TikTok Awaits the Next Dawn

![]() 02/07 2025

02/07 2025

![]() 447

447

By: Guo Chuyu

Editor: cc Sun Congying

TikTok's seemingly blocked path has once again taken a positive turn.

On February 3, local time, US President Trump signed an executive order, officially announcing the creation plan for the first sovereign wealth fund in US history. This move stirred up ripples in the economic field and introduced new variables into TikTok's future development. After signing the executive order, Trump stated that the sovereign wealth fund could potentially be used to maintain TikTok's operations in the US.

TikTok's fate has once again been placed in the hands of this unpredictable and stubborn 'Mr. President.' Flashing back to 2020, Trump, then in his presidential term, made a highly threatening proposition: if ByteDance refused to sell TikTok, the US would ban the platform. This remark sparked widespread public outcry, followed by the issuance of a corresponding executive order, which plunged TikTok's US business into a precarious situation. (For details, see: Zhou Shouzi Faces an Ultra-Difficult Problem)

Fortunately, the federal district court ultimately rejected the executive order, preventing it from taking effect, and TikTok was thus spared.

Four years have passed swiftly, and Trump's attitude towards TikTok has undergone a remarkable transformation. In 2024, Trump successfully achieved a 'second rise' in his political career, returning to the White House, thanks in part to TikTok's powerful influence. He who once threatened to ban TikTok is now cheering it on.

As opportunities for a turnaround emerge, business prospects also flood in. In the US business sector, TikTok's immense potential has attracted the attention of numerous companies eager to secure a slice of the pie. According to the Associated Press, citing sources familiar with the matter, Perplexity AI, a San Francisco-based startup artificial intelligence company, has submitted a revised proposal to ByteDance. The proposal suggests that the US government could potentially hold up to 50% of the shares in the new entity formed after the merger of Perplexity and TikTok.

The birth of this proposal has infused new vitality into TikTok's continued presence in the US market and fully demonstrates the technology industry's positive outlook for TikTok's development in the US. It is worth emphasizing that this proposal is a revised version of the initial acquisition proposal submitted by Perplexity AI on January 18, local time.

Born by Trump, and possibly revived by Trump

On January 20, local time, Trump is set to return to the White House, and the grand spectacle of power transfer is about to unfold. Just two days earlier, on January 18, TikTok was in deep trouble. On the evening of January 18, TikTok initiated the mass delisting of its entire range of operational products in the US region, an action that undoubtedly added more uncertainties to TikTok's subsequent business development in the US.

'I've been using CapCut, but it's no longer available in the US,' Brenna said when she opened the editing software CapCut (a ByteDance product) at 2 pm EST on January 20 and found that the app had been disabled. However, to her surprise, 'TikTok is back.' As a blogger, she relies on CapCut for video editing and, after joining the Xiaohongshu platform, she heavily utilizes CapCut's bilingual subtitle function. Subsequently, ByteDance products such as CapCut and Lark, which were also delisted the previous day, gradually returned to normal use.

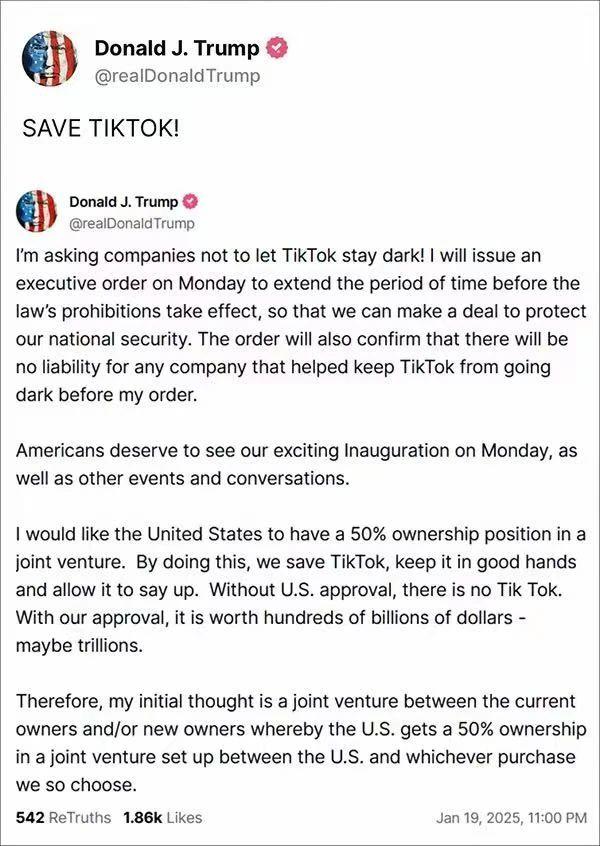

Since TikTok's inception, its fate seems to have been closely intertwined with Trump's. On January 19, local time, Trump posted on his social media platform Truth Social, 'Save TikTok.' With Trump's return, TikTok is expected to break the deadlock and start anew.

At 9 am on January 19, TikTok Policy posted on social media X that TikTok was restoring its services and proposed, 'We will work with President Trump to find a long-term solution to keep TikTok in the US.' This was only 14 hours after TikTok mass-delisted all its operational products in the US, including CapCut, Lemon8, Lark, and others.

On January 20, local time, after taking office as the US President, Trump signed an executive order related to TikTok, granting TikTok a 75-day buffer period to formulate relevant agreements to prevent a nationwide ban in the US. This corresponds to previous US media reports that Trump's advisers were reviewing the TikTok ban set to take effect on January 19 and might find a way to delay it by 60 to 90 days.

In fact, as early as 2024, Trump repeatedly expressed public support for TikTok and did not hide his recognition of it. He even bluntly stated that TikTok played a crucial role in increasing the share of youth votes, helping him win the election. This remark not only highlights TikTok's influence in the field of political communication but also reveals its importance in shaping election results.

Authoritative data from Sensor Tower also strongly confirms TikTok's strong appeal among young people. The data shows that 36% of TikTok's users are post-2000s, in sharp contrast to Facebook, where only 14% of users are post-2000s. Such a stark difference intuitively demonstrates TikTok's significant advantage in attracting younger users. In this era of fierce competition in social media, TikTok has successfully captured the hearts of young users with its unique content ecosystem and powerful social interaction features, becoming an important platform for them to obtain information and share their lives. Trump's support for TikTok also reflects his deep understanding of the influence of social media in the political field and his high attention to the power of young voters.

In fact, TikTok's encounter with a ban in the US is already a well-known 'old news.' As early as August 2020, Trump signed an executive order banning TikTok's operation in the US and transactions between ByteDance and other US companies on the grounds of 'national security.' The second executive order he issued then required ByteDance to divest TikTok's US business within 90 days and sell it to a US company.

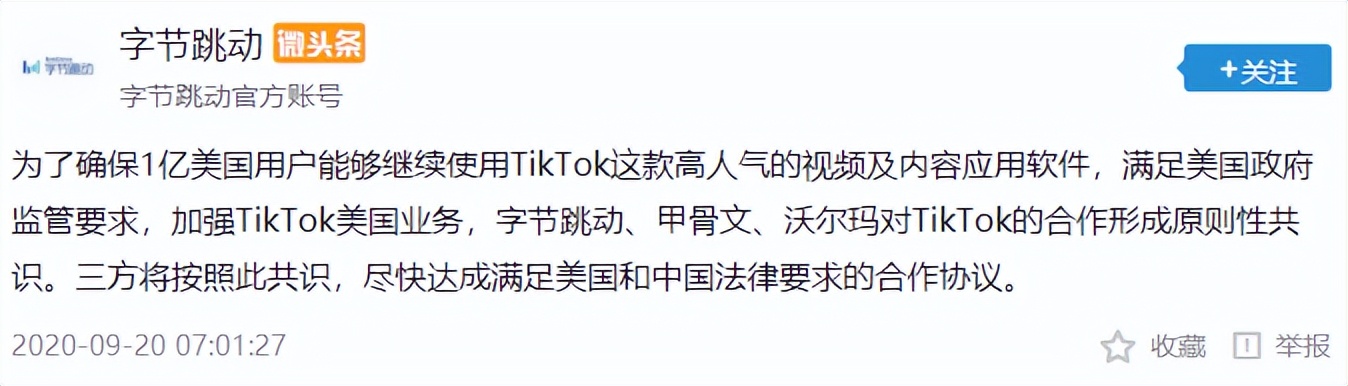

In response, on September 20, 2020, ByteDance's official website announced an agreement with Oracle and Walmart to establish a new company, TikTok Global. Among them, Oracle will acquire a 12.5% stake in TikTok, while Walmart will hold a 7.5% stake.

This agreement helped TikTok secure a delay in the executive order and ease the crisis of the ban at that time. Later, as Trump was preoccupied with party struggles, the issue of banning TikTok was shelved.

However, the current ban situation differs from that of 2020. The 2020 executive order was issued by the president, who could modify it. This time, it was determined by Congress in the form of legislation, which the president cannot modify but can only overturn and re-legislate. Meanwhile, the bill clearly states that the company taking over TikTok must be a non-Chinese enterprise.

Nevertheless, the political stage is ever-changing, and Trump, who is capricious and unconventional, returns to the center of power once again. This dramatic turn brings hope to TikTok.

Chain Reactions Under the Ban

On May 7, 2024, local time, two weeks after the passage of the 'Sell or Ban' bill, TikTok filed a complaint with the US Court of Appeals for the Federal Circuit in the District of Columbia. Before the court heard the case, TikTok continued to carry out public relations activities in the US, hiring lobbying teams from well-known consulting agencies and law firms to communicate with the government and lawmakers.

Image source: The New York Times

On January 10, 2025, the US Supreme Court held a 2.5-hour debate on whether the ban violates the First Amendment of the US Constitution. During the debate, TikTok's lawyers argued that 'no matter how much time is given, selling is extremely difficult' because TikTok's platforms in China, Europe, and the US are managed and maintained by the same global engineering team, making coordination and cooperation difficult if they are divested.

As the countdown to the TikTok ban intensifies, US TikTok users are the first to succumb to anxiety. Suddenly, US TikTok users flocked to various social platforms, sparking a massive wave of 'cyber migration' that swept across the entire internet world. The influence of this wave even crossed national borders and affected Chinese social media.

Since January 14, a large number of American netizens who self-identified as 'TikTok refugees' have embarked on an overnight 'relocation' operation, flooding into and occupying the Chinese social platform Xiaohongshu like a tide. This phenomenon was like a sudden online storm that caught Xiaohongshu off guard. In just two days, the number of new users on Xiaohongshu soared, with an increase of 700,000, a staggering growth rate that fully demonstrates the intense chain reaction triggered by the TikTok ban. (For details, see: Seeking Refuge for 'TikTok Refugees,' Can Xiaohongshu Afford It?)

This is not the first time US TikTok users have protested. Last April, after the signing of the 'Sell or Ban' bill for TikTok, US users expressed strong dissatisfaction. This is because for some users, TikTok is not just a social entertainment platform but also affects their daily lives. Some bloggers posted videos on the platform stating that the ban on TikTok is 'crazy,' claiming that TikTok is their source of information, entertainment, and income. Another book editor said that 80% of her clients were acquired through TikTok. Relevant data shows that TikTok has 170 million US users, and if the ban is finally implemented, its 2 million creators will lose nearly $300 million in monthly income.

Under the shadow of the TikTok ban, the entire TikTok business ecosystem has been greatly impacted. Not only are platform creators worried and actively seeking new outlets, but advertisers and marketing companies on the platform are also in a state of tension.

According to The New York Times, some marketers are redirecting operating funds to Instagram and modifying cooperation contracts with internet celebrities to reduce cooperation risks.

If banned, TikTok will lose billions of dollars in advertising revenue. According to eMarketer, TikTok accounts for about 4% of the US digital advertising market, and advertisers will turn to other social platforms, with Facebook and YouTube estimated to receive 50% of TikTok's advertising revenue. In addition, social media platforms including X, Linkedin, and Reddit will also benefit from this.

Content E-commerce, Shining Brightly

TikTok's popularity in the US has not been significantly affected by the ban. Relevant data shows that TikTok's monthly active users in the US market remained stable at over 170 million in the first half of 2024, ranking first among the many countries it covers. Its e-commerce platform TikTok Shop also performed robustly in the US, Southeast Asia, and the UK markets.

The US is a major market for TikTok and achieved rapid growth in 2024. According to Tabcut.com data, in 2024, TikTok Shop's GMV grew to approximately $32.6 billion, with the US market leading with a GMV of $9 billion, a year-on-year increase of 650%.

The report also shows that in the first half of 2024 alone, TikTok Shop's market share in the US region increased from 15.4% in January to 20.8% in June. TikTok Shop, which has only been online in the US market for a little over a year, achieved this remarkable result.

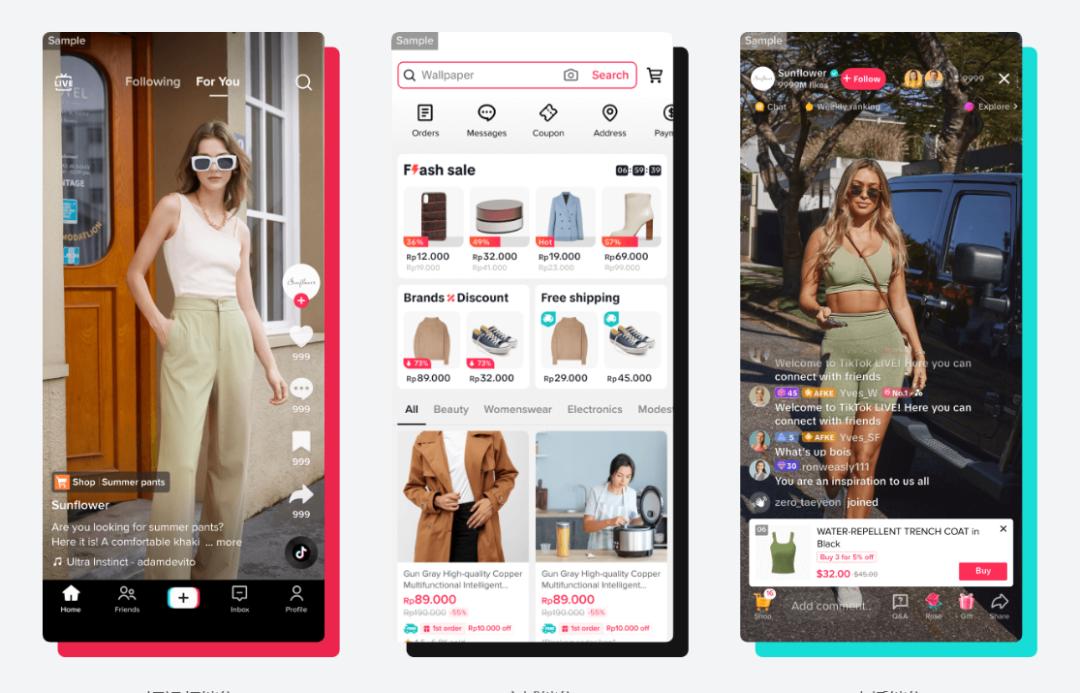

The strong consumption growth is inseparable from TikTok's 'short and concise' content e-commerce model. The platform achieves 'seeding-marketing-conversion' through 'traffic monetization' models such as short video promotion, influencer cooperation, and live streaming sales.

Simultaneously, TikTok has opened a shelf-style mall, TikTok Shop, and enriched e-commerce functions such as platform shopping carts and storefront windows to realize a fully closed-loop marketing model. This marketing model seamlessly connects short video entertainment and product promotion, relying on the platform's user engagement to achieve commercial conversion rates, bringing business opportunities to small brands and individual merchants.

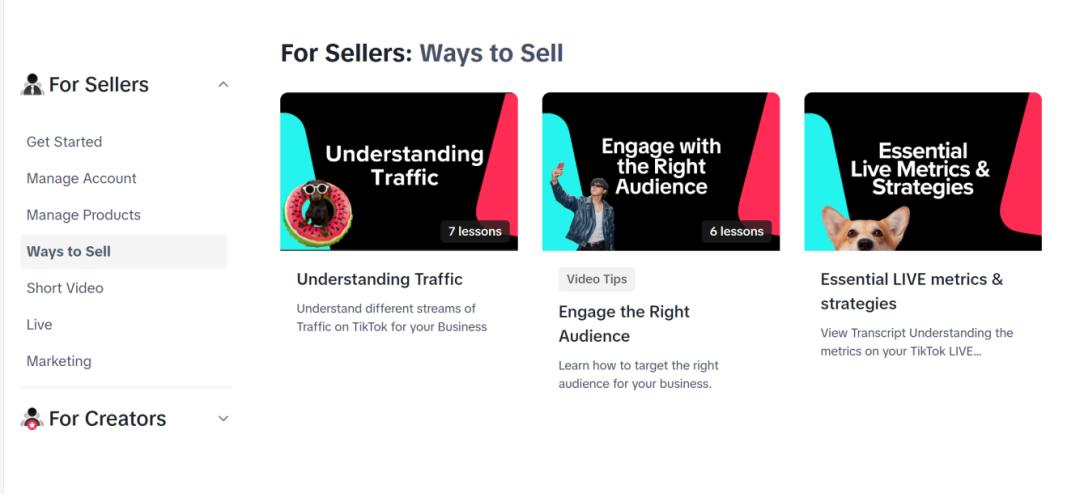

Moreover, TikTok Shop in the US region relaxed merchant entry standards in 2024. In June 2024, it opened up to sellers on platforms such as Amazon, eBay, Walmart, and independent stations, eliminating the requirement that Amazon stores have an annual GMV of no less than $500,000. In July, the standards were further relaxed, allowing Amazon sellers with US entities to join as long as their store ratings were no lower than 4 stars and they had been in operation for more than 3 months, without the need for sales flow proof. TikTok Shop's official website provides one-stop guidance for entry, including account management, influencer cooperation, product listing, and other operation methods, helping merchants quickly get started while enhancing the overall standardization of the platform.

In 2024, TikTok Shop emerged rapidly in the United States, with its sales model increasingly becoming an integral part of American consumers' daily behavior. The Wall Street Journal reported that "shopping on TikTok Shop" has become one of the five major consumer trends for 2025. According to interview data from relevant institutions, half of the users indicated that they had already made purchases on TikTok Shop, and 90% of the users expressed their intention to buy again.

However, as TikTok Shop in the U.S. lowered the thresholds for merchant participation, the benefits available to merchants correspondingly decreased. Despite earning higher profits in the U.S., merchants faced greater anxiety due to the threat of store closures. Elyse Burns, whose brand Elyse Breanne Design boasts 634,000 followers on TikTok, said, "TikTok still contributes 40% of my revenue." To meet sales demands across various channels, she relocated to a larger warehouse and hired additional full-time staff. "If TikTok were banned, the revenue from it would vanish, but these costs would persist," she added.

Beyond the U.S. market, TikTok achieved rapid growth in 2024 by accelerating its expansion into the Southeast Asian market. In April 2024, TikTok Shop merged with Tokopedia, the e-commerce arm of Indonesian tech giant GoTo. Additionally, in January of the same year, TikTok secured a social media license in Malaysia. Following a brief downtime in October 2023, TikTok's Indonesian market "re-emerged on the scene" and maintained steady growth throughout 2024, with annual sales reaching $5.5 billion. Meanwhile, TikTok's sales in Thailand totaled $5.9 billion, exhibiting double-digit growth throughout the year. Vietnam emerged as the fastest-growing market in 2024, with an average category growth rate of 166%.

Amidst the TikTok ban, merchants have redirected their focus to the Southeast Asian market. In December 2024, adjustments to TikTok's Southeast Asian market policy, encompassing cost reductions, logistics streamlining, and phased seller incentives, undeniably presented TikTok merchants with fresh opportunities. Additionally, cross-border e-commerce platforms such as Temu, Shein, and AliExpress have become viable alternatives for merchants. (For more details, see: Platforms Provide Backstop, Taobao Merchants Compete with SHEIN and Temu in Overseas Markets)

Notably, the legal scrutiny faced by TikTok has heightened operational and investment risks for merchants. Despite this, merchants continue to value TikTok's vast user base and efficient content recommendation algorithm, underscoring TikTok's enduring competitive advantage. In early January, AliExpress announced recruitment for its U.S. POP program, offering flexible operations, pricing, and a three-month commission exemption for early-stage merchants. These attractive conditions garnered significant interest, with inquiries from local U.S. merchants interested in joining the platform tripling in the week leading up to the 17th.