Deepseek's Metaphor: GPU Reigns Over, ASIC and SOC Enter the Race

![]() 02/06 2025

02/06 2025

![]() 566

566

This article is based on publicly available information and is intended solely for information exchange, not as investment advice.

As elaborated in our previous article, "The Significance, Value, and Impact of Deepseek," the groundbreaking open-source model Deepseek heralds the dawn of the "Cambrian Moment of Machine Intelligence," propelling the industry into an era of unprecedented application innovation. A logical implication of this trend is that 2025 will mark the year of AI inference, where GPUs cede their dominance, and ASIC and SOC enter the fray.

The storm is gathering. SOC and ASIC sectors have faced speculation ahead of the new year, and post-Spring Festival, a branch of ASIC—the so-called Logic Processing Unit (LPU)—has garnered significant attention.

To unravel the underlying logic, our series of reports commences with edge-side SOC.

01 Low-Cost Multimodality: The Catalyst for AI Terminal Explosion

1. AI as the Newest Interaction Mode: Multimodal Models at the Core

A pivotal clue to understanding the evolution of technological terminal products lies in their interaction modes. Recall the early days of computers, when direct machine language inputs were necessary, limiting applications. It wasn't until 1984 when Apple introduced the Macintosh, leveraging a graphical user interface and mouse, that computers became user-friendly. The next paradigm shift came with smartphones, replacing mice with touch controls, ushering in the mobile internet era. Even the subsequent cloud computing revolution was an extension of this trend. AI can be seen as an underlying innovation in interaction: diverse, uncertain inputs processed by well-trained large models, complemented by high-quality edge models, to deliver optimal feedback.

From instructional to intelligent, Chatbots were the first to break out, but their limitation lies in large language models. Pursuing artificial general intelligence (AGI) requires multimodal inputs and outputs, aligning with end-user interaction needs. As AI multimodal large models mature, starting from 2025, comprehensive multimodal interactions integrating datasets, text, audio, video, etc., will emerge, elevating human-machine interaction to a new dimension. The AIOT, envisioned for over a decade, will witness its first wave of potentially groundbreaking products.

2. Deepseek Accelerates Low Cost and Low Power Consumption

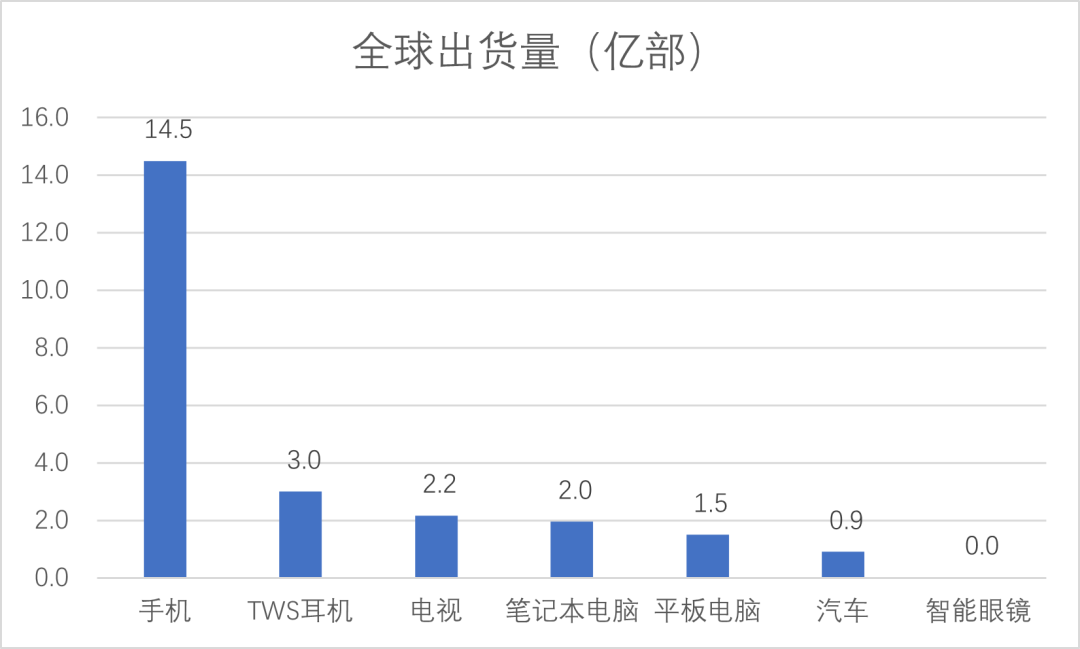

Training pursues scaling laws, but even financially robust US giants can't overlook costs. Annually transforming over 10 million servers globally would exceed hundreds of billions of dollars. The inference era will AI-ize all intelligent terminals—phones, headphones, TVs, computers, speakers, appliances, etc.—with combined annual shipments nearing 3 billion units. High-cost transformations are infeasible.

During the Spring Festival, the domestic open-source model DeepSeek V3 emerged unexpectedly. Among its innovations, Multi-Head Latent Attention (MLA) became key to reducing inference costs. MLA significantly optimized the KV Cache mechanism in Transformer architecture, lowering hardware resource requirements and inference costs. For the industry, this means rapid cost reduction of high-quality open-source models. Small models distilled from these will accelerate the inference era, democratizing model capabilities and substantially lowering deployment costs. Based on multimodal AI, low-cost universal access will enable comprehensive AI-ization of billions of intelligent terminals.

Figure: Global Shipments of Major Intelligent Terminals (Source: IDC)

3. Pathfinding New Products: Glasses

The notion that AI + low cost will drive hardware explosion isn't conjectural. In early 2024, Apple's anticipated MR head-mounted product stumbled due to lack of AI-based interaction and high cost. Conversely, Ray-Ban Meta glasses, with sales exceeding 2 million units in 2024, demonstrated the market potential of AI-infused traditional glasses. Notably, these glasses cost less than one-tenth of MR.

02 From a Chip Perspective: ASIC and Edge-Side SOC to Succeed GPU

1. The End of GPU Dominance

GPUs are at their peak, but cracks in NVIDIA's hegemony have widened since late last year. Broadcom predicts ASIC chips will reach $60-90 billion by 2027, while Deepseek's estimated training GPU hours are only about 25% of similar models. With waning faith in NVIDIA, US stock markets are shifting focus from GPUs to new digital chips—ASIC and AI terminal chips—both breeding new industrial opportunities. AI terminal chips rely on NPU modules for AI functions, requiring cost-effectiveness, energy efficiency, reliability, security, and personalization. SOCs with NPU modules will be the optimal solution. With AI-driven volume and price increases, MarketResearch predicts the global SOC market will exceed $320 billion by 2032.

Figure: AI Terminal Chips Bring New Opportunities to SOC (Source: Guohai Securities)

2. Focusing on Edge-Side Chip AISOC

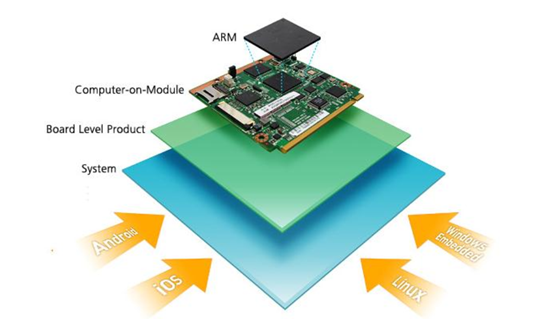

SOC, or System on Chip, integrates computing and other electronic systems onto a single silicon chip. Mainstream SOCs integrate CPU, GPU, NPU, ISP, multimedia codecs, WIFI, various interfaces, etc. Besides hardware design, SOC systems must provide system-level software reference designs, including OSs like Android and HarmonyOS, along with supporting driver software, algorithms, and middleware. SOCs, integrating various software and hardware functions, are true multitaskers capable of processing digital, analog, mixed, and radio frequency signals. They're commonly used in embedded systems and installed in intelligent terminals like phones, wearables, smart speakers, and smart cars.

Figure: SOC Schematic Diagram

Due to the complexity of hardware design and software ecological barriers, the SOC market, valued at approximately $160 billion, is dominated by a few enterprises like Qualcomm, MediaTek, Apple, and Samsung. Qualcomm, due to its SOC monopoly, often wields patents, causing suffering to downstream mobile phone manufacturers. In the era of mobile phones and smart car infotainment systems, domestic SOC chips have faced relentless pressure with no chance to fight back. Domestic SOC enterprises have struggled in marginal markets like TVs, white-label machines, and learning machines. Huawei's Hisilicon was the only domestic breakthrough, designing SOC chips that threatened Apple with annual shipments exceeding 100 million units, but was later targeted by the US.

More exciting than market size expansion is that in the AI inference era, the existing overseas monopoly will change, presenting domestic AI terminal chip enterprises with a golden opportunity for turnaround. With AI's increasing application on the edge side, SOC will increasingly become an AI SOC integrating AI and edge computing capabilities, reaching tens or even hundreds of TOPS. Besides hardware updates, AI large models will loosen the traditional OS ecosystem, meaning the large foundation model will hold discourse power rather than traditional OS enterprises. Changes in industry leaders will follow supply chain reshuffles, especially for SOCs emphasizing both software and hardware. For example, ByteDance's AI earphones use Beken's main control chip, and its smart toys use Espressif Systems' SOC, rather than Qualcomm or MediaTek.

03 Prospects for Domestic SOC Chips

Previously, domestic SOC enterprises struggled due to hardware design gaps and closed ecosystems. AI's reshaping of intelligent terminals will be as significant as new energy's transformation of the automotive industry. Besides possible changes in terminal dominance patterns, long-besieged domestic SOC enterprises may also usher in an overtaking opportunity through a different path.

1. Domestic SOC Enterprises' Technological Capabilities and Ecosystem Reconstruction

Due to lagging hardware performance and inability to penetrate software ecosystems, domestic enterprises are perceived as technologically weak. However, struggling domestic SOC enterprises are not technologically inferior. Market share examples support this: besides Huawei Hisilicon, Unisoc is a mainstream player in 4G mobile phone SOCs, and Amlogic competes with overseas leaders in set-top boxes and TVs. Notably, when product ecosystems are decoupled and reconstructed, domestic chips seize opportunities:

- As domestic TV manufacturers like Hisense, Xiaomi, and TCL increase global market share, Amlogic's TV SOC share also rises, achieving mutual prosperity.

- Domestic sweeping robot brands Stone Tech and Ecovacs become mainstream, significantly increasing Allwinner and Rockchip shipments, achieving mutual success.

- Intelligent driving is dominated by domestic enterprises, with Horizon Robotics' share expected to rapidly increase to around 40%, and others like Black Sesame Technologies also gaining a foothold, boosting domestic domain control SOCs.

- Numerous domestic chip manufacturers emerge in TWS earphones and watches.

AI terminals will reshape the intelligent industry chain's division of labor. Previously, SOC chip development required breaking into the mobile phone market to survive. Now, facing AI, everyone starts on the same line, and domestic enterprises have an edge in low-cost, low-power scenarios. Unlike mobile phones, AI's downstream is fragmented, with devices like headphones, watches, speakers, toys, and sweeping robots emphasizing different functions. The past approach of developing mobile phone SOCs and creating crippled versions for other fields is no longer feasible. Domestic enterprises' rapid response tactics are favored by downstream customers, similar to cloud computing's white-boxing and optical module decoupling trends. Additionally, amidst decoupling and supply chain disruptions, domestic downstream customers support domestic suppliers, such as ByteDance choosing Beken and Espressif Systems.

2. Overview of Major Domestic SOC Enterprises

Besides Hisilicon and Unisoc, most SOC enterprises have completed IPOs with relatively small revenue and profit volumes. However, since 2024, their fundamentals have been undergoing positive changes, warranting future attention. From merely tasting success to joining the feast, the turnaround opportunity for domestic SOC chips has arrived in the AI era.

Figure: Data of Major Listed Enterprises in AI Terminal Chips

(1) GigaDevice Innovation

As a dual leader in global niche memory and domestic MCU markets, GigaDevice Innovation boasts remarkable competitive strength in its core business. For future AI edge-side chip products, the standout feature is CUBE technology's stacked DRAM, which promises to be the optimal solution for overcoming the memory-computation bottleneck at the edge, even earning the moniker of "edge-side HBM." With actual power consumption less than one-third of HBM, this technology is particularly crucial for edge devices emphasizing low power consumption. Notably, major mobile phone manufacturers have already adopted this solution.

(2) Rockchip

With a strategic focus on AIoT, automotive, and robotics, Rockchip stands out as the SOC enterprise among listed companies that most resolutely pursues computing power and adopts the most advanced domestic manufacturing processes. Its extensive clientele includes BAT, Meituan, Lenovo, Xiaomi, Midea, Skyworth, Ecovacs, OPPO, BBK, CVTE, Uniview, and Unitree. Rockchip's products encompass independent SOCs and AISOCs integrated with NPUs. Its flagship SOC chip, the 3588, is a domestic pioneer and one of the few domestic chips viable for mid-to-high-end consumer scenarios, rivaling Qualcomm. Currently, it offers chips with up to 6 TOPs of computing power, enabling the deployment of 3B parameter-level models at the edge.

(3) Beken Corporation

Beken Corporation's distinctive technologies encompass independently developed low-power multi-core heterogeneous embedded SOC technology, Bluetooth, and WIFI connectivity, earning it the title of "king of low power consumption." This core competency has been honed in niche markets such as wireless audio, smartwatches, and smart homes. Its client base spans all mainstream Android brands, Anker Innovation, and Edifier; internet giants like Google, Baidu, Alibaba, and ByteDance; and household appliance brands like Gree and Hisense. Beken holds the top market share in third-party TWS earphones (supplying ByteDance's Ola Friend AI earphones), making it a domestic leader. Watches and bracelets, constituting the company's second growth trajectory, now account for nearly 30% of its revenue.

The company's low-power consumption capabilities perfectly align with the demands of the AI era. In 2023, Beken's BES2700 series solidified its position, and the next-generation 6nm BES2800 main control chip, integrating multi-core CPU, GPU, NPU, storage, low-power WIFI, and dual-mode Bluetooth, completed tape-out and began promotion. AI glasses are poised to become the company's latest growth driver; its next-generation 2900 chip is expected to accelerate its launch, collaboratively fostering domestically produced lightweight AI glasses and anticipated to be introduced in multiple projects.

(4) Amlogic

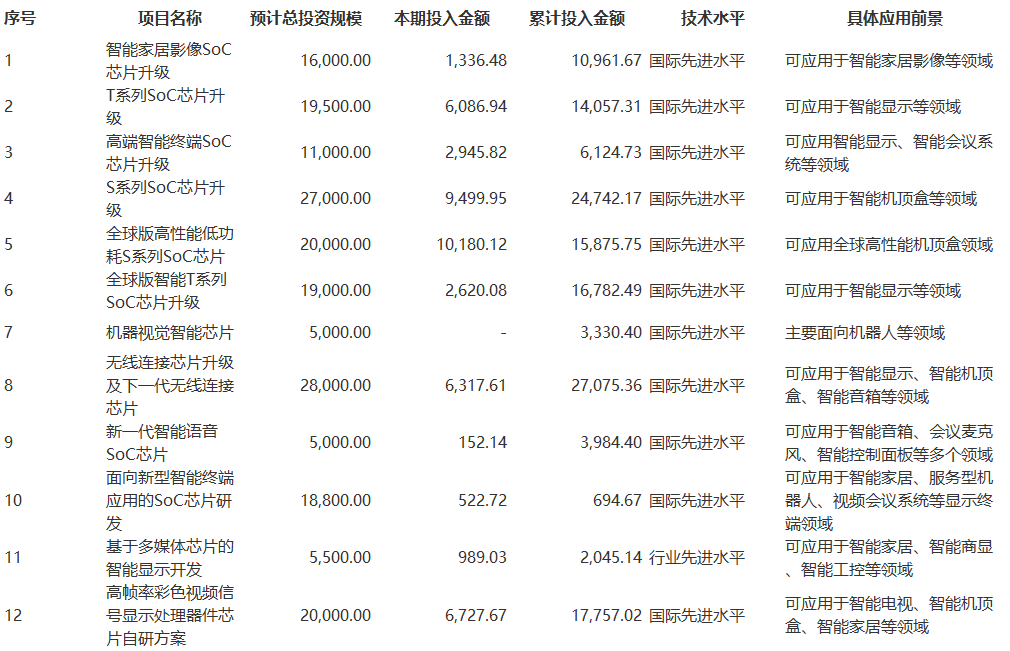

Amlogic's current product line primarily comprises set-top box and TV main control chips, ranking first globally in set-top box main control chip shipments and among the top three for TV main control chips. The company excels in video codec integration within SOCs. In the AI realm, Amlogic has over 15 commercial chips equipped with self-developed end-side AI computing units and independently developed the industry's first 6nm commercial chip, the S905X5, which integrates 4K and AI capabilities, enabling functions like local simultaneous interpretation and simultaneous subtitles. Additionally, the company has numerous ongoing research projects.

Figure: Research projects disclosed in Amlogic's 2024 semi-annual report

(5) Bluetoothel

Bluetoothel began as a SOC provider for white-label TWS earphones, distinguished by its high cost-effectiveness and rapid response. Its clientele includes Baidu, Xiaomi, iFLYTEK, TCL, Lenovo, Motorola, Transsion, realme, and more. For instance, Bluetoothel's Xunlong 3rd generation BT895X chip swiftly integrated with ByteDance's Volcano Ark MaaS platform, offering users software and hardware solutions tailored to the Doubao large model, capable of meeting AI earphone end-side voice processing and high-speed audio transmission needs. Currently, it supports functions like real-time translation, meeting minutes, and real-time dialogue.

(6) Allwinner Technology

An established SOC enterprise renowned for promptly identifying opportunities across the industrial chain's upstream and downstream and boasting robust market expansion capabilities. Key application areas include: 1) Smart speakers, partnering with Baidu DuerOS, Xiaomi, and Tmall Genie; 2) Robotic vacuum cleaners, collaborating with brands like Roborock, Xiaomi, Midea, and Dreame; 3) AI education, working with iFLYTEK and Zuoyebang; 4) Set-top boxes, partnering with Skyworth and Tmall.

(7) Espressif Systems

Deeply rooted in the IoT field, Espressif Systems excels in providing systematic "connection + processing" solutions, serving as the small Qualcomm of the IoT sector. Its "processing" centers on MCU, encompassing AI computing, while "connection" focuses on wireless communication technologies like Wi-Fi, Bluetooth, Thread, and Zigbee. Riding the AI wave, the company's chip products have gradually expanded from the niche WIFI MCU market to a broader range of AI SOCs. Espressif Systems' in-depth collaboration with ByteDance has garnered significant attention:

At the 2024 Volcano Engine Winter FORCE Conference, Volcano Engine jointly launched the AI + Hardware Intelligence Leap Plan with Espressif Systems and ToyCity. This plan integrates the capabilities of the Doubao large model, Volcano Engine's anthropomorphic voice dialogue, ToyCity's trendy toy design, and Espressif Systems' AI chips to propel the popularization of AI trendy toys.

Espressif Systems offers a one-stop Turnkey solution in this collaboration, emphasizing interactivity and anthropomorphic design while focusing on the companionship aspect of the products. For more complex product forms, it adds edge AI functions, enabling an upgrade from simple button control to voice wake-up control through features like speech recognition, emotional recognition, and interactive dialogue.

Espressif Systems supplies downstream IoT chips, modules, and related software technical support. Its ESP32S3 and ESP32-P4 product lines now incorporate edge AI functions, applicable to desktop robots, AI companion products, and more.

(8) ASR Microelectronics

Initially specializing in cellular baseband chips, ASR Microelectronics provides low-power cat communication modules for AI toys, glasses, etc., leveraging its communication functionalities. Recently, the second-generation 4G mobile phone SOC entered mass production, also suitable for AI glasses and earphones. Additionally, benefiting from its extensive IP accumulation, the company possesses ASIC chip capabilities: its revenue in the first half of 2024 was 234 million yuan. Thus, ASR Microelectronics is a rare company benefiting from both AI terminal chips and ASIC directions.

(9) Horizon Robotics

In 2025, shipments of its intelligent driving domain controller SOC are expected to surge, with the number of equipped vehicles anticipated to exceed 5 million. Furthermore, the company may venture into the humanoid robot main control chip market, positioning itself as the Chinese counterpart to the FSD chip.