Palantir: Confounding Short Sellers with Unmatched "AI Faith"

![]() 02/05 2025

02/05 2025

![]() 589

589

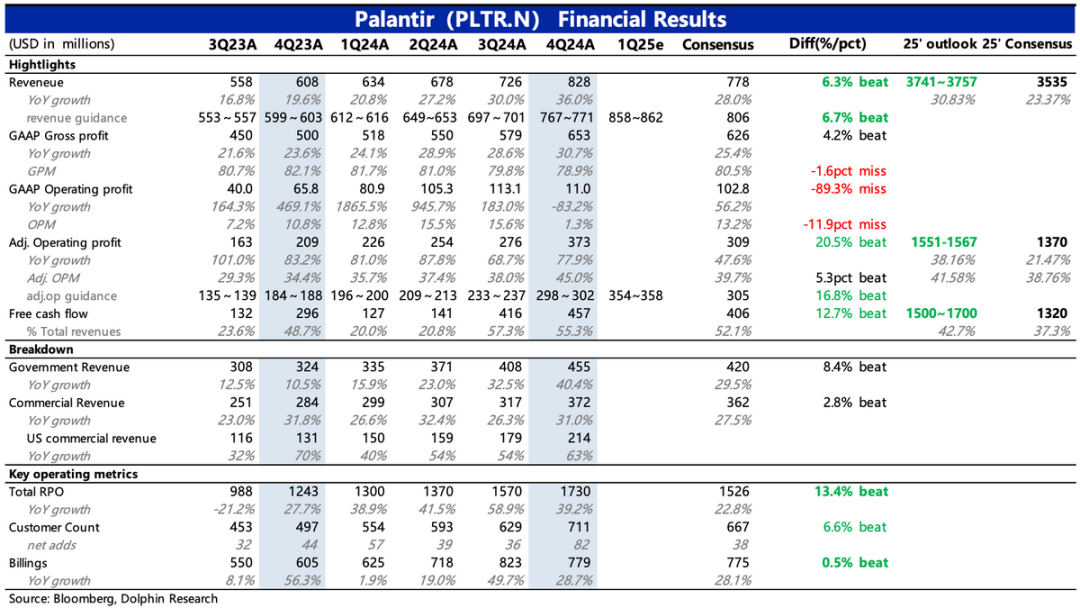

Palantir released its Q4 2024 earnings after market close on February 3, EST. Amidst the ongoing debate over the value of large AI models amidst the Deepseek disruption, Palantir once again demonstrated with its Q4 financial results that focusing on specific vertical AI applications can yield exceptional outcomes.

Let's delve into the core financial information:

1. **Robust Guidance, Dispelling Doubts**: For Palantir, a company with a notably high valuation, nothing could dim its short-term upward trajectory more than a significant slowdown or disappointing growth guidance. The significance of PLTR's management guidance lies in the market's "limited comprehension of the nascent AIP business" and the "challenge in quantifying customized services." In the current competitive landscape with few rivals, Palantir's short-term growth heavily relies on its customer acquisition pace, i.e., the intensity of team expansion (sales personnel, customized solution personnel, etc.). This creates an expectation gap between market and actual performance, with the market heavily reliant on guidance for assumptions.

Prior to the earnings release, the bulls' optimism was evident, while bears harbored doubts about the sustainability of high growth and the pace of profitability improvement in 2025 (due to factors such as short-term peaking of U.S. government defense spending, competition from OpenAI, and AI-enabled enterprise SaaS platforms). While acknowledging short-term growth, bears believed a share price correction might be necessary given the current valuation. However, the Q1 2025 and full-year guidance provided in the Q4 report directly countered these doubts:

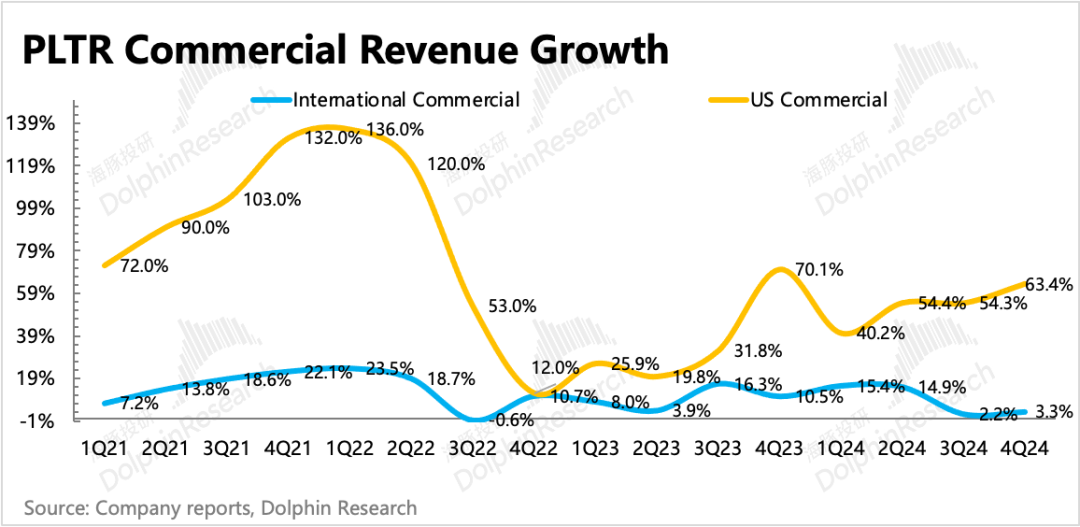

(1) **Unwavering Growth**: Q1 growth is anticipated at 36%, slightly surpassing market expectations. Full-year revenue is projected at $3.74-3.76 billion, with a growth rate (median) of 30%, and U.S. commercial revenue growth is expected to be at least 54%!

(2) **Continuous Profitability Improvement**: Adjusted operating margin for Q1 is expected to be 41%, nearly 4 percentage points above market expectations. Full-year margin (median) is projected at 42%, a 3 percentage point increase from 2024.

2. **Impressive Current Performance**: Besides the guidance, Q4 performance was also noteworthy. In the U.S. market, a key revenue contributor, both government and commercial revenues accelerated, fueled by strong demand for Foundry and AIP. The international market witnessed a recovery on the government client side, spurred by new contracts from defense ministries in the UK and Australia. International enterprise client revenue remained stable with no significant changes.

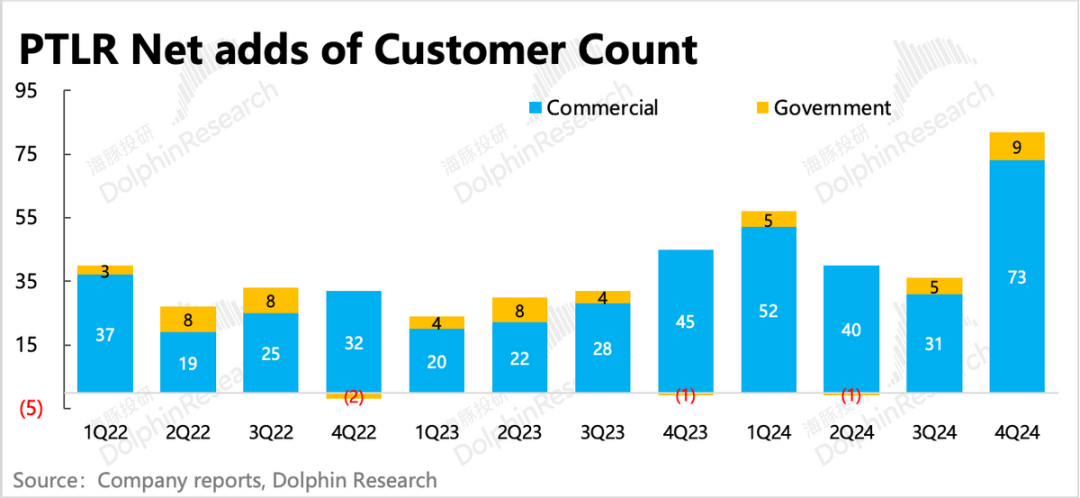

Customer numbers also surged in Q4, far outpacing the previous three quarters. Specifically, the net increase in enterprise customers doubled, and the net dollar retention rate (NDR) for existing customers further climbed to 120%.

3. **Forward Indicators Suggest Short-term Growth is Assured**: Palantir primarily provides customized software services to clients (with some standardization trends in the AIP segment), rendering revenue highly predictable in the short term. The company's narrow guidance range implies high revenue certainty.

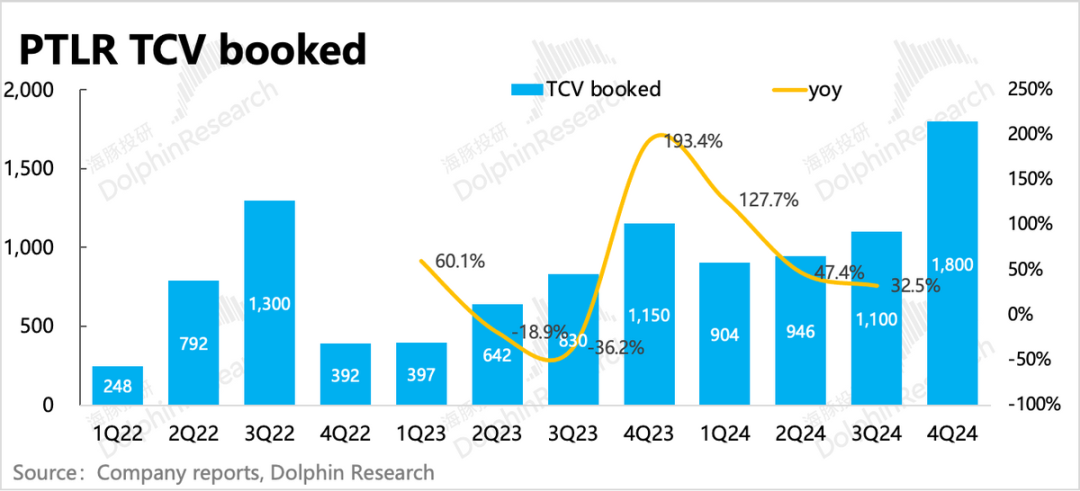

However, to reflect Palantir's true business growth, the market pays closer attention to indicators related to new contracts, such as TCV (Total Contract Value), RPO (Remaining Performance Obligation), customer count (primarily commercial customers), and Billings (current period billings).

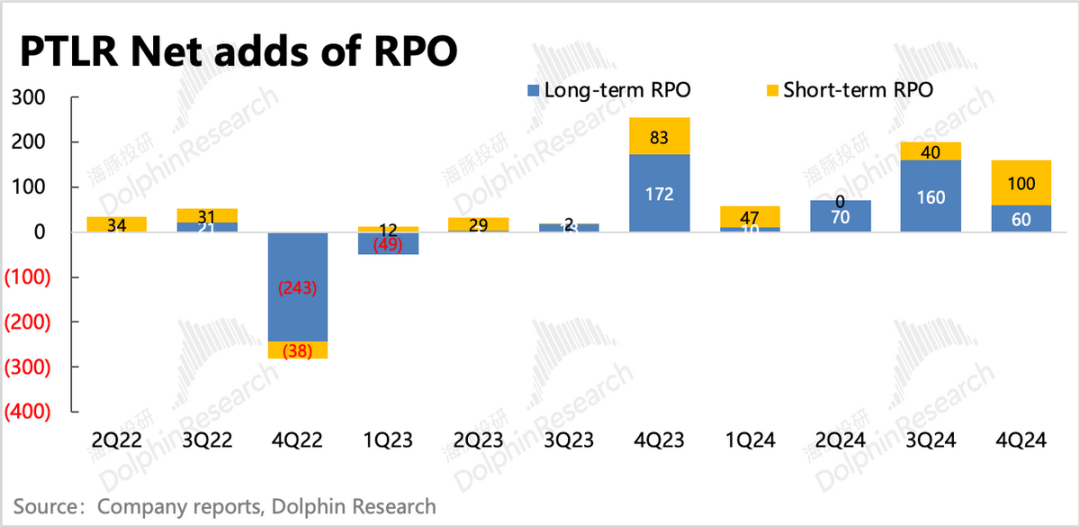

(1) The first three indicators (TCV, RPO, customer count) encompass the impact of different cooperation cycles on revenue changes, making them more beneficial for medium- and long-term growth projections: RPO maintained 40% growth on a high base in Q4. However, when analyzed by contract duration, the net increase in long-term contracts (over one year) significantly slowed compared to Q3, warranting continued monitoring to ascertain if this is merely a holiday season effect.

TCV resumed accelerated growth at 56%, while RPO indicated a slowdown in the net increase of long-term contracts, seemingly contradicting the accelerated expansion of long-term contracts reflected by TCV. The statistical discrepancy primarily stems from whether the customer has a clear invoicing arrangement (i.e., whether it is cancellable). The accelerated growth of TCV reflects that Palantir has indeed secured numerous new long-term cooperation intentions, some of which may be strategic collaborations or non-short-to-medium-term confirmable demands. However, as customers' product experience in Bootcamp continues to improve, these contract values are anticipated to convert into effective orders.

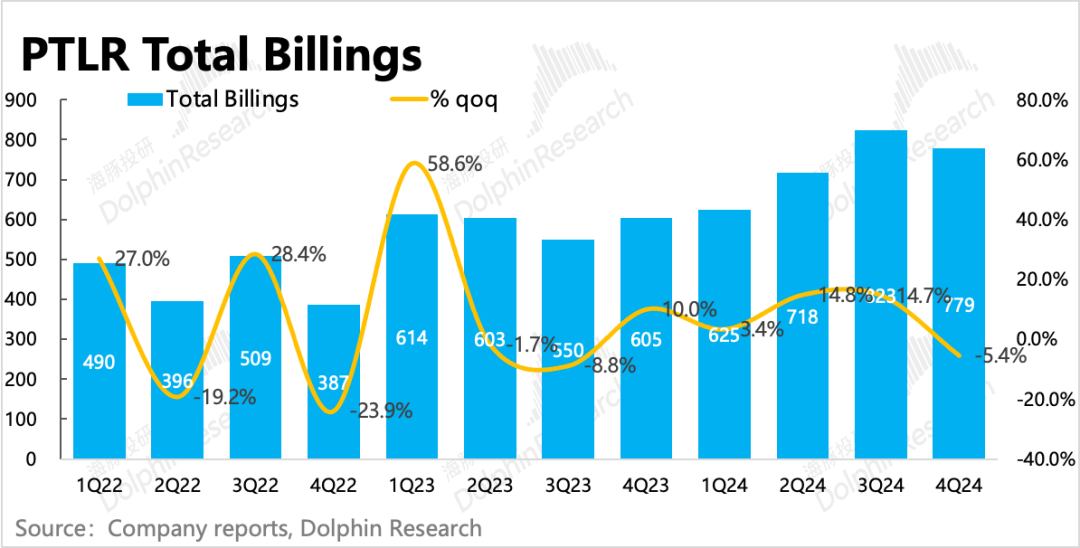

(2) In the short term, the market primarily focuses on changes in Billings: Billings increased by 29% year-on-year in Q4, with a natural slowdown quarter-on-quarter due to a high base (AIP was recently launched and received positive responses). However, deferred revenue continued to weaken, declining by $48 million quarter-on-quarter, mainly reflecting that the amount of new contracts invoiced and collected in the short term may not be high. But when combined with the not-so-poor RPO data, it suggests that a higher proportion of new contracts currently lack clear advance payments/deposits.

By comparing historical data, Dolphin Insights observed similar fluctuations in Q4, speculating that the anomaly might be related to corporate payments being affected by year-end holidays.

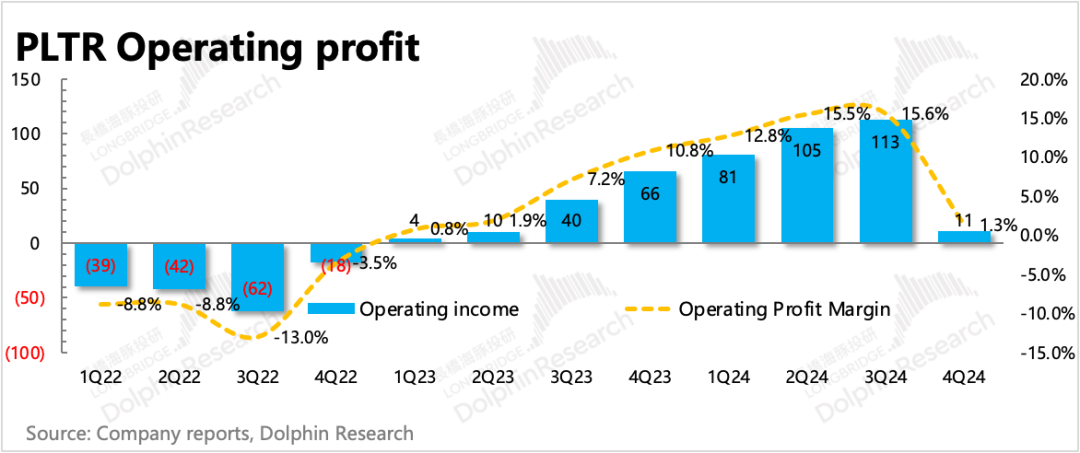

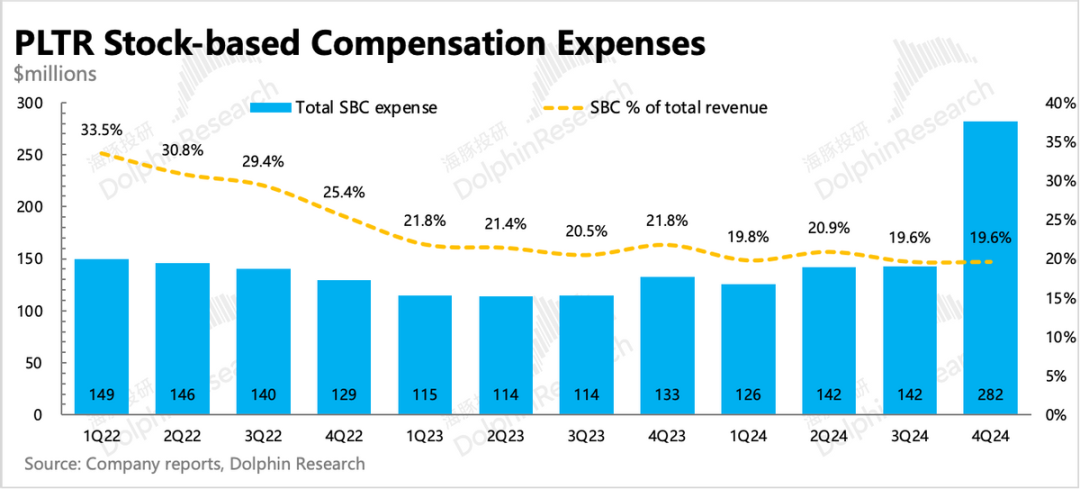

4. **Moderate Expense Expansion**: Last quarter, Dolphin Insights predicted that Palantir would start increasing expenses and investments. While some increases were made in Q4, they were overall manageable, particularly compared to revenue expansion. The increase in expenses under GAAP was primarily due to employee share-based compensation (SBC), partly attributed to a doubling of market value. In terms of actual growth in option grants, the workforce scale should have only expanded moderately.

Excluding SBC, gross margin improved slightly by 1 percentage point quarter-on-quarter, and operating expenses increased primarily by 15%, accelerating from 7% in the previous quarter but remaining overall manageable.

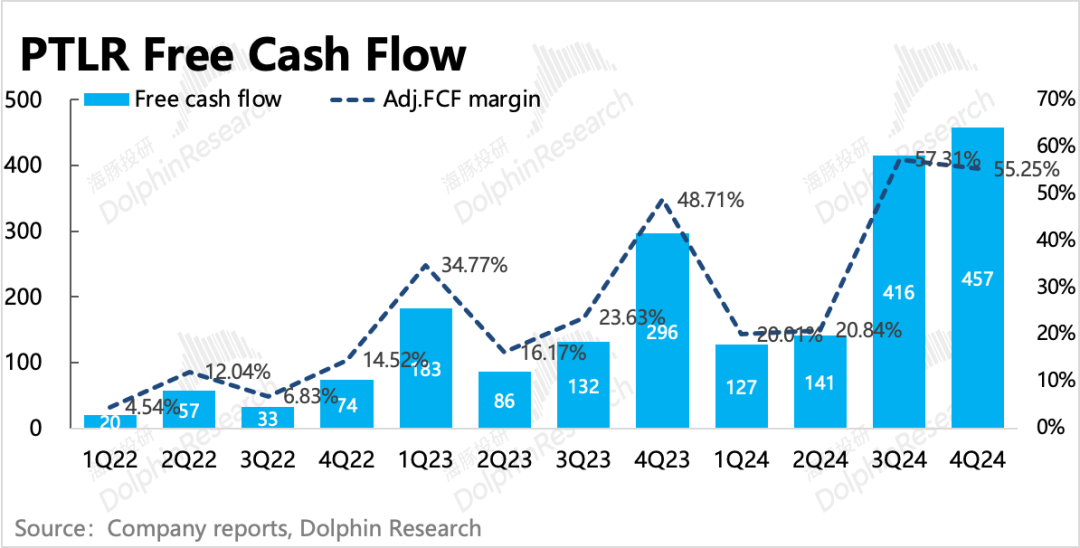

As a result, adjusted operating profit for Q4 reached $370 million, with a year-on-year accelerated growth of 45%, and profit margin further improved to 45%.

5. **Overview of Key Financial Indicators

Dolphin Insights' Viewpoint

For Palantir's trading, short-term fundamental and non-fundamental factors exert nearly equal influence. The robust pre-earnings rally was bolstered by its inclusion in the Nasdaq 100 index and frequent interactions and collaborations between its CEO and Elon Musk. However, strong fundamentals were the cornerstone of the rally, with Palantir securing multiple medium- and long-term defense orders in Q4. Overall, Palantir's valuation has been escalating, fueled by its gradually unfolding growth prospects. In the short term (at least for the next six months), Palantir's strength is likely to persist.

However, compared to its peers, Palantir's valuation is undoubtedly the highest (from an EV/FCF/Growth perspective). It's worth pondering: setting aside horizontal comparisons, from Palantir's perspective alone, how long will the valuation rally endure? Or, in other words, under what circumstances might Palantir's "bubble" burst?

Dolphin Insights believes that the key lies in grasping the inflection point of competition, particularly in the commercial market.

Palantir's short-term strength and ability to consistently surpass guidance and expectations are not solely due to external factors like the development of the AI industry but, more importantly, its internal strength that makes it "unrivaled in sight."

This competitive advantage is not merely reflected in Palantir's robust technology but also in its well-established relationship network ecosystem and the product experience advantages brought by end-to-end services to customers in the early stages of AI development:

1) Palantir's ecosystem relationships are formidable. Its relationships at the U.S. government level are evident, which was a significant factor in Palantir's rapid early success. Currently, with the support of Peter Thiel and even the Trump administration and Elon Musk, Palantir has further cemented this relationship network. This has even prompted potential competitors to choose to ally with Palantir to jointly undertake defense ministry orders.

2) Palantir's product customization results in limited scale expansion effects, which is a primary criticism from the market. However, this might currently be a relative advantage: the nearly end-to-end customized product services offer enterprise customers (especially those in traditional industries) in the early stages of AI application a more seamless user experience. But there is also a logical flaw here: as AI applications become more widespread and customer acceptance thresholds rise, Palantir's significant service advantages may diminish somewhat.

Therefore, Palantir's competition/valuation inflection point arises when cracks appear in its relationship network and when customers no longer require end-to-end services.

The former is difficult to predict accurately and can only be tracked from the perspective of limited expansion space for government defense spending budgets. However, Dolphin Insights believes that the latter inflection point may occur within the next 1-2 years. This is primarily because as the technical thresholds for AI models and applications decrease, enterprise customers will be able to establish basic data analysis and automation process management capabilities internally at low costs, shifting their demand for Palantir from end-to-end to focusing on high-end decision-making analysis and other technical capabilities, thereby reducing the still-not-low average revenue per customer (ARPC).

Of course, even if ARPC decreases, Palantir can still prevail by acquiring more customers. But in such a scenario, as Palantir ventures into broader enterprise service markets beyond its areas of strength, necessary investments in channel building and other customer acquisition costs will also need to expand, thereby affecting profit margin levels.

Another anticipated scenario is whether Palantir can seize the opportunity during the 1-2-year redundancy period before the inflection point and leverage the support of multiple powerful figures to enter a larger stage. We will wait and see.

Detailed Analysis Below

I. **High and Sustained Demand for AI**

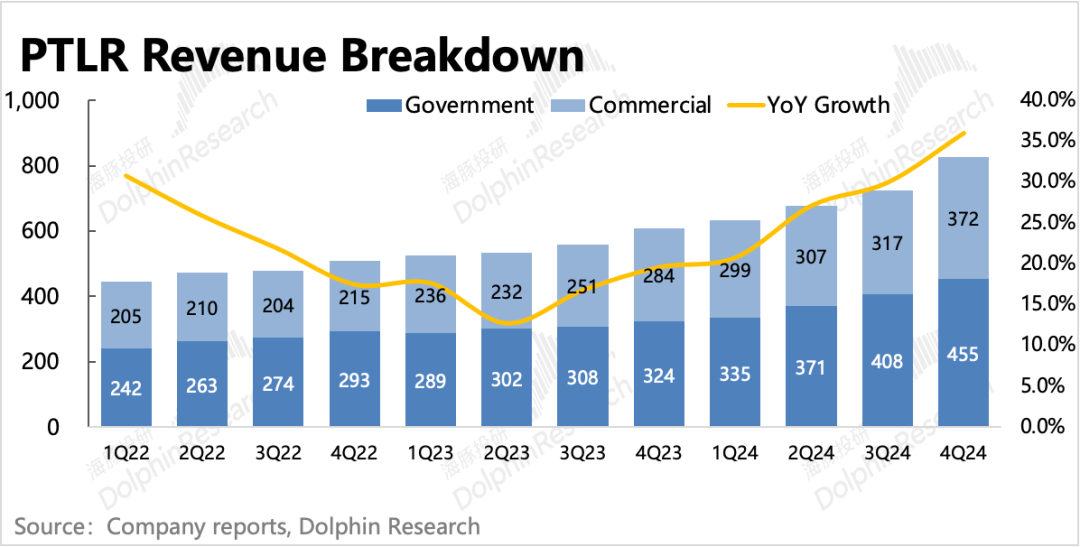

Total revenue for Q4 reached $828 million, a year-on-year increase of 36%, surpassing market expectations (~$780 million), with growth continuing to accelerate from the previous quarter.

Palantir primarily provides customized software services to clients, making revenue highly predictable in the short term, and the company's guidance range is relatively narrow, implying high revenue certainty. However, exceeding the guidance upper limit for multiple consecutive quarters still underscores strong customer demand for AIP and Foundry.

1. **Business Segment Breakdown**

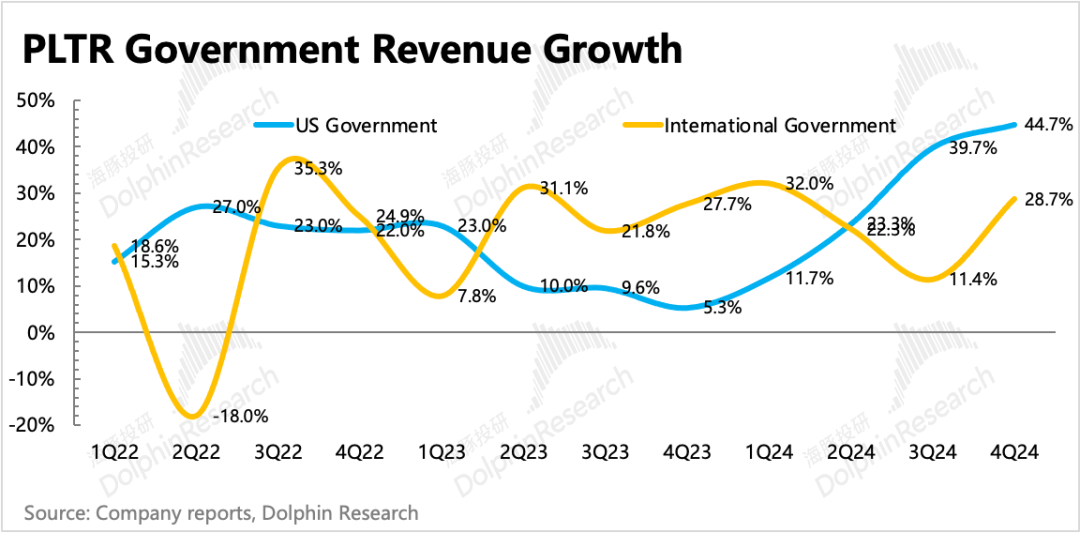

(1) **Government revenue remains the major contributor**: Government revenue in Q4 increased by 40% year-on-year, continuing its accelerated expansion, primarily driven by demand from the U.S. government. However, international government revenue also showed a recovery, mainly due to defense ministry orders from regions like the UK and Australia.

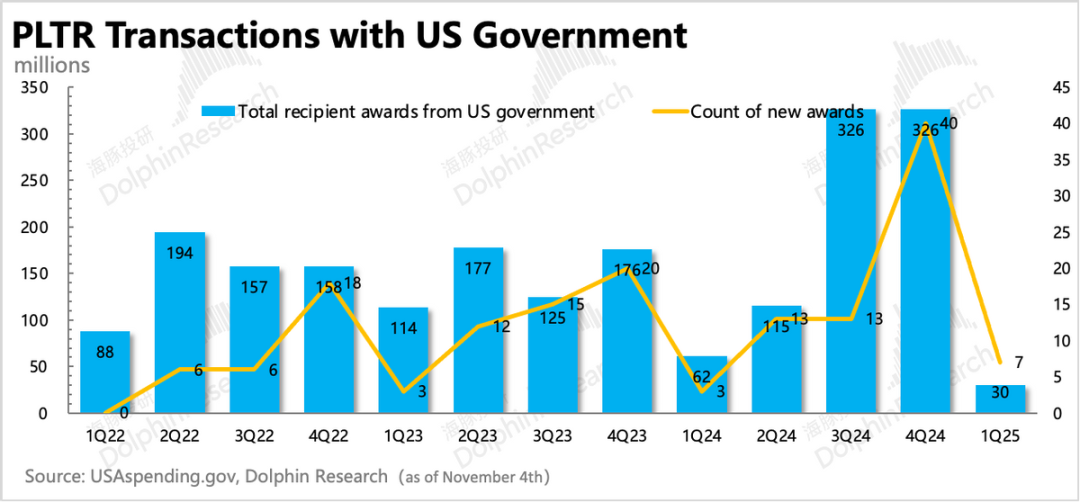

With the support of the Trump administration and many influential figures, Palantir's relationships with governments, especially defense ministries, have become even stronger. This is specifically reflected in Palantir securing more medium- and long-term orders and extending cooperation periods for existing orders in Q4.

For example: In September, Palantir signed a five-year contract with the DEVCOM Army Research Laboratory (ARL) to expand access to the Maven intelligence system to include all military branches such as the Army, Air Force, Space Force, and Navy.

In December, Palantir announced the extension of its long-term cooperation with the U.S. Army to provide Army Vantage capabilities in support of the Army Data Platform (ADP). The four-year contract has a total value of over $400 million, with a contract ceiling of $620 million.

In December, Palantir announced the formation of an alliance with defense technology suppliers such as Oracle, AWS, and L3Harris to expand cooperation channels.

As of February 3 (EST), the scale of new performance contracts confirmed for Q1 2025 is not significant, possibly due to seasonal fluctuations brought about by the Christmas holidays.

(2) **The commercial market is still driven by AI**: Commercial revenue in Q4 grew at a year-on-year rate of 31%, down from the second quarter, primarily dragged down by the international market. The increment in commercial revenue primarily stemmed from customer demand driven by AIP.

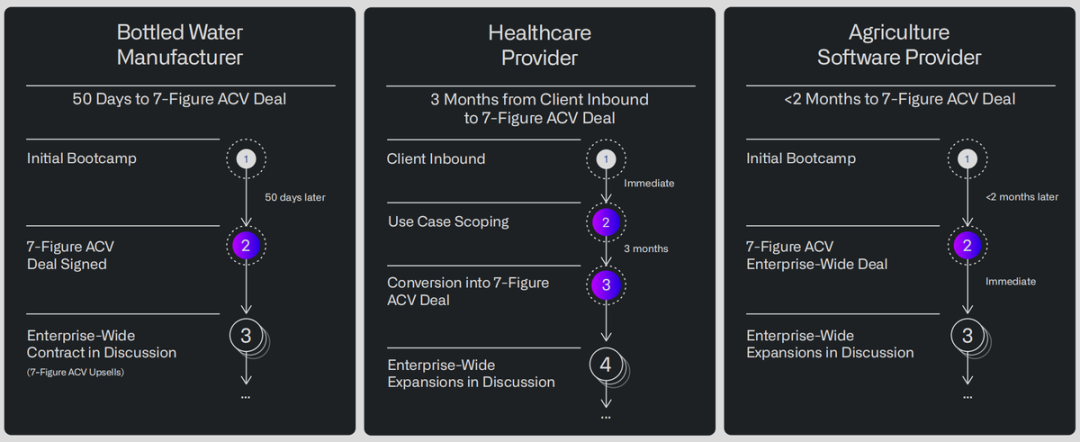

While participating in Bootcamp does not guarantee that enterprise customers will become Palantir's customers, the AIP's Bootcamp strategy has successfully shortened the overall customer conversion time (to 1-3 months), partly compensating for Palantir's scalability disadvantages.

We've been discussing AIP for over a year, so what are its technological advantages? Dolphin Insights believes that AIP further strengthens Palantir's original technological advantages in unstructured data analysis and processing through AI and expands its application scope. Simultaneously, it lowers the threshold and enhances some generalizability, which can also address Palantir's previously criticized issue of excessive product customization.

The specific technical modules primarily include:

a. **Software-defined data integration**

b. Business Ontology Mapping: The capability to automatically map entities and relationships within business ontologies (comprising data entities and relationships) from disparate data sources.

c. Workflow Orchestration: This refers to the automated coordination and management of operations across multiple tasks, systems, or personnel. For instance, it manages cross-departmental collaboration between supply chain and finance departments, automating processes to minimize manual interventions, enhance efficiency, and reduce labor costs.

d. Write-Back Capabilities (Reverse ETL): The ability to feed data back from an analysis platform into business systems, integrating final analytical outcomes into operational processes. This facilitates real-time decision-making and operational efficiency.

e. Software Development Lifecycle Management (Apollo): Efficient management of the software development lifecycle.

II. Contract Situation: Is Net Growth Slowing Down?

For software companies, future growth potential is paramount for valuation. However, quarterly recognized revenue is a lagging indicator. Hence, we recommend focusing on new contract acquisitions, reflected in contract metrics (RPO, TCV), current billing flows (Billings), and customer growth.

(1) Remaining Performance Obligations (RPO): Growth in Medium and Long-Term Contracts Declines

In Q4, Palantir's RPO stood at $1.73 billion, an increase of $160 million from the previous quarter, maintaining a 40% growth rate despite a high base. However, the net increase in long-term contracts in Q4 was lower than that of short-term contracts, indicating a noticeable slowdown compared to the previous quarter. This warrants further observation to ascertain if it was merely due to holiday disruptions. From Dolphin Insights' perspective, increases in long-term contracts are more indicative of genuine growth. Short-term contract increases may stem from the expiration and conversion of long-term contracts rather than reflecting externally driven demand.

(2) Current Billings & Deferred Revenue: Weakening, Potentially Due to Holiday Disruptions

Q4 Billings amounted to $780 million, a 29% year-on-year increase. The first significant increase in AIP demand last year elevated the base figure. Billings in the current period mainly reflect short-term demand fluctuations (including revenue already recognized in the current period). Based on historical data, Dolphin Insights believes that single-quarter fluctuations do not significantly reflect product competitiveness. However, given the company's high valuation, the market will scrutinize its performance closely and pay attention to this indicator.

Similarly, deferred revenue continued to weaken in Q4, suggesting that the value of newly added contracts with invoices issued and payments received in the short term may not be high. Since the company has provided clear revenue guidance for Q1 (ensuring short-term growth), Dolphin Insights recommends continuing to observe to prevent seasonal effects from influencing judgment. However, comparing historical data, Dolphin Insights notices similar Q4 fluctuations, indicating that the deviation may still be related to year-end corporate payments being affected by holidays.

(3) Total Contract Value (TCV): Long-Term Cooperation Intentions Still Prevail, Awaiting Order Conversion

The total contract value of newly recorded contracts in Q4 was $1.8 billion, a 57% year-on-year increase, indicating accelerated expansion despite a high base. The slowing net increase in medium and long-term contracts shown by RPO, compared to the accelerated expansion of long-term contracts reflected by TCV, mainly hinges on whether the customer has explicitly issued an invoice (i.e., whether it is revocable). The accelerated growth in TCV suggests that Palantir has indeed witnessed a significant increase in new long-term cooperation intentions, though some may be strategic collaborations or demand that cannot be confirmed in the short to medium term. However, as customers' product experiences in Bootcamp continue to improve, this portion of contract value is expected to convert into effective orders.

(4) Customer Growth: Enterprise Customers Remain the Primary Force of New Additions

In terms of customer count, a medium to long-term indicator, there was a net increase of 82 customers quarter-over-quarter in Q4, with 73 from commercial customers and 9 from government agencies.

Combining 1-4, Dolphin Insights believes that clients remain highly interested in Palantir's products and have a strong willingness to collaborate. However, due to factors such as holiday disruptions or rapid product changes and iterations, the short-term increase in confirmed effective orders has slightly weakened. This does not signify a change in Palantir's product advantages.

III. Moderate Expansion of Costs and Expenses

In Q4, Palantir achieved an operating profit of $11 million under GAAP, mainly due to a near-doubling of SBC expenses as the market value rose, thereby compressing profits. Excluding the impact of SBC expenses, Non-GAAP operating profit was $370 million, accelerating growth by 78% year-on-year, with profit margins increasing to 45%.

Last quarter, Dolphin Insights predicted the end of the cost control cycle. Although Palantir further increased expenses in Q4 (excluding SBC), the growth rate represented a moderate expansion, increasing from 7% in Q3 to 15% in Q4. Therefore, it did not exert significant pressure on profit margins, which continued to improve due to high revenue growth.

Unlike companies investing heavily in large models, Palantir focuses on applications. Consequently, its AI-related capital expenditures have remained stable, with most actual investments recognized upfront. With the computational power transformation brought about by Deepseek, companies on the application side are expected to continue benefiting.

Dolphin Insights' historical research on "Palantir": Financial Report Review on November 5, 2024, "Palantir: AI Faith Ticket Brings New Hope Again"; Financial Report Review on August 6, 2024, "Palantir: Raised Guidance, Confirming the Growth Story of AI"; Financial Report Review on May 7, 2024, "Palantir: Beat Expectations but Plunged? The Market is More Critical Under High Valuation"; Financial Report Review on February 6, 2024, "AI Initiates a New Growth Cycle for Palantir"; Financial Report Review on November 3, 2023, "Palantir: Growth Rebounds Against the Trend, Thanks to AI Again?"; In-depth Analysis on October 13, 2023, "Palantir: What Justifies Its High Valuation?"; In-depth Analysis on September 26, 2023, "Palantir: The 'Mysterious' Military Weapon Activated by AI"