally, countries have not yet reached a unified standard for L3-level vehicle liability division, significantly limiting the commercial promotion of L3 systems.

L4-L5 intelligent driving technology mainly focuses on autonomous taxi (Robotaxi) and driverless test projects in specific areas. L4-level vehicles can drive completely autonomously under specific conditions but fail to function normally when those conditions are not met (e.g., severe weather or complex roads). L5 level is the ultimate goal of full automation, enabling vehicles to drive autonomously at any time and in any environment. However, at this stage, there are no globally mass-produced L5-level vehicles.

Transformation of Electronic and Electrical Architecture: From Distributed to Centralized

3.1 Definition and Development of Electronic and Electrical Architecture

Automotive Electronic and Electrical Architecture (EEA) refers to the architectural design for integrating and controlling various electronic components and systems within a vehicle, including sensors, actuators, ECUs, wiring harnesses, etc. The EEA system's function is to control vehicle operation through efficient signal transmission and ensure the coordinated work of various subsystems. With the rapid development of intelligent driving, the number of sensors and control systems within vehicles has continuously increased, revealing the limitations of the traditional distributed architecture. To handle complex computational demands, the electronic and electrical architecture is transitioning from a distributed to a centralized design.

Traditional distributed EEA typically uses multiple ECUs to control various vehicle functions separately, such as engine control, body control, and chassis control. While this architecture ensures independent control of each module, the introduction of autonomous driving and smart cockpit functions has increased the vehicle's computational complexity, gradually exposing the distributed architecture's limitations in information transmission speed and resource scheduling.

3.2 Development Trend of Centralized Integrated Architecture

To address the increasingly complex demands of intelligent driving systems, automakers are transitioning the electronic and electrical architecture from distributed to centralized integration. This involves consolidating multiple scattered ECUs into a few more powerful central processors to achieve unified vehicle control. For example, Tesla's Model 3, launched in 2017, adopted a central computing plus zonal controller architecture. By reducing the number of ECUs and optimizing wiring harness layout, it not only improved system processing capability but also reduced vehicle cost and maintenance complexity.

The advantage of this centralized architecture lies in its ability to more efficiently process data from various sensors, particularly for complex autonomous driving computations. The central processing unit can respond quickly, and the centralized architecture facilitates over-the-air (OTA) software updates for vehicles, a key technology for the future of "software-defined vehicles." Through OTA, automakers can regularly push new features or fix software vulnerabilities, enhancing vehicle lifespan and performance.

Evolution and Upgrading of the Intelligent Driving Industrial Chain

4.1 Changes in Industrial Chain Structure

The rapid development of intelligent driving technology is driving profound changes in the automotive industrial chain. The traditional automotive industrial chain exhibits a linear form, with each link from design and development to manufacturing and product sales relatively independent. However, in the era of intelligent driving, all links in the industrial chain are gradually moving towards a networked development, with closer collaboration among various manufacturers. For example, the collaboration of software, hardware, cloud services, and other forces is essential for the implementation of intelligent driving technology.

Today's automotive industrial chain has transitioned from a traditional "OEM-centered" model to a networked structure characterized by the "deep integration of software and hardware." Notably in the realm of intelligent driving, key technological components such as sensors, chips, communication devices, and in-vehicle computing platforms have emerged as pivotal players. Automakers can no longer handle the entire spectrum from design to production alone but rely on suppliers to furnish high-performance software, hardware, and related services.

4.2 High Value-Added Links in the Industrial Chain

In the intelligent driving industrial chain, enterprises possessing core technological barriers typically capture greater added value. Specifically, chip manufacturers, software providers, and OEMs with autonomous R&D capabilities are poised to become high value-added links in the era of intelligent driving.

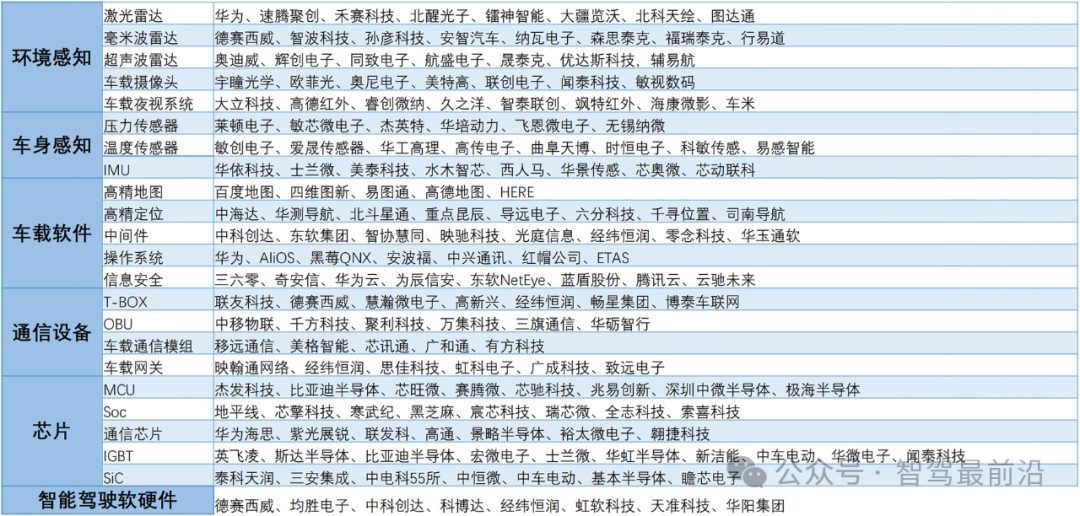

Intelligent Driving Software and Hardware Companies

With the profound integration of intelligent driving technology, the barrier to entry in vehicle manufacturing is gradually diminishing, while the significance of software and algorithms is continually rising. In the future, competition among automakers will increasingly focus on the integration capabilities of intelligent driving software and hardware systems, rather than traditional mechanical manufacturing prowess. Additionally, the maturation of technologies such as high-precision maps, AI algorithms, and cloud computing in autonomous driving systems will further propel the transformation of the automotive industrial chain from a linear to a networked model.

Innovation and Challenges in Business Models

5.1 Asset-light Vehicle Manufacturing and OEM Model

The advancement of intelligent driving technology has not only altered the conventional technical trajectory but also spurred the transformation of the automobile manufacturing model. In recent years, numerous new entrants in the automotive industry have opted for the "asset-light vehicle manufacturing" model, which involves leveraging OEM production to swiftly launch branded vehicles. The essence of this model lies in automakers' ability to forgo the construction of massive production facilities, instead concentrating on vehicle design, research and development, and intelligent driving technology through collaborations with professional OEM factories. For instance, the partnership between Huawei and Thalys exemplifies a successful application of this model.

The rise of the OEM model has further lowered the manufacturing threshold for new entrants, enabling more enterprises specializing in intelligent driving and in-vehicle system development to swiftly penetrate the market. Nonetheless, this model also presents challenges, such as ensuring the quality of OEM production and effectively controlling costs during the OEM process. These issues necessitate joint exploration and solutions by automakers and OEM factories.

5.2 Paid Model for Intelligent Driving Features

As intelligent driving technology continues to evolve, the core competitiveness of vehicles has gradually shifted from hardware to software and services. An increasing number of automakers are adopting a software-based business model to achieve profitability by offering users value-added intelligent driving features. For example, Tesla's FSD (Full Self-Driving) software is available to users through a one-time purchase or monthly subscription, and companies like NIO and ZEEKR have also introduced similar paid services for intelligent driving features.

The advantage of this business model is that automakers can continuously provide users with new features and services through iterative software updates, thereby enhancing user loyalty and securing long-term revenue streams. Simultaneously, the paid model offers automakers additional profit channels, particularly when vehicle hardware configurations become increasingly homogeneous, making software payments a crucial means to differentiate from competitors.

Challenges and Investment Opportunities in Intelligent Driving Technology

6.1 Technical Challenges

Despite the promising outlook for intelligent driving technology, it still confronts numerous technical and commercial hurdles during its deployment. Firstly, there is the issue of technical reliability. As vehicles become more autonomous, intelligent driving systems must exhibit extremely high levels of stability and safety, particularly in applications at L3 and above levels. These systems must adeptly handle various complex driving scenarios and make rapid safety decisions during critical moments.

Secondly, there is the cost issue. Currently, many high-end autonomous driving sensors are still priced exorbitantly, especially core hardware such as lidar and millimeter-wave radars, which maintain the high cost of autonomous vehicles. Reducing the costs of these core technologies is crucial for the large-scale adoption of intelligent driving in the future. Additionally, there are significant variations in the regulatory environment for intelligent driving globally. Policies and regulations across countries have yet to establish uniform standards for autonomous driving technology at L3 and above levels, leading to disparities in the rate of adoption of intelligent driving technology across different markets.

6.2 Investment Opportunities

Despite the challenges posed by technology and regulations, the field of intelligent driving remains a focal point for capital markets. High-barrier segments of the intelligent driving industry chain, including chips, algorithms, lidars, and high-precision maps, have garnered substantial investor interest.

Looking ahead, with the gradual maturation of L4-L5 level autonomous driving technology, emerging application scenarios such as autonomous taxis (Robotaxi) and autonomous logistics vehicles will present even more investment opportunities. Furthermore, the proliferation of intelligent driving technology will also catalyze the development of related supporting industries, including intelligent transportation systems, the Internet of Vehicles infrastructure, and other domains, which will likewise become key areas for capital deployment.

Conclusion and Outlook

Through a framework analysis of intelligent driving technology, it becomes evident that intelligent driving is not only a pivotal development direction for the future automotive industry but also a key catalyst for change across the entire industrial chain. From technology classification, the transformation of electrical and electronic architecture, to the evolution of the industry chain and business models, intelligent driving is gradually transitioning from concept to reality. As technology advances and regulations improve, the popularization of intelligent driving will further accelerate.

Amidst this opportunity, enterprises with core technological capabilities will occupy a favorable position and spearhead the development trajectory of intelligent driving technology. Simultaneously, investors must closely monitor the technical dynamics and market trends in the intelligent driving sector, proactively targeting high value-added segments of the industry chain to seize future investment opportunities. In summary, the evolution of intelligent driving technology signifies not merely a technological shift but a revolutionary transformation within the entire automotive industry, poised to profoundly impact future modes of transportation and industrial ecology.

-- END --