DeepSeek Ignites A-share Market: Who Truly Benefits?

![]() 02/08 2025

02/08 2025

![]() 597

597

During the Spring Festival holiday, DeepSeek unexpectedly sparked widespread public interest. However, within the academic and technical communities, DeepSeek had already achieved prominence by mid-January.

As anticipated, upon the market's reopening post-holiday, stocks related to DeepSeek in both Hong Kong and the A-share markets surged. In the first two trading days of the Year of the Snake, technology sectors, including software development, IT services, electronics, and semiconductors, led the gains in the A-share market.

Amidst this heated market activity, numerous companies announced their integration with DeepSeek or became labeled as "DeepSeek concept stocks." However, according to Baima Observation, some companies are merely riding the wave and have been unilaterally tagged by investors.

For the AI industry, DeepSeek undoubtedly represents a significant "disruptor" that has altered the existing game rules. So, what exactly has DeepSeek changed, and which companies will truly reap the benefits?

DeepSeek Emerges as a Surprise Contender

Founded in July 2023, DeepSeek has been operational for just over a year but has already made a significant impact. The launch of its V3 model on December 26, 2024, triggered rapid user growth. Following the release of the R1 model on January 20, DeepSeek swiftly climbed the download charts in the United States, reaching the top spot by January 27.

According to AI Product Ranking data, as of January 31, 2025, the DeepSeek app had been online for just 21 days, with 22.15 million daily active users, already accounting for 41.6% of ChatGPT's daily active users.

DeepSeek has even garnered some concern within the US tech community. Renowned investor Cathie Wood stated that DeepSeek demonstrates that success in AI does not necessitate vast sums of money and has accelerated the decline in costs.

Public information reveals that several official US agencies have instructed their staff not to use DeepSeek's services.

In response, the US swiftly announced the "Stargate Plan," where OpenAI, Oracle, SoftBank, and Abu Dhabi investment company MGX will form a joint venture, planning to invest up to $500 billion over the next four years to develop AI-related infrastructure and create 100,000 jobs, with an initial investment of $100 billion.

These signs suggest genuine panic within the US tech community.

Renowned researcher Rao Yi asserted that in science and technology-related fields, the greatest shock to humanity that China has presented since 1840 is DeepSeek.

What DeepSeek Has Changed

The most significant impact that DeepSeek has had on the industry is its low cost.

The entire training process for DeepSeek V3 cost less than $6 million, achieving model performance comparable to GPT-4o, which cost over $1 billion; the inference cost is also within one-tenth of GPT-4o's. The pre-training cost for DeepSeek-R1 is approximately $5.5 million, less than one-tenth of the training cost for OpenAI's GPT-4o and GPT-3 models.

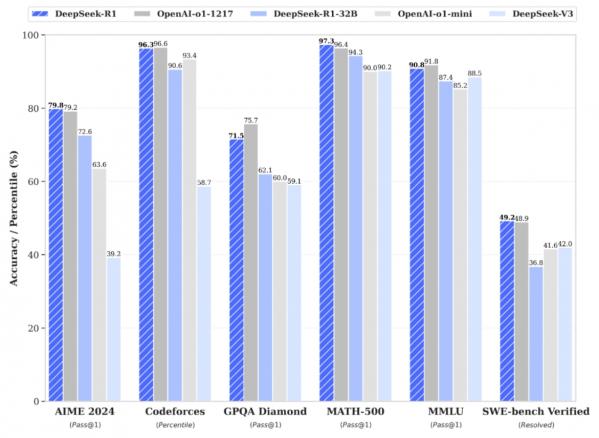

In terms of performance, DeepSeek-R1 performed similarly to OpenAI-GPT-3 in various tests, such as AIME 2024, Codeforces, GPQA Diamond, MATH-500, MMLU, and SWE-bench Verified, and even scored higher in some tests.

In other words, DeepSeek has achieved nearly comparable performance at less than one-tenth the cost of OpenAI, exerting significant competitive pressure on its rivals. Analysts at research firm Bernstein estimate that DeepSeek's pricing is only one-twentieth or even one-fortieth that of OpenAI's comparable models.

Recently, OpenAI released its new GPT-3 large model freely to the public, and Microsoft also made the GPT-3 inference model available to all Copilot users at no cost.

For a long time, the competition logic in the large model field has revolved around "might makes right" — using greater computing power and more data to train models with superior performance. The newly proposed "Stargate Plan" in the US adheres to the same approach, consolidating advantages through increased investment.

As the US has banned NVIDIA from selling advanced GPU chips to China, Chinese AI companies cannot establish an advantage through "piling on computing power" until breakthroughs are made in chip manufacturing. Many were pessimistic, believing that the gap between China and the US in AI would only widen.

Now, it can be said that DeepSeek has fundamentally altered the game rules for large AI models — demonstrating that high-performance large models can also be trained through innovations at the software level, such as architecture and algorithms.

Who Truly Benefits?

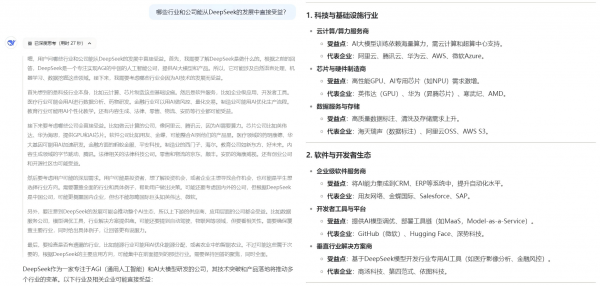

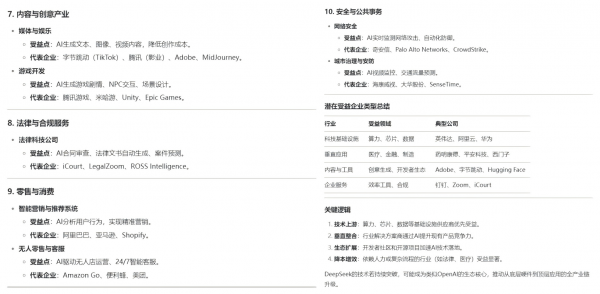

At the industrial level, DeepSeek benefits at least three sectors.

First, domestic computing power-related companies. Research from Founder Securities indicates that collaborative optimization of "algorithms + hardware + system architecture" can enhance hardware utilization, suggesting that the monopoly of leading general-purpose GPU/CPU manufacturers is not invincible. Domestic GPU/CPU manufacturers will thrive as their market share expands and their ecosystems improve.

Second, AI software companies. DeepSeek's comprehensive open-source strategy and relatively low API pricing will foster the growth of AI software applications.

Third, foundational large model companies. The effectiveness of DeepSeek's distillation technology, coupled with cost reductions and algorithm open-sourcing, has encouraged more companies to attempt training vertical large models, leading to an anticipated increase in demand for foundational large models.

Currently, giants such as Microsoft, NVIDIA, Amazon, Intel, and AMD in the US have all announced their integration with DeepSeek, and domestic cloud service companies including Baidu Intelligent Cloud, Alibaba Cloud, Huawei Cloud, Tencent Cloud, and Unicom Cloud have also integrated with DeepSeek.

As of February 6, numerous A-share and Hong Kong-listed companies, including Richinfo Technology, Autel Intelligent Technology, Topsec, and Yidu Technology, have announced their integration with DeepSeek.

Additionally, Wind has launched the DeepSeek Index, whose constituent stocks include Huajin Capital, Inspur Information, iFLYTEK, Tuersi, Feilixin, MeiRiHuDong, Zhuochuang Information, Zhejiang East, Sugon, and Parallel Technologies.

In the first two trading days after the holiday, DeepSeek ignited the A-share market, becoming the most active concept. However, Baima believes that the current surge in DeepSeek concept stocks is a mixed bag, with some companies' fundamentals remaining unchanged, and the surge being purely speculative.

For instance, Huajin Capital, which saw three consecutive trading days of daily limits, clearly stated on the Shenzhen Stock Exchange's Interactive Easy platform that neither the company nor the funds managed by its subsidiaries hold shares in QuantOpus or DeepSeek.

Overall, AI software companies with established business scenarios and clientele are likely to be the genuine beneficiaries of DeepSeek's ecological prosperity.

Finally, enjoy a performance by DeepSeek.

The content and viewpoints of this article are for reference only and do not constitute investment advice. Investment involves risks, and decisions should be made cautiously.