ARM: AI Propels Performance Beyond Targets, Sustaining High Valuation as a "Sweet Burden"

![]() 02/10 2025

02/10 2025

![]() 649

649

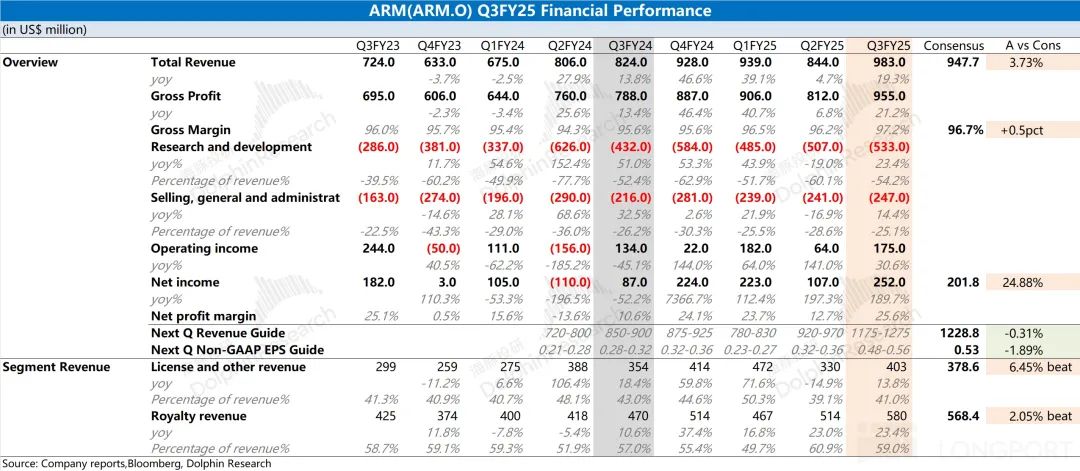

ARM (ARM.O) unveiled its financial report for the third quarter of FY2025 (ending December 2024) after the US market closed on February 6, 2025, Beijing time. Key highlights are as follows:

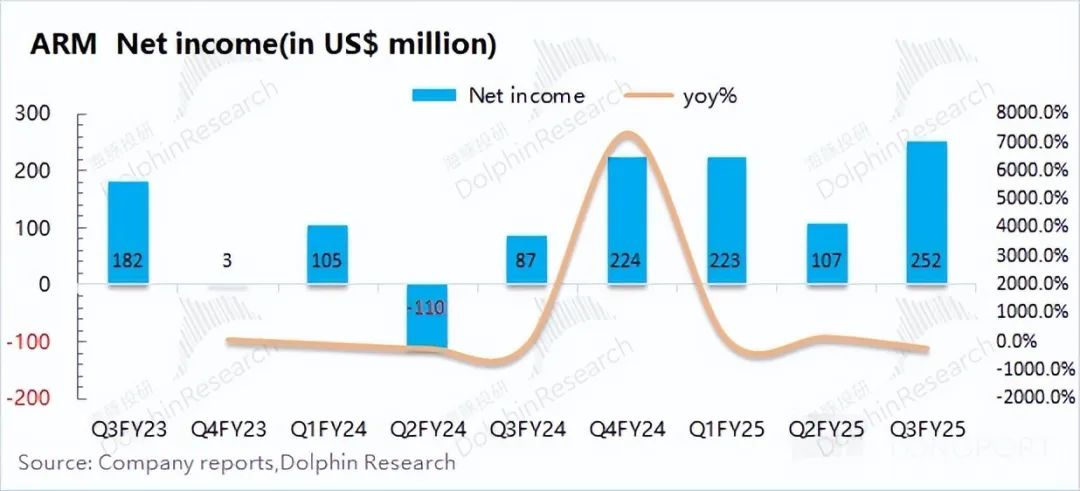

I. Overall Performance: Revenue and Profit Growth Accelerates

ARM reported revenue of $983 million for the third quarter of FY2025 (i.e., 24Q4), marking a 19.3% year-on-year increase, slightly surpassing market expectations of $948 million. This quarter's revenue growth was fueled by both licensing and royalty businesses. The company's net profit for the quarter amounted to $252 million, reflecting a significant year-on-year surge and slightly exceeding market forecasts of $202 million. Due to economies of scale, the company's operating expense ratio declined, further boosting its profitability.

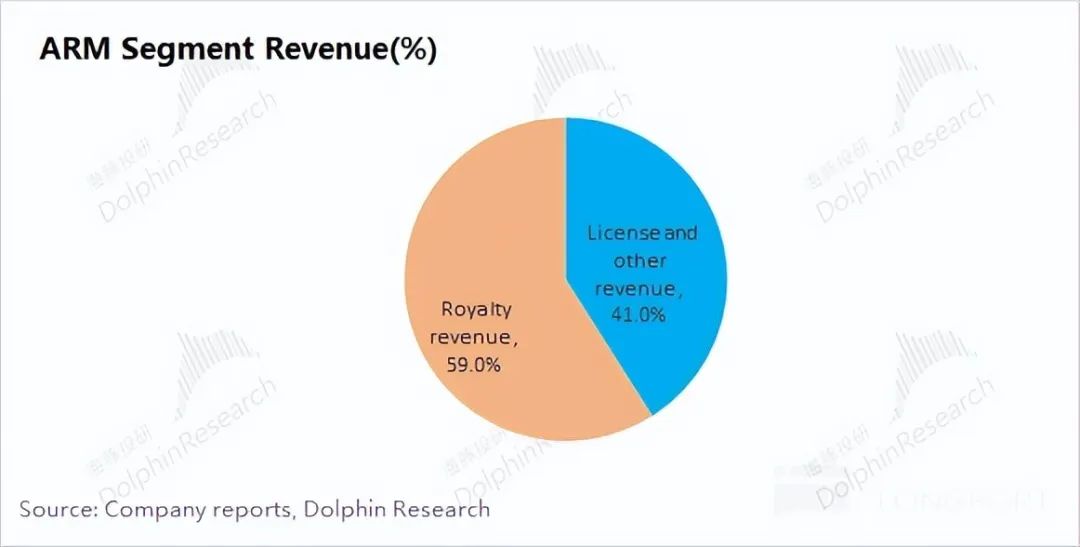

2. Business Segments: Royalties Account for Nearly 60%

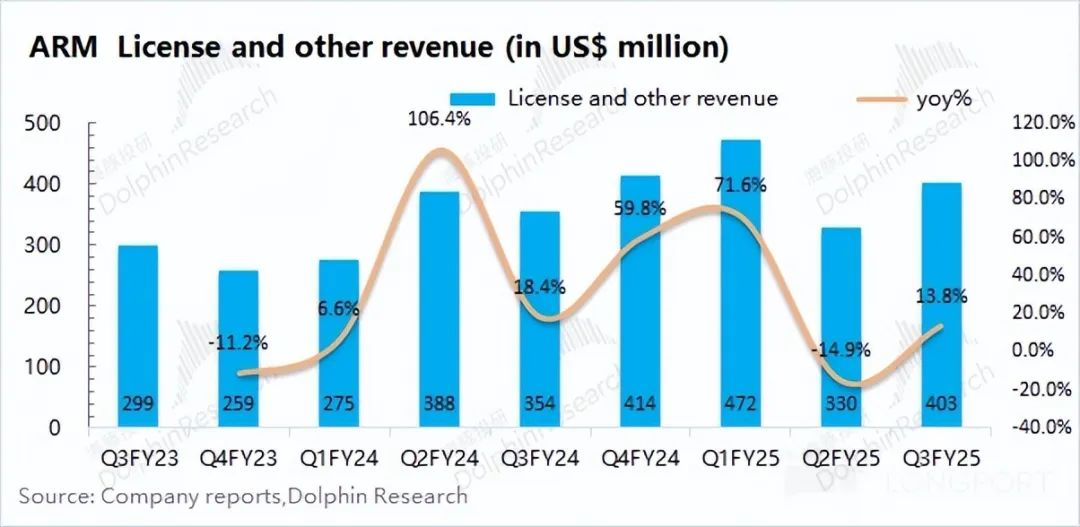

1) Licensing Business: Revenue stood at $403 million, up 14% year-on-year. The Annual Contract Value (ACV) for the third quarter reached $1.27 billion, an increase of 9% year-on-year.

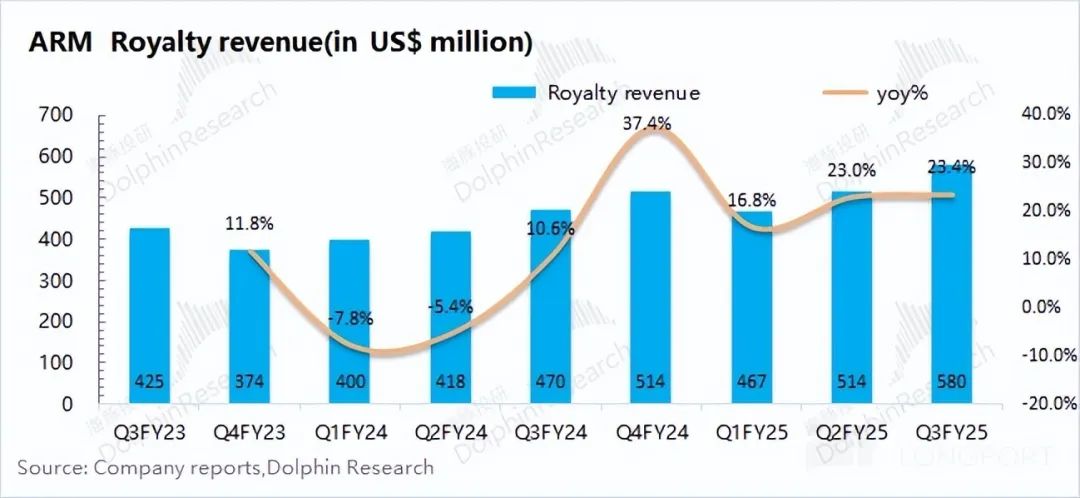

2) Royalty Business: Revenue amounted to $580 million, up 23% year-on-year. This growth was primarily driven by the ongoing adoption of the Armv9 architecture and shipments of chips based on the Compute Subsystem (CSS).

3. ARM Performance Guidance: For the fourth quarter of FY2025 (i.e., 25Q1), ARM expects revenue to range between $1.175 billion and $1.275 billion (market expectation: $1.228 billion) and adjusted profit per share to be between $0.48 and $0.56 (market expectation: $0.53).

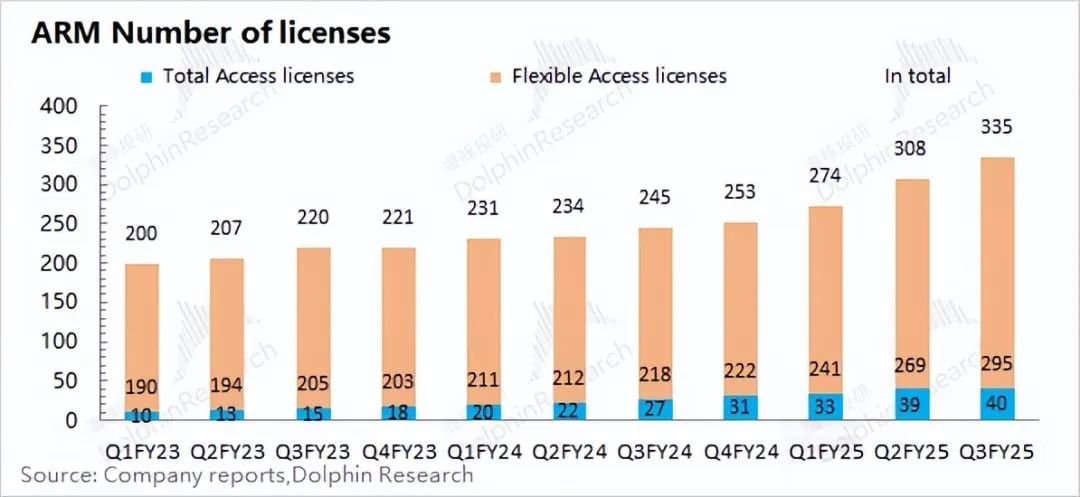

Dolphin's Overall View: ARM's latest financial report is solid, albeit without standout highlights. The company's revenue grew as anticipated, with the gross margin for the quarter further increasing to 97.2%. Leveraging economies of scale, the company's operating expense ratio declined to 25.1% this quarter, fueling profit growth. Driven by demands such as AI, ARM's licensing and royalty businesses achieved double-digit growth. The licensing business customer base expanded to 335, and the Armv9 architecture in the royalty business now accounts for 25% of revenue. Looking ahead to the next quarter, ARM has provided revenue guidance of $1.175-$1.275 billion and Non-GAAP earnings per share guidance of $0.48-$0.56, indicating both revenue and profit growth, and a positive operational trajectory.

Given the timing of revenue recognition for certain businesses, ARM's Annual Contract Value (ACV) and Remaining Performance Obligation (RPO) are also crucial metrics. This quarter, the company's ACV increased by 1.4% quarter-on-quarter, while RPO decreased by 2.4% quarter-on-quarter. Dolphin speculates that ARM may have adjusted the terms and duration of license contracts, introducing more short-term but high-value contracts, thereby enhancing its performance.

Overall, ARM's financial report meets expectations, yet it's noteworthy that the company's revenue growth for FY2025 is projected at around 24%, and its core business in FY2026 is unlikely to experience high growth. Given the current stock price, which corresponds to a PE ratio of over 200 times for FY2025, ARM will face pressure under its high valuation if it fails to deliver significantly better-than-expected results.

Detailed Analysis

I. Overall Performance: Revenue and Profit Growth

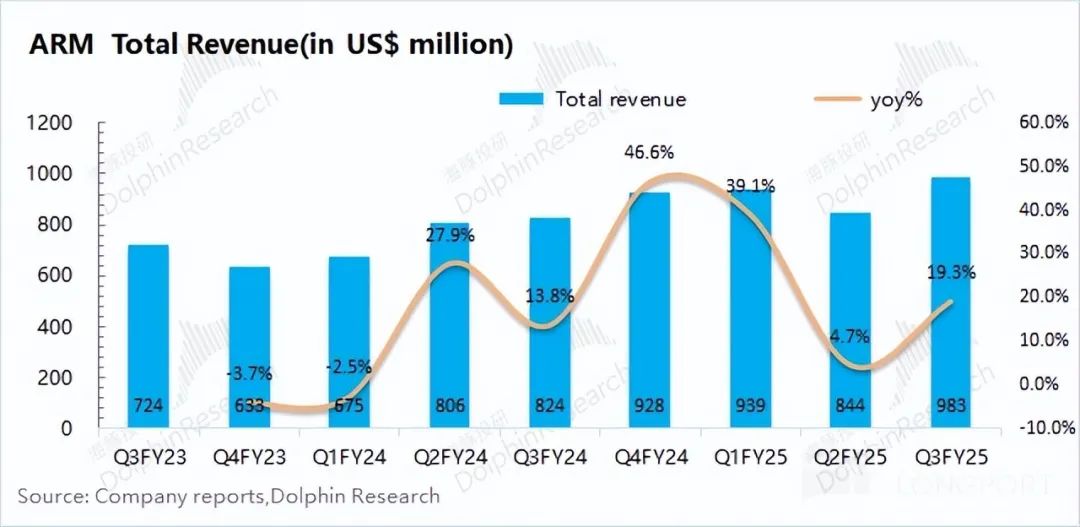

1.1 Revenue

ARM reported revenue of $983 million for the third quarter of FY2025 (i.e., 24Q4), up 19.3% year-on-year, slightly surpassing market expectations of $948 million. Both licensing and royalty businesses contributed to this quarter's revenue increase, with double-digit growth.

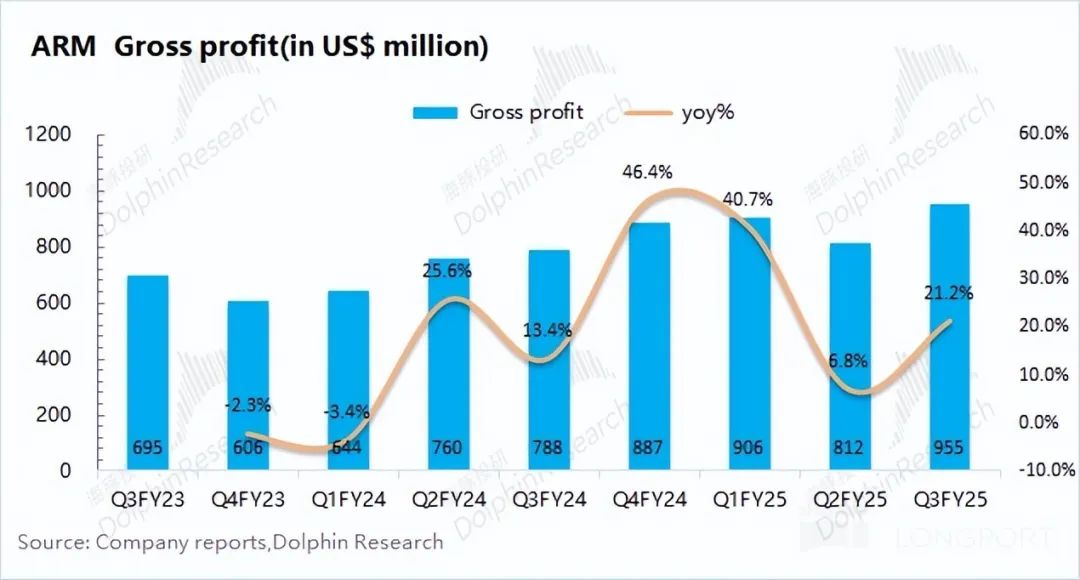

1.2 Gross Margin

ARM achieved a gross profit of $955 million for the third quarter of FY2025 (i.e., 24Q4), up 21.1% year-on-year. The gross margin growth rate outpaced that of revenue. This quarter's gross margin stood at 97.2%, up 1.6 percentage points year-on-year, slightly exceeding market expectations of 96.7%. As ARM's revenue scale expands, its overall gross margin continues to trend upwards, reaching 97% for the first time this quarter.

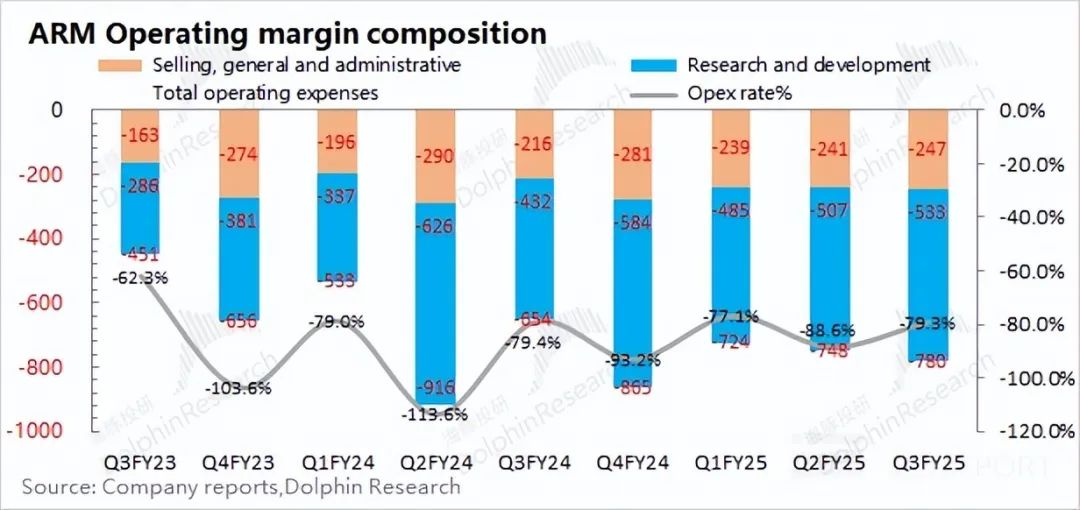

1.3 Operating Expenses

ARM's operating expenses for the third quarter of FY2025 (i.e., 24Q4) totaled $780 million, up 19.3% year-on-year. The company maintains high investment levels, with the current operating expense ratio remaining high at 79.3%.

Specifically, expenses breakdown as follows:

1) R&D Expenses: This quarter's R&D expenses amounted to $533 million, up 23.4% year-on-year. The company's engineer headcount increased to 6,594 this quarter, with R&D investment also rising quarter-on-quarter.

2) Sales and Administrative Expenses: This quarter's sales and administrative expenses totaled $247 million, up 14.4% year-on-year. Sales increased slightly this quarter, with the sales and administrative expense ratio at 25.1%.

1.4 Net Profit

ARM reported a net profit of $252 million for the third quarter of FY2025 (i.e., 24Q4), marking year-on-year and quarter-on-quarter growth and exceeding market expectations of $202 million. In terms of operational performance, the company's operating profit for this quarter increased to $175 million quarter-on-quarter, primarily due to revenue scale expansion.

This quarter's net profit margin stood at 25.6%. Despite ARM's ultra-high gross margin, the company invests heavily in R&D, sales, and other operating expenses. Even with a gross margin of 97% and an operating expense ratio of nearly 80%, the company's final profit is significantly impacted.

There's limited room for gross margin improvement. ARM achieves economies of scale by expanding its revenue, thereby reducing the operating expense ratio and boosting operating profits.

II. Business Segments: Royalties Account for Nearly 60%

In ARM's business segments, licensing and royalty businesses this quarter were nearly evenly split at 46-54. The company's business is currently primarily driven by demands such as AI. With royalty revenue continuously growing, it now accounts for around 60% of total revenue, while the licensing business accounted for 41% this quarter.

2.1 Licensing Business

ARM's licensing business generated revenue of $403 million for the third quarter of FY2025 (i.e., 24Q4), up 13.8% year-on-year. Due to normal fluctuations in the timing and scale of multiple high-value license agreements and contributions from backlog orders, licensing revenue varies quarter-on-quarter. For the company, the Annual Contract Value (ACV) is a key metric to gauge the potential growth rate of the licensing business.

This quarter's ACV increased to $1.27 billion, up 9% year-on-year, a slight slowdown but still higher than the company's long-term plan of 7%. Additionally, the company's Remaining Performance Obligation (RPO) fell to $2.325 billion quarter-on-quarter as ARM delivered products and recognized backlog order revenue in the income statement. The company expects to recognize approximately 28% of the remaining performance obligations as revenue in the next 12 months, 17% in the subsequent 13 to 24 months, and the rest thereafter.

This quarter, both the number of full license customers and flexible license customers increased. The full license customer count rose to 40, while the flexible license customer count reached 295, contributing to the company's overall customer growth.

2.2 Royalty Business

ARM's royalty licensing business generated revenue of $580 million for the third quarter of FY2025 (i.e., 24Q4), up 23.4% year-on-year. This growth was primarily fueled by the ongoing adoption of the Armv9 architecture and shipments of chips based on the Compute Subsystem (CSS), such as MediaTek's Dimensity 9400 chip, used in OPPO and vivo's flagship smartphones.

This quarter, royalty revenue from chips in the smartphone, data center, networking equipment, and automotive sectors met the company's expectations, while royalty revenue in the IoT sector showed signs of recovery after several quarters of decline. The current revenue share of the Armv9 architecture has stabilized at 25%.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Investment Research. For reprinting, please obtain authorization.

// Disclaimer and General Disclosure Notice

This report is for general information purposes only and is intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult independent professional advisors before making investment decisions based on this report. Any person making investment decisions based on or with reference to the content or information in this report does so at their own risk. Dolphin Investment Research shall not be liable for any direct or indirect losses or responsibilities that may arise from the use of the data contained in this report. The information and data in this report are based on publicly available sources and are provided for reference only. Dolphin Investment Research strives to ensure the reliability, accuracy, and completeness of relevant information and data but cannot guarantee it.

The information or opinions expressed in this report should not be construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or advice regarding relevant securities or related financial instruments. The information, tools, and data in this report are not intended for or to be distributed to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or subject Dolphin Investment Research and/or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdictions.

This report reflects the personal views, opinions, and analysis methods of the relevant authors and does not represent the position of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research, and the copyright belongs solely to Dolphin Investment Research. Without Dolphin Investment Research's prior written consent, no organization or individual may (i) produce, copy, replicate, reprint, forward, or make any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.