Leading LiDAR Manufacturer Expands into Humanoid Robots: Should Chaoshan Entrepreneurs Be Concerned?

![]() 02/07 2025

02/07 2025

![]() 733

733

Produced by | TanKeChuXing

Designed by | QianQian

Reviewed by | SongWen

How "hot" are humanoid robots at the dawn of 2025?

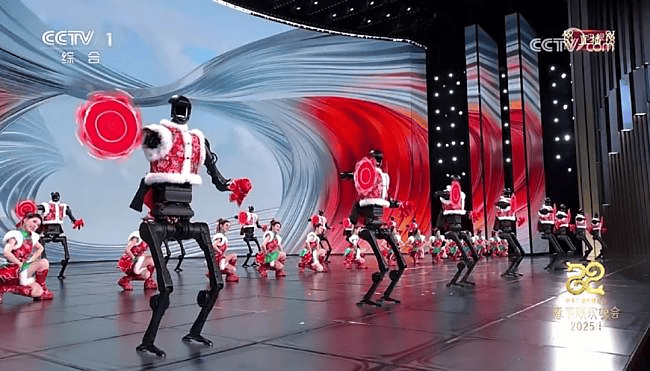

During the recently concluded 2025 Chinese New Year's Eve Gala, the appearance of humanoid robots as dance partners sparked heated discussions among consumers.

"I don't know what to use it for, but my dad is already searching for the same model." This comment from a netizen reflects the curiosity of the outside world towards this new technology.

In fact, humanoid robots are not a novelty in the industry but rather an emerging sector where many technology companies and startups are competing to establish a presence. As early as 2023, the Ministry of Industry and Information Technology officially released the "Guidance on the Innovative Development of Humanoid Robots," clarifying that by 2025, an innovative system for humanoid robots will be initially established, and breakthroughs will be made in a series of key technologies such as the "brain, cerebellum, and limbs."

A multitude of AI and technology companies, including Tesla, NVIDIA, Open AI, iFLYTEK, and Unitree, have successively invested in the humanoid robot industry.

Not long ago, domestic LiDAR company RoboSense also announced its new development direction in the field of humanoid robots.

The automotive supply chain has become fertile ground for nurturing the humanoid robot business. An industry insider told "TanKeChuXing" that the expansion of the boundaries of end-to-end autonomous driving in the automotive field over the past year has provided a reference for the development of humanoid robots, and the interoperability of technologies between industries has presented opportunities for many companies in the automotive supply chain to crossover.

However, in the early stages of industrial development, there is both promise and uncertainty. "It will still take a long time to create a safe and stable product."

As Tesla CEO Elon Musk once said, 1% is product inspiration, and 99% is sweat. For the future market of humanoid robots, prototyping is the least significant aspect. What companies lack most today is production scale. "Subsequent production and manufacturing are the challenging parts."

At RoboSense's latest product launch conference, robots and digitization became keywords beyond LiDAR.

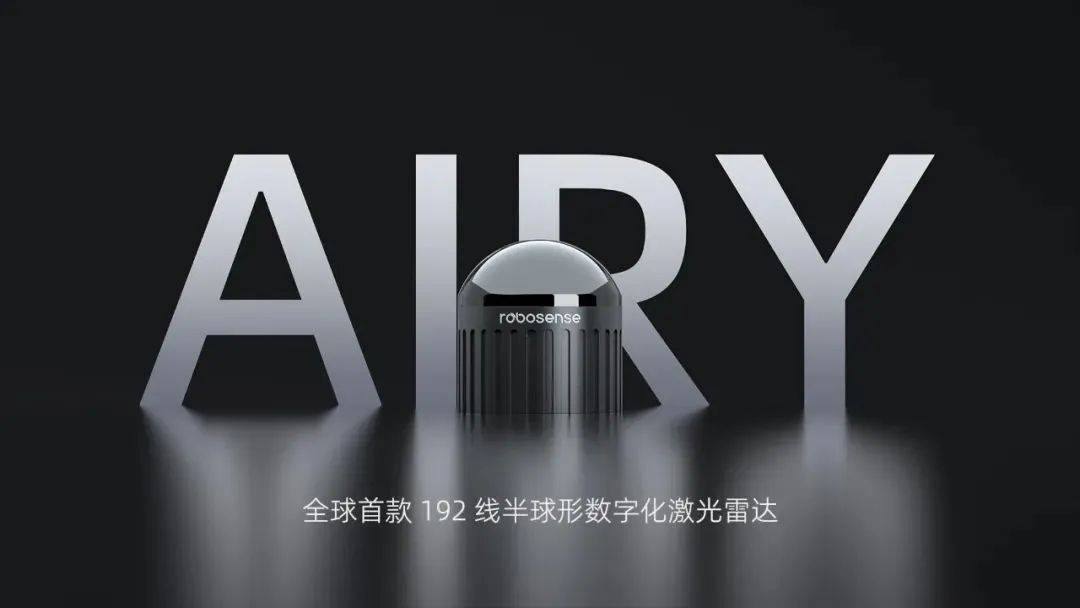

At its global AI robot launch conference, RoboSense presented for the first time its corporate strategy for the robot technology platform and released multiple digital LiDARs, introduced robot vision products, and a series of incremental components and solutions for robots.

During the conference, RoboSense transformed from an "intelligent LiDAR system technology enterprise" to an "intelligent robot incremental component and solution provider."

Beyond the automotive LiDAR market, the intelligent robot market has become a new target for this technology company.

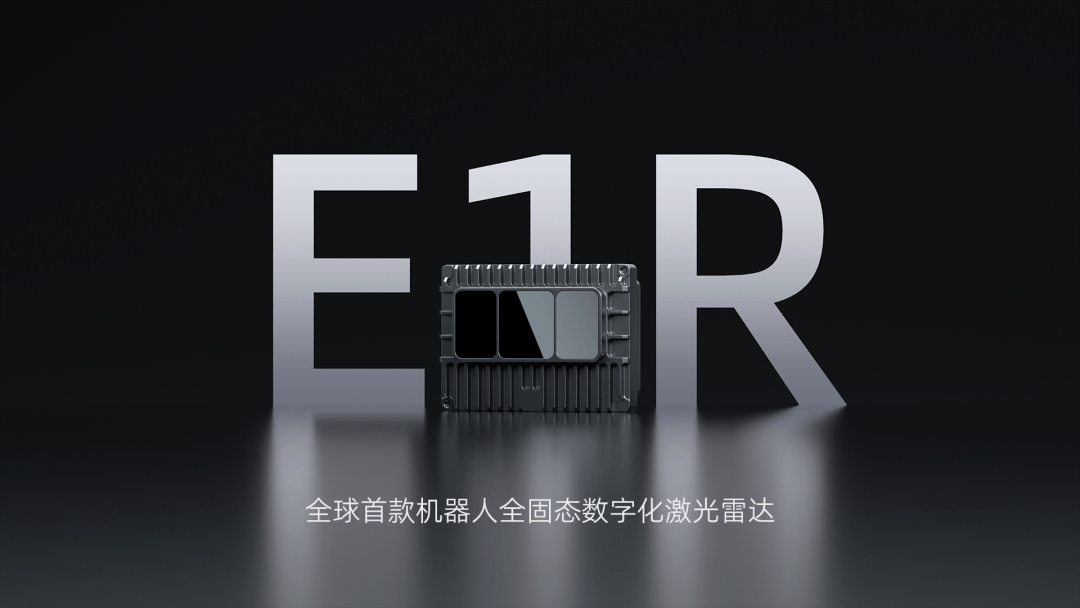

It is reported that at this launch, RoboSense released the world's first "thousand-line" ultra-long-range digital LiDAR, EM4; and for the intelligent robot market, it unveiled two new digital LiDAR products, including E1R.

(Image / RoboSense official website)

RoboSense stated that E1R is currently the world's first fully solid-state digital LiDAR for robots, supporting various types of mobile robots such as industrial, commercial, and embodied intelligence to operate in diverse scenarios.

(Image / RoboSense official website)

According to the company's founder Qiu Chunchao, as robots evolve towards embodied intelligence in the future, it is expected that robots will become an important growth engine for the company.

Qiu Chunchao's confidence is partly based on expectations for the robot market and partly on the strong correlation between its underlying business and robots.

Founded in 2014, RoboSense was established by two Chaoshan brothers, Qiu Chunxin and Qiu Chunchao. Elder brother Qiu Chunxin graduated from Harbin Institute of Technology with a major in mobile robotics technology. His doctoral research topic was "Environmental Perception Technology for Outdoor Mobile Robots." While completing this project, Qiu Chunxin discovered the potential of LiDAR and eventually commercialized it.

Judging from the technical background of the founders, compared to the application of LiDAR in the automotive business, it is now more relevant in the "off-track" field of robots.

However, the initial wave of enthusiasm for autonomous driving at the company's founding did not allow RoboSense to stay too long in the field of robots, but quickly shifted its focus to the development of automotive-grade LiDAR.

According to reports, in 2016, RoboSense cut off other business lines and focused its main energy on LiDAR.

As RoboSense prioritizes price and cost-effectiveness, it has achieved significant improvements in the number of designated orders and shipments. The company's latest financial report data shows that the cumulative sales of LiDAR in the first three quarters of 2024 reached 381,900 units, a year-on-year increase of 259.6%; among them, the sales of ADAS LiDAR reached 365,800 units, a year-on-year increase of 292.9%.

As of now, RoboSense's product revenue structure is concentrated in three directions: ADAS (Advanced Driver Assistance Systems), robots, and solutions. Among them, more than 80% of the revenue comes from the ADAS field.

However, the rapid "transformation" of China's new energy automotive supply chain may have exceeded the expectations of the Qiu brothers.

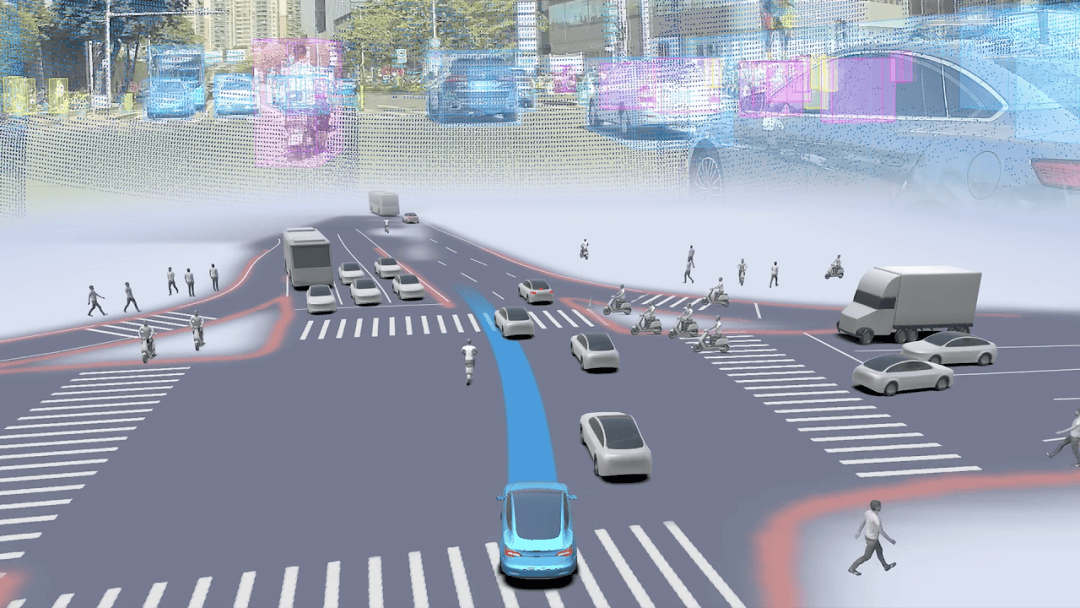

From AI large models to end-to-end intelligent driving, lower-cost pure vision intelligent driving solutions have become the choice and exploration direction of more leading automakers after Tesla.

As the name suggests, the pure vision solution is an intelligent driving solution that relies solely on cameras as sensing hardware. The biggest difference between this solution and past intelligent driving solutions is LiDAR.

(Image / RoboSense official WeChat public account)

For a long time in the past, although LiDAR could provide more accurate perception, it was a significant cost item for a single vehicle and was mostly equipped on models and configurations above the 300,000 yuan price range.

However, with the continuous competition in price wars, the main battlefield for new energy vehicles is in the 100,000-150,000 yuan and below 200,000 yuan price ranges. Under high price sensitivity, pure vision solutions that skip LiDAR and have lower hardware costs are favored by more automakers.

More importantly, according to current market feedback and the verification of high-market-share models including Tesla, under more powerful computing power and visual perception, the flexibility and scalability of pure vision solutions have greatly improved their performance and safety.

2024 was the first year of domestic pure vision intelligent driving, with companies such as LeTao, XPeng, and DJI Auto achieving the deployment of pure vision solutions on vehicles.

This industry change and shift in technical routes have hit RoboSense quickly and fiercely. This ferocity lies not only in the expected reduction in future shipments but also in the reflection of cost compression in the industrial chain.

According to Jiemian News, in the first three quarters of 2024, RoboSense's ADAS LiDAR sales reached 365,800 units, a year-on-year increase of 292.9%.

However, focusing on gross margin, the gross margin of LiDAR products used in ADAS applications is only 14.1%.

According to the financial report information for the third quarter of 2024, the gross margin of LiDAR products used in robots and other businesses is 34.6%. This newly expanded business unit easily "beats" the automotive LiDAR business after achieving scale effects.

Qiu Chunchao stated that in the field of robots, RoboSense has maintained a gross margin level of 35%-50%.

According to RoboSense's plan, the robot industry may become the second growth curve that RoboSense is about to embark on.

As the direction of intelligent driving technology in the entire industry shifts towards pure vision solutions, RoboSense, as a LiDAR manufacturer, has already felt a sense of crisis to some extent.

In fact, Qiu Chunchao has publicly stated, "Automotive is just one application of LiDAR. We are now leveraging the platform, scale, and quality advantages we have achieved in the automotive field to continuously explore larger market spaces in fields such as robots and drones."

However, judging solely from the revenue composition, robot-related revenue is still not the pillar. In the first three quarters of 2024, RoboSense sold 16,100 LiDAR products for robots and other purposes, a year-on-year increase of 22.9%.

(Image / RoboSense official website)

"Currently, the number of partners in the robot field has surpassed 2,600 from 2,400. Among them, multiple new products jointly developed with partners have won mass production orders from multiple leading robot companies in different fields. The order scale exceeds expectations, and it is expected that shipments in the robot field will exceed six figures next year." In Qiu Chunchao's view, the robot field may have a similar application penetration and growth path as the automotive field, and will usher in explosive development in the foreseeable future.

Since 2023, multiple departments have issued a series of policies and implementation plans focusing on the robot industry, carrying out application innovation practices of "robot+." The industrial development goals and application scenarios are basically clear.

From the underlying path and logic, enterprises in the automotive supply chain do have strong synergy with the robot industry. The basic hardware in the perception layer of the two is very similar, especially in terms of commonalities in technologies such as autonomous driving, chips, and LiDAR.

In the field of robots, the technical requirements for LiDAR are not lower than those for automotive-grade applications, and due to the diversity and complexity of robot application scenarios, the requirements for LiDAR are even higher.

Previously, as a supplier of automotive-grade LiDAR, RoboSense's advantage lies in its ability to reduce costs and increase efficiency by relying on vertical integration capabilities in the upstream and downstream industrial chains.

Qiu Chunchao mentioned that from a technical perspective, the company's hardware, chip, and AI technology stacks have versatility and migratability, providing underlying capabilities for the company to become a robot technology platform company.

However, while new business lines bring development opportunities, expenditures such as research and development costs are also testing the company's ability to generate cash flow.

Financial report data shows that in the first three quarters of 2024, the company's research and development expenses reached 465 million yuan, a year-on-year increase of 28.10%. During the same period, the company's revenue was approximately 1.135 billion yuan, with research and development expenses accounting for 41%.

In order to cope with the large-scale research and development expenditures, on December 11, 2024, RoboSense announced the raising of funds through the placement of shares. According to an announcement by the Hong Kong Stock Exchange, the company agreed to place 10 million new shares at a price of HK$27.75 per share, representing a discount of approximately 8% from the previous trading day's closing price of HK$30.15 per share.

RoboSense stated that the total proceeds from this share placement are expected to not exceed HK$277.5 million, and the proceeds from the share placement will be mainly used for research and development, enhancing business development capabilities in overseas markets, and exploring potential strategic partnerships or alliance opportunities.

Although relying on shipments, RoboSense has already ranked among the top automotive LiDAR companies, the company has not yet achieved profitability. In the first three quarters of 2024, RoboSense lost 350 million yuan.

(Image / RoboSense official website)

Therefore, some analysts have pointed out that while the company's business is developing rapidly, RoboSense also needs to raise more funds through the secondary market for research and development and new business expansion.

Zhang Xiang, a visiting professor at Huanghe Science and Technology College, believes that the competitive landscape between automakers and upstream component companies has already changed. RoboSense's profits in the automotive LiDAR business have been visibly compressed in the past year. "While bearing the existing cost pressure, the robot business is still in the investment stage, and it will take time to truly achieve profitability."

Market expectations for humanoid robots are still high, but this early market that has not yet "taken shape" may still "tie down" RoboSense for some time.

"Becoming a robot technology platform company won't happen that fast." The aforementioned industry insider pointed out.

*The title image in the article is from: RoboSense official website.